Love is priceless. Or is it?

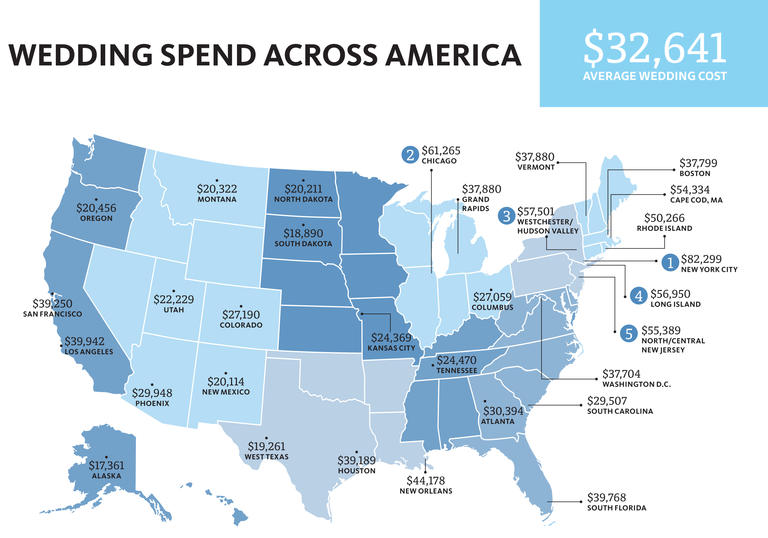

A new study shows the price of love is actually very specific: $32,641.

That’s the cost of the average wedding last year, a number which has grown larger and larger with each passing wedding season.

Yes, weddings now have seasons. Similar to the National Football League, year after year brides-to-be are engaged in a fierce competition which builds all year towards the prime time show: an insanely expensive June wedding.

Off-season begins with intense scouting of the competition. A few jealous scrolls through another couple’s beautiful wedding photos on Facebook sets the stage. Damn that $3,000 photographer for setting the bar so high for next season…

Training is critical. Wedding planners play the role of head coach, ensuring everyone is prepared to mount a knot-tying offense as efficient as a well oiled machine.

For just a few thousand dollars, the planner coordinates a team of specialist coaches. Tailors ensure the custom made dress (which is actually mass produced in an overseas factory) fits just right. Florists decorate every nook and cranny with material which will be brown and rotten just hours after the show is complete. Even dance lesson instructors ensure none of the couple’s closest friends or family can judge any one misstep too harshly on the big day.

Each season, this intense game of one-upsmanship sets the bar higher and higher. Not to be outdone by the rounds of impressive Facebook updates for the past few seasons, the average wedding cost increased $5,000 since 2010 alone.

And yet here we are. In a time where over half of Americans have less than $1,000 in a savings account and the average household is drowning in over $15,000 of credit card debt, the traditional right of passage into adulthood still involves spending over $32,000 on a lavish ceremony that’s over in a matter of hours.

Why? When did this become normal?

The Cost of Weddings, Then and Now

To be fair, the tradition of lavish weddings in America is a storied one. After all, even ‘ole Grandma and Grandpa have a few photos from their special day ornately framed somewhere in the house. So are we really spending any more on weddings today than any other generation?

The oldest and most reputable look into wedding spending dates back to 1939*, in which B.F. Timmons, a sociology professor at the University of Illinois, released “The Cost of Weddings.” If our wedding spending is at all reasonable and not caught up in a competition of bigger and better, we should expect the inflation adjusted cost of weddings in 1939 to be around $30,000, right?

Try $6,689.

Wait, we’re not even close!

*By the way, finding the answer to this question of comparison was surprising difficult. Could this challenge be the result of a changing emphasis from a day of love (1939) to a day of ridiculous price tag measuring (2015)?

Comparing the two studies, we get a very different picture of weddings 80 years ago. Here are some of the startling highlights for average wedding spending in 1939:

- Engagement Ring: $1,259

- Flowers: $294

- Reception cost: $734

And those same categories in 2015:

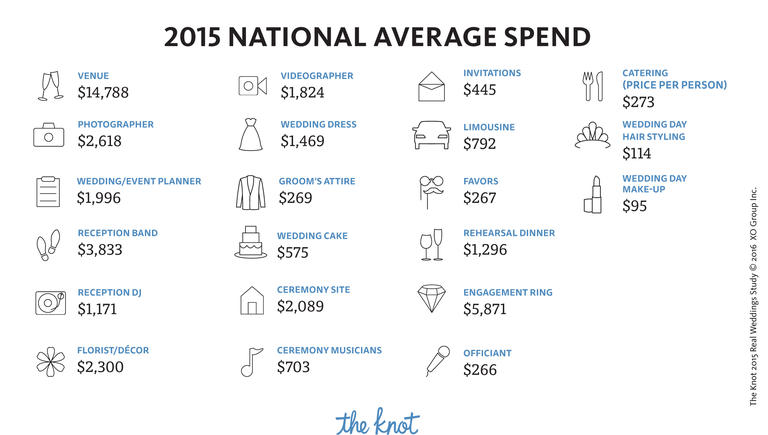

- Engagement Ring: $5,871 (+$4,522)

- Flowers: $2,300 (+$2,006)

- Reception cost: $19,792 (+$19,058!!!)

