How long will it take me to double my money?

We all want to double our money right? This is the whole entire allure behind gambler’s “putting it all on black.” Plus, as the saying goes, if you double your money you double your fun. Count me in!

But there’s an easier way to double your money without the risk of losing everything to a rich casino owner. It involves smart investments and the magic of compound interest.

Taking this approach does require a little more time and patience than one spin of the roulette wheel, but on the plus it comes with the added benefit of not losing everything in the blink of an eye. Just how much patience? The rule of 72 is here to help.

The rule of 72 is a financial shortcut that tells you approximately how many years it will take you to double your money, given a specific rate of return.

Typically in finance, calculating the doubling time requires the use of complex future value algebraic equations or dusting off the old financial calculator. With the Rule of 72, we can get an approximate answer using nothing more than basic division.

How to Calculate the Rule of 72

It’s pretty simple:

Divide 72 by the rate of return = the number of years for your investment to double

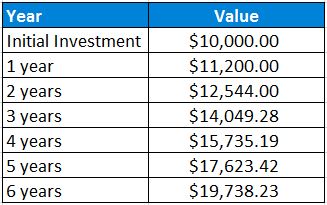

Let’s see it in action. If you have an investment which returns 12% every year, divide 72 by 12 and you get 6 years. Pretty easy!

This. Changes. Everything.

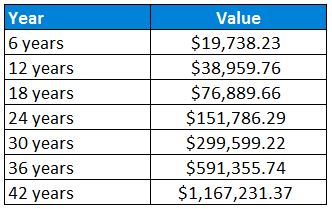

Here’s the amazing thing about the Rule of 72. Your investment doesn’t just double once and stop. In the above example, your money keeps doubling every 6 years. Forever.

This is the magic of compound interest at work. Let’s keep it rolling, remembering that our initial investment was $10,000.

Amazing isn’t it? In this example, a 22 year old could take $10,000 from his first salary, and by the standard retirement age of 64, his investment would have doubled and doubled itself to a startling $1.2 million. Even the best money wizard would be impressed by that sort of magic!

What Else the Rule of 72 Means

There’s an important first step in benefiting from the rule of 72. You have to invest your money!

The rule serves as a friendly reminder that unnecessary purchases not only hurt your wallet today, but they hinder you from experiencing that doubling magic, every few years, forever. Like an annual light storm or lunar eclipse, every few years it occurs and you just have to stop and marvel at the beauty.

Let’s imagine our 22 year old friend foolishly spent that $10,000 after going to Vegas and losing it all on black like an impatient fool. His retirement aged self would be $1.2 million poorer! That’s a lot of vacations.

The Hidden Cost of Not Investing

There’s another interesting, and perhaps more alarming, tidbit we can learn from the Rule of 72: the hidden costs of not investing.

Historically, the average inflation rate in the United States is right around 3%. At first glance, this doesn’t seem too bad.

But using the rule of 72, we know that a 3% return doubles ever 24 years.

This has a huge implication. Any savings which are not invested will lose half of their value to inflation every 24 years.

Sorry doomsday preppers, burying your cash in the back yard is not a wise financial decision.

Putting the Rule into Action

The rule of 72 is intended to be a fun, rough guideline. In practice, rates of return are rarely constant, and varying interest rates as well as the order of returns have very real impacts on your portfolio’s bottom line. But as a quick and dirty roadmap, the rule of 72 is a powerful estimation and an incredible example of the power of compound interest.

As an investor, time is your greatest asset. Every day, month, and year that your money sits idly is time that you can never get back. The sooner you invest, the sooner The Rule of 72 can be on your side.

Where can I get a 12% return on my investments??? ? I need to know!

Haha, I do too! 12% was just too perfect of a number to pass up for illustration’s purposes.

I always bet on black.

I love how The Rule lets you envision how your smallish investment can grow to be huge someday. I hate how it can talk you out of spending money today. Just think of the opportunity cost!

On second thought, maybe that’s a good thing.

Cheers!

-PoF

I always bet on black too. Let’s just say my stock market investments see better returns than my casino ones…

This is the reason the world is going into negative interest rate; PEOPLE SAVE TOO MUCH.

The negative interest rate environment is pretty wild, no doubt about it.

I think we’re on the same page here Rudy. But to avoid confusion for others: It’s worth noting that when I advocate “saving” on this website, the default meaning can be assumed as stock market investment. Negative interest rate environments are primarily the result of investors hording cash and/or fleeing to bonds. Stock market investments are entirely productive to the economy as a whole.

In case anyone doesn’t already know, using 69 instead of 72 gives a better approximation. The number 72 is only useful if you are doing the division in your head, since 72 has more factors that 69. So, it should be “the rule of 69”. It’s also better because 72 gives an overestimate. Nobody wants to over-estimate how long it takes for their money to double.

One could dig into the details to see that this is because 100 ln 2 is about 69. So, it should be “the rule of 100 ln 2”. Or, if you express your rate as a fraction (like 0.12 instead of 12), it should be “the rule of ln 2”, which still ends with 2 and sounds as good as “the rule of 72”. The downside is your calculator has to have the ln button.

Great point Mark, thanks for sharing!