If you’ve followed the investing headlines (or even just watched the Super Bowl commercials) you’ve probably already heard the shocking news.

Fidelity’s declared war with Vanguard. And they’ve now taken the arms race to uncharted territory – Fidelity is literally offering FREE index funds.

The move dethrones Vanguard’s decades long position as the cheapest index fund provider.

Not surprisingly, this has left a lot of well-meaning index fund investors caught in the middle of the war. And they’re smart to ask the question that’s on everybody’s mind:

Is Vanguard or Fidelity the better choice for investing your hard-earned dollars?

Today’s post, to the rescue. I’m pitting Vanguard against Fidelity, and then breaking down all the Vanguard vs. Fidelity nuances you need to know to stretch your investment returns the farthest.

(For the impatient, you can use this table of contents to jump to my final Vanguard or Fidelity conclusion.)

Vanguard vs. Fidelity, The Quick Overview

|

|

|||||||

| Account Minimums | $3,000 (for most funds) | $0 | ||||||

| Cost of Stock Trades | $7 per trade (for most accounts) | $4.95 per trade | ||||||

| Cost of ETF Trades | •$0 per trade | •$0 for commission free ETFs

•$4.95 for all other ETFs

|

||||||

| Cost of Mutual Fund Contributions | •$0 for Vanguard Funds

•$0-20 for non-Vanguard mutual funds |

•$0 for Fidelity funds

•$0-49.95 for non-fidelity funds |

||||||

| Cost of Direct Bond Purchases | $0 to $2 per $1,000 face amount | $1 per bond (usually) | ||||||

| Commission Free Mutual Funds | 2,800 funds | 3,700 funds | ||||||

| Commission Free ETFs | 1,800 ETFs | 91 ETFs | ||||||

| Lowest Index Fund Expense Ratio | 0.04% | 0% | ||||||

| Diversification of Index Funds | 3,573 companies held by VTSAX Fund | 2,500 companies held by FZROX Fund | ||||||

| Percentage Return Lost to Taxes* | 0.58% for VTSAX fund | 0.98% for FKSAX Fund | ||||||

| Customer Service | •Monday-Friday phone support from 8 AM – 10 PM ET

•Email support available |

•24/7 phone support

•180+ physical branches •Live chat and email support available |

*2018 returns used – aligns closely with returns since fund inception.

And from that huge chart of technical mumbo jumbo, here’s the part that actually matters to you:

- You can use either company to open a taxable investment fund, Roth or Traditional IRA, college savings fund, or just about any other relevant investment vehicle. (Put simply, if these guys don’t offer it, it’s probably not an investment you or I have any business being in…)

- On the whole, the two companies are both top notch, and the differences are somewhat splitting hairs.

- In any case, let’s split some hairs…

To the 9 round showdown!

Round 1: Investment and Mutual Fund Selection

Both Fidelity and Vanguard have access to thousands of fine index fund choices. If we’re splitting hairs (and we are…)

- Fidelity technically has the edge in mutual funds, sporting an impressive list of 3,700 mutual funds which can be bought and sold for $0. (Versus “only” 2,800 commission-free funds at Vanguard)

- Vanguard has the edge in ETFs, with 1,800 commission-free ETFs. (Versus 91 at Fidelity)

Honestly though, that’s mostly a bunch of marketing nonsense, in my opinion. Realistically, we only need our broker of choice to have enough solid options to build a good three-fund portfolio.

Either Fidelity or Vanguard serves that purpose just fine.

- Vanguard is anchored by classics like their Total Stock Market Index Fund, Total International Index Fund, and Total Bond Index Fund.

- Fidelity is supported by the highly hyped, hot off the press Fidelity ZERO Funds, which likewise include a Total Market Index Fund, International Index Fund, and US Bonds Index Fund.

Round 1 Winner: Calling this one a draw, since both companies offer elite options for the only type of index funds we should bother with.

Round 2: Fees

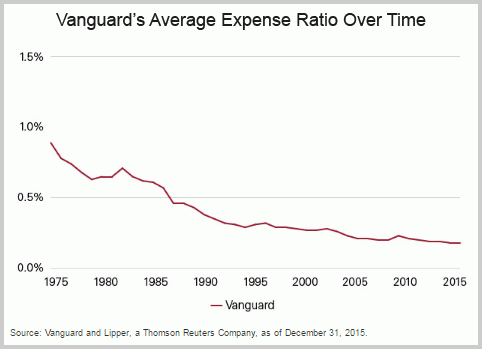

It’s pretty surreal to write, but Vanguard does not actually have the cheapest fees anymore. (Hence, the entire reason for this article.)