Did I mention these numbers are adjusted for inflation?

2015 Average Wedding Costs by Category (Source: The Knot)

To be fair, humans voluntarily deciding weddings are now five times more expensive could make sense… On an alien planet where it rains $100 bills instead of raindrops. But here on planet earth, where the average newlyweds carry $40,000 in student loan debt and more than half couldn’t come up with $2,000 in the most dire of emergencies, this sort of trend is completely insane.

But Money Wizard, it’s important to start the marriage off on the right foot. A nice wedding sets the stage for a wonderful marriage.”

While that may be true, a “nice wedding” shouldn’t be confused with an expensive one. Spending doesn’t equal love or beauty, and there’s plenty of evidence pointing at an expensive wedding as an early warning sign of a stressed marriage:

- Half of middle aged couples cite money as their primary cause of fights.

- Couples spending over $20,000 on the wedding are 3.5 times more likely to divorce as those who spent $5-10,000.

And the group with the lowest rates of divorce? Couples who spent less than $1,000 on a wedding.

I Don’t Care, I Want a Once in a Lifetime Wedding.

Maybe even after all of my urging, you’re still set on a $32,000 wedding. That’s fine; we all have priorities. My job here is just to spout off my one sided opinion, not to judge. If you are hell bent on blowing a fortune, can we at least agree not to go into debt for one of these things?

In which case, consider this. If you start saving for your $32,000 wedding the day you graduate college at age 22, and you are statistically average in marrying by age 27, you have 5 years to save.

You need to save about $520 a month for five years to afford your wedding.

That is, of course, assuming you’re actually paying for your own wedding. Statistically, only about 12% of people do this. The rest shackle the bill to their parents, who secretly stress, budget, and work overtime so the big day can be perfect. Tears stream down the parents’ cheeks after the groom kisses the bridge, presumably because of the bright future ahead. Or perhaps the ridiculously large check that’s about to get cashed.

Other Uses For $32,000?

And then there’s the investment potential. $32,000 sounds bad enough when it’s considered a one time fee. It’s downright painful when we evaluate the future returns on that amount of money.

Instead of spending one third of a hundo-grand on a half day blur which whizzes by in the blink of an eye, what if a “boring” couple instead invested $32,000 into a 529 College Savings Plan?

How much could the couple expect 20 years later, right about the age when their future child is college bound? Only somewhere around $124,000 – more than enough for an entire four year college education for at least one kid.

You can have your expensive wedding, but I’m not buying. Personally, the girlfriend and I are planning on hot dogs in a park and few kegs of beer, followed by a a nice honeymoon and a college education for our children.

We all have our priorities, and I know the expectations for an extravagant wedding must be immense. But can we all take a step back to ask ourselves, is this really worth it?

Next week, we will wrap up this two part wedding series with a look into one of the most evil (and successful) marketing campaigns in history.

UPDATE: Check out Part 2 here!

____________________________________________

The only three things we spent big bucks for were photographer, food, and honeymoon – and they were worth every penny. I want to say it was around $3k excluding the honeymoon…I’ll need to look into that, sounds like a post!

Actually, if we could do it again, we probably would have eloped (and still hired a photographer). There are so many “traditions” around weddings that are hard to ignore or go against the grain, similar to personal finance. Everyone would benefit if there was more rebellion and questioning. 😀

Highly recommend A Practical Wedding and Offbeat Bride for wedding planning inspiration when the time comes for that. 😉

Definitely agree about the traditions Felicity. The key is deciding which traditions are actually worthwhile and which have just become unnecessary spending.

Thanks for the recommendation! Are these the right books? A Practical Wedding and Offbeat Bride?

The NFL analogy was good for a few chuckles but I agree that things have gotten completely out of hand. It does seem that wedding vendors can get away with charging whatever they please as there is no shortage of fools willing to part ways with their hard earned dollars. This leaves us budget savy folks somewhere between a rock and a hard place. My wife and I did manage to have a magnificent wedding only a couple of years ago for apparently less than half of the ‘average’ wedding although still more than I would have liked to spend!

