Hold onto your seats folks! Have we got a battle today!

Last month, we pitted two investing heavyweights against each other. In that battle, Vanguard narrowly won a nine round decision victory against Fidelity, and investing fans immediately began calling for a match up between Vanguard and the last great challenger in the investing world – Charles Schwab.

As Kevin at JustStartInvesting.com so perfectly hyped – “If Vanguard is the seasoned veteran and Fidelity the rookie, Schwab to me is the 5 year guy with enough experience to be dangerous!”

And so today, we’ve got the final investing match up of the century – Vanguard vs. Charles Schwab!

So sit back, get out the popcorn, and let’s see if Vanguard can defend its title as the Champion of Index Fund Investing.

(As usual, readers in a hurry can use the following table of contents to jump to my Vanguard or Schwab conclusion.)

Vanguard vs. Charles Schwab, The Quick Overview

|

|

|

| Account Minimums | $3000 (for most funds) | $0 |

| Cost of Stock Trades | $7 per trade (for most accounts) | $4.95 per trade |

| Cost of ETF Trades | $0 per trade | $0 for all Schwab ETFs, $4.95 for all other ETFs |

| Cost of Mutual Fund Contributions | •$0 for Vanguard Funds

•$0-20 for non-Vanguard mutual funds |

•$0 for Schwab OneSource Funds

•$50 for all other mutual funds |

| Cost of Direct Bond Purchases | $0 to $2 per bond ($1,000 face amount) | $1 per bond ($1,000 face amount) |

| Commission Free Mutual Funds | 2,800 funds | 4,320 funds |

| Commission Free ETFs | 1,800 ETFs | 500+ ETFs |

| Lowest Expense Ratio of Index Funds | 0.04% | 0.03% |

| Diversification of Flagship Index Funds | 3,573 companies held by VTSAX Fund | 3,077 companies held by SWTSX |

| Tax Efficiency | Historical capital gains distributions adds 0% to the expense ratio of VTSAX | Historical capital gains distributions adds 0.07%* to the expense ratio of SWTSX |

| Customer Service | •Monday-Friday phone support from 8 AM – 10 PM ET

•Email support available |

•24/7 phone support

•24/7 chat support •Physical branches |

*See Round 5: Tax Efficiency for calculation details.

As with most brokerages, that mess of cells and numbers means a few things:

- As long-term index fund investors, both companies offer all the investment types we’re looking for. (Traditional IRAs, Roth IRAs, 529 Plans, Custodial Accounts, and regular old taxable index funds… both Vanguard and Schwab carry everything a reasonable person would ever need.)

- These are two fantastic companies, so you can’t really go wrong.

- That said, we’re looking to go full-blown OCD to decide which is better…

So let’s get crazy!

Round 1: Index Fund Selection

We’ll start this match with the tale of the tape.

When it comes to index fund selections:

- Vanguard holds the edge in ETFs, with 1,800 ETFs which can be bought and sold commission free.

- Schwab has the advantage with Mutual Funds. (Currently, that’s 4,320 mutual funds which can be bought and sold at no charge… a full 1,500 more than Vanguard.)

However, none of that is really very important to us. Since we believe the research that says a 3 Fund Portfolio is the easiest and best performing investing strategy, we’ll focus on that.

On that front, both companies offer a fine selection. Vanguard’s three fund portfolio will be anchored by classics like VTSAX, VTIAX, and VBTLX, whereas a three fund portfolio at Schwab has quality comparables with SWTSX, SWISX, SWAGX.

Round 1 Winner: Draw.

Round 2: Fees

For index fund investors, fees are far and away one of the most important factors impacting your long term success. So, we’re entering round 2 with what’s (usually) the most important category.

And on that front, these two companies are coming out swinging!

In recent years, Charles Schwab (like Fidelity) declared war on Vanguard’s low fees. The result is a sentence which still doesn’t get any less surreal for me to type – Vanguard does not actually have the lowest fees anymore.

Expense Ratios

As if to almost taunt Vanguard from its superior position, Schwab lowered their expense ratio on its Total Market Index fund to 0.03%… exactly 0.01% less than what used to be Vanguard’s industry leading position of 0.04%.

And the expense ratio beating continues across the other major index funds.

