On a late Friday night sometime around 2013, I found myself alone in a dark room trying to figure out how to invest in bitcoin.

(I know, sweet social life, 23-year-old Money Wiz…)

Physically, I was in a dark room, and my face was illuminated by the blue hue of my computer screen. But mentally, I was in an all-too familiar place – deep down the rabbit hole of random Wikipedia articles.

Or maybe I was reading an online message board.

The exact details don’t matter. But there is one detail I’ll never forget…

I was reading about people investing in something called Bitcoin. It was a wild new type of money that somehow existed entirely within computers. I didn’t quite understand how that was possible, but I did understand the headline I was reading.

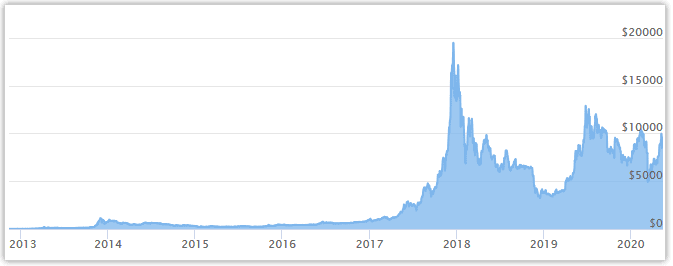

Bitcoin had just skyrocketed in price. It was now over $100, for the first time ever.

“Wow,” I thought. “Some people must have made some serious returns on an investment that grew from $2 to $100 in less than a year!”

“Say, I’ve got an extra five thousand bucks. Maybe I should throw that into this wild new technology?” I asked myself. (23-year-old, Friday-night-loner Money Wizard didn’t have many people to talk to, apparently.)

“Nah, this bitcoin thing has to be a total bubble,” I decided. “It can’t last.”

…Fast forward four years.

By 2017, bitcoin was no longer some unknown discovery buried in the Wikipedia rabbit hole.

Everyone from the Starbucks barista to my own grandmother seemed to have an opinion on it.

And the headlines were again talking about a crazy prince increase. Except this time, those headlines weren’t impressed with a $100 bitcoin.

Bitcoin had just hit $20,000.

In other words, had I pulled the trigger, my sleepy Friday night $5,000 investment would have been worth $1,000,000.

ONE. MILLION. DOLLARS.

I’m not bitter at all…

First, a disclaimer:

To write this article, I:

- Watched Netflix’s “Banking on Bitcoin” documentary

- Read Digital Gold cover to cover

- Got my hands on Satoshi Nakamoto’s original 9 page white paper that introduced his technology to the world

- Read not only the entire Bitcoin Wikipedia page, but the entire History of Bitcoin and Cryptocurrency wiki for good measure

- Read every major article about cryptocurrencies on the front page of google. And the second page. And probably the third page too.

- Opened a cryptocurrency exchange account and made my first bitcoin investment, to the tune of a couple thousand bucks.

After all that? I’m still not sure whether Bitcoin is a good investment.

(I’m also not a professional, so you should always take my investment advice with a grain of salt anyway.)

That said, I definitely learned a ton about the technology. Which is why I’m creating this massive guide to show you, step by step, how investing in bitcoin actually works.

And at the end of the article, I’ll share my personal opinions on bitcoin, along with my exact bitcoin investing strategy.

What is bitcoin?

Before you invest in something, it’s probably worth understanding just what the heck it is. But if you still can’t tell your bitcoin from your blockchain, don’t be discouraged. “Cryptic” is literally built into the cryptocurrency name!

Bitcoin is the world’s first digital currency. It was originally created in 2009 by a mysterious character named (or nicknamed…) Satoshi Nakamoto, which gives rise to a whole host of juicy conspiracy theories.

We won’t get into all that, because the true genius of bitcoin is how it’s not controlled by any single entity or person. Instead, it’s run on a network of regular bitcoin users who volunteer some of their computer resources to the cause. A crude analogy would be the way that Wikipedia isn’t written by any single person. Or how those old music sharing programs like Napster and Kazaa (throwback!) relied on the upload and downloads of all the website’s collective users.

