We’ve all heard the story. It goes something like this:

- Finance Muggle 1: “Joe Average made a killing off his house!”

- Finance Muggle 2: “Really?”

- Finance Muggle 1: “Yeah! He bought his house back in 1995 for $200,000, and he just sold it for $400,000!!! Doubled his Money!”

- Finance Muggle 2: “Damn, and here I am renting like a sucker. I better find myself a shady real estate agent and buy the first house I see!”

Sounds good doesn’t it? Joe Average, making thousands off his brilliantly located home.

Like most people, Joe and our Muggle friends are ignoring a lot of hidden costs in his $200,000 “profit.” If Joe was actually tracking his expenses, he’d see that when the smoke cleared, he actually LOST money on this so called investment.

But Buying is Always Better Than Renting, Right?

Before we take a look at how Joe managed to lose money on something that doubled in value, let’s debunk one persistent myth once and for all. Renting is not always throwing away money.

This is such a persistent fallacy among people who don’t understand personal finance that I will reword it for emphasis:

You can throw away more money owning a home than renting one.

To understand how this is true, we’ll need to take a look at the six most common (and usually forgotten) home ownership expenses.

Money Pit #1: Mortgage Interest

Do you ever feel pressured to buy a home? Ever wonder why you’ve been told since the dawn of time by your Mom, Dad, Friends, Aunt, Uncle, Coworkers, Radio, TV, and even that random guy at the bar that home ownership is the only true American Dream?

Quite simply, it’s because ever since bankers realized they could sell you a home before you could actually afford it, they’ve been making a KILLING off of the interest.

Let’s assume Joe was a diligent saver and was able to come up with a $40,000 down payment on his home. In other words, his mortgage was $160,000 over 20 years with a 4% interest rate.

Using a simple financial calculator, we realize Joe paid right around $73,000 of interest over those 20 years. And that’s using today’s historically low interest rates of 4%.

The next time someone criticizes you for “throwing money away” on rent, ask them if they’ve calculated how much interest they’re paying the bank lately.

Money Pit #2: Closing Costs

It’s amazing; talk to anyone even remotely employed in the real estate business, and the best time to buy is now. When the housing market is hot, you better hurry up and buy now before some else does! (And pay above asking price while you’re at it) When the market is depressed, well hurry up, there are bargain deals to be had!

Perhaps the reason they want you to BUY NOW is so they can get PAID NOW. And paid BIG.

As a buyer, expect to pay “them” around 4% in closing fees.

Just who are they? Bankers, inspectors, attorneys, appraisers, surveyors, and title companies. Buying a home is a complicated process, and all of these people need to be paid.

For our friend Joe, that’s $8,000 to go around.

Money Pit #3: Selling Costs

As annoying as closing costs are, they’re still better than selling costs. Realtor commissions, for both the buyer and the seller, are funded by the seller.

This optimistic advantage here is that a buyer won’t owe his realtor a penny after receiving the keys to his new house. The depressing truth is that his procrastinated payment will come back to bite him in the ass if he ever wants to sell his home.

Average realtor costs vary, but 6% of the selling price is pretty standard.

In our hypothetical scenario, Joe’s house sold for $400,000, which means a whopping $24,000 to fund his selling agent, the buyer’s agent, and the companies that each side works for.

Money Pit #4: Property Taxes

Yet another great place to set your money on fire and never see it again is the world of property taxes. As a true American landowner, every year you owe the government money for the privilege of resting your home on that land.

Property taxes are paid as a percentage of the home’s assessed value every year, and property tax rates vary by state, county, and city. In 2016, New Jersey claimed the dubious crown of highest property tax state at 2.29%, while Hawaii had the lowest at 0.28%.

On average, property taxes cost about 1% of the home’s value every year.

For Joe, this means as the value of his home went up, so did his taxes. Assuming he paid about 1% property tax for 20 years, Joe paid Uncle Sam $58,000 in property taxes while he owned the home.

Money Pit #5: Home Owner’s Insurance

Although home owner’s insurance isn’t required by law, unless you buy your house with “straight cash homie,” most banks will require you to carry home owner’s insurance before they loan you any money. Home owner’s insurance protects the home against the sort of catastrophic events that leave your house burned to the ground or with a meteor sized hole in the roof.*

Predictably, home owner’s insurance rates vary based on the likelihood of a natural disaster where you live. So if you live in Tornado alley or a state which makes for a good hurricane punching bag, prepare to pay as much as 1.5 to 2 times the national average.

In 2016, the average home owner’s insurance premium in the United States was right around $1,000 per year.

Premiums (a fancy word for the amount you pay regularly to have an insurance policy) are calculated as a percentage of the value of your home. Your premium depends on the danger of your location and a few other factors, but a good rule of thumb is expect to pay about half a percent of the home’s value per year.

Since Joe Average is well, pretty average, we’ll assume he too paid the national average of $1,000 per year.

*But not the sort of catastrophic event that leaves your home flooded by Mother Nature. You’ll need to buy flood insurance for that.

