Well folks, it’s official…

Inflation has entered the room!

Let the party begin!

Wait a minute, who invited that guy, anyway?

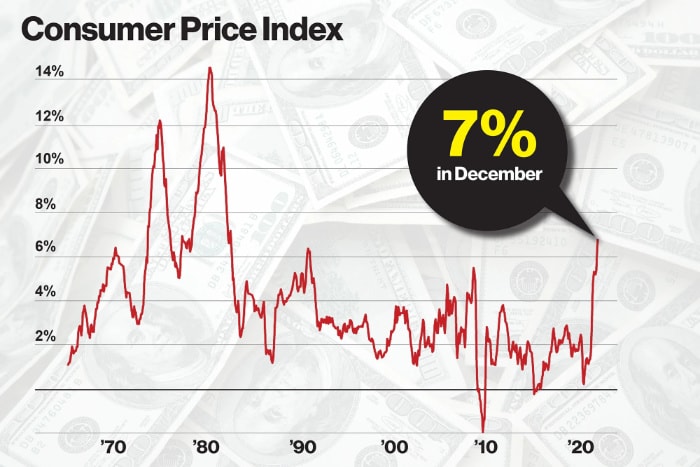

And what does the highest recorded inflation since the 1980s mean for your wallet today and your retirement plans in the future?

Let’s get the party started

You know when you’re hosting a fun get together with a carefully curated guest list, and then your one friend blows the whole thing to smithereens by inviting the worst person possible to join the group?

That’s what just happened in the United States.

The U.S. economy was having a grand old time, and then The Fed went ahead and invited Inflation into the room.

And before you know it, Inflation drank way too much and is totally out of control, and if the Fed’s friend Inflation doesn’t reign it in quickly, he’s about to destroy the whole place, get the cops called on everyone, and ruin everyone’s future.

This dumb metaphor explained

You see, The Fed is assigned a dual mandate. Meaning they have two jobs:

- Maximum employment (MAXIMUM!)

- Stable prices

The Fed and its team of economists interpret stable prices to mean low levels of inflation. Their stated target rate of inflation is 2 percent, so you can imagine their surprise when the latest numbers came back, and… whoops!

Inflation is 7 percent! The highest in 40 years!

(And it’s may be even higher than what they report, since inflation might be total B.S.)

How Inflation Skyrocketed to 7%

In a nutshell?

The Money Printer went brrrrrrr a little too hard.

I explained money printing in my article about the broken stock market.

I wrote that article back in June 2020, at a time when the Coronavirus had just been unleashed from the lab and/or batcave and the U.S. Government responded by printing $3.5 trillion dollars here, $2 trillion dollars there, and I can’t even remember what else.

At the time, inflation was a paltry 1.5 percent.

Well, it turns out printing 80% of all the money ever printed in just two years has some impacts on the economy, after all.*

*Interestingly, I think part of the reason we’re starting to see inflation now, when we hadn’t the last million times the government printed money, is not just the amount that was printed, but also what was done with it. I wrote before about how the printed money never really got loaned out like The Fed planned, whereas large portions of the recent stimulus package were injected directly into the economy, either through stimulus checks, emergency Paycheck Protection loans, and other programs.

(Note there’s also the bit about broken supply chains and a whole host of other factors, which some people are blaming as the inflation cause. Per usual, multiple factors can lead to an outcome, but I’d put my money on the biggest driver being the largest money printing experiment of all time.)

Anyway, enter 7 percent inflation.

What happens next will be really important

In my article about money printing, I explained that there’s really only two main ways The Fed can deal with all the money they brrr’ed into existence:

- Start doing the opposite of printing money. To get technical, this would mean they stop buying government bonds and start selling them instead.

- Let the economy grow (or inflate) its way out of the problem.

Number 2 is interesting to think about. For example, after WWII when government debt was the largest in history, the government never really “paid back” the debt. Instead, they just watched the economy grow so big that the debt payments were tiny relative to the government’s income. (It’s the same concept as buying a house in 1970, and then watching the housing market and inflation climb and climb. Grandpa paying his $50/month mortgage from 1970 is no sweat today, thanks mostly to inflation.)

So, what’s The Fed gonna do?

Evidence in favor of strategy #1

In their January meeting, The Fed announced a plan to stop inflation. Specifically, they will stop buying bonds and start raising interest rates. they will start fighting inflation by raising interest rates and stopping their bond buying.

Translation: they’re saying they will turn the money printer off, but aren’t promising to go so far as actually removing any money from the economy.

BUT, they do plan to raise interest rates. Which through a technical process way too detailed for this article, has the effect of depressing asset prices and curtailing inflation.

