Hey Money Wizards!

Welcome to another monthly net worth update! If you’re new here, each month I share all the details on my progress towards a roughly $1 million portfolio, which I hope will allow me to walk away from mandatory work at the age of 35.

I’m currently 30 with a couple hundred thousand to go, so let’s see the progress!

Life Update: June 2020

Hard to believe we’re already halfway through the year, am I right?

And boy, has it been a year!

June saw a little bit of return to normal around here. A lot of businesses started opening back up, and things started looking somewhat recognizable, aside from all the masks and invisible 6 foot force-fields.

Most notably for The Money Wizard family, Lady Money Wizard and I did not get married this month, as was previously planned.

Instead, the wedding got rain-checked to the same time next year. As did the honeymoon.

Slightly bummed about this, Lady Money Wizard and I decided to get away during the week of our supposed-to-be wedding.

With COVID still raging through the country, our options were obviously limited. So, we eventually settled on one of the most remote places possible – Northern Minnesota.

For those who haven’t experienced this underrated part of the country, there’s an easily accessible ~4 hour road trip north of Minneapolis. This “Scenic Highway 61” wanders along the coastline of The Great Lake Superior, with tons of scenic stops and Minnesota state parks along the way:

We spent a few days heading all the way to the Canadian border, home of Minnesota’s largest waterfall:

That far North, the waterfall is pretty much all there is up there. When I got out of the car, my senses were immediately shocked at the complete lack of noise.

No people. No cars. Just the occasional bird chirp and rustling of the leaves in the wind.

In today’s loud world, I thought it was absolutely beautiful. Maybe one of the most relaxing places I’ve ever been.

Again, I find myself seeing the allure of people who live a little more off the grid than city-folk like myself.

Definitely a thought I’m filing away for when I reach financial freedom in a few years.

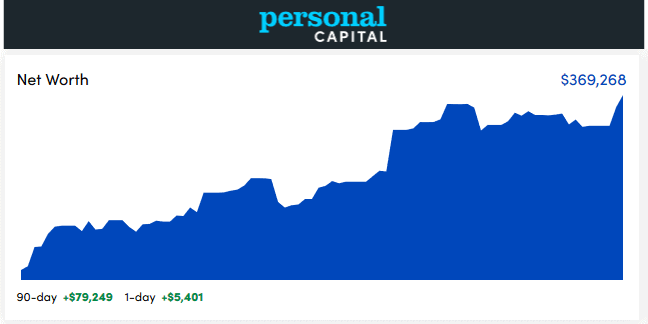

Net Worth: June 2020

Stocks rose slightly in June. Apparently, when you’ve got a decent chunk of change in the market, a “slight rise” can mean a ~$16,000 increase.

Beyond that, I haven’t followed the movements that closely. In June, I intentionally tried to unplug from the constant bombardment of the news, and I think my stress levels thanked me.

Most of all, I found myself extremely grateful to still have a well-paying job.

What’s that ole gosh-darn colloquialism? Something like, “You only know the worth of the water when the well’s run dry?”

As much as us early retirement type complain about “having to” work, being able to continue building wealth in a time when so many can’t is absolutely something to be thankful for.

In these tougher times, I’ve found myself working a little harder at my day job, doing my best to get along with all of my coworkers, and going out of my way to show value.

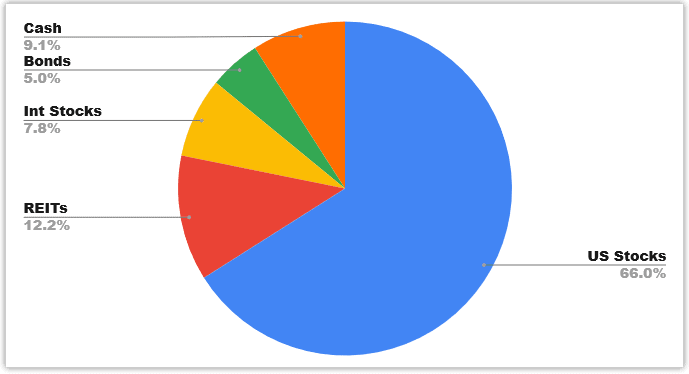

Portfolio Allocation: June 2020

Still working towards my desired allocation of roughly 60% US Stocks with 10% exposures to Cash, Bonds, International Stocks, and REITS.

