As somebody obsessed with saving money and reaching financial freedom, there’s two exercises I regularly partake in.

- Calculating how much money it’s costing me to live in Minnesota each year

- Considering the most efficient places I could live once I’m financially independent

Exercise #1 is the much less enjoyable one, and I’m not even sure why I still do it. (Reminding yourself that you’re getting taxed 7-8% of your income each year for the privilege of experiencing -20 degree Winters isn’t great for morale…)

On the other hand, finding the cheapest livable places is a lot more fun!

It’s not easy though…

3 big problems with most ranking systems

Most cost of living rankings are relatively worthless. Why?

1. They don’t distinguish between different types of taxes

The first problem you’ll see when you look up normal cost of living calculations – their methods don’t make sense for people actively trying to save money.

For example, they’ll rank income tax, property tax, and sales tax on an equal level.

Obviously, this is flawed for anyone who’s not a mindless spending-drone. People focusing on saving money don’t spend as much money as everyone else, so sales tax is less relevant.

Income tax, on the other hand, is completely unavoidable. It represents a direct cost of living wherever you’re living. Me paying $6,000 a year in Minnesota state income tax is money that I could otherwise use to max a Roth IRA, invest in index funds, or any number of other investment vehicles. There’s no escaping it.

2. They put everything in terms of income

This gets pretty useless under these two common scenarios:

- You’re evaluating a similar paying job in another state.

- You’re planning on retiring, so income opportunities are completely irrelevant.

3. They undersell the cost of a house

Who cares if property taxes are low, if the cost of homes are half a million dollars more?

The Money Wizard Methodology

Fed up with the lack of good information out there, I decided I’d have to create it myself.

Here’s the system I came up with. Admittedly, it balances a line between simplicity and sophistication, so it’s not perfect. But it is better than any similar ranking I’ve ever seen.

While taxes and price indices are all interesting… The only thing that matters is how much it actually costs you to live somewhere.

So, I calculated how much it would cost to live in each state for 30 years.

This is convenient because it’s both the length of the average working career and the length of the average retirement.

More info on the methodology:

You can skip this part if you’re in a hurry, but some of you might find it interesting.