That’s because in 2018, Fidelity fired a shot across the bow. The company’s announcement that their index funds wouldn’t just be cheap to own, they’d instead be entirely free, was a cannonball straight into Vanguard’s main competitive advantage. (Get the metaphor?? Vanguard’s logo is an old-timey ship!)

By comparison, Vanguard’s cheapest funds carry a 0.04 percent expense ratio.

So, it’s clear who the winner is. Free is better than not-free, even if the not-free option is still about as close to free as you can possibly get.

How is Fidelity able to offer funds for free, anyway?

It’s a good question, with a two-part answer. We’ll get to the second answer in the next round, but let’s first focus on the part with the potential to impact the average investor the most.

Fidelity is willing to offer their index funds at no cost because they’re essentially taking a page out of the grocery store’s playbook. By offering these funds on sale, the funds act as a loss-leader for fidelity.

That’s because Fidelity has many other actively managed, high fee funds they’re kinda-secretly hoping you buy once you become a customer. Fidelity also sells their active trading and investment advisor services much harder than Vanguard. Both of those have the potential to provide a serious revenue stream to the company, while also wiping out the small savings you might experience from their free index funds.

Whereas at Vanguard, pretty much everything is at its rock-bottom price already. There’s no chance you’ll end up in a fund with an unnecessarily high expense ratio, because Vanguard holds their fees as low as possible all the time.

To keep the grocery store analogy going, Vanguard is the grocer that is always really cheap, but never runs any sales. On the other hand, Fidelity is the store that occasionally runs unbeatable deals. A smart shopper can certainly come out ahead at Fidelity by carefully selecting what’s in their cart, but if you’re not careful, you could end up buying a can of beans for $4.

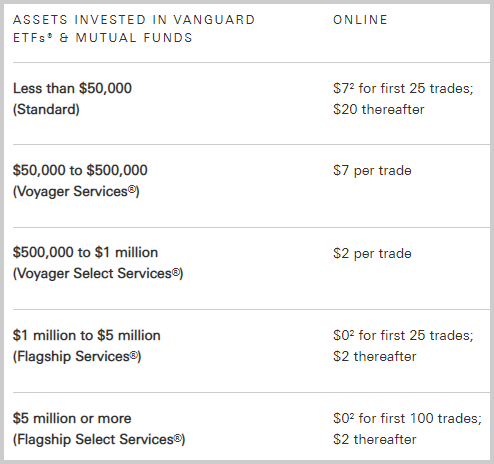

What about fees for stock trading?

Both providers offer free trades whenever you’re dealing with their own index funds. If you’re trading individual stocks or some weird third party index fund, you’ll be hit with a $7 fee at Vanguard (usually) and a $4.95 fee at Fidelity.

Then again, none of those prices should matter to you. Because if you’re looking for the best brokerage for active stock trading, I have to ask… Why are you doing this to yourself? You’ll pay more for your hours and hours of research, and worse, research shows you won’t beat a basic index fund investing strategy anyway.

Round 2 Winner: Fidelity, with a bit of an asterisk. You’ll need to navigate their at-times booby trapped selections, and Vanguard holds a few cost-saving aces up their sleeves in the next few rounds…

Round 3: Securities Lending and Index Fund Tracking

Securities lending is likely the second reason Fidelity is willing to offer free funds. Securities lending is common practice in the index fund industry, where companies like Vanguard and Fidelity lend out index fund shares to active stock traders who are interested in short selling and other more complex trading techniques. In exchange, Vanguard and Fidelity make money.

What does security lending mean for you, the regular index fund investor?

Well, it means the index fund itself can actually make a tiny bit of money, and often times, the manager of that index fund chooses to distribute some of those profits back to shareholders.

Securities Lending at Vanguard

We see evidence of the securities lending effect in Vanguard’s Total Stock Market (VTSAX) index fund. Over the past 19 years, the stock market returned 6.70 percent per year. Given VTSAX’s expense ratio of 0.04%, you’d expect it to have returned 6.66% over the same time period.

But in reality, VTSAX returned 6.68% percent over the past 19 years. That’s 0.02% higher than expectations. The main cause of this overperformance? Vanguard distributes all of their securities lending profits back to shareholders.

