Hang around the personal financial section of the internet for long enough, and you’ll eventually find a contingent of people claiming something more than a little extreme – that the government’s official rate of inflation is rigged. And it has been for over 40 years…

Now, if this is true, it’s obviously a HUGE deal.

Inflation is easily one of the most powerful factors affecting all of our wealth. It’s the only metric that can silently erode the value of our income, savings, and investment returns. And worse, it’s entirely out of control.

So if the inflation numbers are inaccurate, then the assumptions underlying every basic investment decision needs to be reconsidered. As does the entire government policy for every single government program.

So is there any truth to this WILD claim? Or are the people who don’t trust the “official” inflation numbers just wacky doomsday preppin’ nutjobs?

Like most things economics, the truth is… complex.

It’s time for me to brush off the economics degree and lay this all out in terms that a sane human would actually want to read.

Don’t worry. Even if this might be a boring topic, the results are so fascinating that I promise this will be worth your time.

True: Around 1980, the Government fundamentally changed how they calculate inflation

It’s true!

The government has always calculated inflation using the Consumer Price index, aka the “CPI”. Any changes to the CPI = changes to the government’s official rate of inflation.

However, the Bureau of Labor Statistics has made some changes to how that CPI is calculated.

For the rest of this article, I’ll use two terms:

- Old Consumer Price Index – “Old CPI” was pretty simple. Just a huge basket of everything available for sale.

- New CPI – This method had been used since the 80s and 90s, but with a few key changes. (We’ll get to those in a second.)

Myth #1: Nobody knows how the government calculates inflation anymore

You’ll see this claim by lots of anti-government articles. The only problem?

It’s not true.*

Figuring out how the government calculates “New CPI” is actually easy. The Bureau of Labor Statistic’s even includes a handy FAQ page, where they outline the adjustments they made using clear, easy to follow explanations.

Like this:

To illustrate the mechanics of a hedonic quality adjustment, it helps to begin with the generalized form of the hedonic regression equation:

(1)

Where the dependent variable, lnP, is the natural log of price, ß are the coefficients estimates of the independent variables (Xk), and e is the error term…

(2)

…

3)

Where PB,t+s-1 is the quality adjusted price, PA,t+s-1 is the price of Item A in the previous period, and is the constant e, the inverse of the natural logarithm, exponentiated by the difference of the summations of the ßs for the set of characteristics that differ between items A and B.

Oh… wtf!?

Okay so, understanding it won’t be easy, but that doesn’t mean it can’t be done.

Hold on, give me a few days, and if I get stuck, let me call up some of the poor economics assistants I know who spend their days surveying the price of the 80,000 different consumer products included in the CPI basket each month.

Those poor, poor souls…

*It is worth noting that the BLS publishes a ton of info about CPI, but it’s true they never publish the raw data, for whatever reason. So technically it’s impossible for an external auditor to double check their work, although the government agency promises there are numerous internal audits completed constantly.

So, what did they change? (In REAL layman’s terms…)

The changes between Old CPI and New CPI were made to fix a long recognized problem.

CPI is literally a basket of about 80,000 goods for sale in the United States. The purpose of the basket is to measure everything for sale in our economy. But everything available for sale doesn’t always stay the same.

Do you see the problem?

When a newer, more high tech version of the iPhone comes out, it costs a little more. You don’t have to buy it; you can keep your old flip phone if you like. Is that inflation or just progress? Is it fair to count that progress as inflation?

So, the Bureau of Labor Statistics came up with two solutions.

1. Hedonic quality adjustments

- Old CPI assumed any changes to iPhone price is caused entirely by inflation.

- New CPI uses the super complicated math formulas I posted earlier. The goal? Try to decipher which portion of the increase in the iPhone’s price is because of actual inflation and which portion is just due to increasing benefit to the consumer.

Not surprisingly, the economists get pretty anal with this. (I think an anal personality is part of their job description. 😊)

On the BLS FAQ page, they actually walk through an example of removing the benefit of long sleeves versus short sleeves whenever the CPI basket rolls over from summer to winter fashion. Seriously!

2. Substitution adjustments

- Old CPI assumed that people never substitute products if prices changed.

- New CPI assumes people are capable of making this adjustment.

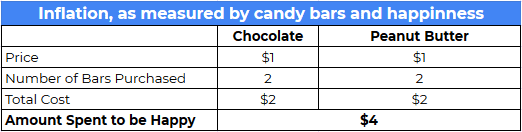

For example, let’s say a person usually buys 2 chocolate bars and 2 peanut butter bars, which all cost $1 each.

Then, a chocolate shortage! Chocolate rises in price to $4 per bar.

Old CPI would measure the old basket as $4, and the new basket as $10, for a 150% rate of inflation.

