I don’t really hide my love for Vanguard around here, and I’m not alone. Vanguard also comes highly recommended by Warren Buffet, more investing books than we can count, and almost every other website on the internet that’s not in the business of selling mutual funds.

But why exactly are Vanguard Funds the best? Why do I choose to put almost all of my eggs into the Vanguard basket?

I did a lot of research and a little bit of soul searching, all to conclude that Vanguard deserves every bit of its stellar reputation. Here are the top 5 reasons:

1. Vanguard funds are cheap.

Founded in May of 1975, Jack Bogle named the company, “Vanguard” which of course in German translates to low fees.

Okay, that may not be true. But the name Vanguard has become synonymous with low expenses, and for good reason. In an era when mutual funds charging upwards of 1% management fees was common place, Vanguard decided to blow the lid off the whole racket by charging fees at a fraction of a percent.

Today, Vanguard charges fees 80-95% less than the industry average, and the “Vanguard Effect” forces down the price of mutual funds for everyone.

Think a few fractions of a percent in fees don’t matter? Think again. A 1 percent difference in expense ratio can cost you half a million dollars.

If $500,000 is not enough to get you excited in the morning, you’re on the wrong website.

Vanguard’s most popular index funds, VFIAX and VTSAX, sport expense ratios of 0.04%, which remains the gold standard for low fee index funds.

2. Vanguard is different – they’re owned by the investors

Most investment companies are owned by a few filthy rich executives, or are publicly traded companies. Both setups present conflicts of interest.

Sure, charging higher fees might be bad for the customer who’s investing his or her life savings, but the added profit is good for the owners and the company’s private investors. See the problem?

Vanguard, on the other hand, is uniquely structured. The company is owned by its funds. Since those funds are owned by the investors, that is, people like you and I who invest in their index funds, we are the ultimate owners of the company.

This is the secret to how Vanguard charges fees up to 95% less than everyone else, and how their expense ratios have actually dropped as the company has grown larger.

Rather than paying profits to private owners and shareholders, the company is able to pass along the economies of scale in the form of lower fund expenses for everyone.

This isn’t just theory, either. From 1975 to 2016, as Vanguard’s assets under management grew from $1.8 billion to $3.6 trillion, Vanguard’s average expense ratio fell from 0.89% to 0.18%.

3. Vanguard’s mutual funds are the most tax efficient funds in the world.

It’s the law.

Literally.

Let’s back up – At a normal brokerage, ETFs are slightly more tax efficient than mutual funds. ETF’s greater tax efficiency is mostly due to mutual funds having to sell underlying assets in the event a shareholder wants to cash out his investment. Selling appreciated assets triggers capital gains, which must be paid out to shareholders. Capital gains payouts = taxes.

Vanguard is different. Until 2023, Vanguard holds a patent on the ability of its mutual funds to flow capital gains through its ETF shares of the same fund.

That’s a lot of legal jargon to say that, unlike mutual funds from all other companies, Vanguard Mutual Funds with a corresponding ETF are just as tax efficient as the ETF itself. Meaning Vanguard investors pay less taxes.

That’s something no other mutual fund in the world can claim. Until 2023, at least.

4. Vanguard created the index fund

The Vanguard company isn’t just another proud advocate of the idea of index fund investing. Vanguard actually created the index fund.

In the early 1970s, Vanguard CEO Jack Bogle investigated a new field of economic research – the idea that actively managed stock funds achieved subpar performance when compared to an unmanaged basket of stocks.

Bogle started crunching numbers and found the average actively managed fund lagged the S&P 500 index by about 1.5% per year, almost the exact costs charged by fund managers. What a coincidence!

In other words, actively managed funds were treading water compared to the index, and they were charging their investors quite a bit of money to do so.

A year later, Bogle established the world’s first index fund, the Vanguard 500 Index Fund, which sought only to mimic the market’s averages while charging investors almost nothing to do so.

It’s hard to name a single innovation which has made investing as approachable to the common man as Vanguard’s creation of the index fund in 1976. In one swift move, Vanguard took the power out of the hands of a few select money managers and instead allowed anyone to match the performance of the entire stock market.

No high paid money manager required.

