Imagine you were born in a middle-upper class country.

Naturally, you spend most of your life believing you live in a stable economy. For decades, your parents earned a modest salary that placed their wages solidly within the “well off” corner of global stage; the local currency sported an exchange rate to the global currency of 2:1.

You graduated school and got a job. And while your country started seeing increasing internal violence and authoritarian leadership, the economy continued prospering despite these underlying cracks.

Then, 2011. A civil war erupts in your country. Not only are 100,000 civilians and children killed, but the economy beings collapsing.

Your country’s previously stable currency plummets. The exchange rate falls to 47:1. Then 515:1. And finally, 765:1.

To escape the violence, you flee the country. Except because of the rapid currency collapse, the $250,000 you’d spent years saving were now worth somewhere around $3,000.

Just enough for a plane ticket.

Sounds terrifying, but this unsettling intro was the recent reality for the ~5 million Syrian refugees in 2011. Thanks to the utter collapse of the Syrian Pound, many immigrated to their new countries with nothing more than the shirts on their backs.

But what if this same story played out, but you literally had an ace up your sleeve?

More specifically, some gold coins?

The Value of Gold Bullion

As a form of money, Gold remains the world’s wise grandpa compared to all these young whipper snappers.

While our current monetary system of fiat currency (currency backed by numbers on a computer screen and the public’s general faith) is working on its 50th year of experimentation, currency based on the shiny yellow stuff has held steady for somewhere around 2,500 years.

Not bad, especially considering that’s a timeframe that encompasses the birth and death of Jesus Christ, the rise and fall of the Roman Empire, the death of Muhammad, the rule of Genghis Khan, a 40% population decline from The Bubonic Plague, and literally all of modern history. As strange as it sounds, if you took a time machine to any country at any time in the past few thousand years and brought along some gold, you’d be able to cash that in for whatever currency that country uses.

Had those unfortunate Syrian refuges arrived to their new countries with even just a few ounces of gold – enough to fit in the pocket – they’d have a portion of their fortune still intact, and potentially enough to get back on their feet with a downpayment on a house or a few months of rent.

In that way, gold serves as not just a potential investment, but also history’s greatest insurance policy.

And perhaps no other form of gold serves that purpose better than the physical nuggets and coins known as gold bullion.

While “paper” versions of gold, like stocks or ETFs, are still subject to many of the same risks as the general stock and currency markets, physical gold represents a small, tangible, portable thing that never breaks down and never corrodes. Instead, it just sits there maintaining it’s value, and at times, even increasing!

Speaking of which…

Gold as an investment

Of course, total civil war and economic collapse is an extreme example of Gold’s value. The commodity also holds some basic investment properties that make it worth considering in small amounts as a hedge to the rest of your portfolio. (Which I still think should comprise almost entirely of the stocks and bonds within a 3 fund portfolio.)

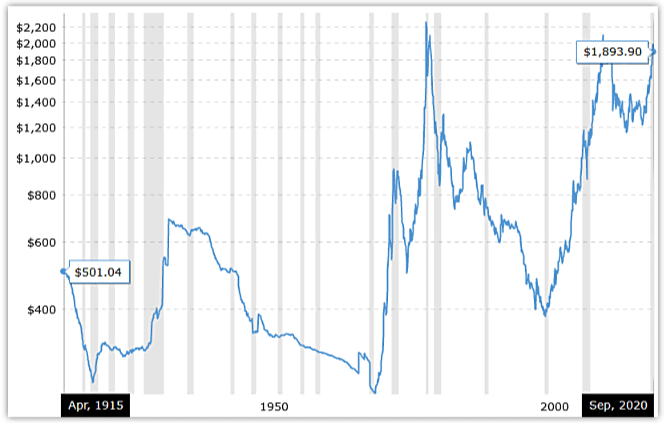

As an asset class, perhaps nothing is less correlated to the stock market than the price of gold.

From 2007 to 2009, the stock market fell through the floor thanks to the trapdoor that was The Great Recession. In that time, the S&P 500’s price dropped by around 35%. Meanwhile, the value of gold rose by 25%.

For an encore, during the massive Coronavirus Crash of 2020, the market again fell by 25%. Gold? Rose by 28%.

