Have you heard?

The U.S. Government is treading water in some seriously uncharted territory.

Not only are they dealing with ongoing virus pandemics and countless shuttered businesses, but there’s also the unprecedented money printing, record-breaking stimulus spending, more stimulus spending, and then some extra stimulus spending for good measure.

Here’s the deal though. If the U.S. Government and their central bankers are piloting the ships (let’s call it the U.S.S…. U.S. Economy, to keep the nautical metaphor rolling) then we’re all hanging from the balconies, along for the ride.

Will the story end with those bankers deploying the life rafts and us piling in to a doomed fate? Or will we all float unceremoniously to the shoreline, where the beaches of happy retirement await?

Sounds like the plot of a movie, and you might even be thinking the whole thing is starting to feel like the tragic Titanic…

But for those of us wondering what’s going on behind all the special effects, there’s one important fact that you need to understand more than any other.

Right now is literally the most important time in history for you and I to be buying assets.

Let me explain why…

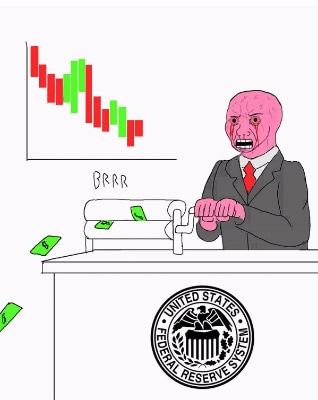

The Government Just Keeps Printing Money

We’ve talked about this before. Back in June I put on my economics nerd glasses and explained why the stock market keeps going up, despite a totally wrecked economy.

Since then, it’s pretty much been more of the same.

Here’s the total timeline so far:

- March 2020: The Fed announces $1.5 trillion of money printing, then another $500 billion more.

- April 2020: The Fed announces they will buy $1 trillion of small business and government loans, funded by… money printing? And another $500 billion of new stimulus loans.

- December 2020: Another $1 trillion ($900 billion, but who’s counting) of printing. Because why not?

- March 2021: Doubling down with another $1.9 trillion

Honestly, I’m not even sure if that list is 100% accurate, since there’s so much money flying around you’d need a forensic accounting degree to track it all.

The point is – the government’s printed A TON of money in the past year or so.

If you’re like me and can’t exactly wrap your head around the shocking scale of $5.4 trillion dollars, here’s the craziest stat I’ve ever heard:

Last year, the government printed almost a fifth of all US dollars ever printed. EVER.

It should be noted that the government is actually printing money so fast that the stat I just quoted, which was calculated just a few months ago in October 2020, is already horribly out of date. It fails to account for the December 2020 and March 2021 packages, which make up over half of the now $5 trillion tally.

But, can you blame them?

Here’s the interesting part about all this.

Imagine you’re a central banker.

You’re tasked with the oh-so-cush job of making sure THE BIGGEST ECONOMY IN WORLD HISTORY runs smoothly. No pressure…

Along the way, teams upon teams of the nation’s top economic advisors tell you to do the same thing to fix a broken economy. Just keep printing…

So you do, anxiously. And…

Nothing happens.

At least, nothing bad happens. Plenty of good things happen.

After a horrible 20% crash to the stock market, your printer ink helps the market recover, almost immediately! Even better, the market ends the year at another all time high!

Of course, you’re an educated central banker, and you know all of this isn’t without risk. All this printing could lead to:

- runaway inflation

- a collapse of the US dollar against other nation’s currencies

- some other unforseen economy catastrophe.

And yet, all your other central banker buddies around the world are doing the same thing. For the past 10+ years. And nobody, anywhere, has really seen any negative consequences. At all.

So, faced with a still broken economy, you just still keep printing….

Where’s the consequnce?

At this point, you and all the other readers are probably wondering:

Why aren’t we seeing the impact? Will we ever see an impact? And what will that impact look like?

Who knows.

The Money Wizard sure doesn’t know. Even the central bankers at the helm, and all their top economists in the world, are watching this experiment play out in real time, with several question marks and a careful hand hovering over the emergency brake.

The economy is funny and fickle like that…

So far, there’s been none of the expected negative consequence for the money printing.

- Inflation isn’t going up (yet?)

- The dollar hasn’t devalued (relative to other nation’s currencies, since those nations are all printing money, too!)

- No other economic catastrophes, other than a big pesky virus. Which, it should be noted, the money printing strategy seems to have contained…

But of course, we all know that every action has a consequence. So, where is it?

It’s seen in the price of assets.

Take a look around…

The stock market is at all time highs.

The real estate market is bananas.

Even crypto currencies, collectibles, and digital artwork is out of control.

The price of assets, everywhere, is skyrocketing.

