Hey Everyone, today is a special day!

It marks the first of hopefully many more financial updates. As promised, I will be exposing my financials on a more frequent, monthly basis around here.

What do you mean by financial update?

Specifically, I’ll be tracking my Net Worth. Although it’s always struck me as a silly term, to imply someone’s worth is tied only to how many dollars they’ve managed to hoard, the fact remains that in the world of finance, Net Worth is king.

Rather than income, which can be spent at any level, or total assets, which can be funded entirely by a poisonous concoction of personal loans, mortgages, and credit card debt, Net Worth does not lie.

Let’s take a step back and get down to basics, since this is the first update after all. What is net worth?

Net Worth is simply a snapshot of your total wealth at a point in time. Put simply, it’s what you own minus what you owe. The finance speak for this is your assets minus your liabilities.

Assets include things like cash, savings accounts, retirement accounts, stock, your home, real estate, and basically any other investment or valuable in your name. Liabilities are your debts: loans, mortgages, credit cards, and any bills not yet paid.

Some Ground Rules:

Different people calculate Net Worth a few different ways, but I will keep things simple. For our purposes here, assets consist of what is in my bank account.

I’m not counting my car as an asset, because cars are money sinks. Yes, I could calculate the depreciation on a monthly basis or look up the Kelly Blue Book value every 30 days, but for simplicity’s sake we will not include the car.

Neither will artwork, collectibles, electronics, or any of my “stuff” count as assets. No, not even my awesome collection of ski gear makes the cut here.

Why are you even tacking this? I bet you feel real cool bragging on the internet, pal.

Definitely not. I am publishing this for a number of reasons, and I can promise you that bragging has nothing to with it.

First, personal finances are a very taboo topic in our society. Time and time again, personal finances rank as #1 most dreaded topic to discuss, outranking such heavyweights as death, politics, and religion.

I consider this a terrible failure of our culture. What is not discussed is ignored, or worse, is fraught with stress and confusion. I hope that by publishing my finances for the world to see, I take away some of this mystery.

Second, tracking and reporting all of this motives me, and I hope it motivates you too. I’m putting myself out there so you can learn from my successes and my mistakes. Hopefully there’s more of the first than the second.

For me, these reports are more than just numbers. Every increase in net worth represents progress towards my goals. The numbers do not lie; they hold me accountable to my biggest and loftiest goals. Every uptick in worth is a reminder that the financial discipline is worth it, because I can see right there on the page how I’m becoming closer and closer to freedom.

Okay okay, put your money where your mouth is already.

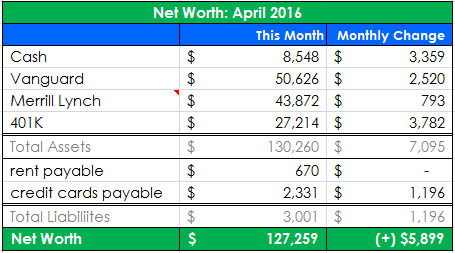

Fair enough. Without further ado, here is April’s breakdown.

April was a good month!

But I do have to admit I cheated. This update is really more of a month and a half, because my previous month’s net worth was actually calculated on March 10, while this month’s net worth was calculated at the end of April. So you’re seeing the benefit of an extra 20 days in those numbers. Rest assured, future calculations will be tracked at the end of the month for consistency’s sake.

Here’s how it all broke down:

Cash Savings: (+$3,359) I was pretty surprised by this myself, because an HR snafu at work led to me owing the IRS a pretty sizeable amount of taxes. While most of my co-workers were celebrating their sizeable refunds, I gritted my teeth as I wrote the government a $1,900 check.

Normally, I would not be carrying this much in my savings account. I always want my money working for me through investments, not just sitting around in a savings account and getting eaten up by inflation.

But with my 13-year-old, ridiculously inefficient gas guzzling truck valued at just $4,000 and sitting on nearly $1,000 in necessary repairs, I have been building up my reserves for the purchase of a newer vehicle. Like Randy Moss once so eloquently said, “straight cash homie.”

Vanguard Account: (+2,520) The total account value of $50,626 is broken down into two parts. $38,738 is invested in VTSAX, an index fund that tracks the entire market. The remaining $11,888 is a Roth IRA that is invested in VGSLX, an index fund which tracks real estate investment trusts.

For the month (and a half) of April, these accounts benefitted from $305 in quarterly dividends paid in the middle of March. Have I mentioned how much I love dividends? There’s nothing better than getting a check in the mail for having money.

I did not contribute any money to these accounts in the past month, so the remaining $2,200 increase was simply due to market fluctuations.

Merrill Lynch: (+$793) All of this increase is related to dividend payments and market changes. This account consists mostly of low fee, exchange traded index funds (ETF). Roughly, it breaks down to:

- $16,000 invested in vanguard ETFs that track the overall stock market.

- $4,000 invested in ETFs which follow the international and emerging stock markets.

- $6,000 invested in ETFs which follow the government and corporate bond market.

- $12,000 invested a large, individual dividend paying companies. McDonalds, Eli Lily, Altria, and Sturm Ruger & Company are some of the biggest holdings.

- $1,000 foolishly gambled in speculative stocks (specifically, a few different Uranium producers) that have CRASHED. We’re talking 50% declines. Ouch… but serves me right for trying to outsmart the market.