- Total International Fund: 0.06% at Schwab vs. 0.11% at Vanguard

- Total Bond Market Fund: 0.04% at Schwab vs. 0.05% at Vanguard

However, a similar disclaimer with Schwab exists as we discussed in the Fidelity post.

Schwab is able to offer expense ratios so low mostly because those ratios are subsidized by many of the company’s other, more expensive options. Schwab carries quite a few actively managed mutual funds and higher priced index funds. So, if you choose Schwab, you’ll have to be careful to tiptoe around their higher priced offerings.

ETF and Mutual Fund Purchase Fees

Both Schwab and Vanguard allow you to buy their lowest cost ETFs and Mutual Funds for free. For our purposes, this is all that really matters.

Stock Trading Fees

Although I think you’re a fool if you try trading individual stocks, if you want to attempt financial suicide, Schwab will only charge you $4.95 per trade compared to Vanguard’s usual cost of $7 per trade.

Round 2 Winner: Charles Schwab. Schwab’s expense ratios are notably lower, and they charge less for individual stock purchases.

But as usual, Vanguard has some tricks up its sleeve…

Round 3: Securities Lending and Index Fund Tracking

As we talked about in the Fidelity comparison, Securities Lending involves index fund managers lending out shares to active stock traders. It’s a common strategy that allows the index fund to earn a little extra money, money that usually gets distributed back to shareholders.

Securities Lending – Vanguard vs. Charles Schwab

This is a draw. Vanguard distributes all their securities lending profit back to shareholders, and Schwab’s investment materials include similar language.

Index Fund Tracking

Here’s where things get a little more interesting.

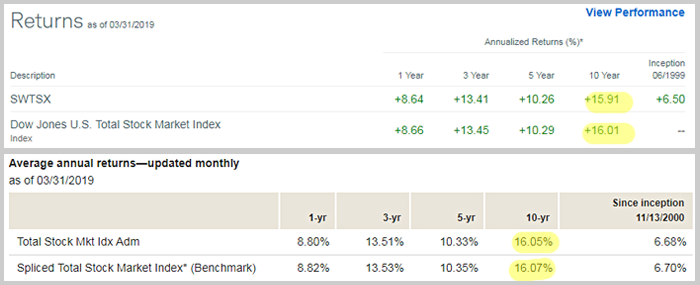

Take a look at this chart I pulled from each provider’s website. It shows the average returns for Schwab and Vanguard’s Total Market Index compared to the fund’s benchmark index. (Schwab is the top half, Vanguard is the bottom)

I’m not posting this chart to say, “Well, Vanguard earned a little more over the past 10 years, so it must be better!”

It’s not that simple.

What’s much more interesting is how each fund did compared to their respective benchmarks.

You’ll notice Schwab lagged its index by 0.10% over the past ten years, whereas Vanguard only lagged its index by 0.02%.

This is called tracking error, and it’s a very real phenomenon with index funds. Why does it happen?

Well, it could be a million different reasons. Some possibilities:

- Fund managers not doing as good of a job re-balancing the fund to match the index

- Differences in securities lending distributions

- The underlying diversification of the index fund itself (We’ll get to that in the next round…)

- Differences in expense ratios (If I was a betting man, I’d say this was a main factor here – until Schwab recently declared war on Vanguard, their index funds had expense ratios around 0.09%)

Whatever the case, it’s worth giving Vanguard some bonus points for so closely tracking their benchmark.

Round 3 Winner: Vanguard.

Round 4: Underlying Diversification of the Index Funds

As index fund investors, we usually have a pretty simple mantra – the more diversification the better.

Total Stock Market Index Diversification

We can compare the number of holdings between Vanguard and Schwab’s Total Stock Market Index Funds to get a rough idea of diversification:

Schwab’s Total Market Fund carries 3,000 companies, versus an extra 600 at Vanguard.

To be fair, those last 600 company have got to be absolutely tiny, and they might not make all that much of a difference. (Although this could be a contributing factor to the tracking error we saw in the last round.)

In any case, to settle this apparent tie, we’ll look at the next staple of a three fund portfolio: each company’s flagship international stock market fund.

