If you ever visit the headquarters of Berkshire Hathaway, Warren Buffet’s behemoth of an investment firm, it might take you a while to notice what’s so peculiar about it.

From the outside, you’re certainly not given any hints.

The building looks so stereotypical cookie cutter it’s laughable. The plain rectangular shape could camouflage itself as any generic office building in any generic city in the world. And the “Plain Beige” color that coats its outside walls doesn’t differentiate it in any way, either.

Step inside, and you still might not be able to spot it.

Here’s a hint…

It’s what’s missing that makes the Berkshire Hathaway headquarters so unique.

Despite the investment firm holding nearly $1 trillion dollars in stock market investments, you won’t find a single stock ticker display.

Nor will you find a host of monitors spitting out the latest charts, graphs, and prices.

In fact, a starry-eyed MBA student once asked Warren Buffett why he chooses to headquarter his investment company in the sleepy town of Omaha, Nebraska instead in the investing hotbed of New York City.

His answer?

Well, for one he likes Omaha.

But more importantly, he says it gives his investing company a competitive advantage.

While his competitors are buried in the chaos of Wall Street, it’s hard for those competitors to ignore the noise and panic of the latest stock prices. Meanwhile, Buffett and his employees can relax in the peace and quiet of Omaha, while focusing on what really matters – the long term view of his investments.

Stock price is not that important to me, it just gives you the opportunity to buy at a great price. I don’t care if they close the New York Stock Exchange for 5 years.” – Warren Buffett

Feeling it first-hand

If you followed my latest net worth update, you know the recent decline made me $15,000 poorer in just 31 days. If you’ve got any money in the market, you probably felt it, too.

So it’d be reasonable to ask the follow up question.

“What do we do now? How do we prepare for a potential economic downturn??”

And you might be surprised at my answer, which can basically be summarized as, “Don’t change a single thing.”

Seriously, Money Wizard? What kind of worthless advice is that??

Let’s break it down.

Losses are only real if you sell.

I get it. It’s human nature to avoid pain. Nobody particularly likes getting punched in the face, and nobody likes losing money either. (Which coincidentally feels remarkably like getting punched in the face…)

So when the economic downturn hits, your human instincts will tempt you towards three common paths.

But they’re all traps!

Let’s examine the three most common ways people blow themselves up in the stock market.

1. Why you shouldn’t try to sell early to “get ahead” of a recession

Okay, let’s say we fall into the temptation of trying to avoid a downturn. We monitor our index funds like a hawk, and as soon as we see the start of an obvious recession, we’re out!

Let’s see this in action with a historical example. This is an actual 12-month view of the S&P 500 a few years ago:

Not so fast, buddy. I played a trick on you.

Because if we zoom out of the above graph, it turns out that obvious downturn wasn’t so obvious. In fact, what we thought was “the start of a recession” was nothing more than a little blip in an epic rally upwards:

Had we sold at the first sign of trouble, we’d have missed out on 145% returns!

Whoops.

2. Why you shouldn’t try to “stop the bleeding”

This is the second most common mistake people make.

