By this point you’re probably sick of hearing me harp about the importance of tracking your spending.

The regular readers will recognize that I mention it during pretty much every net worth update. I bring it up whenever I’m interviewed by the media. And there’s even that time I linked to someone else talking about it in a recent monthly Link-O-Rama.

Safe to say, the horse is sufficiently dead.

So of course, I’m going to talk about it again.

I know, I know. With the frequency and ferocity that I talk about tracking your spending, you’d expect recording your expenses for a month to be the personal financial equivalent of winning the Powerball. And that’s not quite the case.

BUT… it’s pretty darn close.

Put simply, tracking your spending is THE easiest way I know to gain control of your finances. Period.

Why? Because to improve something you have to understand it. And to understand it, you have to track it. Otherwise you’re just fighting a ghost.

Once you’ve shined a light on your ghost of a budget, it can no longer hide. And when every detail of your spending is highlighted, it becomes laughably easy to spot the areas of improvement. Progress becomes unavoidable.

Unfortunately, Most People Don’t Track Their Spending

As amazing as all those benefits are, most methods of tracking your spending are a huge pain in the ass.

Meaning chances are, you’re not doing it.

How do I know? Because I run an entire blog that hinges on my spending patterns, and even I couldn’t muster up the willpower to consistently track my spending every month.

Sure, I review my spending once a month through Personal Capital. But for good measure, I prefer to manually record my expenses in a spreadsheet too.

This may seem redundant, but I’ve found there’s a certain magic to putting pen to paper, or in my case, keypad to excel spreadsheet. As Raptitude explains, simply becoming aware of the numbers behind your behavior will change your priorities, and soon you’ll find yourself spending (and saving!) more efficiently.

In the past, this involved opening Microsoft Excel at the end of each month, combing through my credit card statements, racking my brain to remember small transactions from weeks ago, and then praying I didn’t miss anything important.

This sounds intimidating, and it was. I appreciated the result, but I started to dread the chore.

I attempted to ease the process by keeping running a note in my phone. Even this proved easy to forget, and it turns out the electronic equivalent of napkin paper notes isn’t the most organized tracking system.

I thought I was S.O.L., right until I stumbled onto the iPhone’s Numbers app, and I’m now convinced it’s the single best system to easily track your spending patterns.

How to Track Your Spending with Apple’s Numbers App

I first came across this awesome strategy thanks to DirtCheapWealth.com. The premise is simple enough: use an app already installed on your phone to track all your spending.

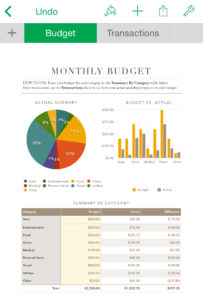

After manually recording your expenses, the app automatically organizes your spending by category. At the end of the month, you’ll have a super snazzy report to help you spot any patterns.

In other words, forget the spreadsheets, credit card statements, and napkin notes. Numbers makes gaining control over where your money is going as easy as sending a text message.

As it turns out, the app has been sitting in my phone next to Garage Band and iTunes U (whatever that is) for years. At some point, I must have shuffled Numbers into my “Extras” folder, which is the abbreviation I use for my Folder of Annoying Default Apps that Apple Somehow Keeps Installing on My Phone.

Basically, Numbers is Apple’s version of Microsoft Excel. And it just so happens to be the easiest spending tracker ever, because:

- It’s extremely simple to use.

- It’s in your pocket all day long. Score one for convenience!

- You don’t even have to download anything.

Setting up the spreadsheet to automatically categorize my spending caused me a little headache at the start, so I thought it’d be beneficial to publish a quick tutorial.

Don’t be like me and spend a few hours googling for instructions that don’t exist. Spend 10 minutes setting up a template using my instructions below. Once the template is set, it’s not an exaggeration to say that tracking that tracking every single expense takes no more than a few seconds a day.

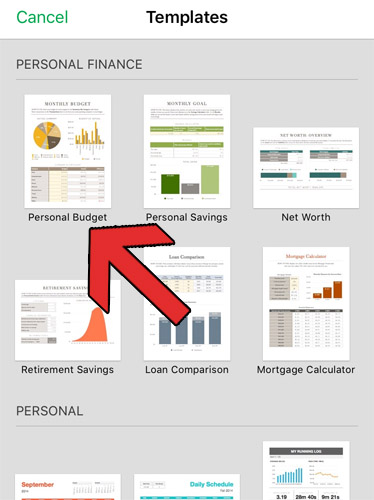

1) Create your monthly budget template

Open the app, click the “Create New” plus sign, scroll down to personal finance, and select “Personal Budget.”