The result is that thanks in part to securities lending, Vanguard’s effective expense ratio is actually 0.02%, rather than the stated 0.04%.

Securities Lending at Fidelity

Fidelity claims they will also distribute some of its securities lending profit back to shareholders. But with their ZERO funds being brand new, there’s no track record to double check this claim.

Looking at some of Fidelity’s other funds, they do have a similar track record as Vanguard, overperforming the stock market by about 0.02% per year. So it’s probably safe to assume they’ll treat their new funds similarly. That said, zero fees is new territory, so there’s no guarantees.

Round 3 Winner: Draw. Both companies operate similarly here.

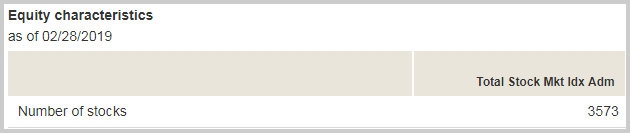

Round 4: Underlying Diversification of the index funds

As index fund investors, we invest for diversification’s sake. Therefore, we want an index fund provider whose funds own as much of the stock market as possible. This will help reduce our risk to any single stock or group of stocks.

Vanguard has the very slight advantage here. Vanguard’s Total Stock Market Index Fund holds a staggering 3,573 stocks. Fidelity’s ZERO Total Market Index fund holds “only” 2,500 companies.

At this point, it’s worth noting the 1,100 company difference mostly includes the tiniest of companies. When companies are that small, they’re unlikely to skew the index fund’s returns all that much. That said, it’s still a minor bonus point for Vanguard’s diversification advantage.

Round 4 Winner: Vanguard, although the difference is pretty minor.

Round 5: Tax Efficiency

If you’re not holding your index funds in a retirement account, tax efficiency should be one of your biggest concerns.

Of course, any investment held in a non-retirement account is subject to taxes whenever you sell at a higher price than you bought (capital gains) or receive interest income (dividend taxes).

But what most people don’t realize is that when a fund manager sells the underlying investments making up the fund, the fund itself has to pass off those taxes to shareholders. Even if you personally haven’t sold any shares.

(This is why actively managed funds, which buy and sell all the time to try to beat the market, handicap themselves by causing so much extra taxes for shareholders.)

Do we expect Vanguard or Fidelity to be more tax efficient?

Vanguard holds a huge advantage here. For two reasons:

- Vanguard owns a patent through 2023 which allows them to flow capital gains through its ETF shares of the same fund.

- In the case of Fidelity’s new zero fee funds, Vanguard’s funds are older. This lets them use down years in the stock market to carry losses forward and reduce tax liabilities.

Who is actually more tax efficient? Vanguard or Fidelity?

Because of this and other strategies employed by Vanguard’s fund managers, VTSAX has distributed $0 in capital gains to shareholders since 2000. That’s amazing.

For comparison, Fidelity’s Total Stock Market index fund distributed $0.322 per share of capital gains last year. (The new zero funds don’t have a track record yet to analyze.)

The end result? Fidelity’s index fund gave up 0.99% of its return to taxes, while Vanguard gave up just 0.48%. (Source: Morningstar has a great breakdown of FKSAX’s pre & post tax returns and VTSAX’s pre & post tax returns)

This is huge.

Think about it this way. Fidelity’s new funds are “free” whereas Vanguard’s 0.04% expense ratio will cost you $4 in fees for every $10,000 in your portfolio. BUT, Vanguard’s increased tax efficiency means you’ll lose $51 less in taxes each year.

In other words, Vanguard’s tax efficiency could save you 13 times as much as its higher expense ratio costs.

Round 5 Winner: Vanguard, by a lot. Vanguard’s tax efficiency completely wipes out the savings from Fidelity’s lower fees, and then some.

Round 6: Minimum Investments

If you’re investing in ETFs, this section doesn’t matter. But I prefer mutual funds over ETFs, so we’ll include this category for good measure.

Vanguard’s minimum investments for mutual funds technically start at $1,000, but almost all the funds you’d want to be in have a $3,000 minimum investment. [ Note: Thanks to some readers for pointing out that Vanguard recently lowered their “admiral funds” share class from $10,000 to $3,000. This means that unlike before, a $3,000 investment in Vanguard mutual funds automatically gives you access to Vanguard’s lowest fees. Apparently when Vanguard and Fidelity compete, we all win!]