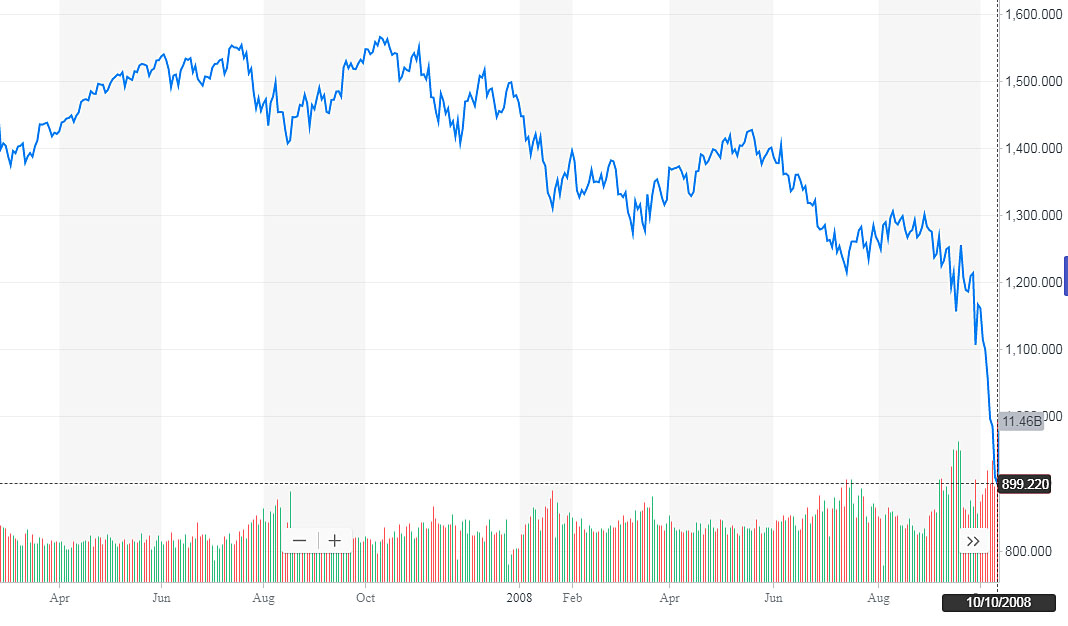

To explore why it’s such a bad idea, travel back with me to September 2008.

The stock market is tanking. Everyone knows it. Over the past 11 months, the S&P 500’s price has fallen and fallen and fallen. A whopping 20% loss in less than a year.

You check the markets and see a 12 month S&P 500 chart that looks like this:

No big deal, you know better than to sell on a downturn.

And then… one week later, this happens:

OH DEAR LORD THE WORLD IS ENDING.

So you panic. Deep down, you know better, but you’ve got to stop the bleeding somehow. That’s your life savings. Your husband or wife is tired of losing money. You’ve got kids to consider.

You sell, and at first, you’re pleased with your decision. In the coming months, the market falls another 20%. “Crisis averted!” you say to yourself.

You continue with your life, avoiding the stock market until things cool off.

Things don’t cool off for a year or two, but eventually, you’re finally convinced the recession is over. Prices are back to levels before the mega crash, so you confidently jump back into the market.

Overall, you’re feeling pretty good. You avoided the “major” downturn and seem to have broken even.

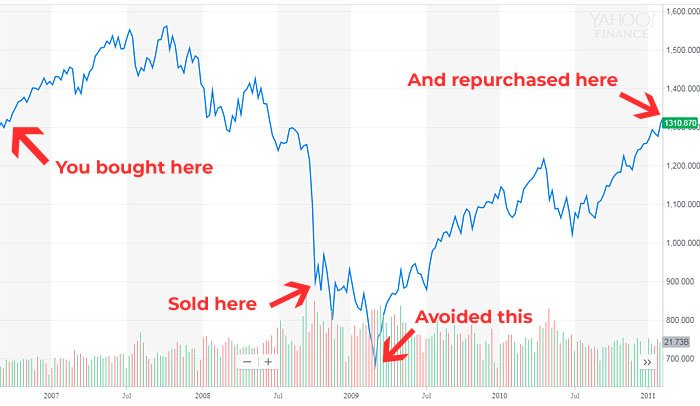

But let’s take a look back at what actually happened. (We’ll assume you’d originally invested 2 years before you panic-sold.)

We can assess the financial damage by analyzing the price of the S&P 500 index.

You’re exactly where you started, and all you’ve got to show for it is a 32% loss in your initial investment. A place you could have been for free, had you just ridden out the recession to the very bottom.

Sure, you successfully avoided the last 16% of the market’s crash. Except, in avoiding that, you turned an imaginary 30% loss into a very real 30% loss.

3. Okay, don’t sell. Got it. But why shouldn’t I build up my cash pile, to take advantage of future low prices?

This is the most common mistake made by newbies and pros alike. They’re worried a crash is coming, so they either cut back how much they’re investing, or worse, they never build up the courage to invest in the first place.

On the surface, this strategy sounds the most reasonable. But we’re walking into another trap…

Because there’s one GIANT wrench in this plan. How do you know when to start hoarding cash?

