If you live in America, you might have heard a little something about the most dramatic change to the tax code in decades.

This sweeping reform has left the news, blogs, and analysts setting themselves ablaze with speculation about how the plan will impact everyone.

Who are the big winners? Who are the big losers?

People taking the standard deduction might save money… married couples with no kids might not… families with two children who are itemizing their expenses might still come out ahead… what about families with three children??

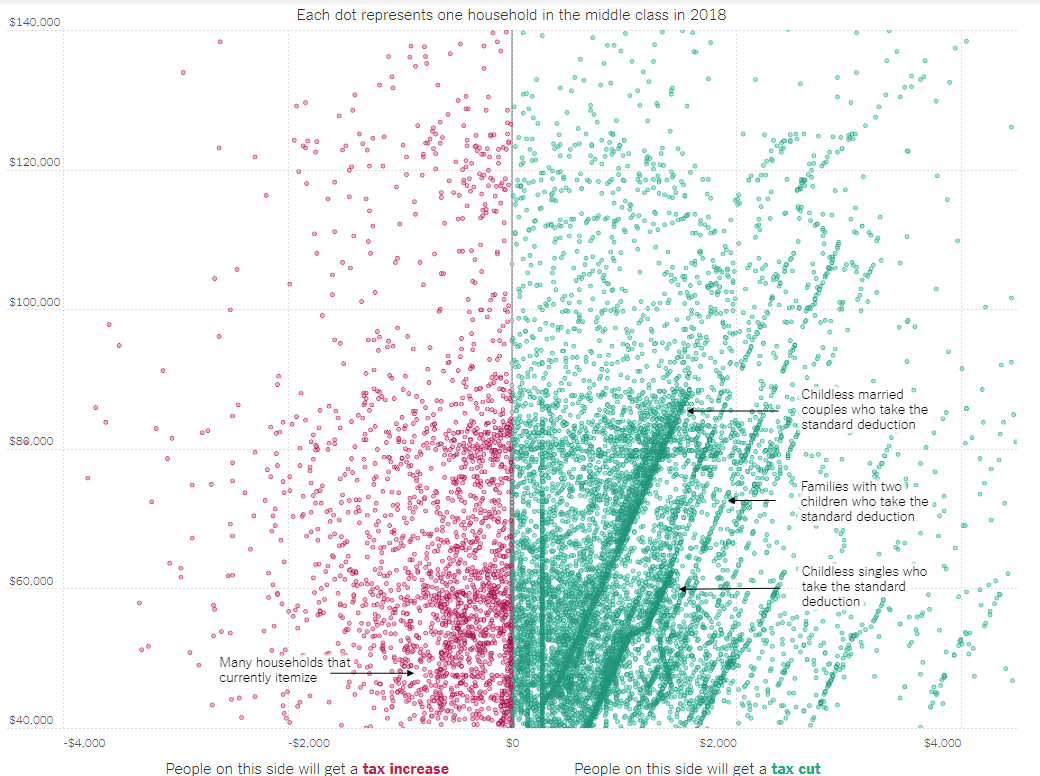

The stress and speculation has reached a fever pitch, as culminated in this astonishingly complex chart, which maps the hypothetical savings/losses for an insane number of scenarios:

And yet through it all, most headlines are pretty consistent – this is yet another example of the greedy corporations coming out ahead no matter what, while the little guy is left scrambling through the gauntlet, and hopefully escaping unscathed.

But what if I told you there’s a way to profit off the tax cuts right alongside those big bad corporations, and it could cost you as little as one cent?

The Tax Reform’s Winners and Losers

I’ll save you the headache of sorting through right wing propaganda and left wing bias. In general, here’s the current state of affairs:

- The house passed their version of the plan in mid November. The senate passed their’s the first weekend in December.

- Like good politicians, they can’t really agree on anything, but they’ve said the next step is to come together for a final version.

- All Trump wants for Christmas is the final tax reform, so that’s the preliminary deadline.

The good news? Despite all the doom and gloom headlines, the majority of people will actually save money under the proposals.

You can see a pretty detailed breakdown of the changes here, in case you love reading about taxes or just feel like punishing yourself.