Total International Index Diversification

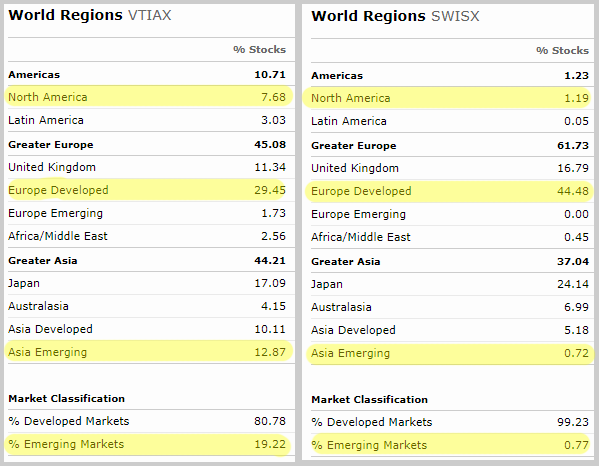

When we get under the hood of the international funds, I see Vanguard pulling away in diversification.

That’s because Vanguard’s Total International Fund is just that; it’s basically the closest an index fund can get to representing the “total” international stock market.

Here’s a comparison of the location of the stocks the two funds are invested in. (Vanguard on the left, Schwab on the right)

Notice the major differences, which I highlighted in yellow.

To sum it up, Vanguard’s International Index fund is pretty evenly distributed across European, Asian, and even a little bit of North American companies. In total, Vanguard’s fund has an 80/20 split between Developed and Emerging Countries.

Schwab, on the other hand, has over 99% of its fund invested in stocks from Developed Countries.

That’s not really bad, per say. But it’s definitely different than the name initially implies.

If the Developed International markets perform better, the Schwab fund will certainly come out ahead. On the other hand, if the goal of the fund to represent the “overall” world economy, then Vanguard certainly represents all aspects of that economy better.

Round 4 Winner: Vanguard. Vanguard’s Total US Fund includes more companies, and Vanguard’s international fund includes both Developed and Emerging Markets.

Round 5: Tax Efficiency

For investors deciding between Vanguard and Charles Schwab for a non-retirement account, Tax Efficiency should absolutely be one of your biggest deciding factors.

That’s because investments held in non-retirement (aka taxable) accounts are… you guessed it… subject to taxes.

Specifically, index funds face two types of potential taxes:

- Dividend Tax – taxes owed on those sweet, sweet checks you get paid just for holding money in the fund.

- Capital Gains Tax – taxes owed when you sell shares at a higher price than you originally purchased.

When it comes to those capital gains taxes, we have to be careful though. Because even if we never personally sell shares, the fund itself might have. This can happen for all sorts of reasons – maybe the manager made an adjustment to better reflect the index, or maybe other shareholders cashed out their investment.

When that happens, Uncle Sam requires the index funds to distribute capital gains to their shareholders. Which, unfortunately, means we owe taxes on those capital gains. Womp. Womp.

So, who distributes less capital gains?

Vanguard.

Because when it comes to tax efficiency, nobody can compete with Vanguard. They own a patent which allows them to use their ETFs to offset the amount of capital gains they owe. It’s a somewhat complicated process that we don’t need to get into, but here’s part you actually care about:

Vanguard’s Total Stock Market Index Fund has not distributed a cent of capital gains since 2000. That’s incredible.

By comparison, Charles Schwab’s Total Stock Market Index Fund (SWTSX) distributed about 23 cents of capital gains per share.

What’s that actually mean? Well, we can do some crude math to get a rough idea of the financial impact.

(Warning: Boring math incoming…)

Looking at the historical charts, the average share price of SWTSX was about $49.13 last year. So, let’s imagine you invested $10,000 into the fund.

You’d have owned 203.6 shares during the year, meaning the 23 cent per share distribution would have you receiving *$46.81 of capital gains. At a 15% capital gains tax rate (which most people earning normal salaries fall into) you’d owe $7.02 in capital gains taxes for the year.

Relative to your $10,000 investment, that’s 0.072%.

This is a real fee, so it’s fair to say this tax inefficiency realistically pushes Schwab’s “true” expense ratio from 0.03% to 0.10%.

In other words, even though Vanguard’s expense ratio is 0.01% higher than Schwab’s, paying that extra 0.01% expense ratio saves you 0.07% in taxes each year.