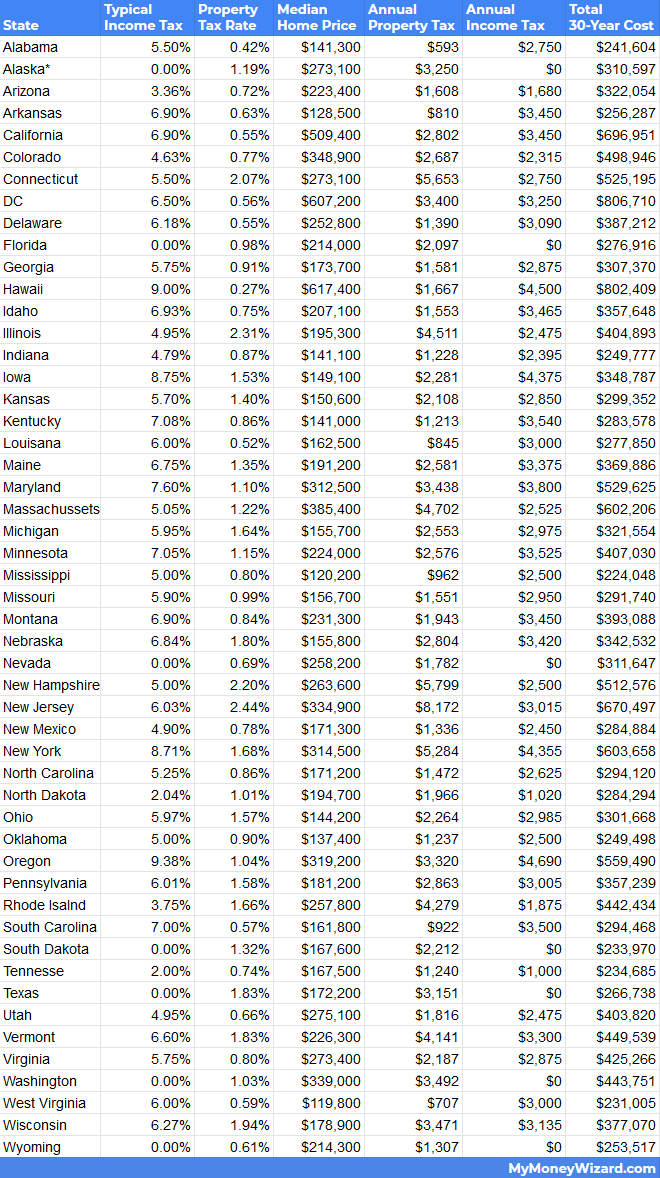

Typical Income Tax Rate: I sifted through the raw data for individual income tax brackets for all 50 states (plus D.C.!) and used the tax rate for a single filer earning $50,000 a year. For the 13 states that also have city/county income tax rates, I added back the state’s average locality tax as well.

I picked the $50K number because it’s a pretty close to the median household income in the US. It also happens to be pretty close to the average passive income of an early retiree.

I was surprised how accurate this rate was. Tons of states have a flat tax rate, and even more charge the same income tax for everyone making more than $1,000 a year or so.

Property Tax Rate: I used this data from Wallethub on the average property taxes. It’s almost dead-on for what we pay for our Minnesota home, so I figured it was reliable.

Median Home Price: I considered using some Zillow data, but their info was crazy high on average. The US Census Bureau seemed most accurate.

Property Tax Estimate: Just the property tax rate times the median home price. If you buy an average priced house wherever you’re living, this is how much you can expect to be on the hook for each year.

Income Tax Estimate: I simplified this by multiplying $50,000 by the average income tax rate explained above.

(Yes, I know how marginal brackets work, and I realize this method overestimates taxes. That said, many readers on this site make much more than $50,000 a year, so this captures their position better.)

30 year cost of living: The total shebang. I added the total home cost, 30 years of property taxes, and 30 years of income taxes.

What I ignored:

I ignored sales tax, excise tax, grocery costs, etc. (Essentially, anything that you, the saver/early retiree would have control over.)

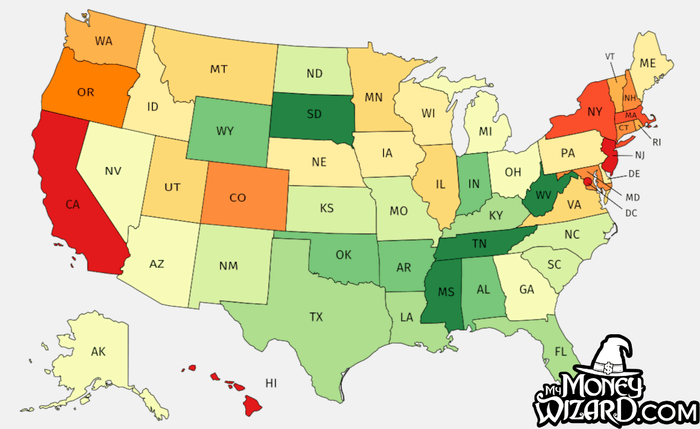

The Results: Ranking all the states from most to least expensive

51. Washington, DC

- Typical Income Tax Rate: 6.50%

- Property Tax Rate: 0.56%

- Median Home Price: $607,200

- 30 year cost of living: $806,710

Not technically a state, but our nation’s capital is the most expensive place to live in the country.

