Pop Quiz: What’s one of your most important yet underrated financial assets?

Hint: It’s not a typical asset, because you can’t buy it, sell it, or invest in it. But it can still leave you thousands of dollars richer or poorer.

The answer is your credit score.

Your credit score is the mysterious key that:

- unlocks the best interest rates on home and car loans

- allows you to get accepted for credit cards lucrative enough to take advantage of travel hacking

- is even checked by your phone and internet company before setting up your account…

It’s calculated on a numerical scale from 300 to 850 by the three major credit agencies. (They are Experian, Equifax, and TransUnion) Each company has their own proprietary mix they use to calculate your specific score, although all scores are based on the same common factors.

For this article, the specific details of the formula don’t matter. What does matter for you, and anyone else who doesn’t want to pay thousands of dollars in extra payments over their lifetime, is that those scores are accurate.

Here’s the scary part… The FTC recently reported that on average, 1 in 5 people have serious errors in their credit scores.

The solution? We’ve gotta get monitoring those credit scores like thousands of dollars depends on it. Because it does!

Credit Sesame vs. Credit Karma: Reviewing The Two Most Popular Free Credit Monitoring Tools

Enter Credit Sesame and Credit Karma, two of the most popular free credit monitoring tools.

On the surface, the two products are very similar. Credit Sesame and Credit Karma both:

- Provide you with a free credit score

- Help you monitor your credit for suspicious activity or fraud (Yes, that’s really important!)

- Show you the details of the underlying factors impacting your credit score

- Give you recommendations to help improve your credit score

- Are free! (Hooray!!)

But beyond that, the two apps have some subtle differences. So, I thought it’d be worth breaking down the two choices.

(Special shout out to all the readers who suggested this one after my 5 favorite money saving tools post.)

Enter the latest showdown in our familiar money app review format – Credit Sesame vs. Credit Karma.

Round 1: Dashboards

After you’ve entered all the info needed for the apps to pull your credit information, you’ll be sent to each app’s main dashboard page. These are the hubs of the programs, and the first area we’ll be diving into during our review.

Credit Karma Dashboard:

