If you’ve been following my net worth updates over the past few months, you might have noticed one undeniable fact:

I’ve lost a TON of money.

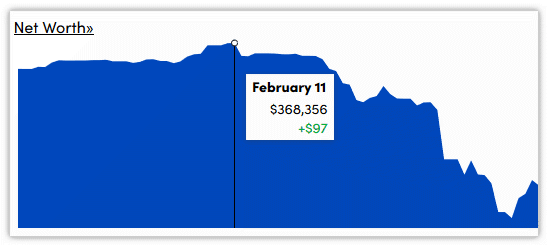

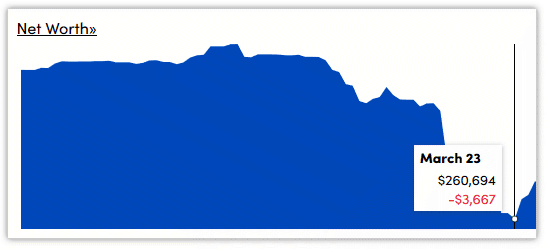

Seriously. Just look at these two Personal Capital charts:

aaand barely a month later…

Yeah, that’s somewhere around $107,000 lost in just over a month. Not fun.

Which is why you might be surprised to learn my reaction to this whole situation is something resembling this:

Let me explain.

How I lost so much money

The answer to that question is simple: I have a lot of money invested in the US stock market.

And with the world shut down from a deadly, zombie-like virus, that US stock market took one of its worst beatings ever. As in, a beating that rivaled the Great Depression, Great Recession, Black Monday, or any other terrifyingly titled legendary economic event.

In response to that, I’ve seen a disturbing trend around the Personal Finance community. People are beginning to second guess themselves, and there seems to be a growing opinion that investors would have been better off if they mostly avoided the stock market. Or even didn’t invest at all.

So, with that hindsight, I thought I’d test a theory.

Fresh off the cusp of one of the worst possible moments for my portfolio, what would have happened if I took a radically different investment approach?

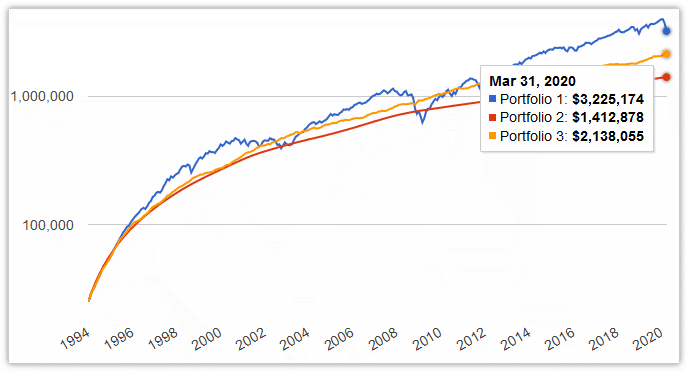

Comparing Three Different Portfolios During My Investment Career

To test the theory, I used one of my favorite tools – PortfolioVisualizer.com. That handy website lets you look at the historical performance of up to three portfolios at a time.

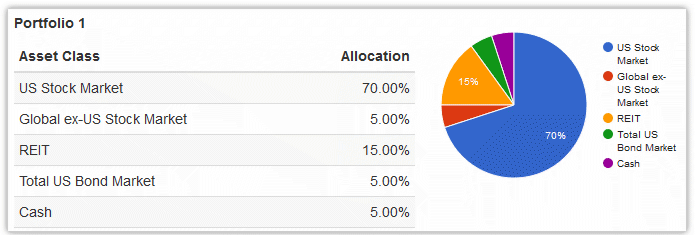

For portfolio 1, I tried to replicate what my portfolio looked like for the past seven years:

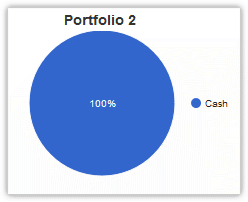

Portfolio 2 assumed I never invested anything, and instead hoarded all my money as cash.