This network of bitcoin users contribute to “The Blockchain” – a public accounting ledger.

The purpose of the blockchain is to verify the accuracy of all transactions on the bitcoin network. No different than the way your credit card company works with your bank to verify whether your impulse Amazon.com buys are legit.

Why invest in bitcoin?

Most people invest in bitcoin for no other reason than its skyrocketing price. As proven by my million dollar mistake, a lot of people got very rich, very quickly off their bitcoin investments.

I mean, just look at this historical chart!

But if “rising price” is your whole investment thesis, you might as well buy a lottery ticket.

Instead, it’s worth looking at the three major advantages of bitcoin. (We’ll get to a few disadvantages and, as promised, my personal bitcoin investing strategy, at the end of this article.)

1. Decentralization from third parties

The reason why bitcoin lovers get so giddy about the technology changing the world boils down to this one word: decentralization.

Remember when we talked about that blockchain verification process? Before bitcoin, the only way to verify transactions was to go through a third party, like a bank or clearing house.

Anyone who’s ever sent a wire transfer knows this frustration. If you want to send money to your cousin in Australia, you wire the money, some clearing house holds onto it for three days and charges you a $15 fee while they double check everything, and you wait around feeling like an idiot, hoping your cash didn’t get lost.

With bitcoin, that verification occurs over the blockchain. Instantly. And for pennies. Your Australian cousin will have their money in seconds.

People who believe Bitcoin will become the worldwide currency of choice are banking on its four unique characteristics:

- Extremely low fees.

- You can use bitcoin in any country.

- Your account can’t be frozen by some third party.

- There are no arbitrary limits on transfers.

2. Decentralization from government shenanigans

This idea of decentralization also expands to Uncle Sam.

Bitcoin is backed entirely by computer code. Compare this to most historical currencies, which were backed by physical gold, or the current US dollar, which is backed by people’s faith in the government.

Say the US government announces a $3 trillion stimulus packages because some banks broke the economy or the government forgot to prepare for a pandemic. Since our government runs a budgetary deficit, that stimulus money usually comes from firing up the U.S. Mint’s printing presses.

The problem? The government printing new money supply creates inflation and devalues the existing money supply.

Since bitcoin isn’t controlled by a government and instead runs on computer code that no single entity controls, government induced devaluation can’t happen.

Which brings us to our next point.

3. Limited supply.

Bitcoin’s code limits the total number of bitcoins worldwide to 21 million. Forever.

The goal here is to mimic the characteristics of other limited resources, like gold.

Bitcoin investors hope that as more people use or invest in the currency, the value of those limited coins will continue to rise.

The 4 Most Common Ways to Buy Bitcoin (Pros & Cons)

If that’s all got you nice and fired up, then let’s get to the main event – How to actually buy bitcoin.

There’s really four main ways you can get yourself some of that sweet, sweet bitcoin. So let’s go through them, and I’ll quickly share my thoughts on each one.

1. Sell a product and accept bitcoin

This is a tough one. Bitcoin’s usage as a true currency is still in its infancy, so this process is somewhat involved.

- First, you have to figure out a product to sell.

- Then you have to create that product, market it, and find willing buyers.

- Finally, you’ve gotta realize that only a fraction of your paying customers will use bitcoin.

For the average person just wanting to invest in bitcoin, this option isn’t the most realistic.

2. Buy bitcoin from a local dealer

For those wanting their bitcoin acquisition to be completely anonymous, the best way is to buy bitcoin directly through a local dealer.

Why would you want your bitcoin acquisition to be anonymous?

Well, chances are, you’re either a criminal or worried about government confiscation.

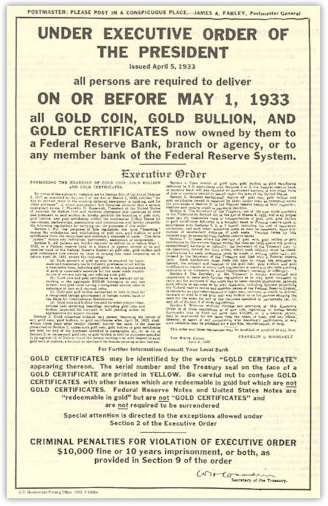

Hopefully the first part doesn’t apply to anyone here. As far as government confiscation, sure that might sound a little tinfoil hat-like, but there’s also legitimate reasons to be concerned about this.