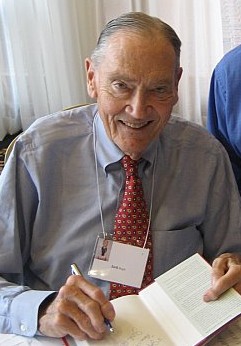

5. Speaking of that Jack, he’s one of the few good guys in the world of finance

By Jack Bogle’s own admission, his net worth is somewhere in “the low double digit millions,” which does sound like a lot, right until you compare him against his peers.

Take Fidelity’s chairman, Edward C. Johnson III, whose net worth totals $9.3 billion. That’s $9.3 billion, with a B, earned mostly from skimming off a little bit from the top of his customers’ accounts.

In addition to having the most pompous sounding name I’ve ever heard, Mr. Edward C. Johnson the III is a walking conflict of interest. He’s the heir of wealthy dynasty who couldn’t more perfectly personify the robbery of high fee mutual funds if they tried.

Bogle, on the other hand, is a vocal critic against the greed on Wall Street, and he’s made a career out of advocating for the small investor. Bogle made the decision to structure the Vanguard organization as owned by its funds, a decision which cost him billions in order to save his investors thousands.

Sometimes Warren Buffett just says it better:

If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. In his crusade, he amassed only a tiny percentage of wealth that has typically flowed to managers who have promised their investors large rewards while delivering them nothing – or, as in our bet, less than nothing – of added value.

In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

-Warren Buffett on Jack Bogle, Berkshire Hathaway’s 2016 Letter to Shareholders

Today, Bogle has stepped down as CEO, but his legacy of making the average investor richer lives on at Vanguard.

Related Articles:

Jack Bogle is truly inspirational. As a financial employee it is my dream to contribute to the industry how Jack has. I was surprised to hear how low his net worth is! Thanks for the info.

In a world today which so widely accepts index funds, it’s crazy to think about what Bogle went through to make it all possible. “Bogle’s folly” was the actual nickname given to the first index fund, and as Buffett mentioned, Jack was mocked endlessly for it.

Had that first index not taken off, Jack would have probably been black balled from the investment world forever, and we’d all be a little bit poorer.

Thanks for the breakdown! We haven’t started heavily investing yet, but we will once our student loans are out of the way. Vanguard will be our index funds of choice, just going off of their rave reviews. But it’s good to know the other reasons why Vanguard kicks everyone’s butts. 🙂

Glad you found it useful!

The only thing that puzzles me about Vanguard is why their UK-based trackers have much higher charges than the US ones. Any ideas?

Awesome article. We do most of our investments through Vanguard so we are huge fans as well. It’s nice to reaffirm what we are doing. Very insightful =)

Hey Money Wizard – I’d be interested to hear your thoughts on robo advisors such as Betterment/Wealthfront/Personal Capital and even Vanguard Personal Advisor Services.

I think we all agree Vanguard leads the pack when it comes to index investing. But at what point do we recognize that we can invest in Vanguard funds through other ways and potentially have more tax efficient portfolios?

I ask because of strategies such as tax loss harvesting – a strategy that can be done on your own, but can also be done through automation. Also because robo advisors typically have more than just Vanguard funds in their portfolios (though, they are usually heavily weighted towards Vanguard, a testament to their industry-leading products).

While there is a certain beauty to a simple 3 fund Vanguard approach, can it be worthwhile to go beyond that and take advantage of advances in computer science and math to optimize our portfolios even more?

I guess there are multiple questions in there… but those are the thoughts that came to mind as i read this article haha. Been reading your blog for a little while now… Keep up the good work!

Awesome blog!!

Quick Question – i know you have your entire Roth IRA made up of Vanguard REITs, what are your thoughts on Vanguard Target Retirement Shares in a Roth IRA? Thanks!

Excellent article! Saint Jack has preached the gospel around the world.

Thanks Bill!

Would you say it’s better to start investing starting with a pretty good amount let’s say $100,000? in the VFIAX? it will almost triple in less than 10 years right

I worked at Vanguard for many years. While I agree with your sentiment that long term buy and hold is a great way to build wealth over time, VGI has somewhat lost its way from Jack Bogle’s vision (and Jack definitely stated this multiple times).

The current c-level will never divulge/publish their compensation. They hide behind the ‘we are not publicly owned’ reasoning, even though they are owned by the shareholders (public). A dubious defense at best. I question whether or not the current executives and those who led after Bogle really aren’t skimming amounts closer to a guy like Edwards than you think.

That being said, I still think it is a great place to invest. It is just no longer what Jack Bogle envisioned.