Here’s what to watch for: if they actually commit to raising interest rates and don’t immediately revert course the moment there’s trouble in the economy, and if they eventually start reissuing bonds, then maybe there’s some hope we don’t all end up carrying our dollar bills in wheelbarrows. (Kidding! Somewhat…)

Evidence in favor of strategy #2

In three words: 7 percent inflation.

The more the government allows inflation to stay at record levels, the more they’re choosing the path of “inflating away” the country’s debt problem.

Final Thoughts

Most people might not get too worried about the difference between 2 and 7 percent, but you all are astute money wizards, so I know you understand The Rule of 72.

- 2 percent inflation means that your cash will lose half its value every 36 years

- 7 percent inflation means that your cash will lose half its value every 10 years!

The clock is ticking!

But here’s the good news: I was careful to say inflation erodes the value of your cash. It often has the opposite impact on your assets.

Case in point: inflation may be 7%, but even counting the recent crash, the stock market is up 17% over the past 12 months.

So, per usual, the most damaging move is to not invest.

A year ago I said that it was the most important time in history to buy assets. The only thing that’s changed since then?

It’s probably an even more important now!

Interesting times!

Disclaimer: Per usual, nothing on this blog should be considered investment advice. I’m not a professional. I’m just a guy with a keyboard.

Related Articles:

7% is nothing to worry about. I started work in world of double digit inflation and double digit house loans. And guess what, people still bought houses, went to college, got married, had kids and generally got double digit raises. I think I was getting about 25% raises back then to stay way ahead of inflation. And after a few years it calmed back down. I doubt it is any different this time, except it will probably calm down much sooner. If you are a key employee making your employer lots more than they pay you, they will raise your pay more than enough for you to prosper. At least that’s what happened in the past. Maybe its different this time but so far, every time someone has said that, they were wrong.

I don’t think you can say it’s nothing to worry about when senior citizen are getting killed by store, prescriptions, tax increase and food increases. During inflation they are not getting any raise essentially. I’d like to hear your advice for them.

You are right, that was a poor choice of words. The experience of fixed income people does suffer, and that should be a source of concern for anyone with feelings. I was speaking from a macro viewpoint. Few people are truly on fixed incomes. Social Security went up over 7% at the last adjustment. Workers at formerly minimum wage jobs like McDonalds have seen nearly 100% pay increases. $20 per hour is not unusual now for unskilled workers. And that’s exactly how things went in my early working days when inflation was much higher. There is a group of truly fixed income people who get killed by inflation. But most of the workforce doesn’t see huge lifestyle impacts. People buy more hamburger than steaks, eat out less and buy fewer toys when inflation hits. And that tends to cure inflation, as long as the government doesn’t create more by printing money to hand out. I’m worth millions and they sent me all the pandemic relief checks. That’s just a crazy waste of money. I’m not at all opposed to sending it to those in need but that’s not me.

I think it’s fair to say that there’s a difference this time because of asset inflation.

Not only is the 7 percent number a little questionable due to the changes made to the calculation since the days of double digit inflation, that number doesn’t cover the impact of money printing on asset prices. Real estate prices are rising at rates way beyond the historical normal (20+% in two years) and the stock market has averaged about 27% for the past three years. Even if you’re getting 25% raises you still might be losing purchasing power.

At least that’s just my opinion based on the numbers. I didn’t live past periods of inflation, so maybe I’m missing something.

Wouldn’t it be a bad time to purchase assets like a home since they are over inflated and will likely fall?

Thanks Money Wizard for the discussion about inflation. I always wondered if when the Government ever shuts down the money “paper” presses (probably will never), what could we turn to next? Everything is changing to digital so what if Bitcoin (or other alt coins) were the main purchasing currency (if paper goes away), what would happen? I’m still learning about buying and selling with cryptocurrency myself but it would be a good topic to talk about. Evidently there is too many different cryptocurrencies and Bitcoin is only limited to about 21 million in the world so they probably won’t work!!! Ah what the heck Government, keep printing “paper” money! 💵🤪

Big difference, Steve. You may also recall that interest rates were a lot higher then too, so you could actually earn something with your savings to at least offset consumer price hikes. Also, inflation “calmed down” because the Fed under Paul Volker’s watch raised short term interest rates from 10 to 20% between 1979 and 1981, which did put the brakes on price increases but also caused massive pain in terms of unemployment and asset valuation crashes resulting in bank, farms, and other businesses to go under. Finally, many of us who were working folks in the early 80’s are now retired, so we can’t rely on being well-paid “key employees” to offset the pain of our shrinking dollars on fixed incomes. I highly recommend “The Lords of Easy Money: How the Federal Reserve Broke the American Economy” by Christopher Leonard for some excellent insights into how we got to where we are now.