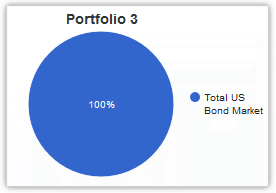

And Portfolio 3 assumed I took an extremely conservative approach to investing, with 100% of my money invested into bonds.

The Test:

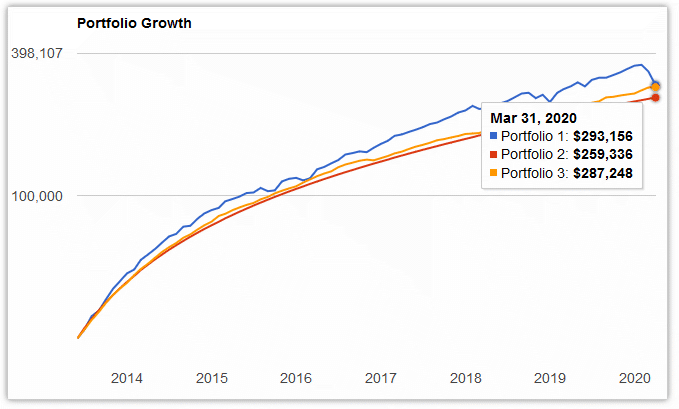

Then, I tried to replicate my exact investing history with each of the three portfolios.

To get specific, that meant I plugged an initial investment of $25,000 in June 2013 into the tool, and then assumed I invested $2,600 a month through March 2020.

While not perfect, this starting value and contribution amount gets pretty close to my real life for the last seven years. Long time readers will remember I graduated college in the summer of 2013 with around $25,000 of savings to my name, and I’ve since saved anywhere from 40-60% of my income each year.

The Results:

Here’s how much those three portfolios would have been worth at the end of March 2020, after literally the worst start to a year in stock market history:

- The money wizard knockoff portfolio would have grown to $293,156. (Pretty close to my real portfolio, which was $295,289 as of March 31)

- The all cash portfolio would be worth $259,336

- The all bond portfolio would have grown to $287,248

Well that’s certainly interesting!

Even while testing this during one of the worst periods in stock market history, the portfolio with ~75% stocks still outperformed the all cash and all bond portfolio.

This should be the time when the “All Cash” or “All Bond” investor can say, “Ha! I told ya so! You stock investors felt rich when times were good, but now that prices have crashed back down, I’ve got the last laugh!”

But they can’t. Because the stock investor still finds themselves $33,820 richer than the guy burying his cash in a savings account. And $5,908 richer than the bond investor who was too scared to make the leap of faith into stocks.

This reinforces what I’ve been harping on forever. Investing your money is a whole lot better than not investing your money, even considering all the risks.

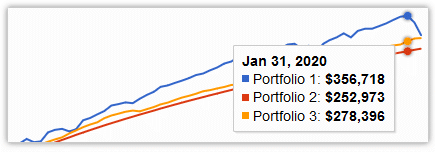

Again, this is about the least advantageous time possible for the stock-heavy portfolio. Had I ran this test a few months ago, say on January 31, 2020, at that point the stock-heavy portfolio would have been nearly $100,000 higher than the cash portfolio!

And the longer the game is played, the more stocks should pull ahead. For example, running this test over a 30 year time period (1990 to March 2020) finds the stock portfolio $1.8 million richer than the cash portfolio and $1.1 million richer than the bond portfolio.

THAT is why I can safely say I don’t regret much of anything, despite all the money I lost.

PS – It’s worth noting that the stock market has rallied in the days since doing this test, and the stock-heavy portfolio is now even further ahead.

Conclusion: How is this possible?

It all gets back to the definition of risk.

Finance professionals define risk as volatility. In other words, how much your portfolio goes up or down during any given time period.

In the test, my stock heavy portfolio was “riskier” than the all cash portfolio, according to traditional finance definitions. Why? The all cash portfolio didn’t go down in value, while the heavy stock portfolio lost 20% in just 40 days!

😱

But obviously, for most investors, that doesn’t make much sense. The stock portfolio still finished with $33,820 more money!

I don’t know about you, but I don’t consider a random drop in the value of my portfolio to be a risk. Because I’m not selling any time soon.