- $4,000 held in cash as a mix of an emergency fund and/or capital for future investments.

Remember earlier in this article when I said putting together these net worth updates holds me accountable? I am reminded of this right now. The majority of this account was formed when a younger, more naïve version of myself was convinced I could beat the stock market by picking individual stocks. My returns in this account have lagged the overall market quite a bit, and I’d be several thousand dollars richer had I just kept it simple.

BUT, this account was a great learning experience. All of my first investments occurred in this account, and the run ups in companies such as Altria and Eli Lily showed me the power of the stock market. Most likely, the thrill of these first few investments are what got me fired up to invest more and more money.

I have considered moving money out of this account, but don’t want to trigger a large taxable event by selling everything. I’m currently in the process of researching options here.

Maybe I’m sentimental about these holdings and don’t even know it?

401K: (+3,782) I decided to max out my 401K this year, and it’s been mesmerizing watching this account skyrocket since. Without a doubt, this has been the most powerful wealth building decision I’ve ever made, thanks to the benefit of investing pre-tax dollars and reducing my taxable income at the same time. This account is invested in a mix of small to large cap index funds and bonds.

Rent Payable: (+ 0) This amount includes rent and all utilities, and is pretty consistent month to month. I rent a modest two-bedroom apartment with my girlfriend near Minneapolis, Minnesota. Apparently a lot of people are afraid of snow, which allows this native Texan to enjoy a pretty low cost of living. It sure beats the $1,300 per month I was paying for a 1 bedroom, suburban Colorado apartment.

Credit Cards Payable (+1,196): This amount includes all of my monthly statements for all cards. Spending was up this month thanks two vacations: a ski trip to Lake Tahoe, California and my first ever visit to New Orleans. To add insult to injury I also bought a $380 ski pass for next year. (And yes, I miss the delicious New Orleans food already.)

Right now I’m on pace to end the year having lived off right around $22,000. This includes all rent, living expenses, groceries, splurges, entertainment, etc.

Using the 4% rule, this means I’m technically already 23% of the way saved to complete financial freedom! Pretty crazy to think about.

Obviously that stat means ohh… just about nothing, since I’m sure my living expenses are bound to change drastically as my life continues and my family grows. Nonetheless, I’m still covering my ears and chanting “la-la-la-la” while I allow myself one free pat on the back.

Calculate Your Own Net Worth

If you’ve never calculated your net worth before, or even if it’s just been a while since you’ve checked, give it a shot! Log into all of your bank accounts, dust off your 401K account information, search for cash under the couch cushions, and subtract your outstanding debts.

No matter where you are in the financial journey, analyzing your net worth can be an enlightening, and dare I say, fun exercise. Give it a go, and feel free to celebrate (or curse) in the comments below!

Let me know what you think of these net worth updates below. And as always, feel free to send me a note about anything and everything through the contact page.

I love when people give net worth updates! You can learn a lot when people let you inside their financial lives. Ate both you Vanguard and Merrill accounts taxable? Great job on saving already! I was no where near those numbers a few years ago when I was 25!

Thanks Thias! It’s definitely a little strange to be completely financially exposed, but I’m glad to hear people are finding it beneficial!

Both the Vanguard and Merrill accounts are taxable, although $12K of the Vanguard account enjoys the tax benefits of a Roth IRA.

This still leaves quite a large portion in taxable accounts, which admittedly is not the most tax efficient way of doing things. We’ll chalk that one up to a young reluctance to embrace the 401K. Eventually though, I learned to stop worrying and love the 401K. 🙂

This allocation should change some moving forward though. These days, over 3/4 of my yearly savings are going to tax advantaged accounts, either through the 401K or my Roth IRA.

Wow, 25 yr old and already in the 6-digit club, congrats! I’m 26 and catching up:) A net worth update is long due for myself…

I’m sure you already know this, but your ML account is not the most tax efficient. My taxable account is solely composed of two funds: VTSAX and VFIAX, so ideally all rebalancing would take place in my 401k. VFIAX is solely for tax loss harvesting purposes.

I have my Roth in Lending Club, which I totally regret doing. Now I’m figuring out the best way to divest.

I love Lending Club, and I will explore investing some “fun money” with them now that I live in a state where it’s allowed. But I agree with you, I’d feel uncomfortable investing retirement money in borrowers who, for the most part, are right on the cusp of insolvency.

You’re right about the ML account and taxes, particularly as it relates to the bond holdings in there.

Definitely give the Net Worth update a shot yourself! You might be surprised what it will highlight; I know I was! Oh, and don’t feel too far behind… I just turned 26 a few months ago. 🙂

Enjoy your sense of humor kind sir…I like to chant la-la-la once in a while myself. And then I face my facts and keep on saving. 🙂

We’re all allowed a free pat on the back now and then!

I just started to read your blog. I have a lot of catch up to do. Next year my wife and I will be debt free and I’m currently reading as much information as possible so we can start investing. do you have a podcast? and where else can your content be found. Thank you for sharing this is really inspirational

No podcast. Every post I’ve ever published can be found in the archives. I also have a Best of My Money Wizard page that highlights the most popular posts.

If you had a primary home, would you consider the mortgage a negative in your net-worth analysis?