Hey Money Wizards!

Another month, another monthly update. These seem to be pretty popular with my readers, so I’ll keep them coming. Must be the voyeur in all of us…

For those new to the community, I get financially naked every month in the form of a net worth report.

It’s all a part of tracking my progress towards a million dollars and an early retirement from the rat race. It does not not, as some people have assumed, have anything to do with bragging. What’s measured is improved, and I hope these reports motive you just as much as they motivate me.

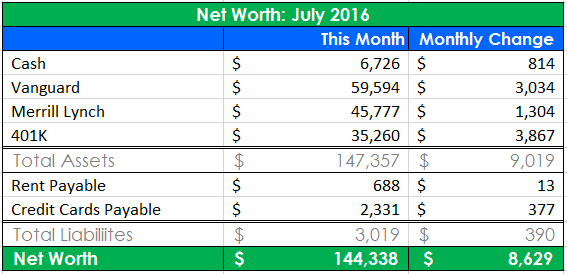

In July 2016, my net worth increased $8,629 or a startling 6.4% since the previous month. This number is mind boggling to me, and I still don’t think I’ve quite wrapped my head around the snowball effect of compound interest.

A special thanks to this month’s Net Worth Update sponsors: the huge rally in the stock market and continued diligent automatic savings.

July 2016 Update

Cash Savings: (+$814) My cash increased $814 during the month. I’m in the process of maxing my annual 401K contributions, which means nearly 30% of my salary is automatically funneled into my retirement account. Not surprisingly, this hampers the size of my paycheck and leaves less cash for saving (and spending!)

Nonetheless, I consider a good month of saving one in which I can save $1,000 cash. Why $1,000? No clue… it sounds like a nice number.

Most months, I’m able to hit the $1,000 goal. In July 2016 I fell short of my savings goal by a couple hundred dollars. I’m blaming the summer lifestyle: I spent a gut wrenching $600 on airfare for an American/Canadian National Parks vacation.

On the plus, I got to see scenery like this:

That’s priceless right? Maybe? Hopefully I do a little better in August.

Vanguard Account: ($3,034) Quite the month in the market!

I believe in simple investing, and my Vanguard account is laughably simple. No fancy charts or analysis here, my entire nearly $60,000 account is just two funds. VTSAX, an index fund that tracks the entire stock market, and VGSLX, a Roth IRA which tracks real estate investment trusts.

At the end of July 2016, VTSAX has a balance of $44,955 while VGSLX has a balance of $14,637. Take a look at this nifty performance chart since I opened the account in August 2014.

Merrill Lynch: (+$1,304) Just market changes here too, since I haven’t added any money to this account in years.

401K: (+3,867) As I mentioned earlier, the 401K is boosted by some serious pre-tax automatic savings. Not only was the monthly run up kind to this account, but so was my complete inability to access the approximately 30% portion of my paycheck that automatically invests into this fund.

Rent Payable: (+$13) It’s been flat out HOT here, and we are running our apartment’s air conditioning a little more than usual.

Credit Cards Payable: (+377) Credit cards were up a little bit in July. Nearly all of my July spending was part of the beautiful National Park road trip I took to Yellowstone, the Grand Tetons, Glacier National Park, and up to Calgary, Canada.

Confession: I’m a wanderluster at heart, and when one trip ends, I can’t help but start planning the next. After chatting with some friends, we all decided to finally pull the trigger on our long discussed dream ski vacation: Whistler, Canada.

In other words, I prepaid some winter vacation expenses in July and have the credit card bill to prove it. Despite the financial sting, this has been in the works for a few years, and needless to say I’m out of this world excited.

Calculate Your Own Net Worth

If you’ve never calculated your net worth before, or even if it’s just been a while since you’ve checked, give it a shot! Log into all of your bank accounts, dust off your 401K account information, search for cash under the couch cushions, and subtract your outstanding debts.

Analyzing your net worth can be an enlightening exercise, and you just may surprise yourself.

Let me know what you think of these net worth updates below. And as always, feel free to send me a note about anything and everything on the contact page.

Yes July was an awesome run for the markets wasn’t it? I’m still waiting for the pullback because I’m not sure this recent rally is justified but only time will tell.

P.s. I am super jealous of your recent road trip, all are high on my soon to visit places!

I know! I’ve been waiting for a pullback for years, and aside from a few blips things keep steady ticking upwards. I’m done with trying to time this irrational market. Steady contributions is the way to go in this environment.

And yes, definitely worth a visit! Such a beautiful part of the country. Yellowstone is like nothing on this planet, Grand Tetons are the most beautiful mountains I’ve ever seen (and I lived in Colorado for years), Glacier is secluded beauty that will soon be gone, and Lake Louise is postcard perfect. Highly recommended, and would be a pretty cheap vacation without the airfare.

Hi Money Wizard,

well done with your investments.

I love your website’s colors and the logo is awesome.

Take care

Rudy

Thanks Rudy!