50. Hawaii

- Typical Income Tax Rate: 9%

- Property Tax Rate: 0.27%

- Median Home Price: $617,400

- 30 year cost of living: $802,409

49. California

- Typical Income Tax Rate: 6.90%

- Property Tax Rate: 0.55%

- Median Home Price: $509,400

- 30 year cost of living: $696,951

48. New Jersey

- Typical Income Tax Rate: 6.03%

- Property Tax Rate: 2.44%

- Median Home Price: $670,497

- 30 year cost of living: $696,951

47. New York

- Typical Income Tax Rate: 8.71%

- Property Tax Rate: 1.68%

- Median Home Price: $314,500

- 30 year cost of living: $603,658

46. Massachussets

- Typical Income Tax Rate: 5.05%

- Property Tax Rate: 1.22%

- Median Home Price: $385,400

- 30 year cost of living: $602,206

45. Oregon

- Typical Income Tax Rate: 9.38%

- Property Tax Rate: 1.04%

- Median Home Price: $319,200

- 30 year cost of living: $559,490

44. Maryland

- Typical Income Tax Rate: 7.60%

- Property Tax Rate: 1.10%

- Median Home Price: $312,500

- 30 year cost of living: $529,625

43. Connecticut

- Typical Income Tax Rate: 5.50%

- Property Tax Rate: 2.07%

- Median Home Price: $273,100

- 30 year cost of living: $525,195

42. New Hampshire

- Typical Income Tax Rate: 5.00%

- Property Tax Rate: 2.20%

- Median Home Price: $263,600

- 30 year cost of living: $512,576

41. Colorado

- Typical Income Tax Rate: 4.63%

- Property Tax Rate: 0.77%

- Median Home Price: $348,900

- 30 year cost of living: $498,946

40. Vermont

- Typical Income Tax Rate: 6.60%

- Property Tax Rate: 1.83%

- Median Home Price: $226,300

- 30 year cost of living: $449,539

39. Washington

- Typical Income Tax Rate: 0%

- Property Tax Rate: 1.03%

- Median Home Price: $339,000

- 30 year cost of living: $443,751

38. Rhode Island

- Typical Income Tax Rate: 3.75%

- Property Tax Rate: 1.66%

- Median Home Price: $257,800

- 30 year cost of living: $442,434

37. Virginia

- Typical Income Tax Rate: 5.75%

- Property Tax Rate: 0.80%

- Median Home Price: $273,400

- 30 year cost of living: $425,266

36. Minnesota

- Typical Income Tax Rate: 7.05%

- Property Tax Rate: 1.15%

- Median Home Price: $224,000

- 30 year cost of living: $407,030

35. Illinois

- Typical Income Tax Rate: 4.95%

- Property Tax Rate: 2.31%

- Median Home Price: $195,300

- 30 year cost of living: $404,893

34. Utah

- Typical Income Tax Rate: 4.95%

- Property Tax Rate: 0.66%

- Median Home Price: $275,100

- 30 year cost of living: $403,820

33. Montana

- Typical Income Tax Rate: 6.90%

- Property Tax Rate: 0.84%

- Median Home Price: $231,300

- 30 year cost of living: $393,088

32. Delaware

- Typical Income Tax Rate: 6.18%

- Property Tax Rate: 0.55%

- Median Home Price: $252,800

- 30 year cost of living: $387,212

31. Wisconsin

- Typical Income Tax Rate: 6.27%

- Property Tax Rate: 1.94%

- Median Home Price: $178,900

- 30 year cost of living: $377,070

30. Maine

- Typical Income Tax Rate: 6.75%

- Property Tax Rate: 1.35%

- Median Home Price: $191,200

- 30 year cost of living: $369,886

29. Idaho

- Typical Income Tax Rate: 6.93%

- Property Tax Rate: 0.75%

- Median Home Price: $207,100

- 30 year cost of living: $357,648

28. Pennsylvania

- Typical Income Tax Rate: 6.01%

- Property Tax Rate: 1.58%

- Median Home Price: $181,200

- 30 year cost of living: $357,239

27. Iowa

- Typical Income Tax Rate: 8.75%

- Property Tax Rate: 1.53%

- Median Home Price: $149,100

- 30 year cost of living: $348,787

26. Nebraska

- Typical Income Tax Rate: 6.84%

- Property Tax Rate: 1.80%

- Median Home Price: $155,800

- 30 year cost of living: $342,532

25. Arizona

- Typical Income Tax Rate: 3.36%

- Property Tax Rate: 0.72%

- Median Home Price: $223,400

- 30 year cost of living: $322,054

24. Michigan

- Typical Income Tax Rate: 5.95%

- Property Tax Rate: 1.64%

- Median Home Price: $155,700

- 30 year cost of living: $321,554

23. Nevada

- Typical Income Tax Rate: 0%

- Property Tax Rate: 0.69%

- Median Home Price: $258,200

- 30 year cost of living: $311,647

22. Alaska

- Typical Income Tax Rate: 0%

- Property Tax Rate: 1.19%

- Median Home Price: $273,100

- 30 year cost of living: $310,597*

*Not only does Alaska have no income tax, they actually pay their residents to live there. So, I’ve adjusted the final cost by $2,000 per year. ($60,000)