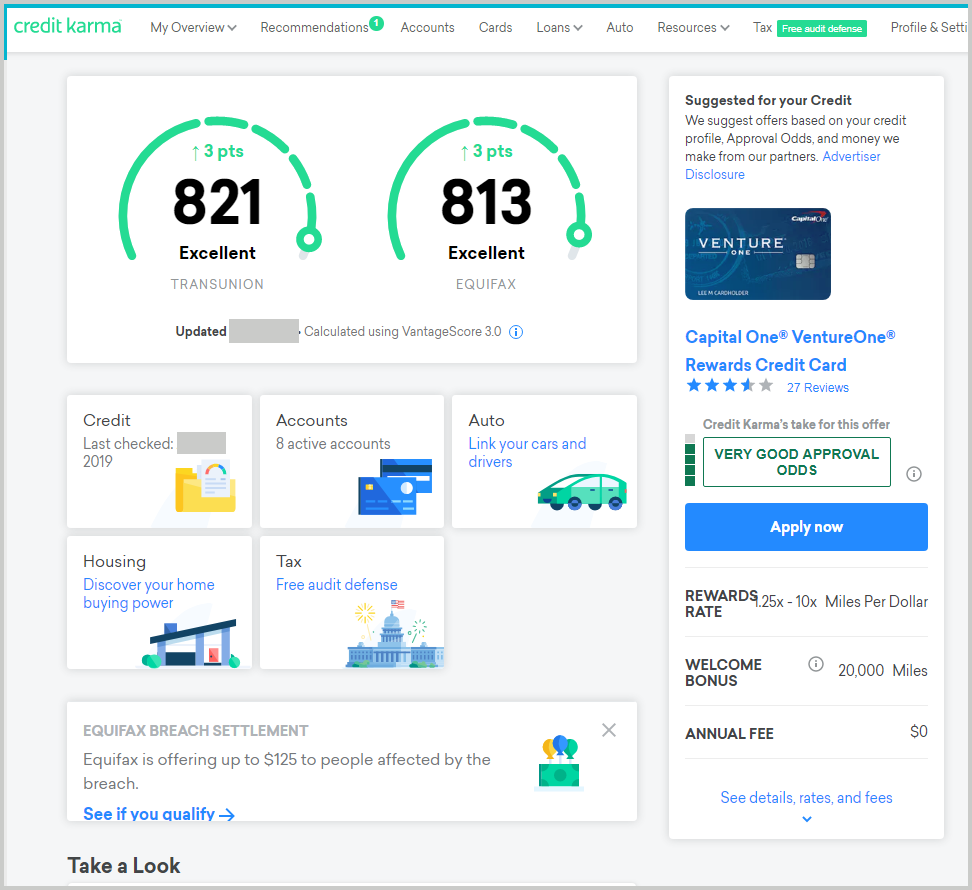

Not surprisingly, Credit Karma’s dashboard focuses on your credit score. You’ll immediately see your specific score for two of the three credit agencies (TransUnion and Equifax) and you’ll also get a neat historical graph of your credit scores over the past several months.

Of the other areas, I find the “credit” box most useful. Clicking it opens up all the different factors impacting your credit score. For each factor, Credit Karma lists some helpful benchmarks to compare yourself against.

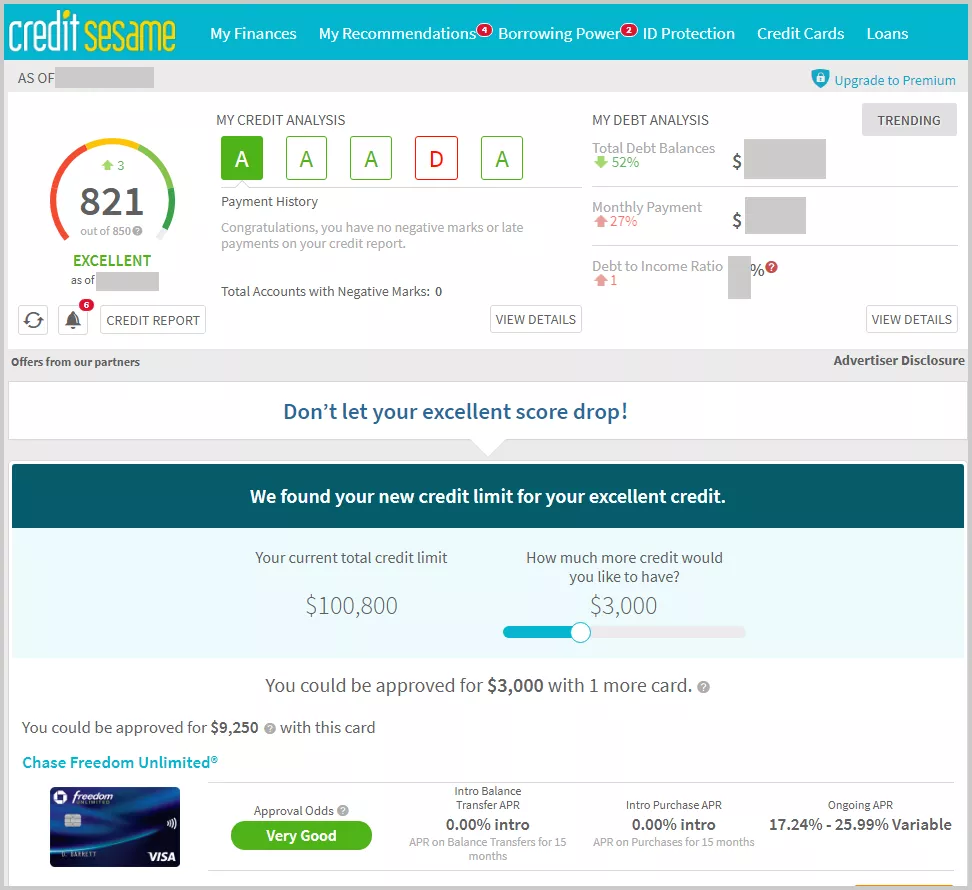

Credit Sesame Dashboard:

The design of Credit Sesame’s dashboard looks a tad more dated than Credit Karma. That said, we’re checking our credit scores, not exactly entering art competitions here.

Unlike Credit Karma, you’ll only see 1 credit score, not two. (More on that later…)

What I do like about Credit Sesame is how their credit analysis gives you a quick summary of the 5 credit factors. The summary translates all the confusing scales and criteria into an easy to understand “A” through “F” Rating.