Money Pit #6: Annual Maintenance

Home ownership: where recurring expenses have a tendency to keep reoccurring, and extraordinary expenses become ordinary.

Experts advise budgeting around 1 percent of the home’s value per year for maintenance. If $2,000 per year of maintenance on a $200,000 home sounds high, consider this:

- The average homeowner spends $6,800 to replace their roof every 20 years. In other words, your roof costs $340 per year.

- The average cost for purchase an installation of a water heater is $1,200, with an average lifespan of 8 years. You’re paying $150 per year for your water heater.

- The average cost of central air conditioning is $5,000 with a 15-year lifespan, or $333 per year.

This calculation can be completed for everything in your home. Windows, doors, and locks… Toilets, sinks, garbage disposals… Washers, dryers, refrigerators… Paint, caulking, pest control, and… Do I hear a smoke detector that needs new batteries?

How to Lose Money on Your House (Even After It Doubles in Value)

Remember, none of those 6 money pits contribute a cent to your equity. Just like rent, the money for the above expenses is “thrown away.”

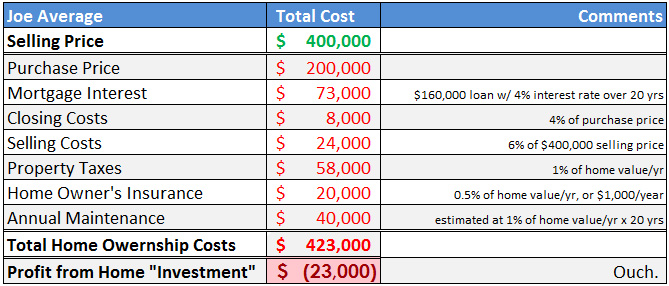

Now let’s get back to Joe Average, who bought his home for $200,000 and sold it for $400,000. This is the sort of story most home owners use to show off their real estate picking genius. Let’s see how he really did:

Yes, you’re reading the table right. Even after his home doubled in price, Joe lost $23,000.

If Joe’s home price instead stayed flat, he would have “thrown away” over $200,000 during his 20 years of home ownership.

Rent vs. Buy

So no, renters aren’t idiots throwing away money, and home owners aren’t living for free either. The truth lies in the middle, and the final answer to the “rent vs. buy” question is more complex than a one size fits all myth perpetuated a loud group of chanters who never stop to crunch the numbers.

There are many reasons to own a home. Fear of throwing money away on rent should never make the list.

______________

[Feature photo credit: taxcredits.net via flickr under cc]

I’ve always been an advocate of buying versus renting. I do agree there is never a once sized fits all approach. Sometimes it can make sense to rent, for example someone who may need to move in the near future and doesn’t want to be tied down to a specific location, however make no mistake about it, that person is ‘paying’ for that added convenience. All 6 of your money pits are going to be baked into a renters rent. In your above example how much would Joe Average lost if he had paid rent for 20 years? I think much more than 23k..You do bring up some very valid and often overlooked expenses, but I still believe real estate is one of the best ways for building wealth.

He would have paid more than $23K in rent, but don’t forget that rent would also be offset by the ~$140,000 he could have earned investing his down-payment in something other than a house. That’s also ignoring his returns investing the maintenance costs, insurance, etc.

From Day 1, our example tied up $48,000 from a down-payment and closing costs into housing, which from 1890-2004, returned a whopping 0.4% after adjusting for inflation. The stock market returned about 7% over the same time period.

You’re right, real estate CAN be a great path to wealth. But it can also be a huge financial mistake. Everyone’s situation is different; the main point here is to avoid basing life’s biggest purchase on an inaccurate cliché.

Like you said though, there’s no one size fits all. Thanks for the comment!

In this example the mortgage payment (PI) would be approximately $12,000/year (20 year fixed $160,000 loan at 4%). Taxes, maintenance, and insurance adds $5,000 (and goes up with inflation). Investors often look to charge 1% of the value of a property in rent, but let’s assume Joe Average would only pay 0.75% of the cost of this home each month to rent a similar home ($18,000/yr). Let’s also assume rent increases 1%/yr while taxes, maintenance, and insurance tracks the cost of the home 3.5%. If Joe invests the difference in his costs vs. renting and the market goes up 10%/yr, Joe would end up more than $120,000 richer than the renter who invests the $48,000 at the beginning of the period. Even after just 3 years, Joe is ahead of the renter with these assumptions – all while choosing assumptions to favor the renter.

But assuming you rented that house for a very conservative $700 per month with no increases (which would be very cheap rent for a 200K propriety), you would have spent $168,000 in 20 years!

Which offset by the $140,000 in investment returns, his total cost over 20 years would be about $28,000 – almost exactly the same as our homeowner who invested in a downpayment and saw his property double in value.

And this is the entire point – renting is not always better than buying, and buying is not always better than renting. The answer comes down to factors including the specifics of your real estate market, how much you value simplicity versus enjoy house projects, etc… and not whether you’re jealous of your friend whose “made so much money” on his house that’s actually losing him money.

The easy and obvious secret – get a roommate!