In contrast, Fidelity’s mutual funds have no minimum investment. Which means if you have less than $3,000, you can immediately jump into their zero fee funds. This is definitely an advantage for Fidelity.

That said, I find minimum investments to be pretty overrated. Hear me out.

You should be making your investment selections with a long term mindset. If you’re serious about building wealth, you’ll likely stick with whichever investment company for 30, 40, or 50+ years. If that’s the case, making your decision based solely on a minimum investment is pretty short sighted, because the amount of time that you can’t afford the minimum will represent such a small portion of your investing career that it’s not really worth stressing over.

Round 6 Winner: Fidelity.

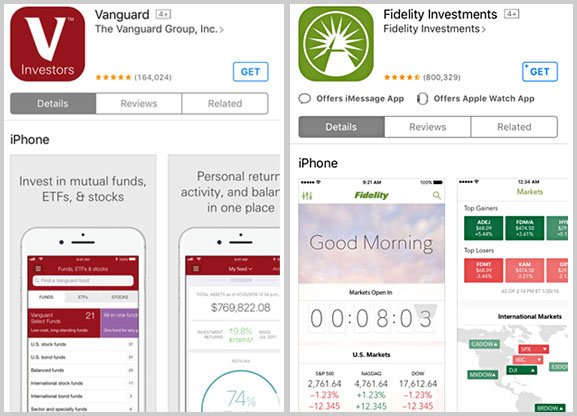

Round 7: Mobile App

To be honest, this isn’t high on my priority list, since I’m not actively trading. Waiting until I’m near an actual computer to buy, sell, or convert funds isn’t the end of the world for me. If anything, it helps helps me to avoid the temptation to gamble in the market.

The only use I have for a mobile investing app would be to check my account balances. And for that, I’d rather see all my accounts in one place with my favorite investing app, Personal Capital.

That said, Vanguard and Fidelity both offer mobile apps with solid reviews on the Apple store.

Since I haven’t personally used either of these apps, and I couldn’t find anything alarming either way in my research, I’ll call Round 7 a draw.

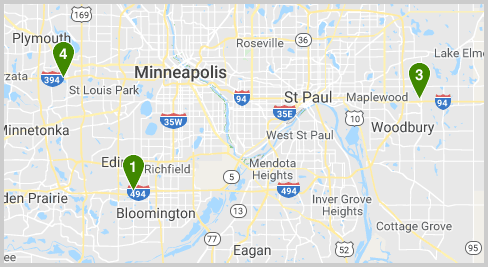

Round 8: Customer Service

I’ve been a Vanguard customer for nearly a decade, and I’ve never had a problem with their customer service.

However, I’m giving the advantage here to Fidelity. For two main reasons:

- Fidelity’s telephone customer service is available 24/7, versus Vanguard’s regular Monday-Friday business hours.

- If a problem gets real serious, Fidelity has physical branch offices you can walk into. I typed my zip code into their Branch Finder and was surprised to see three locations within driving distance.

Round 8 Winner: Fidelity.

Round 9: The Intangible Trust Factor

Lastly, no discussion would be complete without mentioning one important but often overlooked factor. How much can we trust Vanguard or Fidelity?

Because let’s face it. Handing over your life’s savings to an investment company requires a level of commitment that we shouldn’t ignore. The last thing we want is a company that will lure us in with low expenses before jacking up the price on us.

Unfortunately, some investment companies have actually done this in the past, and it leaves shareholders in a terrible position. Switching to a lower fee fund, especially in a taxable account, isn’t as simple as deciding to open a new account or selling a fund. Often, it comes with all sorts of capital gains tax penalties – something we obviously want to avoid.

Who’s been more trustworthy in the past?

Thankfully, neither Vanguard nor Fidelity has a history of these shenanigans. In fact, both have a long history of actually lowering their costs to shareholders, which is admirable.

That said, for my money, the advantage here has to go to Vanguard. Their founder, Jack Bogle, literally invented the index fund, and then spent a lifetime campaigning against the greed and corruption on Wall Street.

And it may be easy to forget in the wake of Fidelity’s ground breaking zero fee funds, but make no mistake. Fidelity’s lowering of expense ratios is a marketing response to Vanguard’s long and storied history of driving prices down for the common shareholder.

Fidelity is jumping on the bandwagon, which is obviously a great end result for its customers, but Vanguard’s been driving this ship for decades. (See! I managed one last ship metaphor!)

Which company has the better structure for shareholders?