Might I reference Executive Order 6102?

That said, buying bitcoin locally sounds super shady to me.

You’re basically doing an in-person Craigslist deal for potentially thousands of dollars worth of bitcoin. People have had success with this, but personally, this sounds like a great way to get shot or scammed.

3. Use a Bitcoin ATM

Most Bitcoin ATMs will also allow you to buy bitcoin anonymously. You can search websites like CoinATMRadar.com to find nearby Bitcoin ATMs, and then you simply exchange cash for bitcoins.

The big negative with Bitcoin ATMs? The fees. We’re talking credit card level fees… usually usually anywhere from 5-20% per purchase.

Depending on the size of your bitcoin investment, that can be massive, especially compared to other options.

4. Buy through a bitcoin exchange

Lastly, we have cryptocurrency exchanges. If you’ve ever purchased stock through your account at Vanguard, Fidelity, Charles Schwab, etc… then you’ll immediately recognize this type of interface.

Bitcoin exchanges are simply websites that connect buyers and sellers of bitcoin. They’re fast, easy, and low fee. (Usually somewhere around just 0.20% of the purchase amount.)

The big negative with exchanges? At least for U.S. residents, there’s no way to use bitcoin exchanges anonymously. As part of opening your account, you’ll have to provide personal information, so there will absolutely be a paper trail of your bitcoin purchases.

How to Invest in Bitcoin (The Best Way, in 5 Easy Steps)

Of our options, I think the most legit way to invest in bitcoin is to do so through an exchange.

Sure, you lose the anonymity. But in my opinion, the chances I get ripped off by the U.S. government seems much less than the chances I get ripped off by a shady bitcoin dealer or high ATM fees.

So, as usual, I thought I’d be your personal financial crash test dummy. I took a small chunk of cash from MyMoneyWizard.com’s earnings and decided to “throw the hail mary” on bitcoin, as Mark Cuban put it. (Again, we’ll get to my personal bitcoin strategy at the end of this article.)

What I learned is that investing in bitcoin really boils down to 5 steps, of varying difficulty.

Step 1. Find a Bitcoin exchange

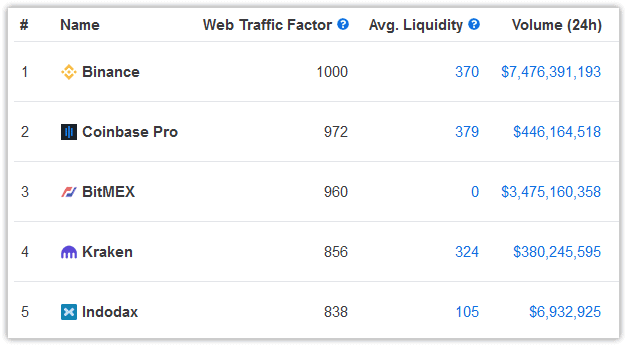

There’s literally hundreds of cryptocurrency exchanges to chose from. The most popular exchange is probably Coinbase.com, which boasts millions of happy customers.

Unfortunately, in doing my research I also found handful of extremely unhappy Coinbase customers too. The most common complaint is nonexistent customer service in the unlikely event something bad happens. (Like this guy, who alleges his $50,000 deposit went missing, and Coinbase wouldn’t answer his support requests until he publicly blasted them on Reddit.)

In general, the best cryptocurrency exchange seems to be Kraken.com. At least according to the enthusiastic users on various cryptocurrency forums.

And I do have to say, Kraken shows many encouraging features:

- I noticed Kraken’s fees were among the lowest.

- I was surprised to find actual customer support, who I could immediately reach via chat or email. (In the world of crypto exchanges, this is surprisingly rare.)

- I also liked that Kraken is one of the few exchanges headquartered in the United States.