I also appreciate that Credit Sesame shows your “Total Debt” front and center. For somebody working their way out of debt, this could be a hugely beneficial and even motivating feature.

Winner: Very close overall, with my personal preference leaning towards Credit Sesame for the easy to understand information.

(Narrow) Winner: Credit Sesame

Round 2: Which is more accurate – Credit Karma or Credit Sesame?

There’s really two parts to this question.

- How accurate is the underlying information used?

- How accurate are Credit Karma and Credit Sesame’s Credit Scores?

In this round, we’ll look at the accuracy of the underlying information, because it’s a little easier to evaluate. (We’ll tackle the second part of that question in the next round.)

What credit bureau does Credit Sesame use?

Credit Sesame accesses data from TransUnion, which is one of the three major Credit Reporting agencies that banks and other institutions rely on for calculating credit scores.

On that front, Credit Sesame’s information about the underlying credit factors should be totally accurate. So long as it relates to TransUnion…

The big catch, of course… what about those other two credit agencies.

If they have information not showing up in your TransUnion history, you won’t see it here.

The most common example of this would be a credit inquiry. Say you apply for a credit card, and the bank pulls your credit information from Experian. This will show up as a “credit inquiry” on your official Experian Credit Report, but may not appear on your TransUnion or Equifax report.

The overall impact of these differences is relatively minor, but certainly worth mentioning.

What credit bureau does Credit Karma use?

Credit Karma has a bit of an advantage here. Their software accesses data from both TransUnion and Equifax.

As far as Credit Monitoring, this provides an obvious advantage. You now have the chance to catch any suspicious activity in two of the three possible places.

Winner: Credit Karma. Technically, both Credit Sesame and Credit Karma are accurate. But Credit Karma has the advantage of more information, which may be more useful to you.

Round 3: How accurate are their specific credit scores?

For most people, the answer is “accurate enough.”

That said, there’s some notable caveats to that statement. Strap in, because it’s about to get complicated in here.

Credit Sesame and Credit Karma both rely on a scoring model called the “VantageScore 3.0.” The VantageScore is an actual credit score, and even more confusing, it’s developed as a joint venture between TransUnion, Equifax, and Experian.

The big catch? Most lenders don’t actually use the VantageScore.

Instead, when you apply for a loan, your lender is probably using Fair Isaac Corporation (FICO) scores. (According to Fair Isaac, over 90% of the scores used to make lending decisions were various versions of FICO scores.)

For this reason, the VantageScore used by Credit Sesame and Credit Karma is jeeringly referred to not as a FICO score, but a FAKO score. The credit agencies prefer a softened term – they call VantageScore an “educational” credit score.

Despite these confusing differences, one government study found that all the different scoring models would still place consumers in the same credit quality category 73-80% of the time. (In other words, you’d get the same interest rate 8 out of 10 times, no matter which score the bank relied on.)

So, how accurate is the Credit Sesame score? (Aka… how close is the Credit Sesame score to FICO?)

Well, we know Credit Sesame uses TransUnion’s VantageScore 3.0.

And since I stop at nothing to get the inside scoop for fellow Money Wizards, I pulled my “more official” TransUnion FICO score for this review. (You can get yours by paying $20 to MyFICO.com, although many credit cards also offer a free FICO score as a cardholder benefit these days.)

The verdict?

Credit Sesame reported my credit score 33 points higher than my FICO score. (820 at Credit Sesame vs. 787 through FICO)

While 33 points might sound like a lot, it’s worth mentioning that the cutoff score for the best interest rates is usually anything above 760. In which case, I’d still classify Credit Sesame’s score as “accurate enough.”

Two other important points:

- Not all Credit Sesame scores will be exactly 33 points higher than FICO. Some users actually report Credit Sesame scores lower than their FICO scores. It all depends.

- Even a purchased FICO score may not be the exact same scoring model your lender uses. With so many different models used, there’s never any guarantees. (Which is exactly why getting “close enough” is usually fine.)

How accurate is the Credit Karma score? (How close is the Credit Karma score to FICO?)

Credit Karma also uses VantageScore 3.0, for both their TransUnion and Equifax scores.