This is a trend that’s been repeated over and over again throughout history.

Would I build a gold-centric portfolio hoping to compound my way to wealth?

No way.

Gold should be considered nothing more than a store of value. Not an income producing asset.

But there’s also legit benefit to diversification. And gold is the old pro at it.

How to buy gold bullion (aka real, physical chunks of gold)

So you’re sold. Buy how do you actually buy?

Buying physical gold comes down to a three step process:

1) Know the current price of gold

This is also known as the “spot price.” Since gold is traded in the financial markets as a commodity, its price fluctuates minute by minute, hour by hour – no different than stocks, bonds, or any other publicly traded asset.

So then it’s logical that you can also find the current price of gold anywhere you can find the price of other stocks and bonds.

For example, Yahoo Finance includes a “Gold” chart along its top header, right next to the price of the S&P 500, Oil, and the Euro to USD conversion rate. You can find similar information on Google Finance, Morningstar.com, Bloomberg, etc. And if you’re really looking for more info than you ever need, there’s always websites like Goldprice.org which leave no question about their topic of choice.

For buying physical gold, it’s important to note that the market commonly quotes gold’s spot price in terms of one ounce* of gold. This information will be important when you start looking at physical coins and gold bars.

*Note that it’s technically 1 “troy” ounce which is 31.1 grams versus 28.35 grams in a regular ounce.

2) Decide what type of gold you want to buy

If you’re buying gold for financial reasons, then you mostly shouldn’t care what form it comes in. Leave the rare, ancient civilization coins to the coin collectors and speculators.

Instead, your #1 goal is to buy gold as close to the spot price as possible.

This can be harder than it sounds, since most dealers charge around 5-10% extra over the spot price, depending on what you’re buying.

The most common types of gold include:

1. Coins

The most common include the American Eagle, Canadian Maple Leaf, South African Krugerrand, and many more. Here’s a comprehensive list of the underlying gold value (aka the “Melt Value”) for nearly every government minted coin in the world.

Since government coins include tons of details and are crafted in official federal mints, they can be much harder to counterfeit. (Although not impossible.) They’re also unique in being legal money with a stated face value, although these days, that value is so far below the price of the metal that it’s pretty much a non-factor.

2. Rounds

These are those goofy coins you’ll see advertised on TV, like the commemorative sea turtle or the “limited edition” Mickey Mouse special. Not surprisingly, they’re not actual currency. But they’re literally worth their weight in gold.

Some of these are cheaper than official government coins and some are more expensive. Overall, I’m not a huge fan of these since they’re not as widely recognized. And if they’re not from an official government, they could hypothetically be easier to counterfeit.

3. Bars

These are the literal bars of gold that would make Scrooge McDuck proud.

If you’re lucky enough to need large quantities of gold, bars can be the most cost effective and practical to buy.

Everything comes with a trade off though. Because bars include less detail, counterfeits are easier to make. It’s also possible for shady characters to shave off tiny fractions of gold from the bar in hopes that nobody notices.

To help avoid these problems, I’d recommend sticking to the most common and legit producers of gold bars, which include Credit Suisse, PAMP Suisse, and The Perth Mint.

Decide on a size (Hint, bigger is usually better…)

Whether you’re buying coins, rounds, or bars, the standard size is 1 ounce. But you can also find cheaper sizes as small as 1/10 of an ounce. (And in the case of bars, as small as fractions of a gram, although the premium you pay for sizes this small makes those mostly a ripoff.)

Just know that in general, how much the dealer charges over spot (known as the premium) becomes more costly the smaller the size of gold you’re buying. (For example, up to 25% of the purchase price of a 1/10 ounce Gold American Eagle coin will go towards the dealer’s premium. If you bought the same coin in the larger 1 ounce size, you can typically reduce those fees to just 5% of the purchase price.)

3) Find your best place to buy gold

No different than picking up some new living room furniture or the latest Nicolas Cage Sequin pillowcase, you can either buy your gold online or in person.

Online dealers:

The biggest online dealers include APMEX and JM Bullion. But gold fans also vouch for many other dealers such as SD Bullion, BullionExchanges, BGASC, etc.