Step 2. Get your account verified.

Next, you’ll have to put your faith in the security of the exchange you’re working with. No way around it…

For all new accounts on Kraken.com (and all other legit exchanges) you’ll need to “get verified” if you ever want to purchase bitcoin with US dollars.

This means handing over all sorts of cozy personal information, like your SSN, driver’s license or passport, proof of residence, and even a weird selfie of your face holding a piece of paper confirming your name and personal documents.

Obviously, this information isn’t shared publicly. But it definitely reinforces the need to choose a trustworthy and security-focused exchange. (Kraken, from what I’ve seen, has some of the highest marks in the industry on that front.)

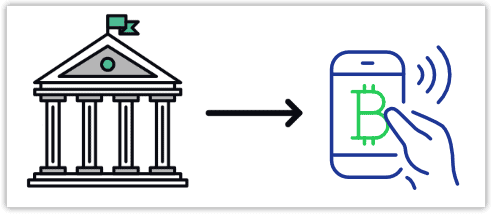

Step 3. Fund your account.

Next, we have to fund our account with however much money we want to invest in bitcoin. To do so, we’ll have to initiate a wire transfer from our personal bank account to the cryptocurrency exchange, with ourselves listed as the ultimate recipient.

Personally, this was the scariest part of the process for me.

As a millennial through and through, I’ve never initiated a wire transfer in my life. I learned the process goes like this:

- Get the wire transfer address from Kraken.com, and then copy those details into my bank’s online wire transfer form.

- Get charged some ridiculous $15-30 fee.

- Wait an agonizing amount of time, anywhere from a couple hours to a couple days, depending on the amount of fees you paid.

- Pray your transfer doesn’t disappear into the ether of cyberspace.

I was actually paranoid enough in this process that I first did a test transfer for the minimum amount, even though it meant double the fees in the end.

Apparently, my paranoia was all for naught, because the transfers went through without any hiccups.

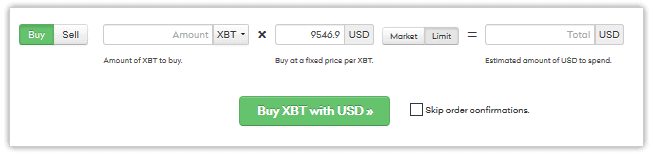

Step 4. The main event: buying bitcoin.

Buy! Buy! Buy!

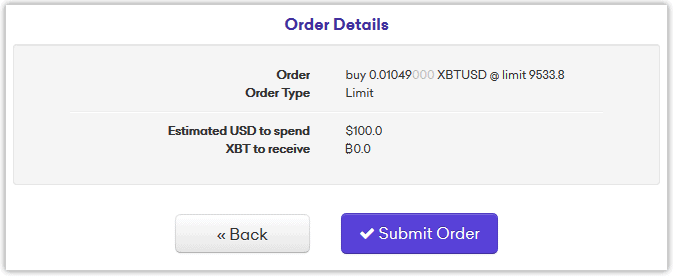

Except, in the world of bitcoin, that hot market action looks more like this…

Actually buying the bitcoin was the easiest part of the process. You simply navigate to your exchange’s trading page, and then enter how much you want to invest.

Select “Buy XBT with USD”…

And review your order like an Amazon.com shopping spree. (Hopefully this turns out as a little better investment…)

Hit submit, and…

Congrats! Welcome to the wild west world of bitcoin!

(FAQ) Is there a minimum bitcoin investment?

One of the cool things about bitcoin investing is that you can invest in fractional bitcoins. This means you don’t have to save up the full price of 1 bitcoin before making your first investment.

Technically, the minimum amount of bitcoin you can purchase is 0.00000001 bitcoin, known as 1 “Satoshi.” At today’s prices, that’d be about .01 pennies.

In practice, most exchanges impose slightly higher limits. Kraken.com, for example, has a minimum bitcoin investment of .002 bitcoins, or about $20.

Step 5. *IMPORTANT STEP* – Get a bitcoin wallet.

If you made it this far, you’re the proud new owner of some bitcoins.