2) Customize the budget

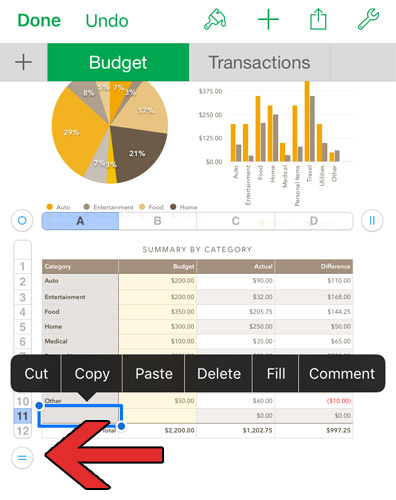

Apple will have already entered an example budget. Rename the categories by double clicking on the cells. If you want to add more categories, click any cell and press the blue “=”sign.

3) Make transactions insanely easy to track

Press the “Transactions tab.” This is where you’ll add a line item each time you spend money during the month.

You’ll notice that clicking any cell in the “Category” row lets you quickly classify your spending, rather than recalling and typing out each category by hand. This is a huge time saver, BUT if you’ve added or changed any of the default categories, your new categories won’t show up on this multiple-choice list just yet.

The key to making this app ridiculously easy to use is to get those categories working smoothly. We want everything to match, which allows the budget table to automatically update.

To do this, we need to edit the row’s formatting to be what Apple calls a pop up menu. Here’s how:

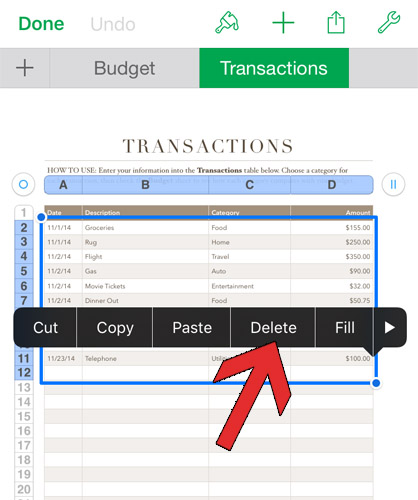

First, delete all the example transactions by dragging the blue circle in the corner and clicking “delete.”

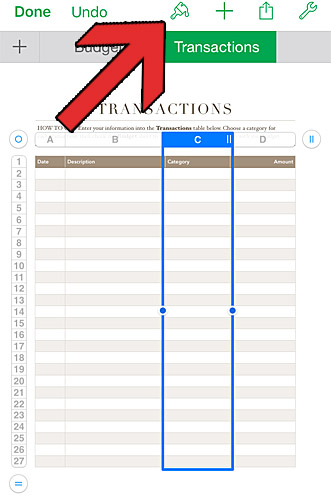

Then click “C” to highlight the entire row, and click the paint brush button to open up cell formatting.

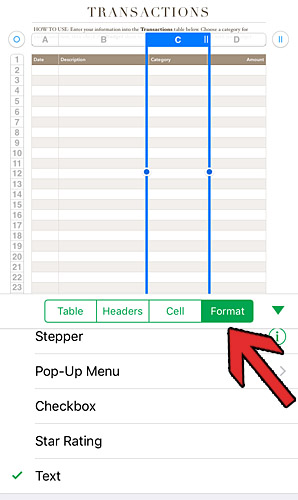

Click “Format”

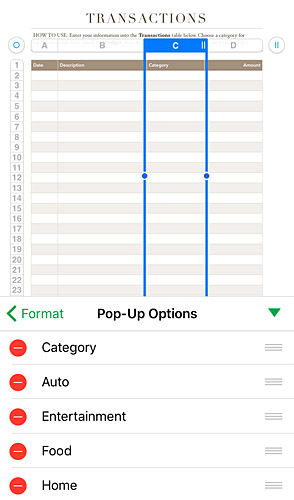

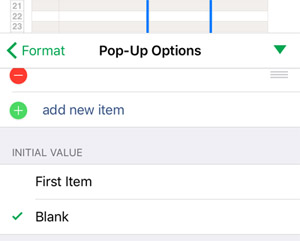

Choose “Pop-Up Menu.” Here you can edit all the categories to match your budget.

When you’re done adding categories to match your budget table, make sure to scroll to the bottom and make the “Initial Value” set to “Blank.” This will make adding new rows, aka transactions, easier as the month goes on.

4) Enjoy the easiest budget tracker ever!