Like Credit Sesame, Credit Karma also showed an 820 TransUnion score, which was 33 points higher than my FICO score. No surprise there, since they’re using the same VantageScore as Credit Sesame.

Credit Karma reported my Equifax score at 808, which 28 points higher than Equifax FICO score of 780. Again, I’d classify this as “close enough.”

Winner: Draw. Both Credit Sesame and Credit Karma use scores which aren’t 100% accurate, but are probably close enough for monitoring purposes.

It’s also worth noting that the main benefit of these credit monitoring services is exactly that – credit monitoring. For that reason, I put more stock in the monthly changes in credit scores that these services provide, rather than the absolute number itself.

Round 4: How do they make money?

A wise question to ask any time you’re dealing with a free service. (You don’t want some shady company selling off your credit info to the ‘ze Russians, do you? Me neither.)

Both Credit Sesame and Credit Karma make most of their money through referrals, mostly to credit card companies and banks. So, don’t be surprised to see few ads for credit cards, pre-qualified loans, etc. sprinkled throughout your dashboard.

I didn’t find any of these to be too intrusive at all, but if the sight of ads drives you completely nuts, you may want to look elsewhere.

Credit Sesame also earns money if you upgrade to their “premium” service, which comes in three tiers ranging from $10 to $20 a month. A premium account gets you access to VantageScores from all three bureaus, advanced monitoring, and expert help.

Personally, I’ve been plenty happy with the free version, and I imagine all the premium features would probably be overkill for most users.

Winner: Draw

Round 5: Bonus Features

Outside of the obvious monitoring, both Credit Sesame and Credit Karma sport some awesome extra features.

Extra Features from Credit Sesame:

Credit Sesame comes with a few neat extra features, but we’re really only interested in one of those features, because it’s that awesome.

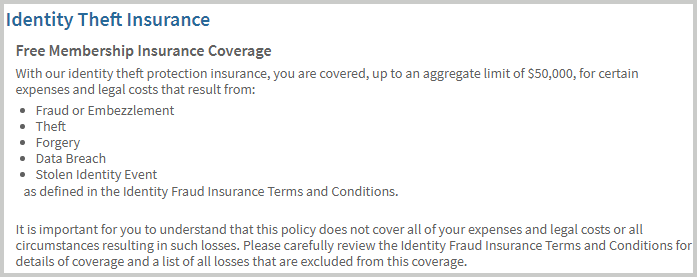

1) A free $50,000 worth of Fraud Insurance: If you’re a Credit Sesame member and your ID is stolen, Credit Sesame automatically provides $50,000 of ID Theft insurance and a free helpline to talk with experts.

In a world of constant data breaches, this is awesome, and in my opinion, absolutely worth the free sign up by itself.

Extra Features from Credit Karma:

Credit Karma doesn’t have anything quite as awesome as Credit Sesame’s free insurance, but they hold their own.

1) Credit Score Simulator: Credit Karma includes a tool that helps estimate what will happen to your credit score under certain scenarios. Those scenarios run from ho-hum activities, like opening a new credit card or getting a credit limit increase, all the way to the truly boot-shaking-scary, like having your wages garnished or going into foreclosure.

2) Free unclaimed cash: This is a weird one, but actually more common than you think. When businesses owe you money, a lot of time they will turn that cash over to the state. Credit Karma lets you run a search for your name and state to see whether, say… you skipped town before your internet provider got a chance to return your over-priced deposit for their crummy wireless router. Not that I’d know anything about that…

3) Miscellaneous calculators: The dashboard includes handy links to a few different calculators, like a mortgage repayment calculator, debt refinance calculator, etc. These aren’t anything groundbreaking, and all can be found in a million places with a quick google search, but it can’t hurt to have.

Winner: Credit Sesame. Credit Karma’s simulator and other features are really neat, but as far as I’m concerned, SHOW ME THE MONEY! A free $50,000 insurance policy is incredible, and enough to convince me that everybody should take the 90 seconds to sign up for Credit Sesame.