(For security purposes, bitcoin is still held separately, but I think moving forward I will consider bitcoin part of my 10% cash pile. In other words, my true long term target is probably around 8% cash and 2% bitcoin.)

I prefer to make those allocation changes by shifting my cash flows, which is a luxury enjoyed only by people living far below their means. Compared to traditional rebalancing, which is done by selling assets, this approach saves on taxes and transaction fees. (With the big negative being that it takes a little longer to implement.)

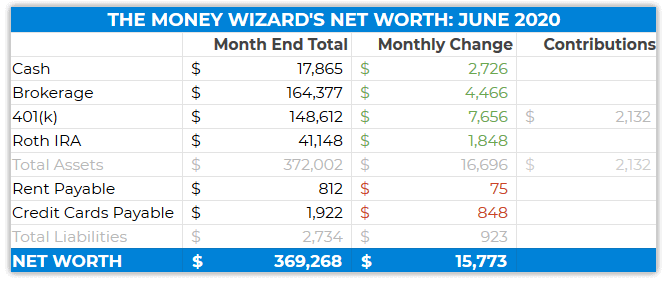

Checking Account: $17,865 (+$2,726)

This is actually getting a little silly. At the very least, I need to move this portion of my cash pile to a better interest-earning option, like Vanguard’s Money Market account. (Here are some other good places to park your cash.)

Brokerage: $164,377 (+$4,466)

Mostly made up of:

- Vanguard Total Stock Market Index Fund (VTSAX): $105,000

- Vanguard Total Bond Market Index Fund (VBTLX): $17,000

- Vanguard Money Market Fund (VMFXX): $14,000

With the rest being some individual stocks back from the days I thought I was Warren Buffett. (Sadly, it turns out, I’m not.)

401(k): $148,612 (+$7,656)

Still maxing out my 401k this year. The gain includes both the market movement and $2,000+ of contributions from my paycheck.

My contribution breakdown remains:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $41,148 (+$1,848)

Includes:

- Vanguard REIT Index (VGSLX): $35.5K

- Vanguard Total International Index (VTIA): $5.5K

Rent Payable: $812 (+$75)

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

The $150 increase (split in half to $75) was mostly due to running the AC more this month.

We also have one of those home warranty repair services, where you pay $X per month and they’ll come out for free whenever your appliances try to ruin your day. After a dishwasher scare made us realize how woefully unprepared we are to maintain our own appliances, in June we decided to increase the plan by $20/month so that basically everything in the whole house is covered now.

Definitely not the best “deal” but it’s one of those conveniences that’s worth the peace of mind for me.

Credit Cards Payable: $1,922 (+$848)

Another liability, which gets always paid in full each month.

Let’s check out the exact spending.

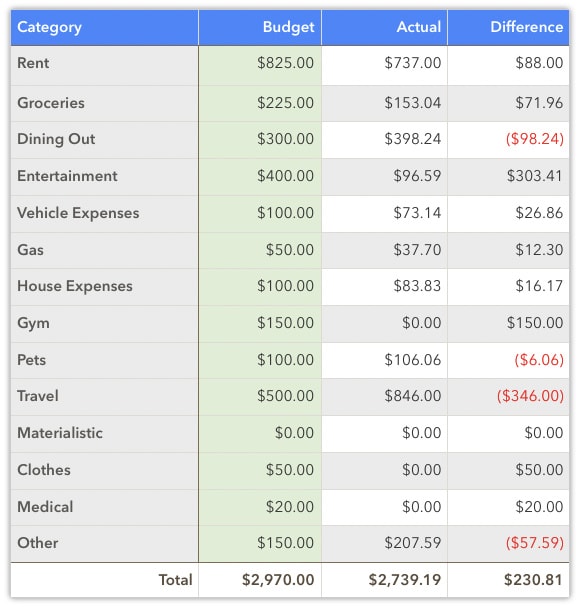

Total June Spending: $2,739

After a few months of lockdown level spending, I opened up the wallet a bit this month yet still stayed under budget.

Dining Out: $398

A lot of our favorite restaurants started opening back up, so we bumped up the takeout to try to support our favorites during these tough times. Because I swear, if I lose my favorite Chinese food place during this crises, I’ll never be able to eat fried rice again!