It’s time to start tracking!

Each time you open your real-life wallet, simply take out your phone and spend the 3 seconds it takes to add a new transaction to your Numbers spreadsheet. Staying in total control of your money could not be easier.

At the end of the month, you can export your fancy report in all sorts of formats, including Excel and PDF. You can even share your reports with others, if you feel like bragging about your frugal wizardry! DirtCheapWealth does a good job explaining how to export and share the reports here.

Conclusion

I can say with 100% honesty that tracking my spending may be the single most important habit that set me on my course of big saving.

And Numbers is far and away the most convenient method I’ve found to do so. Put simply, I’ve been completely blown away by this app, and I hope you are too!

Random Tips:

- Turn on your credit card’s mobile alerts. Why? Push notifications flying across your phone’s home screen will remind you to update your spreadsheet, and will make remembering the cost as easy as copy and paste.

- If you’re not a fan of 1970s yellow and brown, you can change any chart’s color scheme by clicking it and pressing the paint brush button.

- If you’d like a free copy of the exact budget template I made, sign up for the Money Wizard email list using the form below, and I’ll send it over. 🙂

Related articles:

Another great post. Since I am dirt poor, I use Google Sheet from my Android phone. It works just as well.

One nice thing about our own budget sheet that I find is:

1. greater control of your finance

I don’t have to input the transactions that I know would get refunded later.

Unnecessary credit card payment transactions / or transfer transactions.

2. you can add more charts to your liking. More visual the better.

3. you can improve your sheet if you happen to see something cool in other finance app

One example is I somewhat imitate LevelMoney’s spendable money that shows higher overview since it is easier than “I am half way of the month, I use only 35% of shopping, but I am over 80% of eating out, am I doing okay or what?”

4. It is yours.

No need to get freaked out when Mints just counts every transaction twice, messing your budget. Total control.

One bad thing is I have to input things manually. But it actually helps because it makes me look at my budget before going out for clothes shopping.

Nice comment. Like you said, I’ve found the negative of a tracking spreadsheet (manual input) is actually a positive, since it makes you more aware of your spending habits.

I was thinking the same thing! Also, what are your thoughts about the budget items that are quarterly/annually? Should you just put the monthly “actual” amount and just leave it in your bank? Or should you transfer it to another account and then pay from another account when the payment is due?

I’d like to know the best way to do that too.

What I like to do is break those down by the month and pay that as a monthly bill to my second account that my standard monthly bills are paid from (nothing else comes out of that account except my Living expense bills i.e. rent, utilities, etc.). That way when the bill comes through quarterly or annually it is already in that account. This also gives me a monthly view of the bill versus just a once a year “boom” here is this bill you forgot about.

Hope that helps

What are your thoughts on using something like Mint instead? That way it automatically updates?

I hate Mint. It doesn’t actually update credit card transactions as individual ones. So even though I use my credit card and pay it off every month, it’s one lump sum that needs to be manually broken up. It just didn’t work for me. I had even contacted them about it, but they said that it wouldn’t be something that they were expecting anytime soon.

I hate mint also.. I have used excel and then got out of habit because of the hassle of it all and thought to try mint. I gave it a year but it isn’t as awesome as it sounds. I hated most that I couldn’t set a budget in advance of the month. I had to wait till the 1st. I am trying this numbers budget and will see if I like it. Like Lee said, not lump payment can be broken up and tracking your true spending only works if its one category expense at a time. Thumbs down for mint!!

Great post. Would like to have your free sample, but since I’m already subscribed I can’t seem to get it..

And I lied, again to impatient. It landed in my mailbox. Sorry and thanks again for the great tips!

This is a great idea. I currently use Penny, which is an iPhone app (I have nothing to do with it and I don’t get any kickbacks from them, it’s just what I use.) It’s free and, if you are like me and only use your credit card to pay for everything to get the points and then pay it off 100% at the end of the month, it will automatically pull in all your charges and categorize them and send you notifications anytime you make a charge and it’s free! Great for tracking to see if your card has been stolen too. Again, this solution only works if you charge everything really. The Numbers solution is awesome for people who go cash.

I would love your template, but since I’m already a subscriber (who is catching up on posts) how would I get it!?

I sent it out to all the existing subscribers before I published this post. Check your inbox from August 22,, and don’t forget to check the spam folder. Let me know if it’s still not there.

Is there a way to use Siri to dictate transactions to the spreadsheet without even opening Numbers?

Thanks you very much for this instruction. It’s very hard to find advice how to changes the categories in Numbers of ios / iPhone. (I mean when you change the names of the categories in the sheet ‘Budget, they won’t show in the sheet ‘Transacations’.