And lastly, Vanguard is unique in its structure. While Fidelity is owned primarily by one rich family and a few venture capitalists, Vanguard is structured so that it’s owned by its shareholders.

The result, in theory at least, is that rather than juggling the average investor’s hope for low costs with the private owner’s need to maximize profits, Vanguard’s structure is aligned in the best interest of shareholders. Vanguard keeps no profits, and instead funnels all earnings back into the funds themselves.

Sounds a little dreamy, perhaps, but Vanguard’s history backs up the claim.

Round 9 Winner: Vanguard, although both are highly trusted investment firms.

Vanguard vs. Fidelity: The Money Wizard’s Final Conclusion

|

|

|

| Investment and Mutual Fund Selection | ||

| Fees | ||

| Securities Lending/Index Fund Tracking | ||

| Diversification | ||

| Tax Efficiency | ||

| Minimum Investment | ||

| Mobile App | ||

| Customer Service | ||

| The Intangible Trust Factor |

Despite Fidelity’s aggressive moves to undercut what was once Vanguard’s #1 selling point (low fees) my usual recommendation still doesn’t change.

Vanguard is still the best choice for long term index fund investors.

Vanguard just holds too many advantages over Fidelity in the most important areas. Some of those areas, like their patented tax efficiency, is actually very quantifiable, and enough to offset Fidelity’s marginal cost savings. Others, like their four decade history of doing the right thing, are more intangible.

For that reason:

- If I were a new investor debating whether to open an investment account with Vanguard or Fidelity, I’d still choose Vanguard.

- If I was an existing Vanguard customer (I am) wondering whether I should jump ship (boat metaphor #3!) to chase Fidelity’s lower fees, I wouldn’t.

- And for current customers who are happy with Fidelity, the company has enough advantages that I don’t see any pressing reasons to change.

The last point highlights an important distinction. We may have reached a point where the competition has grown so close, the differences are almost too small to matter. And on that front, we all win.

No matter which investment company you use, I still think Personal Capital is the best free app to help manage your Vanguard or Fidelity investments. Personal Capital automatically 1) tracks your investment performance 2) breaks down your asset allocation (across all your accounts) better than any tool I’ve ever seen 3) reports on your fees, to make sure you’re not getting overcharged.

For the price of free, it’s a no brainer.

One of the reasons Fidelity is able to offer Zero fee funds is that its not actually tracking the total market index. Instead they created their own total market index and avoided the index free – which is charged to all index trackers. Now this could be very similar or it could not. Time will tell. But in the meantime, would you like to actually track the total market index or not? That’s the question that the Zero fund investors should answer.

Good clarification, and one of the reasons I gave Round 4 (Diversification) to Vanguard.

Ok then but the total market index that tracks the licensed index and pay .015% still cheaper then vanguard

Very thorough analysis. The tax efficiency of Vanguard is the key for me in taxable account.

I agree, and thanks!

Can you please do a comparison of E*TRADE and Vanguard?

Great little shootout. You should review this comparison every couple of years to see if the winner changes. Like you said, the differences between the two are quite small…. but subject to change over time.

I think I will! Definitely will be interesting to see how this war plays out. Vanguard could respond or Fidelity could get even more aggressive. Either way, I intend to keep this page updated for sure.

A real service to those who do not have the time or resources to research. Thanks much

I find Vanguard to be easy to navigate through it’s website and when you call they are very helpful. I have recommended Vanguard to several people over the years. I have been with Fidelity several years ago, and they are a good company, but I prefer Vanguard.

Cool to hear from a customer of both! Thanks for sharing.

Wow thanks for indepth article. Been with Vanguard since early 90’s. Although small investor they never, ever talk down to me. They have always been truthful and gracious.

I agree. If only my bank could learn a thing or two from Vanguard!

Wow that’s huge. That should also take points away from Fidelity’s “Intangible Trust Factor” since they’re pitching it as a direct competitor to VTSAX

I somewhat agree and somewhat disagree. I do think it’s fair to say Fidelity’s ZERO funds are Vanguard’s closest competitor to VTSAX at this point. I wouldn’t exactly expect Fidelity to admit Vanguard’s funds are more tax efficient any more than I’d expect Vanguard to admit that Fidelity’s got better customer service options.

Each company hyping their own funds just gives unbiased blogs like us something to write about. 🙂

How does that affect vanguard?