But pay careful attention here, because this might be the most important step in the list.

Once you’ve bought your bitcoins, you have two choices for how to store them.

- Leave them in your account on the exchange

- Transfer them to an offline bitcoin wallet. (Aka “cold storage”)

If you’re serious about not losing thousands of your hard earned dollars, you’d be crazy not to choose option 2.

Why?

When you leave your bitcoin in the exchange, you’re taking a serious risk. Bitcoin remains a big target for hackers, which means if your exchange login ever gets compromised, they could drain your whole account. And there’s no take backs or FDIC insurance when it comes to bitcoin…

Equally scary is the idea of putting all your faith into the exchange itself.

Look no further than the infamous Mt. Gox debacle. Mt. Gox was a bitcoin exchange that by 2014, was handling 70% of all worldwide bitcoin transaction. Then, the entire exchange got compromised and promptly declared bankruptcy, leading to over $450 million in stolen bitcoin.

Yeah… not a good time.

You can avoid both of these risks by storing your bitcoin in an offline wallet.

What’s the best bitcoin wallet?

The two most popular on the market today are the Ledger Nano X and the Trezor.

These are essentially specialized USB sticks that plug into your computer and have their own unique bitcoin address. The only way for a hacker to steal these would be for them to break right into your home. Even then, offline wallets can be backed up across multiple devices.

Setting up an offline wallet works like this:

- Buy the wallet. Here’s an affiliate link for the Ledger Nano X, which in my opinion is the best intro wallet on the market today.

- Set up the wallet. This involves memorizing or writing down a unique “recovery phrase” which is a list of 24 words. This phrase acts as the wallet’s password, and can even be used to recover the device if something were to happen to it.

- Send your bitcoin from the exchange to the unique address that comes with your wallet. This can all be done through the exchange itself and is actually pretty simple… no different than sending bitcoin to a friend.

- For extra protection, backup your wallet onto a second wallet. Ledger is currently offering a great deal on its backup pack designed specifically for this job.

Step 6. Wait… and… profit?

Hopefully…

Just get ready for a ride.

And not a normal “wild ride” in the sense of stocks or any other asset classes. Bitcoin sports volatility like a raging bull, ready to buck you off the back and knock your teeth out in the process.

If you’re not comfortable with the idea of 50-70% losses from one day to the next, well then it’s time to move on to a different investment idea.

(Here’s 18 other passive income ideas to get you started…)

My personal bitcoin investment strategy

Phew. With all that out of the way, it’s time for me to share my own thoughts and strategies for bitcoin.

First thing’s first. Personally, I don’t think you should even consider throwing a single cent at cryptocurrencies if you don’t, at a minimum, have a well-funded 401k and a rock-solid after-tax investment portfolio, consisting mainly of something more stable, like a 3-fund portfolio.

And even then, you should heed Mark Cuban’s advice, when he says,

If you’re a true adventurer and you really want to throw the Hail Mary, you might take 10 percent [of your savings] and put it in bitcoin or ethereum… But, if you do that, you’ve got to pretend you’ve already lost your money.”

Why do I think it might be worth investing in bitcoin?

Well, over the past few years, bitcoin seems to have proven itself enough that it does present an interesting case of diversification with serious upside.

A bet on bitcoin is a bet that more people are going to use or invest in bitcoin. And with the increasingly digital world, it’s not that hard to imagine a totally virtual currency.

On the high end, experts estimate there’s no more than 75 million people currently invested in or using bitcoin. But there’s over 7 billion people in the world.

Remember, bitcoin’s supply is limited by the code to no more than 21 million bitcoins, ever.

The upside case is that bitcoin gets adopted as a true world wide currency. If that happens, 100 times as many people will share the same limited number of coins, so the value of bitcoin would presumably increase by at least the same amount.

Of course, that’s a huge if.

Personally, I don’t see how bitcoin could be adopted as a true currency as long as its price still jumps around so much day to day. Who’s going to use a currency when you’re not sure if it’s going to be worth 30% more tomorrow?