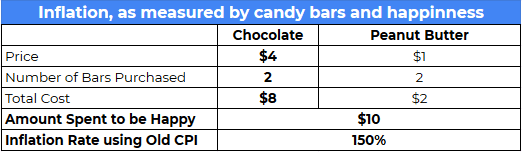

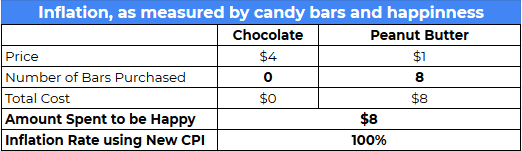

New CPI, on the other hand, would assume the person could substitute four peanut butter bars instead of the more expensive chocolate bars, and still only spend $4. But New CPI also recognizes that some people really, really like chocolate.

After some complex math, New CPI would probably decide that assigning an $8 cost to the basket is a good compromise, since a person who used to buy 2 chocolate bars and 2 peanut butter bars might be equally happy buying:

- 3 peanut butter bars and 1 chocolate bar

- Or even 8 peanut butter bars

- Some other mix.

In this case, New CPI would calculate a lower inflation rate of 100%, instead of 150%.

That explanation got crazy wordy, but here’s the important take away. When the government calculates inflation these days, they assume we can substitute things that increase too much in price. In reality, this usually reduces the rate of inflation.

Is that a perfect system? I’ll leave that up for you to decide.

Cliff notes: CPI shifted from a “Cost of Goods” measure to a “Cost of Living” measure

All this means that CPI is no longer simply a measure of the cost of goods. Instead, its intention is to measure cost of a steady standard of living.

(That’s not my speculation. Those are the exact terms used in BLS publications.)

Where they start lose me

I get the sentiment and need for some adjustments, but let’s take this standard of living measure of inflation to the extreme.

It’s been said that the average American now enjoys a standard of living that blows John D. Rockefellar out of the water. Keep in mind, this was a man who’s relative wealth today would be about $418 billion dollars.

Does that mean we’ve experienced zero, or even negative inflation since 1839?

You can buy an 1800s “standard of living” which includes telegram technology, a lack of air conditioning or electricity, and no modern medicine for pretty cheap these days. MUCH cheaper than the 1800s prices, in fact.

Obviously though, we haven’t experienced zero inflation since those days.

Common Sense and Inflation

I think most people intuitively know something is up with inflation.

The cost of necessities like healthcare, education, and housing are through the roof, yet we keep getting reports of “low to modest” inflation.

In the 1950s, my Grandfather bought a decent sized house in a nice part of town. He did this even though he was the family’s only wage earner, never graduated college, worked a blue collar job, and still gave FIVE children a solid middle class lifestyle.

Does anyone really think that’s a viable strategy today?

While I don’t buy into the conspiracy theories that the government is intentionally underreporting inflation, I do have my concerns about the methods used to calculate it.

Even most economists will tell you their inflation rates aren’t perfect, so they attempt to fix these imperfections with complex adjustments. My main issue with economists, as well-intentioned as they are, is that they tend to get caught up in their own complexities. (This coming from an economics major.)

The more complex a system gets, the more things that can go wrong.

At certain point, you get blinded by the echo chamber of your own field. And economics as a field is far from perfect. (The first rule of economics is literally to “assume a rational individual.” But anyone who’s checked out their ranting friends’ facebook feeds lately might agree this is a stretch…)

Alternate Inflation Calculations

BLS data is one way to calculate inflation, but it might not be the only.

This Investopedia article explains that while the BLS calculates a 2.2% inflation ratio lately, other economists used the same data and calculated inflation anywhere from 5-8% over the same time period.

Possible? I guess so.

Plot twist! Why Inflation Might Be Accurate, After All

After just spending thousands of words explaining my doubts about inflation, I also have my doubts about people claiming that “true” inflation is actually near the double digits.

Anyone who’s ran a compound interest calculator knows that the difference between 2% and 8% over 30+ years is absolutely massive. If those higher inflation estimates were true, that $3 movie ticket wouldn’t cost $12 today; it’d be well over $50. And that’s just not happening.

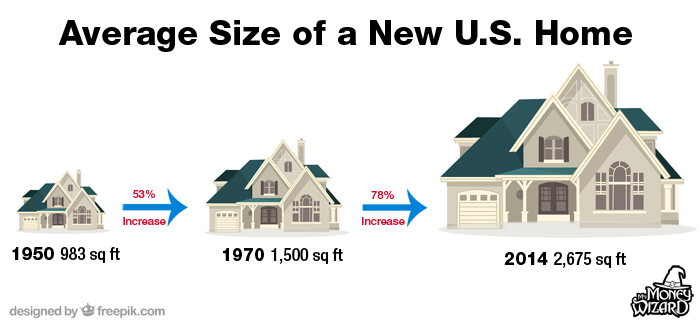

Plus, we know consumer preferences have changed. Cars are bigger, heavier, and yet faster than ever. And that house my Grandpa bought on a single salary? It was, on average, about 2,000 square feet smaller.

I’m not personally sold that inflation is as rampant as these alternate calculations say. But it’s at least smart to consider the possibility.

So, what you can do about concerning inflation numbers?

Not a thing, that’s what!

I joke, but there’s some seriousness there.