For an easier approach, Business Insider ran the numbers for the average single person earning between $25,000 to $175,000. Each group saved between 11-18% on their federal income taxes.

The biggest break actually came to those in the $75,000 salary range. Hey, that’s me! Wohoo!

Meanwhile, they ran the numbers again for a family of four and found anywhere from a 1% increase to a 56% reduction.

It’s not all rosy though…

Among the complaints, both plans eliminate most itemized deductions. While 70% of tax payers don’t itemize, that still means 30% of hard workin’ itemized deductin’ ‘Muricans could get the shaft from this change.

(There’s also a little something about increasing the federal deficit by about $1.5 trillion dollars over the next 10 years. Sliiiight problem for us millennials set to inherit this ticking time bomb of a federal balance sheet. Plus, the cuts aren’t permanent, which could leave folks with the bait and switch of the century. But those are topics for another post.)

And if there’s one feature of the plan that has people fired up more than any other, it’s who’s set to win the most from these sweeping changes…

Any guesses?

The tax reform’s biggest winners? Those damn corporations.

Yep, the rich corporations win again.

While individual tax rates are dropping a couple percentage points, both plans have the corporate tax rate slashed from 35% all the way down to 20%.

“Hey, no fair!” you might be saying.

On the surface, this looks like yet another benefit for the those greedy corporate executives intended to cut out the middle class.

But don’t worry, there’s a way to benefit from those corporate tax cuts, whether you’re a poor working family raising The Brady Bunch or single dude making a killing.

Become a corporation owner by buying stocks

When you buy a stock, you’re not just buying a piece of paper or numbers on your computer screen. You’re buying a percentage of ownership in a real company.

This might be boring investment 101, but it bears repeating in times like these.

When the emotions of tax breaks for the rich start getting thrown around, and the 99 percent start the rallying cries against those greedy corporations, everyone forgets we already have the most inclusive system in the world for anyone to profit alongside the corporations.

It doesn’t matter your age, race, annual salary, or sexual orientation. Step up to the stock market with $30 in your pocket, and congrats! You’re Bank of America’s latest corporate partner.

So, how to profit off the tax cuts?

At this point, you might be thinking, “Yeah, big deal… how does a tiny sliver of a company let me take advantage of these tax changes?”

It’s pretty simple actually. When corporations receive tax cuts, it directly hits their bottom line. By saving millions (or billions) on their tax bill to the government, their profits increase.

And earnings are the biggest driver of stock price. In fact, investors measure the value of a stock using something called the Price to Earnings ratio (aka the P/E Ratio).

If you’ve ever watched Shark Tank and heard Mark Cuban angrily shout “You’re nuts! At that valuation I’m paying 20 times earnings!!” then you’re already familiar with the idea of the P/E ratio.

Imagine the stock market has a P/E ratio of 17. This means investors are willing to invest $17 for $1 of earnings.

Now, imagine the market’s earnings suddenly get a huge boost from money raining out of the sky, or even say, a massive decrease in taxes paid. We know investors are already willing to pay $17 for $1 of earnings, but now there’s more than $1 of earnings to go around.

For the market to continue to trade at the same PE multiple, the price of stocks has to increase. Early estimates say the market would have to increase about 7% to adjust for the impact of the proposed tax cuts.

Lift yourself above the political BS

Of course, nothing is guaranteed in investment. It’s possible the anticipation of the cuts is already priced into the market. Or maybe not.

This article isn’t meant to promote market timing. That’s a bad move, and over the long run tends to leave you broke.

But one thing is certain. The dudes in power are set on seeing this one out.

Whether their decisions translate to the good of the country is debatable. Whether it translates to the good of companies is less so.

More money for companies is good for companies. They can use that money to invest, grow, or distribute profits to owners. When these things happen, it’s good for the owners of those companies.

Put yourself in position to be an owner.

You can do so for as little as one cent, since that’s the share price of some of the market’s cheapest stocks. It might sound silly and inconsequential, but it’s not.

With that tiny investment, you’re elevating yourself above the fold of Joe Average, Regular Tax Payer. Instead of staying at the mercy of politicians, you’ll win alongside those lobbying corporate executives.