Captain Obvious would answer this simple question with, “When the market is at the top, dummy…”

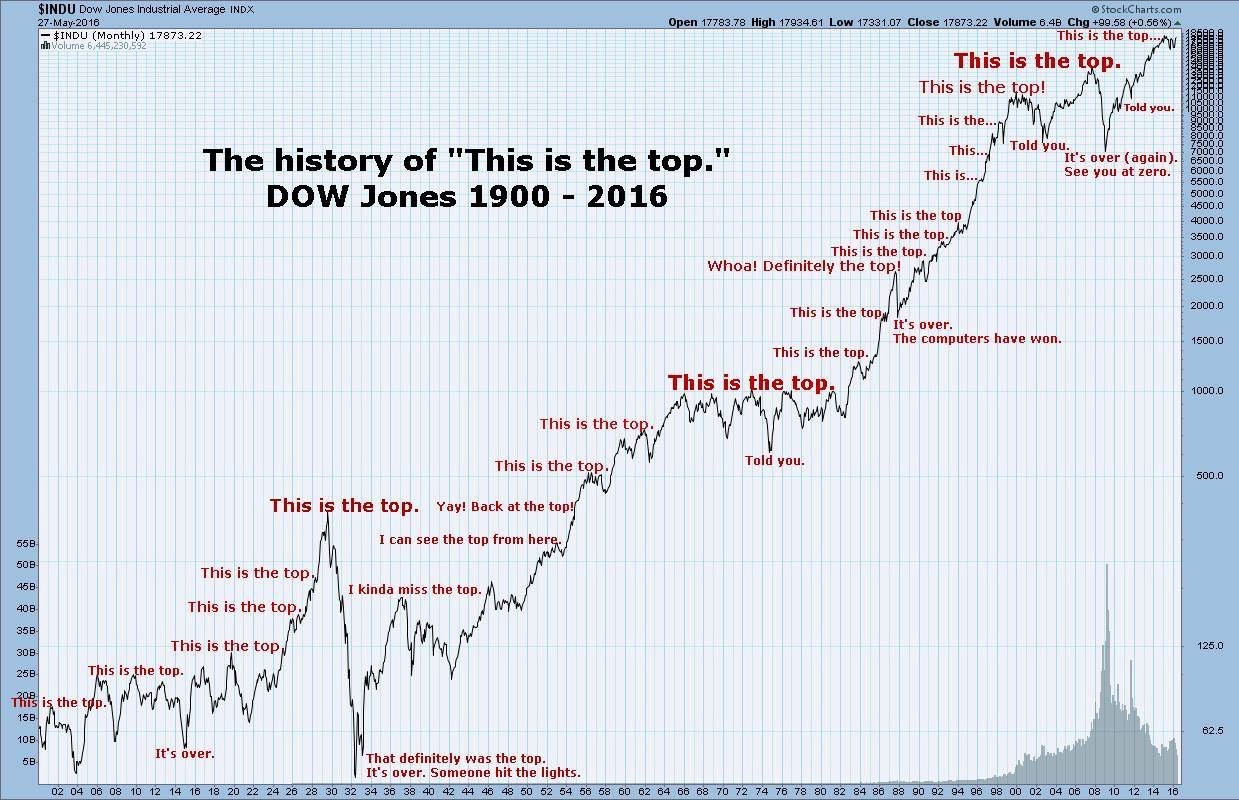

And to refute that claim, I’ll simply reference this graph of the stock market over the past 116 years:

Surely, you see the problem with this strategy. While you’re busy waiting around for prices to “come back down from the top” the stock market is busy compounding and compounding and compounding.

For me, this approach hits the closest to home. Back in 2014, I can clearly remember the pundits claiming the market was overpriced. And in my naivete, I seriously considered whether I should dial back my investments.

We all know what’s happened since then…

The stock market went on to climb another 60% or more. Meaning even if a huge recession hits, there’s no guarantee prices will ever come back down as low as 2014’s “overpriced” levels.

Worst case scenario? Things will probably work out.

In the last net worth update, I talked about the unluckiest investor in history. He put all of his money into an S&P 500 index fund, right before one of the worst crashes in the history of the S&P 500.

It would take powerball-esque bad luck for this to happen, and most people would assume he’d be broke.

But despite involving himself in this doomsday scenario, our poor unlucky investor still made a 75% return on his money in the end.

Because our unlucky investor was smart, and he didn’t panic.

He didn’t try to predict a recession, stop the bleeding, or hoard cash.

Instead, he took the easy path.

He invested, then he did nothing. And his bank account thanked him.

Awesome post! Everyone should read this, especially younger people. Get in the market and stay in the market! We’re all in it for the long term.

Thanks Brian!

The analysis you do to consistently publish high-caliber material is evident with this post. Very informative and perfectly timed with the Dow getting hammered again today;-( Thanks for the great reads as I always look forward to reading them!

That’s awesome to hear, because quality content is always my #1 priority with the site. Glad you like it!