That’s because so far, the danger of government money printing isn’t showing up in any of the economist’s traditional negative metrics.

The “danger” actually sits in the rapidly rising price of assets.

From the plush seatbacks of a corner office at the Fed, this is good news. A market recovery! And even better, this is also good news for the asset holders watching their portfolios climb in value.

Emphasis on asset holders.

The Dirty Truth

As the experiment plays out, it’s becoming clearer that the danger of unlimited money printing doesn’t sit with the economy as a whole, the banks that comprise it, or the ultra rich that dominate it.

The danger of unlimited government money printing lies with everyday wage earners, like you and I.

As more money is printed and flows into the economy, that increased money supply chases the same limited number of assets.

- The same number of stock shares

- The same number of houses

- The same ounces of gold

This hits everyday wage earners the hardest.

As more money is printed, and the price of assets rises, that price becomes more and more unattainable for the average wage earner. Throw in some stagnant real wages, and their stable salary simply buys less and less of the assets.

Why you have no choice but to buy assets as fast as possible

Make no mistake. In the current environment, people like you and I can’t sit around hoping that strong wages, affordable real estate, and high interest savings accounts will let us float to freedom.

Those days are long gone. The boomers took that raft and ran…

People like you and I are literally in a race against the clock to accumulate as much assets, as fast as possible, in order to break through the plane. To build up enough momentum to reach financial lift off, that magical moment when compound interest starts driving our wealth.

Simply put: you have to jump that chasm from “wage earner” to “asset holder.”

If you don’t, you will continue to fall behind the pace of the fed’s money printer. Your annual raises won’t keep up with the increased money supply. And you will watch from the sidelines as investments, all across the board, continue to rise out of reach.

Ask yourself this. If 20% of all the money ever printed entered the economy last year, did your salary increase by 20%?

If not, you probably fell behind. (Sorry to break the bad news, please don’t shoot the messenger!)

We’re only left with one option.

We have to start buying assets as fast as possible.

It’s the only way to make the jump and get on the right side of the Fed’s money printer. To start swimming downstream, instead of fighting against the current.

While there might be some market bumps, crashes, and corrections along the way, the trend is clear.

But here’s the good news…

Eventually, as you accumulate more and more assets, you will reach a point where those assets can work harder than you can. You will reach a point where the increased money supply, and its oversized inflation of the financial markets, far outweighs anything you can earn at your 9-5 job.

This is known by another term – living off your assets.

Or as this blog usually calls it – financial freedom.

Related articles:

Buy assets? What kind of assets. Can you please explain that furthur.

Stocks, bonds, real estate, gold, cryptocurrencies. Whatever strikes your fancy… basically anything except for a new car, haha.

My personal opinion is that building a good 3 fund portfolio is the best place for most people to start.

https://mymoneywizard.com/3-fund-portfolio/

Money Wizard’s answer is not a bad one. A more fundamental answer is, in the words of John T Reed:

“Have everything you will ever need [or the means to produce it], today.”

Whether you need to buy that “everything”, find a friend who has it, etc. The more you are able to decouple your needs of daily living from money, the less inflation can hurt you.

Sounds like it’s time to throw the emergency fund to the wind! The wind that sails the U.S.S. Economy using your analogy. (half kidding)

Good article, but as you pointed out in a kind of oblique way, if the velocity of money remains low we won’t necessarily see inflation in things like CPI (the inflation we are seeing there is more likely the result of supply chain challenges than it is in more money in the system, I think this is relatively temporary), but in assets and in other non-consumer related services (check the price of college tuition lately?). The issue here is that by buying assets we are likely buying into asset bubbles as well. Equities overvalued? Bonds nearly worthless? Housing exploding in price? Gold prices through the roof?

Don’t get me wrong, a person who has assets is certainly safer than one without, but I’m not sure there will be that many places to hide when this all implodes in a few years…. after all, if you buy a property for 1.2 million that is worth 400,000 in a few years, you may have a property, but you have lost money as surely as you would in a market collapse.

Emerging markets perhaps?

Agreed – the bubble concern is real. But I look at it this way:

Option 1 – Do nothing. Horde cash. This basically guarantees that your salary’s purchasing power and cash emergency fund erodes due to money printing.

Option 2 – Take a risk and invest into assets. At a baseline, you’d expect them to be helped along by money printing. But they also might be overpriced, and it’s possible that you lose money.

The way I see it, I’ll take a possible loss over a guaranteed loss every day. I’ll probably never reach my financial goals by taking option 1, but I actually have a chance reaching my goals with option 2, albeit with the long tail risk that the whole thing implodes. Then hedge against that risk of implosion by also buying a small amount of emerging markets and cryptocurrencies.