Not only will you share in their profits, but your portfolio will also benefit from any of their tax savings.

Unfortunately, most people won’t do this.

The media knows this, so they promote the spin that will resonate with the biggest audience – that there’s nothing we can do about the decisions of the elite.

After all, saving money and investing is hard. Shopping on Amazon and complaining about politicians is easy.

Most people do more of the latter than the former. They buy junk instead of investments. When their strategy doesn’t work out, they shift the bulls-eye of blame to whoever the TV says is today’s enemy.

My final advice for the Trump tax cuts?

Worry less about the potential impacts of decisions outside of your control, and use investment to lift yourself above this back and forth political BS.

Get your spending in check, and put your money to work as a corporation owner. Keep those index fund contributions strong, and ride the wave of corporate benefit.

Become an investor, not a consumer, and you’ll join the corporations in their party of tax savings.

Most giant public companies do not pay the corporate tax rate of 35%. They have massive tax accounting departments and most pay much less than 35%

Correct, the average effective corporate tax rate is about 18%. A lower “official” corporate tax rate will still decrease the effective rate down, which benefits companies, their owners, and the shareholders.

As always , I love your non nonsense practical approach to the current flap. Thanks for rooting out some more facts and figures and charts and encasing it in an entertaining, informative article. I have excerpted a few choice nuggets and shared with my fb as a teaser to my fb friends. Some will come back and read the whole thing, but many will take the easy way you described so well.

Praying that you thrive, even as your soul thrives. mim

Thanks. You don’t know how much I appreciate the share!!

Great post Money Wizard. Some of my high-tax-paying shares have been going crazy the last couple weeks in anticipation of these tax cuts.

I wish I could say I was as enthusiastic. We typically itemize our taxes so we’ll likely be paying more. Boo!

Sorry to hear, Mr. Tako.

From what I can gather from the info we have, itemization isn’t an immediate death sentence. Especially since mortgage interest is still deductible for mortgages up to $500K-$1 million, depending on the plan. The second chart says 60% of itemizers could still save on taxes.

I was also pretty surprised from that NYT chart how many families with two kids still came out ahead. The chart’s a little deceiving because although it looks like a 50/50 split at first glance, there’s actually about twice as many dots on the “win” side than the “lose” side. Then again, that chart is the most confusing thing I’ve ever seen, so I might not be reading it 100% right.

Great way to look at it. Why stress over what you cannot control or listen to the media talk about it without a solution. As you said, the best way to benefit from the breaks that are given to the wealthy is to become wealthy. Investing in stocks is a path to wealth for the average person to take advantage of.

I love those last two sentences of yours Dave. So true.

Given the current situation, lower corporate tax rates will just serve to back fill for increasing interest rates and then some. Workers have historically low savings rates, low stock ownership rates, and low employee union membership to fight for higher wages, while having all-time high debt levels. Workers will get the bad end of the higher interest rate, low corporate tax rate scenario.

Ultimately what I hope for is financial stability for myself, and by extension, the US and world, but it’s as if people pushing for this tax plan and other policies are just trying to perpetuate current trends which will eventually run into a wall and incite conflict. Although I can’t “control” my family, community, or the country that I live in, I still have a long-term interest in these things. I am a bit of a stoic and this trend isn’t anything new, so I’m not particularly worried, but it’s an interesting thing to watch nonetheless.

The higher standard of living most Americans have enjoyed in recent decades keeps the average person distracted from the reality of wealth inequality and the debt-fueled indentured servitude that they’ve sold into. All to be able to have the “freedom” and “choice” of 287 different brands of cheap cereal, and whether they get to pay an arm or a leg for their health costs. I think current trends will continue as long as the older generation keeps blaming immigrants, and us millennials keep embracing “co-habitating”, ripped jeans purchased at thrift stores, and biking to work, not because they’re trying to retire early but because they’re poor and indebted.

Great point as usual Mr. Wizard!! Somehow the news always misses that in retirement 3.0, we all need to be investors to have a prayer or retiring some day. This means that corporate tax cuts that lead to benefits in the stock market are actually good for the individual. Of course most of that would go to those that started investing say a year or more ago. Still as they say, the best time plant a tree is 20 years ago. The second best time to do so is now.