Great article. Have been with Vanguard since the 80’s. Have done well. Great customer service, essentially non-profit, and no gimmicks. Their managed funds, eg Primecap, Wellington, and Wellesley, have been solid consistent winners

Glad you liked the article, and glad you’ve had success with Vanguard!

Insightful. If you dig under the cover, I’d be surprised if the ZERO funds don’t have a different securities lending fee policy. As soon as I saw the 0% expense ratio on those new funds, I speculated that Fidelity would recoup that by not rebating any of the securities lending fees. Those fees are likely not insubstantial. Maybe I’m wrong, but check the prospectus. Note too that the tax efficiency of the Vanguard funds does not generate an economic benefit for the shareholder if those funds are held inside of tax-favored accounts like Traditional or Roth IRAs.

I searched high and low, including the prospectus, but wasn’t able to find anything specific about securities lending distributions on the ZERO funds. Fidelity reps have gone on record to say that some revenue from securities lending will flow to customers. No clarification on exactly how much “some” is though, so obviously that shouldn’t be taken as gospel.

Good point about the tax efficiency.

Isn’t Fidelity being investigated right now over hidden fees? Also small correction regarding fund minimums. End of the year last year Vanguard got rid of investor shares on index funds. They brought admiral shares down to $3k with the smaller expense ratio. Managed funds still have investor and admiral but that’s a 3k/50k minimum. Vanguard also does have a selection of funds for $1k

From what I’ve seen, the hidden fee investigation is related to third party index funds, so should be completely unrelated to Fidelity’s own ZERO funds and other Fidelity index funds. Still a definite negative mark for their “intangible trust factor.” Probably should have mentioned it in the article.

Didn’t realize Vanguard lowered their minimums for the admiral funds. That’s an awesome win for investors, thanks for the heads up!

They’re being sued for collecting payment on the registration of funds in tmobiles 401k. But it wont go anywhere. Every asset management company that services 401ks has been sued. ERISA is a nightmare to navigate.

Yes even vanguard has been sued. They just settled a 20mil lawsuit.

https://www.investmentnews.com/article/20190410/FREE/190419994/401-k-lawsuit-over-vanguard-fees-ends-with-23-7-million-settlement

This isnt saying anything bad about vanguard. Just an example that anyone operating on that side of the industry is going to get hit.

The zero lineup does not include a us total bond. It’s a total us, total international, large cap and extended market.

Although they decreased the price on licensed index funds as well with the launch of the zero funds. I think us aggregate bond is 2.5 bps.

They also have well north of 91 commission free ETFs. I believe it’s closer to 300 now.

I can’t believe you wrote this TODAY. Good article. Very thorough. But I think I disagree with your conclusion. I’m puzzled. We’re 50ish. Are we the only ones with kind of large monthly ins-and-outs that we don’t want passing under all the noses at the local banks and earning NOTHING? All y’all just want investing services and nothing more?

Today I’ve decided to leave Vanguard after 10 years for reasons no one ever mentions: it’s not a bank. (I don’t want to bank locally for privacy reasons that aren’t going to change.)

They recently announced they are dropping the VanguardAdvantage account and all its banking features. No more Billpay, no more direct debit (like my mortgage payment), no more ATM, only certain check writing. They do still have mobile deposit, so you can give them your money, but there aren’t many ways to get it back anymore.

And the customer service kind of sucks really. I’m supposed to have one regular customer service person to deal with because of my balance, but of course, he’s rarely available. I had an annual consultation with a different guy who’s an advisor and it was clear that I was small change to him. He obviously hadn’t reviewed my account before our initial conversation, and he jumped to an erroneous conclusion during it. Then when I got his recommendation, he included my mother’s account (which I have some sort of supervisory permission to, but is in HER name and is not MY money!) and my children’s 529s! Ridiculous! He also recommended moving from some index funds to actively managed funds, which surprised me coming from Vanguard.

The worst on the service end though was when I called to ask why they only notified my husband that they are ending VanguardAdvantage. We’re old-school and it’s a joint account, but I handle our finances pretty much single-handedly, so I need to know this! I was told they are not required by federal law to notify both owners of JOINT account changes. WOW!

Our portfolio is simple and I have found similar Fidelity funds and ALL the bank features I need. I think the 2% credit card is interesting and it looks like I can further simplify my bookkeeping by transferring our HSA account too.

Vanguard isn’t a good fit for us anymore. I told my husband, “It’s starting to feel like we’re getting what we pay for at Vanguard.”

