Hey Money Wizards!

It’s been a crazy month for me. June started with a week-long vacation to Cape Cod, Massachusetts and ended with back to back wildly busy weeks at work. In between was filled with a wild ride of house sitting, car shopping, and house(boat!) shopping. For the past few week’s this blog has been the quiet eye in the center of that storm, but look for more updates on all these crazy happenings in the near future!

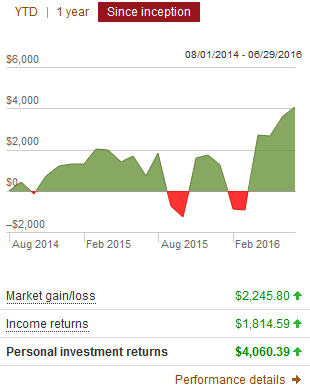

The financial world has been equally unruly in that time. The stock market saw one of the steepest and craziest plunges in recent memory due to the vote for Britain Exit’s, annoying and all too cleverly coined Brexit, from the European Union.

I won’t pretend to know enough about international politics to understand what’s all going on there, but I can claim enough interest in personal finance that I jumped on the opportunity to pour some money into the On Sale stock market.

I really thought June would be my first month with a net worth decline, thanks to all the market madness. I’m starting to learn I shouldn’t be so quick to dismiss the diligent power of consistent savings.

Onto the update…

June 2016 Update

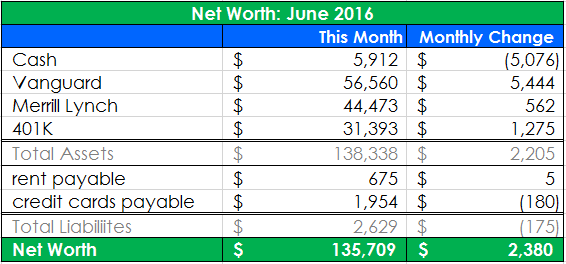

Cash Savings: (-$5,076) Yikes! Luckily, the loss isn’t as bad as it first looks.

In the past updates, I’ve talked about saving up my cash in hopes of buying a new car soon. But with nearly $12,000 sitting in my checking account and watching stock prices fall and fall, I couldn’t sit on the sidelines any more.

I transferred $4,000 from my checking account to one of my Vanguard mutual funds and another $1,000 into my Vanguard Roth IRA. Those two moves are $5,000 of the cash reduction, so the actual decline was a whopping $76.

Vanguard Account: (+$5,444) That cash was burning a hole in my pocket! Thanks to the Brexit panic, I injected another $4,000 into VTSAX, bringing the account total $42,651. Which then motivated me to finally make some 2016 contributions to my Roth IRA, so I added $1,000 to the REIT index fund which makes up my now $13,909 Roth IRA.

This was my first Roth IRA contribution of the year, which means I am still allowed to contribute another $4,500 in 2016. My current plan is to invest $1,000 increments between now and December.

It’s June, and that can only mean one thing. Quarterly dividends! These two accounts were boosted by $280 in quarterly dividends received.

Merrill Lynch: (+$562) Just market changes here too, since I haven’t added any money to this account in years.

401K: (+$1,275) My 401K is nearly 75% small and international funds, so this account felt the hit of the market turmoil pretty hard. About $600 of market losses were offset by about by $1,900 of contributions.

Rent Payable: (+$5) Summer is here, so we are running the air conditioning a little more than usual. I live in Minnesota though, so I still can’t help but laugh at my summer utility bills as I remember my days living in Texas.

Credit Cards Payable (-$180): I buy pretty much everything using credit cards (gotta love those reward points!) so this amount usually equals my previous month’s spending, although delayed due to the cutoff days for credit card statements.

Major spending in June was all about the Cape Cod vacation, which totaled nearly $900. Definitely a magical, laid back part of the world. I’ve been dreaming of the relaxing pace, beautiful sunsets, and delicious lobster rolls, clam chowder, and fresh oysters ever sense.

In any case, I should end the year having lived off right around $22,000, which means I’m still on pace to retire by age 37.

Calculate Your Own Net Worth

If you’ve never calculated your net worth before, or even if it’s just been a while since you’ve checked, give it a shot! Log into all of your bank accounts, dust off your 401K account information, search for cash under the couch cushions, and subtract your outstanding debts.

Analyzing your net worth can be an enlightening exercise, and you just may surprise yourself.

Let me know what you think of these net worth updates below. And as always, feel free to send me a note about anything and everything on the contact page.

Good update though I am late at reading this

Thanks!