If some realtor came to my house every morning and told me my home’s appraised value, would I care? Of course not. I don’t plan on moving for years.

The only true risk that I care about is whether or not I’m maximizing my wealth. And if that’s the goal, then taking on a little more “risk” with an aggressive stock allocation makes the most sense. Even if that makes the ride a little bumpier.

Bonus: There is one portfolio that did outperform my allocation

There is a way to both smooth the ride and capture strong returns.

I plugged in a basic 3 fund portfolio like I’ve been recommending on this site for years. I used the “your age in bonds” rule and went with 60% stocks, 30% bonds, and 10% international stocks.

The result? A final portfolio balance $2,587 higher than my actual portfolio. (The trade off being that during January 2020 highs, the 3 fund portfolio was $18,380 behind the more aggressive 75% stock allocation.)

Interestingly, this is similar to the allocation I began moving towards when I called an upcoming recession back in August. It’s also how I’ll probably shift my portfolio over the next five years or so as I prepare for early financial freedom.

Stay safe and happy investing, everyone!

Related Articles:

Does your portfolio include IRAs and taxable accounts? And do you treat them different, meaning how you invest your money? I’m 67 and just began investing in mostly Vanguard index etfs as the market was falling. My nest egg came from real estate, which I sold 2 years ago and I have been waiting for this opportunity since then. Knew something would break the market sooner or later. Does your website have pie charts?

I’m impressed with your calmness! Hopefully it’s because it’s also bc you have gained back a lot of it.

I can’t take the volatility, so have invested much more conservatively.

Things feel much better now. Hope improvements continue!

Sam

Great insights, and as my old boss used to say, “In God we trust, all the rest, data…”. Thanks for doing this analysis as I took a similar hit and yet I still have the same number of shares and we will recover at some point. I also have an extended zombie apocalypse emergency fund…so that helps.

For all those who have lost their jobs – I feel for you. It’s been 6 months since I received a check myself (business is up and down like every cycle). Stay safe, be well!

You don’t lose it until you sell, right? It’s all “losses” on paper but it doesn’t make a difference until you sell?

Money Wiz- very helpful article. Really helps to re-enforce the idea of stocks during tough times. Thank you.

Hi,

I lost about $150,000 as well.

Like you I am calm about despite a large paper loss. I am 100% in stocks. After 2008 I went through the same pain. But I kept adding to my investments.

For the next number of yeas I manage to grow the funds about 18% a year from gains and savings.

Trying to save enough for $100k income/growth per year or double my current salary.

Very tough to do but I am going to give it a try.

Nice to know there are a lot other investors trying to do the same thing.

All the best

Don’t take this the wrong way please. I am not complaining. I’ve been blessed far more than I deserve. I’m 75 and living on SS and dividend income. My portfolio is down $295,000 from $750,000 to $455,000. Is that a big “loss”? Yes it is. Paid for house, two very successful sons, a loving wife, no debt and food on the table. Gotta keep things in perspective. Live in the greatest country in the world and this too shall pass with many great lessons learned.

I wish everyone in the country would listen to you! I congratulate you! Wow, keep going!! Please let me know what you have invested in. I am 56, will have my house paid off in 3 years and want to retire in 3 years. I don’t have much in my TSP but I have been living frugally the last 3 years, so I won’t need much money. No debt except for the mortgage. Again I congratulate you!

When you say that most of your investments are in the US Stock Market, is it most on ETF’s or specific stocks?

Love your site, I’m new here!

Cheers

Murilo

I’m all in on ‘MERICA. Your comparison is convincing. Would look even more fire not in log-scale. Sky’s the limit. Loading the rocket.

Love your site! I have also tracked a 60/40 as well as a 70/30 against a 90/10 and consistent with your article found the 60/40 smoothed out the market fluctuations the last 4 years. The 60/40 might not have kept up with the 90/10 growth but I found the losses much more in line with a 30/70 allocation. In short, the 60/40 might not profit as much in the best of times but it does perform better in the worst of times. Stay the course!

What about doing one more scenario: 100% stocks?

Yes, I’m with Alejandra. Could you do a 100% stocks scenario, please?