Agree. I also switched from Vanguard to Fidelity. In my case it was a good move. The 2% cash back credit card is awesome too! Money goes right into your money market account. Low fees and lots of extras like local Fidelity branches you can just walk in and meet with someone.

JB – I am so glad to hear good news on Fidelity as I just started investing and banking with them (the 2% credit card started it all).

I also switched after almost 15 years with Vanguard. After doing some research the full service Fidelity offers fits my needs much better. Vanguard is great for the simple passive investors but once you mature as an investor Fidelity is the place for your money.

Some items are more important than others and deserve a higher weighting. It was because of the lack of customer service that I left Vanguard. I understand the problem: Vanguard’s fast growth and Vanguard’s drive to keep costs low. I’ve heard that Vanguard has turn over problem with personnel because of the low cost structure. I also found Vanguard’s on-line interface to be lacking when compared to the competition.

I have managed accounts at both due to work and retirement. Vanguard is much less flexible in recommended portfolio items. Fidelity is more flexible in investment scenarios but not as good in customer service. Fidelity offers much better and easier to use investment information. Probably a wash. I am now contemplating a Schwab account given their new fee structure. Any opinions on their service in financial planning?

Fidelity recently added 500 or so ETFs to their commission free lineup. Otherwise, awesome and thorough post!

I think round 2 should be Vanguard with Schwab! Would love to get your thoughts on that.

If Vanguard is the seasoned veteran and Fidelity the rookie, Schwab to me is the 5 year guy with enough experience to be dangerous.

I know some of their funds have 0.02% fees, but honestly have not looked as thoroughly as you did here into their securities lending and tax efficiency. Would love to get your thoughts!

I like this idea!

How do you calculate the 0.99% drag from taxes? I wouldn’t trust the Morningstar numbers because they might assume the most pessimistic tax assumptions (max federal/state taxes: e.g., 20% federal, 3.8% Obamacare and 13.3% top CA state tax. But if you’re in a lower bracket that drag is much lower or even zero. And the drag is zero in a retirement account.

I took Morningstar’s numbers at face value just because I didn’t want to bog the post up with math.

Another simple way to look at it. According to Fidelity, FSKAX distributed about 47 cents per share over the past 12 months, with an average 12 month share price of $75.34. Say you held $10,000 of stock. You’d have theoretically held 132.73 shares during the year, therefore incurred $61.72 of capital gains. (132.73 shares * 47 cents) At a 15% capital gains tax bracket, you’d owe $9.26 in taxes, or 0.09% of your investment. (I realize that’s rough math and the true calculation is more complex.)

Not quite as bad as Morningstar’s 13x figure, but you’re still paying over twice as much as Vanguard’s 0.04% expense ratio.

It appears that the greatest advantage of Vangard index funds over Fidelity’s is Vangard’s tax efficiency. If funds are held in a retirement account, does that change your overall conclusion?

Yeah, the tax efficiency is a moot point if it’s held in a retirement account.

I have a Roth IRA that I need to invest . Would Vanguard ETF total Market be better than the total market mutual fund? I am 66 and retired and looking to invest this long-term. I’m also thinking of buying some Fidelity zero total Market and over the years determine which company outperforms.

How To Decide Between An ETF Or Mutual Fund?

Vanguard dropped the $10k minimum for admiral shares down to $3k at the end of last year.

Thanks! I updated the article.

I used to work at one of these companies and have been a client at both, and I will admit that this is a really fair comparison. Fidelity has a better app and extra features like a checking account and credit card if you want all in one service, but Vanguard has that peace of mind that you will never be bait and switched on so you can truly set and forget it. Both are great companies though obviously. I think that if you’re an active trader at all, use mobile apps often, and maybe want to use extra features like checking accounts and a credit card all in one place, Fidelity is the way to go. But if you just truly want to set and forget your portfolio with a company you can trust long-term, Vanguard is the way to go.