Entertainment: $96

Mostly take home crowlers from a lot of the favorite local breweries.

House Expenses: $83

Lots of thrilling items here, like new new batteries for the smoke detector and new chip clips for the pantry.

Pets: $106

The Money Pup needed a re-up on his allergy meds.

Travel: $846

It’s been a while since we’ve seen a travel expense!

Given the current world situation, this expense didn’t include any plane flights and instead was limited gas for our road trip to northern Minnesota, plus lodging at a remote Airbnb cabin.

How was your June?

Hope you’re staying safe and sane. Good luck out there.

PS – Regular readers know by now that my favorite free tool for tracking your spending continues to be Personal Capital. The free software allows you to automatically see all your accounts in one place, and generates cool spending reports so you can easily stay on top of your money goals.

Related Articles:

We just did a similar vacation, but to the top of Wi, and then over to the U.P. I felt the same way you did upon being met with beautiful silence!

I’m curious about your REIT holdings; I see real estate value dropping as more companies shift to remote work, and brick and mortar retail is… interesting. Do you see an upside? Is this more of a “portfolio balancer,” or something else?

Very nice. A trip to Michigan’s Upper Peninsula is next on my bucket list.

The REITs are just for diversification. I’ve held them long before covid and intend to hold them long after.

Hi Money Wiz – any reason to use VMFXX over another money market fund or bank? Others out there offer 1 – 2% (currently) whereas VMFXX returns 0.11 (with a 0.11 expense ratio, so it’s basically a wash).

Admittedly all these rates are super low in this market anyways, just wondering your thought process of using Vanguard over the others. Thanks in advance

I talked about why I chose VMFXX in that article I wrote about investing cash. The interest rates were much different a year ago.

Hey Money Wiz,

been reading your columns for a good while now now and really enjoy them. I loved the Minnesota pics and didn’t realize how pretty that state is, I’ve only been there once.

Just curious if you had the option to put your 401K money in a Roth account and pay the taxes now? If tax rates go up in the future, like everyone predicts, you’ll come out way ahead with the time you have for your accounts to grow.

thanks, keep up the good work.

Bo in the Bluegrass

True, although it’s also possible I’ll be in a lower tax bracket than I am today. That’s why I like have a traditional 401k with a Roth IRA, because you’re diversified for both scenarios.

Too bad you had to put off the wedding 🙁 . To get the best of both worlds, you should get married now (just the legal thing), and have your wedding party next year.

The north shore! Going up later this month myself. Were at those falls last year and yes, it’s quiet up there. 🙂

Awesome! Have fun!

The best and cheapest Chip Clips…..the black office supply clip. They are awesome for using on everything and they don’t need to be replaced.

Genius!

You are an absolute inspiration. I find myself eagerly awaiting these net worth updates and mirroring my own finances after yours.

Thanks man, awesome to hear. That’s what it’s all about.

I’m sorry to hear about your wedding man! What a time we’re living in huh?

“That far North, the waterfall is pretty much all there is up there.” I live in Toronto, so I found that hilarious! lol

Anyways, good read. I’m trying to promote my net worth page as well. Check it out:

https://cashaffect.com/long-term-growth-investing-june-net-worth-report/

Thanks!

We had a great June! Tons of dividends rolling in, and we finally could get out of the house to enjoy some of them…

Good times!

Couldn’t you avoid fees and taxes on rebalancing by adjusting your allocations in your IRA or 401K?

True. But you’d be limited to whatever is in those accounts.

Sorry to hear about the wedding my dude. Looks like you had a nice trip. Just got back from a trip myself. Hiked 1.2 miles uphill and through tears and heavy breaths and saw four different peaks (Mt. Hood, St Helens, Adams and Rainer). On the way down I realized I needed to do that more. Not the bracing myself on a tree almost throwing up, but the breathing in deeply enjoying fantastic views part. Anyway, ‘nother great month! You da man.

The Cascades are magic. I’m glad you had a good time out there!

What are your thoughts on Fundrise? It’s the highest reviewed crowdfunding platform for housing, but I can’t decide if it’s any better than just getting REITs via a regular brokerage.