(*I’ve left it out for simplicity, but some of the capital gains distributed were short term. This would likely push the total amount of taxes owed up a little bit higher.)

Morningstar’s Tax Efficiency Comparison

We included this metric in the Vanguard vs. Fidelity comparison, so I’m including it here as well.

Morningstar’s Tax Analysis shows that Charles Schwab’s SWTSX fund lost 0.75% to taxes over the past 15 years, while Vanguard’s VTSAX fund lost only 0.48%.

(To be fair, it’s not clear how Morningstar calculates this, and given the huge returns lost, I suspect they’re assuming the highest tax brackets for everything, because any time I run the numbers for people who aren’t Billionaires living in California, the tax obligation is about 10 times smaller than these reported figures. In any case, the metric does confirm something we already knew – Vanguard’s fund is noticeably more tax efficient.)

Round 5 Winner: Vanguard, without question. Although I will be interested to see if this category gets closer when Vanguard’s patent runs out in 2023.

[Note: If the index funds are held in a tax-advantaged retirement account, this tax advantage doesn’t matter.]

Round 6: Minimum Investments

This is an easy round to call. Vanguard’s flagship index funds require a $3,000 minimum investment, whereas Charles Schwab flagship funds have no such restriction.

[Note: Both companies have no minimum investment for ETFs. That said, I prefer mutual funds over ETFs for most people.]

I’ll also throw my usual caveat in here though. Minimum investments are overrated, because you’ll likely be staying at whatever company you choose for years, if not decades. At that point, the couple months it took you to build up the $3,000 minimum investment will be a moot point, because it will represent such a tiny fraction of your overall investing career.

Round 6 Winner: Charles Schwab.

Round 7: Mobile Apps

Except for Personal Capital, mobile investing apps aren’t really my jam. I think in general, they encourage too much active trading – having all my money available for deployment at my thumbtips just doesn’t seem like the best idea.

That said, I realize to some people, this is an important category. And while I can’t comment on either the Vanguard or Charles Schwab apps directly, I can say that both come highly reviewed on the App Store:

Further digging couldn’t uncover any major complaints with either one. So, I’m calling this round a draw.

Round 7: Draw

Round 8: Banking Services Offered

I’m adding in an extra round, since some readers brought up an interesting concern with Vanguard during the Fidelity showdown.

Vanguard recently closed their main banking features. For younger investors mostly interested in building up their wealth in the most efficient way possible, this isn’t much of a concern. Personally, I have no problem transferring money in and out of my Vanguard account whenever I need to.

But for folks who are nearing retirement and want the benefits of an investment company which also lets you use a debit card, easily withdraw cash, etc… you may be more interested in a company offering banking services.

On that front, Schwab has the clear advantage. Schwab is the 14th largest bank in the US. They actually offer a full fledged Investor Checking account, and it’s a pretty good one. The account offers a respectable interest rate on cash, and even reimburses you for those annoying ATM fees.

Round 8: Charles Schwab, because their banking services could be a nice feature for certain investors.

Round 9: Customer Service

I’ve had a great experience with Vanguard since I first opened my account with them around 10 years ago. That said, I’ve never had a pressing need for over-the-top customer service.

If I did, I would probably appreciate Charles Schwab’s 24/7 phone service and online chat service, or even their physical office branches scattered around the country.

I plugged in my zip code into Schwab’s Find a Branch tool and found four locations.

This definitely beats Vanguard’s online-only presence and regular business hour phone lines.

Round 8 Winner: Charles Schwab

Round 10: The Intangible Trust Factor

Now this is an interesting round.

We have two pioneers of two different categories.

You’ve heard me talk about the Vanguard story a million times. Vanguard literally created the index fund, and then spent years campaigning against active managers and their overpriced fees. To say the least, the number of unsuspecting investors they’ve saved, and the millions and billions of dollars they’ve put back into the hands of regular investors, is admirable.

Then there’s Charles Schwab. Known as the original discount brokerage, Schwab took Wall Street head on during the late 1970s. In an era when buying and selling stock cost lots of money and was often out of reach for the average investor, Schwab worked hard to make investing affordable for the masses.