What seems much more likely is that bitcoin becomes a sort of “digital gold.” That is, a store of value which also comes with the bonus of some potential upside. With the vast majority of bitcoin activity so far coming from buy and hold investors, this seems the much more proven and likely path at this point.

If that’s the case, then bitcoin’s limited supply is extremely appealing. For one, this makes it similar to gold. And just like gold, people seem to flee to it when they’re worried about big picture concerns. (Like the U.S. Government going wild printing trillions upon trillions of new dollars, an act which poses a very real concern of future inflation and/or serious devaluation of the US dollar.)

Secondly, the Fed’s government imposed mandate is to target a 2% inflation rate each year. By definition, that means that our cash becomes 2% less valuable year after year.

But because of bitcoin’s limited supply, it’s a actually a deflationary asset… meaning inflation actually makes it more valuable.

As the government prints more money, and more money floods into the financial markets, some of that money flows to bitcoin, which remains limited at its 21 million total coins. Using this logic, you can envision a long term situation where bitcoin’s value rises at a minimum of 2% per year.

Speaking of the long term, bitcoin has actually held up surprisingly well. Bitcoin is certainly still in its infancy, but in just 7 years, it’s gone from a fringe marketplace for illegal side hustlers to being accepted as a legitimate business by JP Morgan.

That’s during a time in which the US stock market experienced one of it’s wildest corrections in history. And sure, bitcoin experienced a bit of a flash crash during the initial coronavirus panic, too, but it’s since recovered fully.

At times, the asset class has even moved extremely uncorrelated with the rest of the stock and bond market.

For all those reasons, I think bitcoin presents an interesting diversification tool for an already established portfolio. It also serves as a hedge against monster black-swan type risks, like the entire collapse of the USD dollar. Unlikely? Probably. But man, that would suck if it happened.

So, how much will I invest in bitcoin?

Billionaire hedge fund manager Paul Tudor Jones recently made waves when he announced he’s got around 1-2% of his portfolio in bitcoin, and for me, that sounds about right.

In response to that, I saw a funny twitter comment that said: “Just because this billionaire admitted he invested 2% of his portfolio into bitcoin, a lot of regular people are going to invest 100% of theirs.”

I don’t want to make that mistake.

At my current net worth, 1-2% is just a couple thousand dollars. Would I lose sleep if a $5,000 bitcoin investment went to zero?

Not really. In fact, I don’t think it’d impact my current or future plans much at all.

Would I feel really bummed if I missed out on another lost million dollar opportunity, in the event the coin increased 100-fold again?

Yes. Very much so.

When the downside is a 1-2% loss, and the upside is potentially massive gains, the next logical question is what’s the probability? Or even, what’s the likelihood that bitcoin is worth the same or more in the future than it is today?

Personally, my belief is that there’s a greater than 50% chance that bitcoin is worth more in the future than it is today. In which case, the expected return is skewed far higher than the risk.

This means that logically and mathematically, I feel I have to invest a very small portion of my net worth in the asset. Both as a speculative play and as a hedge against catastrophic events.

So, that’s what I’m doing…

But what do I know? I’m just a guy who already lost out on a million dollar investment opportunity! 🙂

Resources from this article:

- Kraken.com is my favorite way to buy bitcoin.

- Ledger and Trezor are the best offline bitcoin wallets right now, in my opinion.

Related Articles:

Great article and appreciate your detailed research.

Do you have any thoughts on using Robinhood’s cryptocurrency trading platform? Also, did you consider spreading your investment in multiple cryptocurrencies for diversification?

Just curious on your thoughts. Thanks!

For now, I’m considering an 85% Bitcoin, 15% Ethereum allocation.

These two coins make up about 80% of the crypto world, so I feel like this allocation gives me a sort of DIY index fund of the asset class. The other coins are so small, and the amount I’m investing is so small, that the fees and hassle of purchasing doesn’t seem worth it at this point.

Great Post. 3 books I recommend are The Little Bitcoin Book, Inventing Bitcoing and The Bitcoin Standard. After reading those 3 I highly doubt you’d have 15% in ETH and not 100% in BTC. Also see Real vision ep with Dan Taperio and Raoul Pal are good starters.