Still it doesn’t work for me. In my version (Dutch, 3.3.1) it doesn’t show the option ‘format’. It only gives the four categories (translated) Table Cel Notation Organize. So no option to format. It frustrates me a lot, because I’ve been trying to find information for quite a while now. I hope you can help me.

Did you ever figure out the answer to your problem? I seem to have the same thing and was hoping that it was answered here. 🙁

All, I used to use Mint and now switched to Tiller. Tiller uses pre-built Google Sheet templates (like Numbers) but actually auto-ports in your transactions from every account (Bank, Credit Card, etc.).

So, it blends the great things about “Numbers” above (Spreadsheet based templating/tracking) and the best part of Mint (auto-populating).

You actually create the auto-population, so whereas Mint made errors as it “guessed” how to auto-categorize, this works significantly better.

If you like to manually type in your transactions on a daily basis, numbers is probably great. However, we have way too many transactions in our busy family of 5 to stay on top of it. Right now, with a weekly check-in, we can categorize open transactions in about 5 minutes time.

Instructions on how to sort Category names alphabetically would be helpful and is there a way to manually move/sort Category names (Yes maybe, while in pop up menu mode – but change in order in pop up menu mode is not reflected in spreadsheet) or simply create new category rows exactly where you want them ?

When you’re done adding categories to match your budget table, make sure to scroll to the bottom and make the “Initial Value” set to “Blank.” This will make adding new rows, aka transactions, easier as the month goes on.

None of the changes show up and you do not state how to exit Formatting and insure your changes are saved. Also you do not give an example of entering data so that users following your instructions are sure they are doing it correctly and know what to expect. If you are doing this for the first time you many want to add data from previous months so that your annual budget can be accurately determined.

Does Numbers automatically know when a new month begins ? Do you need to save a record every month or does Numbers allow you to review/select a specific time frame/month and how do you do that ?

Formatting the pie charts and graphs would be nice to include.

I think these instructions leave some important considerations up in the air.

Thank you for this tutorial. It was exactly what I was looking for. I have not created may spreadsheets so I am a beginner. My question is once I complete a budgeting month and need to start the next month, do I need to copy and paste my budget into the template again or is there an easier way to do that?

Thanks

Corinne

You can duplicate the spreadsheet by holding down on it and pressing copy. 👍

I cannot figure this out. Sometimes I format it correctly, and I can use Numbers. Then the next month I forget what I did, and it just won’t format. For example if I erase their sample budget, and even try to use their categories, and erase their sample transactions, the transaction won’t transfer to the budget. I need more detailed instructions. Or did Apple change the way Numbers works? Please give me more step by step instructions for the newest operating system.

Hmmm… I never update my iPhone so it is possible that the instructions don’t match up exactly with the latest iOS. One tip though – once you get everything formatted, make a duplicate of the spreadsheet. You can then start with that each month, so you won’t have to reformat every month.

I am still trying to get this program to work. I am using the desktop Mac, not the iPhone to set it up. The transactions just won’t show up in the budget as spent. I know the iPhone apps often work differently than the desktop. I want to use the desktop Mac to set it up. Can you direct me to where I could get help? I looked at all the message boards and a few other people seem to have the same problem. I have Apple Care. Do they give help with software issues like this? My basic problem now: the transaction does not get subtracted in the budget. And I am careful about the spelling, so that is not the issue. Please help; I really want to use this. (and a few months ago, it did work for me)

The same thing you do to the Transactions tab, is the same thing you have to do in the Budget tab. When you edit the categories in column C of the Transaction tab, you will also have to edit the categories in column A of the Budget tab. At least this is the way I was able to get the spending to reflect on both tabs.

First time working w/numbers. I have no idea how to make the pop-up menu work. I get to the options pane, but I can’t figure out how to populate the cells with the selections.

Never mind. Figured it out. Thx for helpful article.

How?? Please help!

This saves me a lot of money on unnecessary expensive apps, thanks mate.

I am not seeing the “transactions” tab. And I did select the Simple Budget template. Any suggestions? Thank you.

Hey can u convert the spreadsheet from the number’s format to XLS for those without an Iphone

How Do i link the transactions to the budget sheet

Thank you so much for this Step-by-Step tutorial! I spent more time then I’d like to admit about to rip my hair out because I could not figure out how to add the drop down categories on the Transaction page. This was exactly what I needed and now everything is syncing beautifully! Many thanks!

Thank you for this. I was going insane.