So buy Index ETFs, REITS?, Real Estate, maybe some commodities or a little gold …anything else I am missing? 🙂

NFTs….lol

I agree that last year was a great time to buy assets, and it’s always a good time to buy assets if we’re talking about long-term investing.

One thing I’ve been thinking about is that, in normal times I wouldn’t typically say that a person should make big life purchases based on market dynamics. Your home isn’t an investment property, so trying to time the purchase of your primary residence, or a car purchase, shouldn’t really be determined by asset price fluctuations. If you need a just had a kid and you need a place to live, then just buy a home (if you can afford it). We are in interesting times though, and specifically considering the growing affordability issues, I think that if someone needs a house or car, now is a terrible time to buy either of those things, and so if there’s any possible way to push the purchase off, I would wait. I think that many people purchasing homes and cars right now are stretching heir budgets to the limit.

I think the problem, on top of the affordability component is that cars will inevitably begin to depreciate again after the supply chain issues are resolved, and people often move after 7-8 years of living in a house. So you have people paying 25% more for houses or 40% more for cars that they don’t even like that much because they only had 1/4th as many to choose from. And then with interest rates about to go up, asset prices will inevitably fall and anyone who bought in the last 12 months without 20% down will easily be underwater.

The question I ask myself is, is it possible for home/car prices to stay as high as they are relative to incomes long-term? The answer is no. Wages have come up a lot for very low wage restaurant workers, but for white collar workers, annual wage increases are still only 4-6%, and that 5% raise doesn’t bridge the gap to homes and cars being 20% and 40% more expensive, respectively. If not only because of rising interest rates, home and car values are about to come down because people can’t afford them.

Another thought-

Many people keep drawing a comparison between current inflation, and inflation of the 80’s, as if to imply that 7% inflation isn’t that bad. The difference is that in the 80’s, while inflation was double digits, savings accounts were also paying double digit rates, mortgage rates were double digits (and people could actually still afford to buy a home), and *real* equity returns for the 80s as a whole were also still in the double digits even after considering inflation. And it’s great and all that the stock market was up a lot in 2021, but the majority of Americans won’t experience the wealth effect from higher stock prices, and we’re kidding ourselves if we think that at these kind of valuations, the market will continue to surge. Additionally, we all know that a 1% fed funds rate would cripple the stock market, and a 2% interest rate would cause a market crash, just like in December 2020. So unless supply chain issues are actually what’s causing most of the inflation, and these issues ease, there’s no way that rates are able to get high enough to bring inflation, without crashing the stock market and freezing credit markets.

All in all what I’m saying is that while the runaway inflation of the 80s was certainly scarier than our current 7% inflation, the 7% inflation of today is destroying more wealth due to the lower outlook for returns. There is no such thing as free lunch. The stimulus checks weren’t free. The PPP loans weren’t free. People not working for 18 months and collecting unemployment wasn’t free. We’re paying for it all through inflation. My ultimate takeaway from the current situation is that unless inflation subsides on it’s own and the economy continues to grow despite that, people will need to save more for retirement than they did in the past. Vanguard has been preaching for years that future returns were going to be much lower than in the past. We’re no longer in a 2% inflation, 10%+ equity, and 4% bond return world. We’re more like in a ~4% inflation and 6-10% equity, and 1.5% bond return world for the decade. For people hoping to FIRE in the next decade, the implications of this are meaningful.

Every financial advisor will tell you that 60/40 is dead and the only hope is 100% stocks, which is kind of a symptom of the problem. Without a raging, innovative, and growing economy, compounded by favorable demographic dynamics (they aren’t), equity returns won’t be able to sustain the normal 10%+ returns in a rising interest rate environment. Just see December 2018 for evidence. Without outsized organic growth, wealth will continue to be destroyed. Long-term interest rates are also evidence of this. Long-term interest rates are a indicator of growth, not inflation. Despite high inflation, long-term rates continue to be low. We have to hope and pray that either growth picks up to give room for rates to go higher, or the resolution of supply chain issues alone is enough to bring down inflation, cus I’ll tell you what, a 0.50% ffr isn’t going to help inflation. Unless the fed goes up above ~2% and causes an actual recession to really dampen demand, raising interest rates won’t be enough. And based on 2018, it doesn’t seem like the fed has enough guts to cause a recession, because letting any size recession occur automatically is a fed policy “error” or mistake in the eyes of historians and the hysterical media. Sorry for the rant.