New Doc on amazon Prime too called Baking in Africa: The Bitcoin Revolution came out today.

Thanks, Tom! The use case for third world countries with limited banking resources is definitely interesting!

looking forward to seeing your bitcoin allocation in your monthly NW report

Thanks, but I actually might not be able to include it. I’ve read that sharing your bitcoin wallet balance opens you up to a bigger risk of hacking. Any crypto experts have more info on that?

Plus, since I bought them with the blog’s earnings, they’re still in the separate blog account for now.

Great write up. I too just put a little into BTC. I’m going to slowly buy dips and see if it can hold 9k. A slow cost dollar buy in over a few months is my plan.

I’m not sure if you read Chamath but he had some excellent analysis below.

https://www.google.com/amp/s/www.forbes.com/sites/ktorpey/2020/04/05/billionaire-explains-the-path-to-a-1-million-bitcoin-price/amp/

Seems like this is the type of swan event BTC bulls have been waiting for. Holding my breathe and hopefully riding the wave.

Interesting comments from Chamath. I agree with him that bitcoin needs to get out of the “ghetto of day traders and speculators” for the currency to truly be worth something. We’ll see!

Great article. If there is someone genuinely interested in Bitcoin, but struggling to understand the innovation, which is quite important if you are going to invest in it, I send them to a video by 3Blue1Brown on YouTube. It is by far the best explanation of how all the pieces fit together and walks the viewer through the problems each peice solves. https://www.youtube.com/watch?v=bBC-nXj3Ng4

Yes, that’s a great video! I remember watching that one in particular a while back, and it definitely helped me wrap my mind around it all. I may add that video to the post!

My hubby is obsessed with bitcoin since the beginning. I sent him this article and he agreed with your conclusions, so I’m impressed you did so much research. I would add that people shouldn’t invest in things they can’t explain, so everyone should read and learn about cryptocurrencies before they jump in. Or they might end up on bitcoin.com and accidentally buy the knock-off “bitcoin cash”.

Thanks, Samantha!

I’ve used Coinbase before but their fees are ridiculous. Have you looked into using Robinhood to trade Crypto? It’s supposedly free .

I briefly looked into it, but I didn’t like that Robinhood doesn’t support transferring the coins to an offline wallet. From what I’ve seen, you either have to keep your holdings in Robinhood or sell for US dollars.

In my opinion, this defeats the entire purpose of cryptocurrency as a hedge. You don’t really own the crypto unless you can physically have it in your possession via an offline wallet. In the main use case of bitcoin (adoption of bitcoin as its own currency and/or devaluation of the USD) your Robinhood bitcoin would still be tied to the USD.

Question: so when you get onto your bitcoin wallet can you see your balance & what it’s worth??

You mean the offline hardware wallet?

Yes, Trezor and Ledger both have app interfaces that let you see your current holdings and value.

I fail to see why you’d buy crypto before gold. GLD has outperformed VTSAX since it’s inception inclusive of compounded dividends on VTSAX. Of course bitcoin has outperformed either of them, but you can’t really consider bitcoin’s performance normalized until the point at which it fully saturated mainstream media back when it peaked at $20k.

Whatever your allocation to crypto is, your allocation to gold should probably be 5x to 10x that of crypto. I definitely see the value in owning crypto, but I’m just saying that owning gold logically seems to be a prerequisite to owning crypto.

I agree gold has a better track record of diversification than cryptocurrency. The main reasons I bought bitcoin first:

-Buying physical gold was less accessible to me than opening an online account and getting an offline wallet shipped to me.

-Mark Cuban’s comments about having a *small* amount of higher risk speculative assets in your portfolio rang true to me. Since I’m still in the capital accumulation phase and not the capital protection phase, I wanted to give myself 1-2% exposure to speculation, and the asymmetric risk of crypto was more appealing to me than gold.

I do want to add an equally small amount of Gold to my portfolio in the near future. 5-10x seems extreme to me though.