You can’t control how the government calculates inflation. Nor can you control how much money they print. Debating about it endlessly from across isles definitely won’t make you any richer.

(And on that note, writing 2,000 word blog articles about it probably won’t either. Rats!)

What you can do is look at the facts and respond accordingly.

No matter what inflation is or how they calculate it, we have two possible truths:

Option 1:

Option 2:

Here’s the interesting part, no matter which is true (and even if the answer lies in the middle) the wisest course of action is similar.

Holding tons of cash has always been a recipe for eroding your wealth to inflation. If the naysayers are right and inflation is actually way higher than reported, then holding cash is just an even worse idea.

You shouldn’t stop doing a bad thing because that bad thing is made worse. You shouldn’t ever do the bad thing to begin with!

The answer then, is the same answer as always. Invest in assets, not eroding dollars. Put your money to work to make you more money.

I don’t care if you think that’s the stock market, gold, bitcoin, or any of the other 18 wacky income producing assets I’ve written about.

That’s the only way to swim with inflation, instead of against it.

You’ve just gotta do something.

Do you enjoy my free blog? Share this article on your favorite social media or try my favorite free financial software or this awesome cash back portal using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

Awesome as always Sean,

Relevant and simplistic (I mean that in a complementary tone),

Easy to understand and digest, no wonder I love your articles.

A lifelong fan

Mark

Thanks, Mark! I really appreciate it.

People who believe in government conspiracy theories have way more faith in our governments capabilities then I do. And I’ve been working for government for the last 12 years.

Breaking it down Barney style, Inflation is a function of money supply (which the federal government knows) compared to population numbers (for which we have reasonable data that we have to swag a bit because not everyone in the US participating in the economy has a social security number) and available goods and services (here is where CPI methodology is important). However, as you mentioned in your blog, our expectations have evolved over time, and so the standard of living has adjusted as well in interesting ways. Perhaps a better way to look at this is the varying percentages of average household income are eaten up by “essentials” like housing, healthcare, and food, and then look at how much that buys and how much is left over for purchasing “non-essentials”.

Intuitively I would say we have two problems. First is the cost of essentials is increasing as a percentage of our income… this is why the 5 children your grandfather raised would be a financial hardship, or perhaps a catastrophe in some areas of the US today. Houses have not gotten more expensive per square foot, but they have gotten bigger, and it is much more difficult to find modest houses then it was. Health care and education, now practically required to improve your earning power as a barrier to entry in a way that it wasnt in the past, have been increasing at a rate well above the official inflation rate, both in large part due to certain long term disfunctions in how those systems have evolved over time within our society (to note, 4 years ago the cost of going to Boston University for 1 year was about 44,000… now it is 58,000… that is nearly 8% yearly increase and it is not an outlier).

2nd is the poverty of plenty. Namely, the number and quality of consumer products has risen at the same time the requirement to pay for essentials has increased… so we are more aware of all the things we can’t buy, and there are a lot more of those things. This expands the value of goods and services at a rate that is perhaps commensurate with the increase in money supply and population, but also creates the perception that we are poorer then we are.

Great analysis, Matt. Thanks for the contribution.

You bring up an interesting point. Is measuring inflation via CPI even the best way to go about it? Interesting thoughts…

Sean, you broke down the complex topic of inflation into such clear layman’s terms. To be honest, I had never heard of CPI until your article. Loved your reaction to the new CPI formulas haha! Not only have I learned something new, but this has also reinforced how important it is to ensure your cold hard cash is growing at a reasonable rate to fight off inflation.

Thanks, man! That’s what I was going for… maybe I don’t always hit the mark, but it’s great to hear when I do!

It’s not hard to imagine why there’s so many conspiracy theories when the CPI formula looks like that! Thanks for the simple explanation of what goes into calculating inflation. Great middle ground between the common simplistic explanations of what inflation is and the full-on economic theory.

Haha, so true. They’re just inviting wild theories with that formula…

You did a pretty good job of explaining it. Fundamentally the government is not ‘covering up’ inflation with bls. But… lies damnable lies and statistics. While the adjustments are justified in aggregate as you pointed out, the individual change is based on the governments perception of what is a reasonable adjustment. And that’s something that can infinitely be second guessed and can deeply bias the numbers.

Great point FullTimeFinance.

This was a really awesome article breaking down a very complex topic into understandable terms. I’m sure there were many times parts of this were edited/reworded/deleted/undeleted 🙂 Thanks for taking the time and the grey cells.

The Feds balance sheet is almost 8 trillion, the stock market is at a all time high, health Care has sky rocketed, so many family’s are priced out of home ownership and are angry. But the FED is saying we have low inflation.

The overly complicated CPI equations and fancy words like qualitative easing makes the FED look like they are obfuscating the situation, adding fuel to the antigovernmental groups.

At the end of the day you can only vote for the people you think are honorable. An like you said, try and protect your hard earned labor by not holding cash. Which by the way drives up asset prices even more.

They knew about all this way back in the old days:

“If the American people ever allow private banks to control the issue of their currency, first by “INFLATION”, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless.” –Thomas Jefferson