I think that’s what bothers me the most. Weddings have become one of our economy’s most inelastic goods. What’s supposed to be a day of love has turned into a cash grab.

Oof. Making me feel bad.

Ms. FP and I are currently in the throes of wedding planning (getting married next spring) and these costs are adding up. We have parental help, but it’s crazy these costs.

Condolences, Financial Panther. Gotta be a stressful time for anyone budget conscious.

In the words of the 300 Spartans, this is madness.

Love this post! Big money weddings are an excess I cannot understand at all. I love how you make a connection between marital strife (divorce), and money problems. Why would any couple ever want to set out on such an expensive path, it’s almost as though they’re setting themselves up for failure.

My guess is autopilot spending driven from societal expectations. Hopefully one day we can reverse the trend.

Great post! I have a big interest in wedding costs because I have four daughters. FOUR!! We are still 10+ years away from average wedding age for my girls, but I’m thinking about it already. I’ll have to remember these stats and hope the cost trend reverses, but I doubt it.

I was fortunate that my father-in-law paid for the majority of our big wedding while we picked up the smaller expenses. I was merely a spectator in the planning stage, there to nod and agree with my fiance on her decisions. Thankfully she is a frugal type and kept costs down.

Four weddings?? Good luck, sir.

Spread the word, and hopefully we can get the message out and reverse the trend.

Your so right about the higher cost not equaling a long lasting marriage. My husband and I were broke so our wedding was around $5K total in 2000…16 years later we’re still going strong. As a Physician now being around other docs on second and third marriages, I know we did the right thing. I think people that elope have great stats because they’re really doing it for the love of each other as opposed to doing it for “the wedding or big day”.

That’s an incredible story! Congrats!

I definitely think you’re right. I actually knew a girl who admitted to getting engaged just because she wanted the ring.

In a world with that kind of insanity, your story is an inspiration!

Spent ~ 60k on a Wedding in Chicago (right at the average based on your map).

Regret it every single day! It was nice but what a waste of $$.

If only I could do it over again…I guess my kiddos (twins) will have to be taught to see the light 🙂

Sorry to hear about the regrets. At least this is one time where it pays to NOT be above average.

I would like to see a similar survey, asking how many of these average wedding spenders have regrets over the cost. Something tells me the wedding sites wouldn’t want to sponsor that one!

When your kiddos get to age, you’ll have to show them the Money Wizard wedding series. 😉

Gentlemen, in regards to marriage, the only reason would be to sire and create a family. Apart from that, there is little utility in the institution. Would you enter into a business partnership using our current family laws? No, of course not. So, why then would you expose yourself to the legal, emotional and financial perils of our current family law system? This reasoning is not reserved only for men. Women run the same risks. However, the motivations for marriage are different for each gender.

Having said all of that, if you must enter into this enterprise, Here’s my tip: an extension ladder and a full tank of gas.

I’ve read that one reason the average price of weddings has increased so much in recent years is that the average couple getting married is wealthier. Today, the young couple who have no money who “have” to get married just don’t, they live together. More and more marriage is becoming a middle to upper class institution. Put another way, the wedding of Donald Trump’s daughter probably didn’t cost much more in inflation adjusted dollars than the wedding of a daughter of a business tycoon 100 years ago. However, 100 years ago her maid would have had a wedding too–one that bore only a faint resemblence to that of her employer and which cost a lot less. Average the two costs and the “average” wedding was far less than tycoon’s daughter spent and far more than the maid spent. Today, the maid doesn’t get married, she and her boyfriend just move in together planning to get married “someday”. How much would it cost to get married at the church you belong to followed by a reception in the church hall or a backyard BBQ for family and friends? That’s the kind of wedding the working class used to have. If you average that with the extravaganza the middle to upper income couple throws, and the average cost of the wedding goes down.

Good point, and I think you may be onto something. My two counter points however, would be:

1) This trend only compounds the Keep Up With The Joneses effect. The underlying pressure to throw a huge wedding, whether it can be afforded or not, is stronger than ever. Just look at the number of new grads throwing $50,000 weddings as proof.

2) Most people today aren’t nearly as wealthy as they think they are. People might be waiting to get married until their salaries are higher, but consumer debt is at an all time high. Expensive weddings only compound the problem, making it even more irresponsible to throw one of these wedding when the bride and groom are both chained to jobs they hate, have no plan for their kid’s expenses, and retirement is a distant impossibility.

You bring up an interesting point though, and I agree it’s definitely a factor in the numbers. Thanks for the unique perspective!

Sounds like you’re ready to pop the question my main man. Save me a hotdog and a beer at the park! Wait have you popped the question yet 🙂

Haha, not yet! I’ll add you to the invite list though! 😉