Don’t get me wrong, it is better to be invested than not, as I say above. That being said, cryptocurrencies don’t seem like a good hedge to me (more like an asset bubble without the asset). My concern with emerging markets is that they are generally so dependent on exports to DEVELOPED markets that anything that takes our economies down is also likely to drag them down with us (although Europe and Japan have much stronger deflationary pressures than we do with rapidly shrinking populations and economies that have been much less growth oriented, so perhaps they will fair better).

The idea that anyone of us can determine if there’s a bubble, and if somethings going to implode, and when it will happen seems impossible IMO… The experts have predicted crashes every year since 2010. Doesn’t mean it won’t happen… but I think I’ll take my chances as well and keep buying… and if it implodes, buy some more.

Haha, true. Definitely folks much smarter than me who have been wrong repeatedly…

Good point about emerging markets. I strongly disagree about the crypto comment though, but to each their own.

Cash has become trash. It rhymes so it must be true 🙁

To use your nautical theme, it seems “stay the course” makes the most sense even if there are concerns about inflation. A correction of some kind seems inevitable but timing it will be impossible and in the meantime buying appreciating assets acts as a hedge.

I know the first comment already asked it (and you responded with an answer–thank you), but it might help to update the article describing what “assets” mean and what people should be buying.

Things just are SO much out of control. I’m actually quite happy we saw like a 5% decline in just the past three days alone. it was getting too high. Valuations are just off the charts, although I think we are far better off than how it was in the 2000 tech crash.

Inflation numbers are scaring some people… I’m a little relieved that inflation is coming up higher than the 1.7% that we’ve been reading about so much but I still don’t like living in an inflationary world with prices rising but wages are not.

Keep speaking the truth and sharing those solid investment tips, MW! Stay the course, right? Even when dips happen, consistent investment wins out in the end.

I love that you’re doing a crypto experiment, and like it as a hedge against current cash these days. I have yet to dive into any crypto myself, but looking at the popularity of NFT’s etc., it seems like it might be a smart move to have some, just as you said, as a hedge.

In a similar fashion, I’m curious if you’re more inclined to lean towards investments that are more tied to “physical” assets in nature these days (gold, real estate – maybe in the form of REITs, etc.) as opposed to the standard 3 fund portfolio as has become your trademark. I too have a majority of my net worth broken down amongst basic stocks in various retirement and brokerage accounts, but am thinking of expanding that into items beyond index fund stocks given the constant spending of the fed right now. I’m particularly interested in REIT’s, gold mutual funds, and even crypto, just to add the variety to my portfolio.

Would be curious to hear your thoughts, even if it’s just speculation, as you’ve been doing this a bit longer than I have. That said, we all know that there’s no way to truly know what’s coming, and that’s why the consistent investing is so key.

Thanks for kicking these articles out! Always love getting them in the inbox. Keep up the great work!

Yeah, I’ve been doing a lot of thinking lately, and I’m starting to think a 4 or 5 fund portfolio is a wise move for most people. The 4th section being crypto, and the 5th being some other uncorrelated asset, like real estate or gold. Both those two are tricky though… physical real estate is a bit like running a business/side hustle, and I view gold as a segment of cash. (Gold is basically a more expensive, speculative, and doomsday-ready emergency fund.)

In any case, I think we should think of a 3 fund portfolio as the financial foundation. From there, you can build on it, depending on your goals or beliefs.

Good piece. Very much feels like we’re reaching a tipping point and that the Fed has come close to painting itself into a corner.

I think the difference between 2018 and now is the scale of the money printing and fiscal stimulus (which may find its way into consumer inflation) coupled with far higher public and private levels of debt (meaning that trying to ‘normalise’ interest rates will collapse the house of cards, leaving the Fed stuck printing to keep US bond yields down).

HH

Too many people not working to get serious inflation. Methinks the next tipping point will be social unrest, not inflation. We saw a lot of social unrest last year centered around political concerns. The next round of social unrest will center around economic concerns. There is one thing in very short supply that people seem to be hoarding and the manufacturers cannot keep up with demand that was not mentioned – all types of ammunition, from .44 to .223 even .22. In a way, the current administration is doing the best they can, running the printing presses, placating the masses of people one step away from homeless. Shelter from the storm, come up with a plan, and stay away from cities, especially those cities that seem to be flash points (Portland, Minneapolis, Boston, Chicago, Denver, Columbus, Detroit, D.C.)

Ultimately, the USD is the reserve currency, which is what allows the US to keep printing money.

Good one MW! Assets that matter are the ones whose value grows over time, not depreciating assets like cars, motor bikes, etc. Taking on new debt during inflation is also a bad idea.