21. Georgia

- Typical Income Tax Rate: 5.75%

- Property Tax Rate: 0.91%

- Median Home Price: $173,700

- 30 year cost of living: $307,370

20. Ohio

- Typical Income Tax Rate: 5.97%

- Property Tax Rate: 1.57%

- Median Home Price: $144,200

- 30 year cost of living: $301,668

19. Kansas

- Typical Income Tax Rate: 5.70%

- Property Tax Rate: 1.40%

- Median Home Price: $150,600

- 30 year cost of living: $299,352

18. South Carolina

- Typical Income Tax Rate: 7.00%

- Property Tax Rate: 0.57%

- Median Home Price: $161,800

- 30 year cost of living: $294,468

17. North Carolina

- Typical Income Tax Rate: 5.25%

- Property Tax Rate: 0.84%

- Median Home Price: $171,200

- 30 year cost of living: $294,120

16. Missouri

- Typical Income Tax Rate: 5.90%

- Property Tax Rate: 0.99%

- Median Home Price: $156,700

- 30 year cost of living: $291,740

15. New Mexico

- Typical Income Tax Rate: 4.90%

- Property Tax Rate: 0.78%

- Median Home Price: $171,300

- 30 year cost of living: $284,884

14. North Dakota

- Typical Income Tax Rate: 2.04%

- Property Tax Rate: 1.01%

- Median Home Price: $194,700

- 30 year cost of living: $284,294

13. Kentucky

- Typical Income Tax Rate: 7.08%

- Property Tax Rate: 0.86%

- Median Home Price: $141,000

- 30 year cost of living: $283,578

12. Louisiana

- Typical Income Tax Rate: 6.00%

- Property Tax Rate: 0.52%

- Median Home Price: $162,500

- 30 year cost of living: $277,850

11. Florida

- Typical Income Tax Rate: 0%

- Property Tax Rate: 0.98%

- Median Home Price: $214,000

- 30 year cost of living: $276,916

10. Texas

- Typical Income Tax Rate: 0%

- Property Tax Rate: 1.83%

- Median Home Price: $171,200

- 30 year cost of living: $266,738

9. Arkansas

- Typical Income Tax Rate: 6.90%

- Property Tax Rate: 0.63%

- Median Home Price: $128,500

- 30 year cost of living: $256,287

8. Wyoming

- Typical Income Tax Rate: 0%

- Property Tax Rate: 0.61%

- Median Home Price: $214,300

- 30 year cost of living: $253,517

7. Indiana

- Typical Income Tax Rate: 4.79%

- Property Tax Rate: 0.87%

- Median Home Price: $141,100

- 30 year cost of living: $249,777

6. Oklahoma

- Typical Income Tax Rate: 5.00%

- Property Tax Rate: 0.90%

- Median Home Price: $137,400

- 30 year cost of living: $249,498

5. Alabama

- Typical Income Tax Rate: 5.50%

- Property Tax Rate: 0.42%

- Median Home Price: $141,300

- 30 year cost of living: $241,604

4. Tennessee

- Typical Income Tax Rate: 2.00%

- Property Tax Rate: 0.74%

- Median Home Price: $167,500

- 30 year cost of living: $234,685

3. South Dakota

- Typical Income Tax Rate: 0%

- Property Tax Rate: 1.32%

- Median Home Price: $167,600

- 30 year cost of living: $233,970

2. West Virginia

- Typical Income Tax Rate: 6.00%

- Property Tax Rate: 0.59%

- Median Home Price: $119,800

- 30 year cost of living: $231,005

1. Mississippi

- Typical Income Tax Rate: 5.00%

- Property Tax Rate: 0.80%

- Median Home Price: $120,200

- 30 year cost of living: $224,048

Conclusion

There you have it. We’re all moving to Mississippi! Just kidding…

Admittedly, this is far from a perfect system. If you make more money, you should obviously prioritize a place with lower income tax. If you’re a shop-a-holic, maybe you should look into sales tax too. (And read a couple articles on this site – I suggest this one. 🙂 )

Nonetheless, I found it fascinating to see how much living costs vary across the country.