Nice post Wizard. Thanks for the follow on twitter. Now I need to go find myself of these shady real estate agents quick. All too many people just assume buying a house a good idea without running the numbers.

Thanks Matt, glad you liked it! And watch out for those shadies.

Those muggles, always perpetuating the house buying cliches. I love seeing the numbers laid out like this, showing the breakdown.

I wanted to see the rent costs for Joe Average as compared to the house buying costs, but I never thought about investing the up front costs (down payment, closing costs) and the potential returns there. These numbers keep getting deeper the more we look.

Great stuff, really enjoyed it!

Thanks Brian! Maybe an idea for a future post, stay tuned!

I recently used this calculator http://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html?_r=0 on deciding to rent vs. buy. While I lived in California, renting made more sense. Now that I moved to Georgia, turned out to be better to buy.

That NY Times calculator is a cool one! Thanks for sharing.

Thanks for the calculator, awesome!

I am currently renting (since I move, on average every 3 years), but one day, after we travel around the world me and my fiancee will buy our house to raise kids in.

This was a good check on what to pay attention to.

Thank you for sharing!

Something worth noting is the interest and tax credits for owning a home…that does not appear to have been factored in your calculations.

Let’s not forget tax breaks exist for stock investors as well. Margin interest paid to brokerages is tax deductible, and while this sort of investment strategy isn’t for everyone, it’s worth noting for a true apple-apples comparison.

As someone who owns 7 houses (1 to live in, 6 to rent), I always find these articles interesting. A primary residence shouldn’t be looked at as an investment, but you can’t forget that the owner was paying off the principal while he lived there. If I’m reading correctly, the borrower took out a 20 year loan, which means the mortgage balance would be 0 when he recently sold, so after accounting for all the expenses, he would have walked away from the sale with $177,000, or am I reading thing wrong?

Yes, he would have walked away with $177,000 after the expenses, but he still paid $200K for the house over the life of the loan. Just because he has a big check doesn’t mean he’s any richer. If someone gives you something for $10 and you pay them two dollars per year for 5 years, then sell it for $15… you haven’t made $15.

That’s awesome you have 6 rental properties!

Hey! But didn’t the buyer only invest $40,000? So he would have a profit of $137,000?

Investment $40,000

Expenses $223,000

Profit $137,000

Annual ROR 7.72%

^bump

I think a big point that is being missed here, is yes he paid 200,000 for the house but he gets that money back on the sale. When he rents, that money is gone.

You’re making a great point, but I think you’re flying a little to close to the sun when you include the purchase price in your equation.

Hey fellow Minnesotan, welcome. I enjoyed your rant on, let’s call it, a 20 year investment. A few considerations, did you include deducting mortgage interest & property taxes in yearly taxes? Not to mention the smart play to is pay off additional principal. If I pay off a $350K house in 10 years, my discretionary cash on hand each month increases by about $1,500, in addition to taking the deductions while a renters payment will increase an average of 4.5%/year. Completely agree with you on closing/selling costs. My note would be always utilize the expertise of a realtor, they are the ones that understand what is likely the single largest financial transaction you will make in a lifetime. Their brokers typically have insurance to back you up in case of a really bad deal. I also agree with the first comments from “Frugal” typically a landlord will bake in the expected insurance and maintenance costs to help them maintain the property. It’s not like they net the full rent each month/year. Looking forward to more from you.

A few things that will get you thinking how much these conversations need to stay as dynamic as possible. Food for thought.

How Much things cost in 1996

Yearly Inflation Rate USA 2.93% Year End Close Dow Jones Industrial Average 6448 Interest Rates Year End Federal Reserve 8.25% Average Cost of new house $118,200.00 Average Income per year $36,300.00 Average Monthly Rent $554.00 Cost of a gallon of Gas $1.22 US Postage Stamp 32 cents Average cost of new car $16,300.00 Loaf of Bread $1.15 Minimum Hourly Wage Raised To $5.15

I think there are a lot of good points made here. However, I think a lot of people forget about one key thing… after 20 years you no longer have mortgage payments. If you were 25 years old and paid off the house at 45, that’s 20 years of not having to deal with a mortgage or rental payment. Of course that leaves property taxes and maintenance but that’s still cheaper than renting over those 20 years.

Doesn’t it make more sense to broaden the argument and explain that it really all comes down to how long the person plans to stay in the home?

This is definitely an important consideration, and I agree with your thought process.

My problem is: 1) most people don’t consider the ongoing costs of property tax, maintenance, etc. when they think about owning a home “free and clear” and 2) most advice you hear pushing first time home buyers into “starter homes” inaccurately suggests it’s the right decision, regardless of whether they plan on moving in a few years or not. The average person moves 12 times in their lifetime, and the average time spent in the same house is only 13 years. Blindly making the home buying decision while ignoring these averages isn’t the wisest financial move.

Can you elaborate on perhaps the misconception of tax shelters created by purchasing a home? ie. Being able to itemize due to property tax & interest?

My thoughts on the tax advantages of a mortgage: You don’t spend money to save money.