My biggest issue here isn’t who will benefit, but the giant hole in the budget. This leads type of thing eventually leads to hyperinflation and then there is nowhere to hide.

Just wondering your thoughts for those that Itemize. What about the idea of prepaying property taxes (if you own your home out right) or several months of mortgages payments (If you have a lien) in order to increase itemized tax benefits in 2017 before they go away in 2018.

Since you and the Girl are now quasi home owners, have you put any thought into this, or does the timing of your purchase (limited interest to date) not allow for the benefit of itemizing in 2017.

The mortgage interest deduction isn’t really going away, so long as your mortgage is less than $500K or $1 million. (House vs. Senate proposal)

Since our mortgage is only $160K, nothing really changes for Lady Money Wizard, other than not being able to deduct property taxes. And with the doubling of the standard deduction, and the mortgage being so small, it will probably be a moot point anyway. Under the new plan, I’m guessing she’ll be better off taking the standard deduction rather than itemizing.

Prepaying property taxes is an interesting idea. I’m definitely NOT A tax planning expert, but I guess I could see it working out under the right scenarios. Property taxes are usually pretty low though, so I’d wonder just how much of a benefit that would really provide.

Mr. Wizard, 🙂

As a fellow Minnesotan and someone else who gets to pay 7% state taxes. Prepaying property taxes of lets say $3,000 would equate to (pending on your tax bracket) ~$450 – $750 of an increase to your tax refund for 2017 (average tax brackets of 15%-25% brackets). Now this is for filers that would be itemizing in 2017. But would loose the benefit of itemizing in 2018 due to the proposed changes in the tax code.

The limiting of SALT – is the biggest hit for most people in this determination. If SALT is limited to $10K, your mortgage interest expense would have to exceed $14K to make itemizing a positive option. This starts to come into play more for duel income households that own a home with AGI of $100K+ (the 7% state tax quickly eats into the SALT max).

I enjoy reading your work and hearing your opinions and ideas about the Twin Cities area – thanks

I’m glad to see US corporations get a tax rate that makes them more competitive globally. I’m a shareholder in many and glad to benefit. However, I don’t like seeing it come at my expense. I live in a high tax state and a high property tax county. Our taxes will go up. It has my wife and I thinking about quitting our jobs, selling the house, moving to an apartment in a low tax state and traveling to see the world while we are young enough to do so. The tax savings will pay for most of it. Tom

Sorry to hear Tom.

High tax states are the worst. Growing up in Texas (0% income tax) I still can’t believe how willing some residents are to pay such high state taxes.

I wouldn’t blame you at all for moving. I still have no clue what Minnesota is doing with the ~7% income tax I’m paying them, and it really makes me wonder if living here is worth it.

For those living in high tax states who currently itemize, that might end up taking the new higher standard deduction going forward as a result of the proposed tax changes, what are your thoughts on these strategies? Some of these might also be beneficial even if you’re in a low tax state.

1. In 2017 prepay your Jan mortgage before 12/31/17 so you can take the interest deduction this year, instead of losing that deduction next year if you end up taking the standard deduction in 2018. Same for student interest loan interest which might also be getting the ax.

2. Ditto for property taxes. I have a 2nd half school tax bill that’s due 1/31/18 but I have the option of paying it before 12/31/17 if I want, and taking the deduction in 2017.

3. If you have any donations you’re planning on making, make sure you do it before 12/31/17 so you can claim a deduction for it, since you won’t be able to in 2018 unless you itemize.

4. If you own your own business, hold off on invoicing your December work until after 1/1/18 if you think you’ll be in a lower tax bracket next year.

Well said!

It’s crazy when I go back home and talk with old friends and they always complain about politics. Its such a waste of time IMO. I’m trying to worry about things I can control and ignore all the noise.

This new change gives me another reason to do another audit on my taxes. I think ill get a break as a single filer with a W2 job.

Also, good point about being an investor rather than a consumer. I’ve been getting better about weighing the options of buying something when I frame it as “this purchase is taking away money to be invested” mindset. However, Amazon does still get me from time to time – most recently the “InstaPot” on black friday. 🙂