The thing I can’t shake from my head… how much different would my life be in dirt cheap Mississippi vs. crazy-expensive Washington DC? More similar than I’d think, I’d venture to guess.

And is it really worth paying twice as much to live in Minnesota versus neighboring South Dakota?

Definitely something to consider.

Where did your state stack up?

The Data

I’m sure lady wizard wouldn’t mind Mississippi 😉

Great article. However, Tennessee does not have an Income Tax. They have a 2% Hall Tax which most residents don’t have to file and will also be fully repealed in 2022 (bill already signed; decreasing in stages).

Interesting, Tennessee never gets mentioned in the 7 states without income tax. Seems it will soon be a sleeper no-income tax state!

Additionally New Hampshire does not tax wage income, only dividend and interest income @ 5%.

I think if you start from the top of your list (most expensive), you’ve just found the places that are most desirable to live 😉

That’s a joke of course. But there is a reason its expensive.

Or most desirable places to vacation. 😉

Haha yes! I was thinking that too but I guess I didn’t type it.

I live in a resort area, Palm Springs CA. So I save money by not needing to go anywhere else on vacation. All of the beauty in the world is right outside my door to enjoy day after day, week after week, year after year.

I am just down the freeway….pass area….and I agree. There’s no place like Southern California. It takes more than 2 hours to go to the beach, but on the same day I can go the opposite way and be in the mountains/snow. But the income taxes (I am still working) and the cost of everything else is awful. But once I pay off the house (3 years left) it’ll be smooth sailing!

Also California has two great programs called Proposition 60 and Proposition 90, which allow you to downsize your house (if you’re 55 yrs or older) and buy a new one and transfer your property tax base to your new home, there by saving you hundreds.

americanseniorcitizen.com

I am in the Pass area also, Beaumont, and I do love the ability to go to the desert, mountains, beach – all within a 2 hr drive.

Averages can be quite deceiving. we live in Dallas Texas and to live in a desirable neighborhood, you will have to pay $1-200k or more in addition to the average. Also the property tax can range between 2.25 and 3% in most Metro areas. The states with no income tax definitely help with the accumulation phase, but you would definitely want to look at property taxes when you are in your drawdown phase.

I agree with that Scott.. I live in the North Dallas area as well and property taxes fall right around that 2.25-3% threshold. With Texas being such a big state, I can see how the more rural areas of Texas would cause the average to drop considerably. I’m sure the same can be said for parts of Alaska and California due to their size and I’m sure they would also have high property taxes in more of their metro/higher populated areas.

You rock, Money Wizard. Thanks for putting all of this together.

I also live in the Twin Cities and would love to read a Minnesota-specific blog post!

As a resident of one of the deep red states on your map, I can confirm!

Nice to see Arkansas near the top of one good list since we are near the bottom of many others. It is a great state to live in if you like spending time outdoors. And unlike more famous venues like Yosemite you don’t feel like you are standing in line at a Disney park. On most hikes we might see two or three other hikers on a day hike. Very nice AirBnb’s are usually under $100 a night in scenic areas. So it is not only affordable, but it offers an uncrowded wilderness experience few states can match.

Someone wanting to move elsewhere needs to do this analysis on a city by city basis. My own state of Virginia has a huge range of taxes, from Northern Virginia’s McMansions and traffic congestion, down through the beautiful mountains. My wife and I moved in 2013 within the state, kept the same online job, and made/saved more money in a lower cost of living area of the state. We had to keep telling the realtor showing us houses we did not want to live in Roanoke City, but we did want Roanoke County, because we had looked at the business and property taxes.

This was an interesting read! I’m glad you took the time to build your own calculations because you’re right — most ranking systems are useless for early retirees and those pursuing it.

A couple of thing to keep in mind though when making generalizations across entire states:

1. Many states have a huge variety of housing options. The low end of the market might swing a state’s median home price into a budget-friendly area, but those might not be the locations where you’d want to live, if given the choice. Every state is going to have cheap areas.

2. The next iteration of this system should include the income side of the equation. True, South Dakota might be much cheaper than your area of Minnesota, but is the money as good? I left Utah (cheap) for Colorado (expensive), but came out ahead because my income increased by much more than my expenses did!

I agree with what Cassandra G. said! It would be cool to see you dive into this same analysis on an intrastate level, on Minnesota, for example.