This is a really fantastic way of looking at things and something I’ve thought a lot about as well. I like the way you lay out each cost and I agree that many people ignore both the buy and sell side closing costs.

Have you thought about the tax benefits, though? Property taxes and mortgage interest are tax deductible. Say you are in a marginal tax bracket of 40% between state and federal taxes. When you see a dollar of mortgage interest expense, you are actually spending an effective 60 cents of after tax dollars. By contrast, rent is all after tax dollars.

If I go back to your example and re-calculate for the effect of after tax dollars, you have to add back $52.4k of profit. So in your example, the guy is actually making about $52.4k plus the current negative balance of $23k = $29.4 profit.

Furthermore, if you live in the property as your primary residence for 2 years, the first $250k in gains per person is not taxed at the federal level So to see the equivalent of a $29.4k profit, assuming you pay 20% cap gains taxes on your stock market wins, you’d actually have to make $36.8k.

The advantages skyrocket for those in high marginal tax brackets, and I’m hoping we all have opportunity to find ourselves in high paying jobs where this is extremely relevant.

http://www.investopedia.com/advisor-network/articles/092916/comparing-true-costs-buying-vs-renting/?partner=YahooSA&yptr=yahoo

I am going to throw out a real life example (me), and why 23k for 20 years of housing is a bargain. My wife and I got married a few years ago. We rented our first apartment for $1190 a month, at the time we lived in one of the most expensive locations in the US. $1190 got us a decent 2 bedroom 1 bath apartment, with a neighbor who screamed obscenities at his toddlers every night and regularly threw stuff at his walls. We lived there right at a year before we got a better offer.

$1190 * 12 = $14280

Last time I checked the rent on that apartment has been raised to 1300. When we moved out, some good friends blessed us with one of their rentals in an old rundown neighborhood, but the property was a completely remodeled duplex. We were getting a bargain at $1250/month, with the renovations they had made; they could have asked 1500 easily. Interestingly, the owners were still making a profit and they got to rent to someone they knew would protect their investment. We lived there for 15 months.

$1250 * 15 = $18750

So in 27 short months we spent $33,030 on housing. Or 10k more than it cost for you example did to live for 20 years. And while I have nothing to show for that time, somebody else made a profit and added to their wealth even counting your money traps.

When we left the duplex we moved to another state and we purchased our first house. While housing costs between half and a fifth of what it did in my old state (depending how long of a commute I was willing to make), property taxes are about 3x higher. This meant I had a much lower down payment to get into my house (16k, with just under 10 being applied to principle), but my mortgage amounts to about the same. When my wife and I realized the property tax rates, we also chose to drop our price range by a third to compensate. We now pay 1420/month, which will drop by 90/month when we get to 20% equity. I can rent my house out for about $300 more than my mortgage and make a profit. Assuming a 4% rule, when my home is paid for I will need $300 in retirement for every dollar my house costs to maintain. So if I own my house, I will only be responsible for repairs and taxes. If I assume an average of 2000 a year in repairs and another 4600 in taxes, I need just 165k to sustain my home after I quit working. If I was renting this house I would need $519,000. I would need 3.14X more in investment funds.

As a side note, I could have purchased my first house in 2011 in the first state. The homes I was looking at were running under 200k during the housing crash. Since then those same homes have increased in value to between 400k and 500k. I have more than one friend who doubled their money in the last 4 years. Because I chose to put money in savings and pay off college debt, I have much less than 2-300k to show for it. I freely admit that a buying opportunity of this magnitude may never hit again in my lifetime, but if I had taken that chance I would own my home out right today. Next time we move, we can take some portion of the 17,000 a year we pay in housing with us.

I forgot to mention that both my property taxes and my property interest are tax deductible. This amount is deducted against my highest tax rate and reduces my cost federal taxes by about 4k/ year.

Article is missing an important point. you pay the bank the payment and build equity in your home. using – http://www.amortization-calc.com. – I calculate a 30yr loan at $160,000 at 4% interest. In 20 years or 2036 you have 74,000 left on the loan. $160,000-$74,000(to pay bank back) means he amassed $86,000 in equity for the home. If you did a 20 year mortgage you would build more equity.

I disagree. The scenario was assuming a 20 year mortgage that was completely paid off. In other words, he had 100% equity in the house which was realized when he sold. But just because you have equity in a home doesn’t mean you still didn’t spend money for that equity. See my response to Ashley above:

If someone gives you something for $10, then you pay them back two dollars per year for 5 years, you’ve spent $10. If you sell it one day for $15… you haven’t profited all $15 of those dollars. You still paid $10 for $10 worth of equity, making your profit only $5.

In your example Joe paid 23k for 20 years accommodation. Show me a renter that can do that and I’ll concede that buying is not better than renting.

True, although this was driven by his his house doubling in value. Not always the case. The housing market as a whole has a 0% return for the past 100 years or so, after adjusting for inflation.

Again, I’m not saying that renting is always better than buying. I’m saying that housing is a pretty expensive investment overall, so don’t be swayed by people bragging about “making a killing” on their home sale. Usually, those same people are actually losing money once you crunch the numbers.