The GLD vs. VTSAX argument is very misleading, IMO. According to PortfolioVisualizer.com:

-If you invested $10K into Gold right after the US got off the gold standard (1972) you’d have about $350K today.

-If you invested the $10K into the US stock market, you’d have $1 million.

This even includes the best decade for gold in history, when gold rose 1,300% over the 70s.

Yeah OK my GLD vs VTSAX timeline is very misleading. That said, I don’t know if gold’s growth can really be expected to keep up with the return of stocks since stocks are supposed to be higher growth and gold is essentially just for purchasing power preservation. Over the long-term, it would be more fair to compare the growth of gold to treasuries. A long-term investor’s allocation to gold and treasuries should probably be very similarly weighted in these two assets as well.

I don’t really view this as a question of which one of these assets have historically returned the most though. If that were the case everyone would be 100% stocks and call it a day. 100% stocks is not smart, and nor is 100% corp bonds, treasuries, crypto, REITs, etc. etc….but when you consider the portfolio taken as a whole, gold’s contribution to the sharpe ratio of a portfolio is undeniable and under appreciated.

I am currently invested in the golden butterfly portfolio (40% stocks, 20% s-t corp bonds, 20% l-t treasuries, 20% gold) and am considering taking 2% of my gold and putting it into bitcoin making my gold position 9x the size of crypto.

Fair enough, we’re mostly in agreement then.

I’m curious – what do you think is the best way to invest in gold? I can see the convenience of ETFs, but if you really get to gold’s purpose as a catastrophic hedge then physical seems the way to go. The markups on physical gold are crazy though, especially if ordering online. And local dealers seem pretty shady…

I use gold as more of a basic hedge on inflation and for preservation of purchasing power, and so I am OK with owning most of my gold via an ETF. I use GLDM. As a catastrophic hedge, physical gold would definitely be better. I definitely admit there is some destabilization risk in using gold ETFs…the inverse of what happened when oil futures went negative could potentially happen to gold. I do not know how to get my hands on gold without a markup or long wait right now, and so I am going to wait until things settle down and put maybe 1/4 of my gold allocation into physical.

Highly recommend anyone who, like myself, has followed TheMoneyWizard for several years, and was waiting for him to make a post about Bitcoin, to check out the online Medium articles written by “PlanB”. His articles explain the Stock to Flow ratio of Bitcoin. This ratio extrapolates the price of Bitcoin based on its scarcity, and obtains a correlation of 92+% between the price and PlanB’s model over the past 8 years, as well as projects a $250K+ price by 2022. Happy to discuss more!

Thanks for the suggestion, I checked it out. Very interesting. You always gotta be careful with backtests, because they always fit… until they don’t. That said, he’s basically hypothesizing that bitcoin becomes a digital gold, which as I mentioned in my article, seems the most likely use case at this point.

Hi Money Wizard! Thank you for this article, it was pretty much useful for beginners.

I’m your big fan from Brazil.

Glad you like it, Ramon!

Thanks Wizard, excellent article on many levels.

I’ve thought about doing something similar but with a slightly lower risk exposure IMO. I’ve been 100% all-in on VTSAX but using portfolio visualizer look at top tech stocks (e.g. Amazon + Apple + Tesla + Microsoft) and seeing how well that would’ve fared. I’m tempted to take the Mark Cuban advice of allocating ~10% of my future investments into a handpicked “tech stocks” portfolio. Thoughts?

Great article, thanks. Regarding the hardware wallet: do you think that Ledger Nano X is that much better than Nano S? The price of Nano X is almost 2x more than of Nano S.

Nano S is perfectly fine if your plan is to just buy and hold.

What’s the process for cashing out ? Or I guess ‘bitcoining’ out ? Can you revert your bitcoin on the exchange back into USD ? Any fees associated ? Great article as usual. Thank you.

I enjoyed every bit of you here, look forward to more as I now get subscribed to you, thanks.

I am in Nigeria… pls how can I invest our naira is very weak to us dollar.

How did you fund your Kraken account: using Etana or your bank? Any advantage/disadvantage of one over the other. Thanks!

have you tried using your debit master card