(A great place to compare the price of online dealers is FindBullionPrices.com.)

At this point, I probably know what you’re thinking. As nerve wracking as it sounds to potentially drop thousands of dollars online and then wait for a tiny golden package to arrive on your doorstep before the package thieves get there first, you can rest assured that the whole process isn’t nearly as shady as it sounds.

Any reputable online dealer literally churns through thousands of hassle free orders per day, so by now, they mostly know what they’re doing. (I was relieved to know that they ship in discreet packaging, insure all shipments, and require signatures for most deliveries over a certain threshold.)

A lot of these guys also do so much volume that they purchase their coins directly from the largest mints, so their authenticity is as good as it gets.

The biggest con of the online dealers is the price. If purchasing online, there’s usually no way of getting around a ~5% premium over the spot price.

Local coin stores:

An equally shady but usually smoother-than-expected option is to head to your local gold store. (Hint, just look for those sketchy “CASH 4 GOLD” signs in the iffy part of town.)

These dealers usually have a stash of gold coins and bars. Their big advantage? There’s no shipping or other logistical challenges to deal with.

If going this route, it’s obviously important that you find a reputable, trustworthy dealer. A reputable dealer should be willing to verify the gold’s authenticity in front of you using a precious metal tester, a scale to verify the weight, and any other concerns you have.

Fake coins do exist, so you want to be careful.

Also know that these guys prefer to deal in cash. Using a credit card or debit card is likely to add a processing fee and tax surcharge, so you can usually find better deals if you’re willing to pay in cash.

Allegedly, the truly paranoid also like the idea of dealing locally in cash to avoid a paper trail. From what I gather, this concern mostly stems from when the U.S. government tried to confiscate all public gold back in the 1930s via executive order. Since gold is often popular with the anti-government crowd, this lurking quirk of history obviously doesn’t sit well with them.

Important! Don’t forget to stash it like buried treasure!

One of the unexpected pros of buying physical gold is that it makes you feel like a pirate. Investments on a computer screen sure seem boring when you’re fondling a shiny loot of gold coins!

But this also opens up one of the larger cons about physical gold bullion – you have to protect it. Yes, gold undoubtedly presents some increased risk of loss, theft, or a horrible fire. (What’s the melting point of gold, again?)

Also note that most home owners insurance policies don’t cover precious metals.

On the plus, this means you now have an excuse for building out the top-secret hiding spot of your childhood dreams.

Think secret room accessed by a door hidden in a bookshelf, discrete bricks wrapped like a kilo of cocaine and then taped in hard-to-find areas, and the true doomsday prepper’s preference – buried in the backyard.

Oh! And I almost forgot the grossest yet most genius hiding spot for gold I’ve ever read about – in the freezer, frozen inside ground beef.

Just don’t accidentally throw out that two thousand dollar an ounce beef!

What do you think, is stashing gold a smart financial decision or a crazy prepper’s idea?

Related articles:

- How to Invest in Bitcoin? A SIMPLE Beginner’s Guide (My Bitcoin Strategy Revealed!)

- 3 Fund Portfolio: The Lazy Investing Strategy that Crushes the Pros

- Rich vs. Wealthy (How a teacher can be wealthier than a millionaire athlete…)

I agree with most of what you said. Gold is a great place for 5% of anyone’s portfolio. Right now as I type this…..The U.S. Debt to GDP is 138%. We are printing money so fast that the dollar will eventually lost value. Gold will help hedge that devaluation. Trust me they will keep printing more and more money. Think about this…..I bought my new 1997 Ford Truck for $26,500. Today that same truck would be $55,000. Inflation eats away at the value of the dollar.

A portion of your investment in gold is a good thing!

Hi Eric Hoffner ,

That’s interesting I did the same thing purchased a new Ford Ranger xlt 4×4

had some issues that ford did not fix under warranty, that was a battle…!

Go for the gold…$

So your advice that bigger is better should instead be usually bigger is cheaper. The premium on 1 oz ASEs is significantly less than 10 x 1/10 oz ASEs as an example. But on the flip side fractional gold is easier to resell without losing that premium

Gold is also a way to transfer family wealth w/o gov involvement/tax.