I’ve been with fidelity for 10 years when I started invested, then switched to vanguard really because of the low fees for the past 10 years. Now I’m considering switching back for a number reasons. Firstly, fidelity’s costs for all the funds I need are all lower, if not free. Yes,its not much difference for your core TSM index but you see the savings add up in international, reit, small cap and bond funds. Sure, NO one knows about future index performance between these two companies, but historically the fundamental returns have been pretty darn close, so yes time will time, but diversification generally leads to the same performance in terms of broad market returns. The point guaranteed is I will save money on fund expense fees. Having a healthy retirement saving of $1.5 million nets me around $700 a year if I switch to fidelity. Over the long run that adds up. My suspicion is fidelity will continue to lower or eliminate fees. if you have a self employed 401k with vanguard, you cannot but admiral shares but must buy more expensive investor shares, fidelity does not have this issue. Comparing the two companies, fidelity has always had better customer service hands down. Better bill pay, check writing, etc…plus the people you talk to actually give you opinions and real advice, I found vanguard frugal and limited in customer service. If you have a health savings account, switch now from your present custodian to fidelity, without a doubt you are paying too much. I did get great results from vanguard, there are a fantastic company, but remember what John Bogle originally wrote about the higher cost of funds. Money in my pocket will always be better than in there’s.

Would it be best to invest retirement accounts like 401k and roth IRA in Fidelity, then any taxable account after that in Vangaurd? Could be the best of both but maybe im missing something here.

I have my ROTH and some other investments at Vanguard, my 401(k) is at Fidelity. Roughly the same amount at each place.

We recently set my 18 year old daughter up with Fidelity. The zero minimum investment is pretty important for a teenager, whereas I would probably never put less than 5 or 10K into anything. Dear lord but their customer service was horrible. Took almost two months to set up a simple ROTH. I never had such a bad experience with Vanguard. I do think that the zero minimum is a great marketing strategy, especially for folks who are just starting out.

Vanguard’s website is also much easier to navigate and use, and I can invest directly from my bank account, while Fidelity makes you move it into a cash holding account first, so investing requires two steps, which is slightly annoying.

Also Vanguard does have physical locations. Not nearly as prevalent as Fidelity. I’m in the Phoenix Metro, and we have three Fidelity locations and one Vanguard.

Probably the best comparison i have ever seen. Thank you for doing this. I have been torn about leaving Vanguard to Fidelity and I have a Roth. Because I have a Roth IRA (retirement account) it would make more sense to go to Fidelity if I understand correctly, but I’m still torn about the move because of the securities lending. If what you stated below is true the real difference is only 0.02% gain if i switch to Fidelity.

The result is that thanks in part to securities lending, Vanguard’s effective expense ratio is actually 0.02%, rather than the stated 0.04%.

Would love to see a follow up to this article a year or 6 months later to see how Fidelity has handled this to make it worth it or not to move.

Thank you for this great article. The best comparison I have read so far. I have a 401K account with Fidelity for many years. I would like to move it into a Rollover IRA mainly to be able to send The yearly RMDs directly to a nonprofit organization (orphans support.) After reading your article I am torn between Vanguard or Fidelity. Would you please let me know which one you prefer for my case. Thank you.

When I faced this choice ~2 years ago (needed a Rollover IRA as a vehicle for QCDs), the two companies were so nearly equal on all other counts (for me, not much of a trader) that the decisive consideration was that Fidelity’s QCD form was much easier to deal with. Also, they set me up for QCD checking so that I can send my own cover note along with my donations if I wish.

On the other hand, my Roth IRA has been at Vanguard for years, and my simple needs are well satisfied.

Thank you so very much. I’ve been anxiously waiting your response. Good Day!

Deal breaker for me is a Fidelity office in my town and a physical person to chat with, he’s a great guy, knowledgeable and no sales pressure. The bonus is what I think is a better web site for research.

I just opened a taxable account with Vanguard, then had second thoughts after seeing Fidelity’s ‘Zero’ funds, though I was a little suspicious. Is anything in investing truly free?

This article makes me feel better about Vanguard. Their tax-efficiency and dividend redistribution more than compensates for negligibly higher expense ratios. And yes, I also appreciate that Bogle originated index funds, that Vanguard functions very much as a non-profit.

I agree the differences are so negligible it’s not worth switching if you’re already with one of them, but for those deciding I agree with your Vanguard recommendation.

Great article. Have been with Vanguard since the 80’s. Have done well. Great customer service, essentially non-profit, and no gimmicks. Thank you for best article.

Vanguard offers the best index funds (e.g. VTI, BND) but Fidelity has the best brokerage account with a sleek, beautiful, and easy-to-use trading portal with outstanding, round-the-clock customer service. My advice is to buy Vanguard funds using Fidelity accounts.

I’ve been looking for this info for a long time. You wrote a very thorough comparison. Thank you.

thank you for the detailed comparison. I have been so confused comparing these two companies as i am a newly started investor.