I get what you’re saying. Buying a house does have a load of expenses. I guess I just struggle to see in which way renting could be better. If a renter could be lucky enough to pay 1k per month for 20 years they would still be worse off than Joe, even if his house stayed the same.

Another drawback to buying you could add is utilities. Most rentals include things like water, trash, heat and sewer. It ads up quickly when you have to pay them all in addition to mortgage

Renting becomes better if your area has a very high price to rent ratio, or if you have a high aversion to home maintenance or really value flexibility.

Hey Money Wizard. Nice to see a fellow Millennial working towards the early retirement goal- it seems we have a lot in common. I’m enjoying the posts!

It was touched on in comments above, but as a homeowner (and rental property owner), I felt obligated to add my thoughts on some things. First of all, your cost estimates are very accurate, and I hope many readers who read this become aware of all the costs associated with buying and owning a home.

There is something I think you should consider correcting though. Your calculation backing up your argument against owning real estate is missing a critical piece – the actual benefit of providing shelter for the 20 years above. If you consider the average national rent of a 2 bedroom rental for November being $1270 as just an example, that would swing your calculation by $304,800. Neglecting to factor that in is equivalent to not considering the dividend a company pays when evaluating their stock performance – it’s only half the picture.

That being said, as other people above also mentioned, it’s rare that people consider their primary residence an “investment” per se, unless they are renovating/rebuilding it to resell, which is a whole different ballgame(maybe another article?).

Good read, and thanks for spreading the word on financial independence.

Thanks for your insight Dan. You comment is a fair one, so long as the person also adds the returns on investment from money that would be tied up in down payment on a nonproductive asset. I responded to a comment earlier which showed how after adding all those years of rent payment and those investment returns to the picture, it can still be a toss up between renting and buying, provided the price to rent ratio stays low enough.

I think it is also different to rent a house vs an apartment. My friend rents in a house and her rent is a ridiculously reasonable and hasn’t gone up the entire time she has been there. I rented in apartment complexes, and the price went up each year at lease renewal which was one factor that influenced my decision. While it had not yet eaten into my savings rate, in the next few years, it was going to. Due to my industry being prone to layoffs (often just before the have to pay out raises), and then not being in the next job long enough to be eligible for a raise, the 3% ‘they’ talk about is mythical to me. While bonuses swing more wildly with company performance, it seemed like in scarcity years the raises were also less.

With a mortgage it will be a fixed expense, allowing me to put possible raises towards investments rather than counting on it to pay for the roof over my head. My industry tends to be in high cost of living areas, and I am hoping to make my job more flexible / remote work to decrease my cost of living at some point.

Another factor was housing costs closer to work – houses were way out of my approved mortgage range, and apartments $300-500 more than my previous place. That would definitely affect my savings rate. County taxes are higher closer to work (than one county away, where I picked) and they charge you for plastic bags, if you forget or don’t have enough, which I consider a tax too.

The emotional factor was wanting to put down roots instead of having one foot out the door. I really like this company, my management and the company values, I want to commit and housing is part of that. I did make sure it could be rented if the job situation changes, and I stuck to a mortgage payment in line with previous rent which I can cover on unemployment if necessary.

But this isn’t my forever home. Moving (just 1x) as a kid, and other things in life I know a house is 4 walls, and feels like home but can be taken away from you through nothing you did (natural disaster, apartment fire in the building). As mentioned a lower cost of living area would be ideal. I’m far enough friends and family I get a visitor 1x every 1-2 months, being closer would be nice. I’d love to design my ideal house with attention to green materials, increased efficiency, and a layout that makes sense to me. Ah, FI dreams.

I 100% agree that the rent vs buy as primary residence is a personal decision with many factors.

Buying investment properties is a different can of worms, that can be great when executed well. It can wipe you out if done poorly. My ex boyfriend tried it and the 3rd property sold for about what he bought it for yet he was out closing costs and all the renovation costs. When he originally asked friends and me if he should use the money for a house, grad school, or something else, we all voted not house. Oh well. I think we all learned lessons.

Although you highlight some important costs that homeowners often look over, this post is quite biased. You make a case for home ownership being the same or more costly than renting. However, you are not accounting for the costs required to rent. When you rent, you are renting for your entire life, not just 20 years. When you own, you pay for accommodation for 20-25 years. So your renting costs are not 1K a month for 20 years, they are 1K a month for 50 years if you are renting from 25-75 (this is estimating that rent prices don’t go up which never happens and that you will die at 75 years). This equals to $600K. Now compare THAT to $23K.

I live in the suburbs of Toronto and my parents bought their house for just under 500k 10 years ago. In 10 years, its worth 800k and with the rising house prices I can assure you it will be worth 1M in the next 3-5 years. So, in 15 years they will have doubled their home price. I don’t think that this is possible to do with investing your money for 15 years, unless you have some magical luck and never lose any money. Also, psychologically speaking, most people won’t invest 500K. Instead, if they are not aiming for home ownership, they will just not end up saving that much. Also, when my parents retire, they don’t need to worry about rent. They have a house that is already paid off. If they experience financial difficulties after retirement, they can sell their house and move into something smaller.