Great article but the timing…. Once gold (or any other “hot” asset) is all in the news and all of our favorite bloggers are blogging about it… the ship has likely already sailed. “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

If it gets so bad that we need to resort to trading in gold, I think an investment in guns and food will likley be more beneficial 🙂

I agree with your point about guns and canned food. I also hardly see gold as a currency when the government crumbles – likely we’d want to barter for things that actually have value, right?

I’m curious about your wealth transfer comment. There’s a misconception that passing stocks upon death requires payment of capital gains tax (at least with our current system). Or are you saying that passing gold isn’t subject to the estate tax? This seems illegal or at best a shady practice – but I’d love to be corrected!

I also don’t see gold ever being used as a currency in our country.

The most likely scenario is what I explained in this post’s intro – immigrating to another country and using gold as a way to preserve your wealth once you’re there. Or using it within your own country as insurance against the rest of your portfolio.

But actually using it as bartering for economic activity seems too unlikely. As far as I know, that never even happened in Venezuela or other notable economic collapses throughout history.

If (I mean WHEN) the U.S. dollar collapses, Au 71 (gold) will be worth so much that it’ll be difficult to use in trade. My thought is that until so many resources, such as jeans. Leather, ammo, fresh foods, ect. are getting thin,,… Au wouldn’t have a large part in commerce. However., Ag (silver) is more likely to be a “product of commerce” that can be used “under the radar” for use in trade. Food is a big deal! We’ve already seen inflation this yearand I await the promises of rioting by “protesters” when the media commenses thier plan to get eccentric about the narrow win of president Trump. Look it up yourself. “Integrity Transition project”. Not to mention the “Great Reset” being pushed by the world economic board to “reset” the Capitalistic economy. Read sbout it in Time magazine! Both very much worth investigating! Sounds conspiratorial, yes. But, prove me wrong PLEASE!

Anyway… unrest will happen soon. Supply lines will likely be disrupted. This means food, water and shelter are #1. Ammo to protect #1+1. A way to maintain the ability to trade for essentials 1+1+1? A balance of these essentials should be made priority. Gold is a great for the longer term, and small tradable bits MAY be great, or maybe not… Silver as well may be or may not be. But…food, shelter with water will ALWAYS maintain the top of essentials for survival. I’m lower end in American income, which puts me materially above most of the rest of the world. I grabbed what I could economically and just want to survive decently.

We have also seen the collapse in recent times in Cuba, Zimbabwe, Argentine, Venezuela, and several others. Question, would silver also be viable as a store of wealth? Great article by the way!

If you’re going the physical route, I’d prefer gold over silver for a couple reasons:

1. Silver is subject to more market speculation so the price tends to fluctuate more than gold.

2. The premiums on silver are usually a higher percentage of the purchase.

3. Silver is so much cheaper than gold that to get enough of it you’d literally need hundreds of pounds of the stuff.

Make sense, thanks for responding.

Honestly, you want some of both if possible. They are similar but have different qualities. Gold is more portable and less volatile. Silver is easier to get into for the small investor. It is also probably more undervalued. It is also preferable for barter. Get some “junk silver” old 90% silver coins. Also get some silver bullion. Also get some gold. Some food. Some guns. Some ammo, Some real estate, etc.

Get some of a bunch of things if you can.

Thanks for this guide!

I’ve been super curious about physical gold for a few years – I knew it was a “thing” that people still bought, but I never knew how people went about it.

Now the question is should I invest in some myself? lol

Maybe I’ll get a bar just for the novelty of it. Thanks again for the information!

Glad it was helpful!

Make an electric fence surrounding the property out of silver wire?

Gold jewelry on your personal security guard or 150 lb dog.

Ground beef? Hilarious! I’d try to hide mine in a Knorr bouillon cube box. No one would look for bullion in the bouillon.

Hahaha! Genius.

Yes, Good article, yes you can buy gold online, absolutely true, findbullion is the right place to check the price comparison if you are concerned about price, payment options,s and delivery. I have found Apmex, Jm bullion and Sd are always on the list but in terms of pricing BOLD Precious Metals is also a great option, especially for silver bars..