Both interesting stories, but you probably already know which way I lean.

Vanguard pioneered the low fee index funds. Watching their competition jumping on the bandwagon, and in certain cases, even swooping in to undercut Vanguard, is interesting. And it’s a huge win for investors everywhere.

But, we still know they were charging those higher fees for years. And they probably still would be, if it weren’t for Vanguard’s 40+ year history of looking out for the everyday investor.

I’m also partial to Vanguard’s ownership structure. Their founder, Jack Bogle, selflessly structured the company so that its only shareholders were the owners of the funds themselves. As a result, Bogle never amassed the huge fortune of say, Charles R. Schwab, (Net worth – $8.3 billion) which begs the question. Where did Mr. Schwab’s net worth come from?

The answer to that question lies in the Schwab company’s structure, which is a publicly traded company with a constant obligation to maximize profits. In theory, this can create a conflict of interest. Do you charge customers lower fees, even when you have a responsibility to maximize shareholder earnings?

Others may disagree, but I know who I’m awarding this round to.

Round 10: Vanguard.

Vanguard vs. Charles Schwab: The Money Wizard’s Final Conclusion

|

|

|

| Index Fund Selection | ||

| Fees | ||

| Securities Lending/Index Fund Tracking | ||

| Diversification | ||

| Tax Efficiency | ||

| Minimum Investment | ||

| Mobile App | ||

| Other Services Offered | ||

| Customer Service | ||

| The Intangible Trust Factor |

After a grueling 10 round battle, the decision is clear in my eyes. Vanguard remains the undisputed champion of index fund investing.

Mostly, that’s because Vanguard takes a clean sweep in three critical areas – index fund tracking, diversification, and tax efficiency. Together, those three quantifiably wipe out the fee advantages that Charles Schwab advertises.

In summary:

- If I was a new index investor debating between Vanguard and Charles Schwab, I’d personally go with Vanguard.

- If I was a current Vanguard customer (I am) wondering if I should switch because of Schwab’s lower fees, I wouldn’t.

- And if other features besides rock-bottom pricing were important to me, such as banking or improved customer service, I’d choose Charles Schwab.

That last point highlights something that’s worth putting into perspective.

After breaking down all the minute details, we’re still only looking at the tiniest percentages of a percent difference between the two companies.

Even if you’re lucky enough to have a multi-million dollar portfolio, these differences are no more than a few hundred bucks a year. At that rate, you’re not crazy to stay a customer at one place or the other for something as minor as liking one website better.

So relax, because both Vanguard and Charles Schwab are great choices. And enjoy, because we might be in the golden age of index fund investing. Do your best to take advantage of it.

No matter which investment company you use, I still think Personal Capital is the best free app to help manage your Vanguard or Charles Schwab investments. Personal Capital automatically 1) tracks your investment performance 2) breaks down your asset allocation (across all your accounts) better than any tool I’ve ever seen 3) reports on your fees, to make sure you’re not getting overcharged.

For the price of free, it’s a no brainer.

Thankfully, they’re all so close you can’t go too wrong with any of them. Three cheers for competition!

Very true! Hip hip…!

I like the concept of the service that Personal Capital provides, but it apparently does not concern you that you have to give them access to all of your financial accounts? Potential for hacking through PC?

I talk about this in my Personal Capital and Mint comparison.

I was concerned about this, until I thought about it more. You don’t actually give Personal Capital access to your accounts. Only access to the account balances. You can’t transfer money into or out of your accounts from the PC dashboard, so if someone did hack your PC account, at worst they’d see your balances. As far as technical security, PC uses a level of encryption that “would take 50 supercomputers checking a billion billion keys per second about 3,000 years to crack. (Seriously!)”

Quoted in the third paragraph… awesome! Thanks for the nod there Money Wiz.

Really great post. The part on tax efficiency is huge and commonly overlooked (I overlooked it a few years ago when I saw Schwab’s slightly lower expense ratios and pulled the trigger with them).

I also have to note, I’ve used Schwab’s chat service a number of times, and it’s extremely useful!

As you say, both great options.

Thanks Kevin! And thanks for the intel on schwab’s chat service.