And lastly, my parents will be able to pass on their home equity to their children, improving our financial stability, which we will then pass on to our children in addition to the home equity that my partner and I will have built. This actually facilitates intergenerational transmission of wealth, stability, and home ownership. And yes this could also be done with the invested money but people are less likely to save it if its available in a liquid form.

But most importantly, you will be paying 600K in rent for all your life (25-75 years), which is significantly more than any home ownership costs you will pay.

I appreciate your feedback. The main point I was trying to convey with the article is all the hidden costs of home ownership, and I don’t think I did a very good job explaining the rent vs. buy decision in the post. There’s far too much there to tackle in a side note like I tried, so this may be a subject which needs its own dedicated post or two. Your feedback will help me more coherently organize my posts in the future, so I want to say thanks!

Now about that real estate example of yours: $500k to $800k over 10 years is an annual return of just 4.8%. In the same period, the US stock market returned 7.8% per year. From an investment perspective, your parents would have been much better off investing $500,000 into an index fund, which would have increased in value to $1.06 million.

This is exactly the point I was trying to make in the article. Real estate owners often get far too excited about doubling their money. Using the rule of 72, we know that doubling your money in 15 years only requires a 4.8% annual return. This certainly doesn’t take any sort of magical luck. A below average investor could earn 4 percent from a ton of different investments – high interest rate CDs, bonds, or even an underperforming stock, and none of these have the drag of insurance fees, property taxes, or toilets to fix.

And we haven’t even addressed the elephant in the room… that your example is about as good as it gets for real estate investors. Toronto is in the middle of a notorious real estate bubble right now, and all the Canadian investors I know have serious concerns over its sustainability. And they should; for the past 100 years real estate has an average inflation adjusted return of… 0%.

Lastly, I disagree that people need real estate to encourage saving. One of the reasons I publish my net worth updates is because I want to show how you don’t have to be pouring all your saving into a mortgage to build wealth. The criticism that someone is less likely to save when they don’t have a big mortgage or an illiquid asset holding them back is far more reflective of the flaws of the average saver, rather than the asset class itself.

Anyway, I don’t mean to come off sounding combative. I appreciate hearing different ideas and think we can all learn from different perspectives, myself included! Thanks for the insightful comment!

Thanks for your reply. Yes true but you can also lose money by investing. Also, they bought a house worth 500K so they didn’t buy it upfront. They probably made a 25% down payment which is 100K. Also, to rent a house our size and in our neighbourhood, your rent would be 3000K per month. 3000K/month for 50 years of your life is 2M.

Sorry meant to say 3K, not 300K

I thought your blog was good but this page made me un-bookmark your blog. You never mentioned tax break for property taxes and mortgage interest. I paid $0 federal taxes for years because of that.

In comparison to renting the tax break is an advantage, but overall, I’m not a fan of spending $1 to save 50 cents.

If you are renting, you are still paying the mortgage interest but you are not getting the deduction. That mortgage interest is built into your monthly rent, so you are definitely paying for it, you just don’t get the deduction. The owner of the property you are renting from is getting the deduction, and you are paying for it.

Rent: Spend $1 to save $0.00

Own: Spend $1 to save $0.50

I was just analyzing the results we’ve achieved over the last 30 years of buying/selling/renting property when I came across your blog. My spouse and I are currently renting. Our lease will expire soon, and I’m debating whether or not it’s a good idea for us to buy right now. Without getting into every detail, here’s a brief history of our experience;

1.Rented the first 2-3 years after college.

2. Bought starter home $76k, sold 3 years later $98k. Paid closing costs.

3. Bought move up home $163k, sold 2 years later $173k. Company paid closing.

4. Moved to new state bought $163k, sold 7 years later $184k.

5. Moved to new state bought one of the last new construction homes in a nice neighborhood for $290k, sold 2 years later $320k. Company helped with closing.

6. Moved to new state (2005) bought new construction in a neighborhood with many empty lots left for $435k. Tried to sell multiple times. Best offer was $310k. Turned into rental for 4 years ($2500/mo in rent). Spent $30k just to get it ready to sell. Finally sold for $400k 12 years after initial purchase. Paid about $30k in closing costs. The renters covered the monthly mtg, property mgmt, with a couple hundred left over each month, but the losses from depreciation weren’t tax deductible each year.

7. Meanwhile, moved to a new state rented for 1 year. Enjoyed the lower expenses of renting, less work around the house.

8. Bought a house for $432k, planning on forever home. Spent $50k on renovating. Sold 3 years later for $446. Company paid closing costs.

9. Moved to new state with sticker shock, started renting.

This experience taught me that we have not always made the best home buying decisions , nor is it always “profitable”, but you won’t find that out until you need to sell it. We’ve had our share of good luck, that was ultimately wiped out by the bad. We currently rent a house for the same amount of our last mtg. It’s smaller so our utilities are 1/3. We don’t spend on renos, the lawn is much smaller, and when the AC stopped working, we didn’t pay for the repair. Right now, I’m just not sure that buying a house is a good idea for us. When we do buy, we’d be better off down sizing and spending much less than we can afford. Our mantra has always been, just because a bank will let you (borrow a ton of $), doesn’t mean you should.