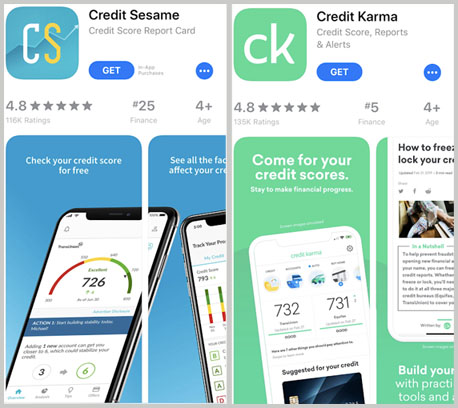

Round 6: Mobile App

Both Credit Sesame and Credit Karma offered mobile apps for my iPhone. And interestingly, both apps have identical 4.8 star-ratings.

I can agree with those ratings, because in my couple weeks of testing, both apps worked A-Okay for me.

Winner: Another draw! It’s getting down to the wire!

Credit Sesame vs. Credit Karma: Conclusion

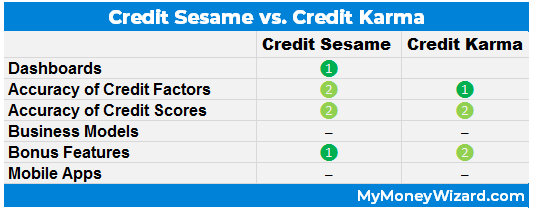

So with the smoke cleared, let’s take at the notes I’ve jotted on my super fancy, official Money Wizard Scorecard:

For my money, you’ve got Credit Sesame eking out a slight victory, thanks to the advantages in the dashboard and bonus features. But it’s a close one.

Credit Sesame’s $50,000 of identify theft insurance is amazing, and something everyone should absolutely consider signing up for free. And while I hope I don’t ever have to the test out the process for claiming that money, it looks to be an incredible feature.

Meanwhile, Credit Karma’s bonus features don’t quite match Credit Sesame’s identify theft insurance. BUT, their advantage of pulling credit factors from two different reporting agencies is definitely a big advantage.

The real winner? US!

Credit Sesame and Credit Karma are both great tools that help us monitor our credit. With a free signup that takes just a few minutes, we can get another watchful eye on all the important info included in our credit report.

Trust me, the last thing any of us wants is dealing with the headache of an inaccurate credit report, or worse… undetected identify theft.

And since they’re both free, that raises the obvious question. Why not use both?? Doing so could help you protect one of your most underrated financial assets.

I think many people overlook how important it is to keep track of this stuff and how it could legitimately cripple them if something were to go wrong. Nice article, my wife and I will be taking a look at Credit Sesame in the near future.

Thanks and cheers!

-chris

Thanks Chris. Yeah, credit monitoring is one of those chores that’s easy to put off because of how boring it is. Nobody really wants to spend the time checking, especially when the reward is just “everything looks good.”

But like you said, the consequences of not checking make this decision a no brainer – it’s 100% worth taking the 5 minutes to add a layer of defense, IMO. Especially when this stuff is completely free.

Thank you for the awesome, detailed article! Good stuff to know about Credit Karma and Credit Sesame….I’m off to sign up 🙂

Hmmm. Let’s see:

• Credit Karma- TWO different bureaus (TU and Equifax)

• Credit Sesame- ONE bureau (just TU)

• Credit Karma- free service checks both scores once a week

• Credit Sesame- free service checks one service ONCE A MONTH

•• Bonus points: Credit Sesame runs frequent, exceedingly annoying, wannabe-clever/funny (but neither) TV ads, some have implied that their service makes you richer (suddently the person has a far better apartment, nicer stuff, etc.— as if they actually have more income, not just decent credit ‘thanks to Credit Sesame’)

Summary: To me, Credit Karma is far more useful with their free WEEKLY scores from two of the three bureaus, vs. Credit Sesame’s free MONTHLY score from only one bureau; plus CK seems to let their service speak for itself without nightly TV ads blaring about how wonderful it is.

🚩Conclusion/Winner: Credit Karma by a mile.

Hard to see how you gave CS the advantage, even with their insurance perk. I personally find CK’s “What’s Changed” list very useful, and I don’t find CS’s Dashboard anything special. And the “only once a month” thing is a dealbreaker in any contest between the two, even without CS showing only TU, vs CK’s showing TU + Equifax.

Credit Sesame’s *free* service is hardly worth it. They want you to pony up a monthly fee for their ‘premium’ service.

That’s my take.

Credit Sesame is changing the Free Insurance to part of their Premium Plan. Might want to update your review.