I was a client at Vanguard for years and years, was with Fidelity for a short while, but I’m now with Schwab. I really wanted to have banking and my brokerage firm all in one, and Schwab also has an American Express credit card that can link into your Schwab account. Also, Vanguard doesn’t allow for trading of leveraged or inverse ETFs like UVXY or TQQQ which was a deal breaker for me. Schwab is more supportive of stock trading in general whereas I feel like Vanguard almost looks down on people who trade stocks. That said, Schwab will try to up-sell you on stuff.

To be an online-only firm, it’s kind of surprising that Schwab has 24/7 customer service and Vanguard doesn’t. I work long hours and hate having to call businesses between 8am and 8pm when I’m in busy season at work. Schwab also has a full list of commission free SPDR and iShare ETFs so I’m covered there. Overall, I think that if you strictly invest in ETFs or index mutual funds, Vanguard is fine, but if you want to combine your banking account, or do any amount of stock trading, I would go with Schwab (or Merrill Edge or Chase).

An interesting comparison would be BoA Merrill Edge and/or Chase YouInvest against Vanguard since Merrill Edge and Chase offer free stock and ETF trading above $50k and $75k, respectively (plus other free features like unlimited ATM fee reimbursement). You could just buy low cost Vanguard, SPDR, or iShare ETFs in the account and then still have the convenience of banking at the same location.

Thanks for the first hand report. I definitely agree – Schwab has the edge if you’re looking for a bank or more stock trading features.

As an older person who is also interested in having my banking and brokerage all in one I would be interested in a comparison between Schwab and Fidelity. I know Schwab is a real bank but Fidelity’s cash management account also looks interesting

I have an account at all 3: Fidelity, Vanguard & Schwab. In terms of the App, Fidelity and Schwab over Vanguard. Many times I have had to enter password on Vanguard App to access certain things.

I LOVE lower minimum investments. Schwab #1 with low $100 min on many non-Schwab funds and $1 for additional investments. In this day and age, why have $2500 minimum (@ Fidelity for non-Fidelity Funds or $3000 for Vanguard Funds @ Vanguard). Does it truly cost so much to maintain small accounts if you don’t receive paper statements? I would gladly pay Vanguard a $25 or $50 annual fee until I reached the minimum in the Fund. I can see in the day of paper statements and reports it being much more costly but nowadays, the infrastructure is built out so it is a sunk cost and practically everything is automated, except if you require phone calls for assistance. I have been using Schwab more lately over Fidelity due to low min investments in other funds.

I have a preference for Mutual Funds over ETFs. I like all my money going to work immediately and not having to have up to $200+ depending on the ETF. I even still like actively managed funds. Some years top funds underperform but other years they outperform.

I do like all 3 : I also like Schwab because I can use Google Pay to send money from my local credit union debit card to my Schwab Checking debit card and have it in my account within seconds. I still can’t do that with my Fidelity Account.

What does everyone think about having a 3 fund Vanguard portfolio at Schwab over using Schwab funds?

VTSAX/SWTSX

VTIAX / SWISX

BTLX /SWAGX

I like having the banking option at Schwab, but wonder if there is a big advantage of putting money in Vanguard index funds over the native Schwab index funds? Is the advantage of Vanguards funds also apply when using them at Schwab?

That’s exactly my question. Did you get an answer?

correction: VBTLX not BTLX

Hi,

Good job, I really liked your article. I would love to open an account on Vanguard. However, I am from Spain and I am not sure how could I be able to do it. Could you give me any ideas?

Thanks,

Maria

I currently have about 250k in IRAs with Fidelity, a Schwab checking account, and I want to start buying ETFs with an after-tax investment account (about $1k per month). I want to keep the checking account, and I was thinking about creating a Vanguard account for the ETFs, but do you recommend just consolidating everything into Schwab?

Do you use the Securities Lending option with your investments or not? Do you have a blog that addresses this option that brokerages are now allowing individual investors to do?

I’m relatively new to investment and I found this article very helpful!

Question: what would be the impact of buying into Vanguard’s index fund through Schwab? I went with Schwab for the checking account (exactly like you explained above) and I notice I have access to what appears to be all of Vanguard’s best index funds. Would I still benefit from Vanguard’s superior tax efficiency even if purchased through Schwab?

Thank you!