Hey Teo, thanks for sharing your journey! There’s a lot to learn from it, so I appreciate you taking the time to spell it out.

Sounds like you’re probably saving money by renting in your current situation. I agree, it doesn’t always make the most sense to buy or borrow just because you can. Do you plan on staying in the high cost of living area for a while?

Good luck with your future housing plans!

Why would you deduct the $200,000 purchase price from your earnings after paying a mortgage for 20 years? Hopefully you own the home and have your mortgage paid off after 20 years which means you would recoup the $200,000 purchase price when selling the property. Even if you don’t have it entirely paid off, the majority of the mortgage would be paid off meaning you would regain most of the purchase price and the $200,000 deduction is inaccurate.

Another thing you didn’t speak to was the tax savings benefits offered by deducting mortgage interest. If you are paying $1,000 per month on rent or $1,000 per month on a mortgage, there is a significant difference in the bottom line after deducting mortgage interest annually.

Many real estate transactions are “for sale by owner” which reduce selling costs from 6% to 3%. Also available are services such as Redfin which sell properties without using a realtor and reduce selling costs from 6% to 4%.

Furthermore, closing costs typically range from 1%-4% but are not set at 4%. In my real estate purchases, I have negotiated that the seller pays for closing costs which eliminates that expense from your analysis. In the one instance where I did pay for closing costs it amounted to 2% of the purchase price.

Buying also gives you the option to purchase a home, live in the property while renting out rooms to friends and use the rental income to cover the mortgage and eliminate housing costs entirely. Overall, there are many flaws and inaccuracies with this article.

You deduct the $200,000 purchase price of the house because you paid $200,000. Like many of the above commenters, you are confusing revenue with profit.

Yes, you built equity, but equity isn’t a magic gift. It’s just your net worth in a house, and you have to pay money to get it. It’s a cost.

Your way is like saying “I bought $1,000 of Apple stock. Two days later I sold it for $1,500. $1,500 profit!!”

No… you earned $500.

If someone gives you something for $10, then you pay them back two dollars per year for 5 years, you’ve spent $10. If you sell it one day for $15… you can’t say, “Look how great I am, I made $15 on my investment.”

You made $5, and you spent $10 building equity.

I believe you are missing a few big points in the calculation. First, property taxes are a tax deduction, Second, interest paid on a home mortgage is also a tax deduction, and third, every month you make a payment it is still going towards equity in your house. If you had a 1800 mortgage payment and an 1800 rental agreement and only $450 was going towards the principal every year that is still $5400 going towards equity. I think you should run the calculator again and factor in these numbers before telling people not to buy a house.

Wow, the math in this article is SO bad it hurts. I feel terrible for the people who take this seriously. The the money wizard tries to defend his position with even more junk.

The person selling the house not only walks away with $200k in profit but the 200k value of the house. You totally missed that.

If the person had the 200k to invest at the start, he would not have taken a mortgage in the first place and saved the $78k in interest.

The tax advantage of owning a home for folks that actually pay taxes is substantial and totally missed here. My tax advantages are worth about $500 a month. Add that up for 20 years.

And what about the cost/stress of living with multiple moves and landlords for 20 years? In my area, find a single place to rent for 20 years is pretty rare. Heck, I was kicked out of 3 rentals in less then 5 years when the market got hot.

Anyways, a lot of comments already shoot this mess down. Figured I would just jump on.

So you’re saying if I buy a house for $200,000, and sell it for $200,000… I’ve made $200,000?

And I’m the one who’s bad at math…

Hi Money Wizard. I’m from Brazil and my english isn’t very good, by the way, i’ll try to send my question to you. lol

First, i HAVE to say that your website changed my vision about finances, and after reading almost everything, I managed to organize myself financially and I’m on the right track to make good money.

My question is: My father owns an apartment on the beach, approximately 60 square meters, and told me that if I wanted to live for an unlimited time, he would not charge me any rent. It turns out that I already own my apartment which costs approximately R $ 350,000.00 and with this amount applied, I can return without risk of R $ 3,500.00 net. I’m thinking of selling him to apply that money, and living a period in my father’s apartment.

What do you think about it? is a good idea?

Tks for the answer!!!

Your site is really awesome.

I will agree with you that home-owning is not always the best way to invest, but in my case, the property taxes and homeowners insurance are baked into the monthly payment. And my monthly payment is about $200 less than what it would cost to rent this same-sized (studio) unit in this building or nearby in my city.

My home value has doubled in the FIVE years I have lived here so…..