A very enjoyable read moneyWiz! Plenty of good ideas here, but I just have to comment on #3.

I’m a person with a very large cashpile and I can’t emphasize enough how powerful the psychology of having a large reserve of cash is. When markets are down and you don’t have a job, a cash pile can be an incredible buffer that helps individuals keep investing in down markets.

I’m not suggesting people try to “time it” of course, but defeating that ‘fear of running out of money’ is very helpful.

Mwiz’s #3 is about not trying to build a cash pile with an intent to invest it later at ‘future’ low prices. If I understood you correctly, you are suggesting that having a cash pile is a buffer to continue investing in the down markets. 2 different things I think.

Agreed.

It’s also worth mentioning that Mr. Tako is financially free. So he’s at a stage where preserving what he’s already got is more important than investing for growth.

Ha! Was looking forward to your your comment on this after seeing your post about your massive cash pile.

Question for you: Do you think you’d still keep a huge cash pile if you weren’t already financial independent, and you knew it would likely delay your retirement by a few years?

Thanks for the reassurance and logical points! Your blog is what made me realize how important it was to get started with investing in my 20s (well, as early as possible!) and I am glad that I have not panicked with the bumps in the road when remembering your advice.

I hope you continue writing for the foreseeable future because I enjoy your outlook and tips!

That’s awesome to hear! Thanks.

Under normal market conditions a buy and hold strategy with broad market index funds is a great strategy for most investors. Buffett openly recommends this strategy but that said, coming from him it’s more of a “do as I say, not as I do” kind of recommendation, which is hard to swallow given that valuations have officially risen into stupid territory.

Howard Marks said back in January that “In the past, levels like these were followed by downturns. Thus a decision to invest today has to rely on the belief that ‘it’s different this time’.” This kind of sums up how I feel about this market, and I adjusted my strategy as a result.

I admit, even armed with all of the evidence of how overvalued stocks are, that knowledge is rendered basically useless. There was a post on the blog Of Dollars and Data titled “Why The Best Predictor of Future Stock Market Returns is Useless” that you might be interested in.

Thanks for the comment, and I’ll check that post out. I’m a big fan of Nick’s blog.

The only question is what do you do if you are of an age (75) where you don’t (may not) have enough time for the market to come back.

Good question and it brings up a good point – this post was written for the average younger, growth oriented investor.

In the 75 year old’s scenario, the textbook answer is to adjust the portfolio to a more conservative allocation (higher percentage of bonds) like I talk about in the 3 fund portfolio post.

Great reminder! I feel better already. Thanks for the free therapy!

Haha, mymoneywizard.com – demystifying the magic of financial freedom… with free therapy too!

Great post. And even more so the graphs and illustrations really helped dipoct a clearer picture. This is an ever too common misconception that timing the market can have tremendous benefits on ones networth. Reality is it has little effect on the overall picture. The biggest issue is that many people give in to emotion and think from a monetary standpoint rather than a down the line perspective. When it’s all said and done, and the dust has settled! Better to still be holding than to be have sold at a loss.

So true, Dr. Dividend!

Greetings Money Wizard,

Extremely valuable reminders to remain calm and patient during times of volatility.

Thank you much for the ongoing motivation and wise insights!

Great post! I was wondering was I the idiot you just talk about. I have some investment that I was going to cash out and use it as a down payment for a condo. When I saw it went down I panic and switched it to a income secure portfolio..I still haven’t find a condo I like but loss in my portfolio still hurts

Has your position on saving for your investment property changed? Would moving your funds back into buying stocks while the market is low a consideration?

Thanks

Hey Wizard,

Great to see a post like this in the midst of all the chaos. I too was hit pretty hard by the downturn but that didn’t stop me from investing even more at lower prices. Keep up the good work!

– MP

Yes, the first thing to do is not to panic. The next thing to do is keep investing. Ignore the pundits!

Miriam

Hey Sean,

I can’t say how impressed I am right now by reading your website and analyzing how investments works; as this is my first time getting into the market investment. Been in the market has never caught to my attention until couple months ago. Just to let you know, I am constantly reading your site to analyze what I should do with my income, and I want to thank you for doing such an amazing effort to help people like me. I’m very nobbie in this field, in fact, I haven’t invested in anything yet (only paying bills and not buying expensive stuff- just the usual: food, cloths, etc). What’s your best advice for someone like me, trying to start in this field? (I like the idea of an early retirement) By the way, I’m 23 years old, with no kids.