I get that you are trying to stress that owning a house has a lot more expenses than one normally expects, but you could have used a better scenario to prove your point. If you are staying in a house at least 5 years, it is pretty much always a better decision than renting. Why do you have purchase price of $200K and then right underneath you have mortgage interest? Did Joe put down all $200K for the house and buy it outright or did he put down a 20% down payment w/ a loan? Can’t be both. You don’t pay 100% of the purchase price ($200K) and then have a $160K mortgage? Your analysis is flawed. You didn’t account for tax deductions either. Renters do not get those deductions and the deductions are very significant. Even using your flawed numbers, it cost Joe $23,000 to have shelter for 20 years (which spread out over 20 years is $1150 per Year). That’s pretty damn good if you can shelter yourself, with a house, for $1,150 per Year.

Using a monthly mortgage calculator with your numbers – $160K loan, 4% interest, 20 years, 1% property tax, $1500/yr home insurance – yields a monthly mortgage payment of around $1261/month.

Say Joe was the renter of that house instead of being the owner. Joe’s monthly rent would be at least $1500 as he will cover the $1261 mortgage, repairs, capital expenditures, vacancy, and extra cash flow for the real estate investor. If Joe stays 20 years in the same rental house at $1500/month, over 20 years, would cost him $360,000.

20 years rent: -$360,000

20 years ownership: -$23,000 (not including tax deductions)

Spread: $337,000 difference between owning and renting over 20 years.

_________________________________________________________

Using correct numbers, not including tax deductions:

Down payment (20%): $40,000

Mortgage Interest: $73,000

Closing costs: $8,000

Selling costs: $24,000

Taxes: $58,000

Insurance: $20,000

Maintenance: $40,000

Total Cost of Home Ownership : -$263,000

Home Sale: +$400,000

Profit : +$137,000

20 years renting: – $360,000

20 years owning: + $137,000

Spread: $497,000 difference between 20 years of ownership and renting.

You’ve understated the cost of home ownership by $160,000. Here’s why.

The purchase price is included with mortgage interest because you pay the purchase price.

Even if he put 20% down, he still paid $160,000 of principle to the bank throughout the life of the loan. And if he sells the house before the loan matures, he’ll have to pay the bank off before collecting any profit. No matter what scenario, a house that sells for $200,000… costs $200,000.

Equity is not a magic gift from the bank. You buy it. You can imagine it like this. You pay the bank 4% a year. You “pay yourself” the equity over the life of the loan. Say it goes into an “equity” savings account. But when you sell the house or the loan matures, the bank asks you to trade in your equity savings account for the original purchase price.

If you still don’t believe me, answer this. If he bought the house for $200,000, put $40,000 down, and sells the house for $180,000… did he make money?

Your math says he did, but of course he lost $20,000. Because if you buy something for $2 and sell it for $4, you haven’t made $4. It doesn’t matter if there’s a loan involved or not; loans only add the cost of interest too.

I did omit the taxes for simplicity, and it’s admittedly a big benefit for homeowners. But this overreaching idea that equity is some magical inheritance, which comes for free if you just pay your interest, is completely flawed. Based on the number of similarly flawed comments here, you’re not alone in thinking this, which is probably a big reason why so many sing the praises of building equity no matter what.

Failing to take into account that the mortgage interest and property taxes are tax deductible is pretty significant. Based on your own math that changes the cost of owning a home from a loss of 23,000 to a gain of 108,000…From experience I know there are many hidden costs of owning a home, but Joe Average didn’t lose 23,000 as you stated above he gained 108,000.

Love the article, though i have a slight issue with your conclusion that he lost money. (I mean, he did lose money, but is it a significant amount of money…).

Surely you want to compare this example to the rental costs over the same period, otherwise the $23,000 he lost is a meaningless figure.

I have posted a full reasoning for this on my own site – https://www.southbysouthwest.co.uk/blog/the-renting-owning-question – but do not assume the fact that i disagreed with your methodology enough to write a post on it indicate i have anything but respect for your premise that home ownership is not the pinnacle of western civilisation and that it actually a ‘horses for courses’ situation.

I think your article is a pretty strong argument for buying rather than renting, but does a nice job of pointing out some of the expenses that people tend to just want to forget about. I would like to see the article updated with some of the things left out.

However, let’s take this scenario one step further. You have the guy selling at year 20 right when the mortgage was paid off. Let’s assume that this guy want to retire early like most of us here. He takes is $400,000 and spends $200,000 of it on a new house paying it off. Possibly he downsized or moved to a cheaper location. He then takes the remaining $200,000 and invests in it Vanguard Total Stock Market Index ETF which for the past 5 years has had a return of 7.79%. In 5 years, he would have $294,877 with only home repairs and taxes/insurance due on the new home. How does this compare to the renter at this point even if he had started off with the down payment invested?

The $40,000 downpayment would be worth $278,685 at the 25 year mark at 7.79% (assuming same percentage which is not likely but can always go either way). So at year 25 the homeowner has a house paid off and $294,877 in the bank.

Also, to be more realistic, rent has increase at the rate of 3.2% a year for the past 20 years. If rent started at $700 a month and add an annual 3.2% increase, then the renter would have spent $246,131 in rent over 20 years and $332,889 over 25 years.

For simplicity I left out some of the tax consequences on the investments.

Thank you for the advice, I can apply this before getting my own home.