Okay, Money Wiz, you’ve invested hundreds of thousands of dollars into the stock market, and you’re counting on earning average returns to get rich. But what are those average returns, anyway?

Good question!

Any investor, whether they’re just learning about the market or already have enough invested to be sweating bullets about the future, is wise to ask this question.

And well, I’ve got good news and bad news.

The good news is that there’s a simple answer to this question. The bad news is that simple answer still opens up a lot more discussion.

Let me explain…

Why the “average” return is a trick (and what you should use instead)

It’s only logical that to find the average return of the stock market, you’d calculate the average, right?

Not so fast.

The stock market’s average return is actually really misleading. (What! Why you gotta be so difficult finance?)

Imagine you invest $100 into the market, and on the first year you lose 25%! Ouch.

But on year two, you gain 25%! Hooray!

To find your average rate of return, you’d do this:

(-0.25+ 0.25) / 2 = 0%

If you earned a “0% return” then you’d expect your $100 investment to still be worth $100.

But what actually happened?

- Initial Investment: $100

- Year 1 (25% loss): $75

- Year 2 (25% gain): $93.75

- Total Return: -6.25%

Wait, what!?

How’d you lose money when your return was supposed to be zero?

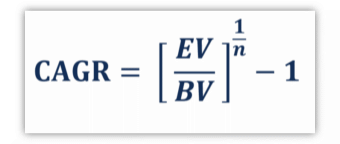

This is the difference between “Average Return” and what’s called “Compound Annual Growth Rate.”

Because it takes larger percentage gains to return to even after a loss, we always want to use the Compound Annual Growth Rate calculation whenever we’re evaluating investment performance.

And that calculation isn’t simple!

But fear not, fellow math-averse investors. There’s an easier way.

How to easily calculate CAGR of the market

Your school teacher lied to you, and you do always have a calculator in your pocket.

So whip out that cell phone and turn to your trusty pal google, who hosts all sorts of CAGR calculators, just a tap away.

These are my two favorite:

Both of these use stock market data of the S&P 500* dating back to 1870, and that data’s been compiled and double checked by the famed Nobel Prize Winning Economist, Robert Schiller. (Here’s Schiller’s website for any psychos who want to dig into the raw data.)

*IMO, the S&P 500 is the best metric for the “overall stock market” since it represents a basket of the 500 largest companies in the US.

So, what’s the true average stock market return?

We can use those calculators to find out. And the verdict is…

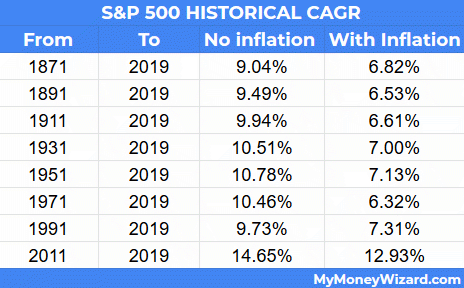

In all of modern history, the average long term return of the stock market is usually around 7%.

Three key stipulations to this number:

- “Long term” means at least 15+ years. And more like 30…

- It assumes you reinvest all your dividends. (I always do and you probably should too.) If you ignore dividends, your inflation adjusted annual return drops by 2-3%.

- It is adjusted for inflation. A lot of people get this wrong, because the press always ignores the previously mentioned dividend reinvestment. Instead, they like to quote a 7% return of the stock market, and then adjust down another 2-3% for inflation. (The true annualized return of the market without inflation is 9-11%)

I went ahead and ran the numbers (with dividends reinvested) every 20 years. Take a look for yourself:

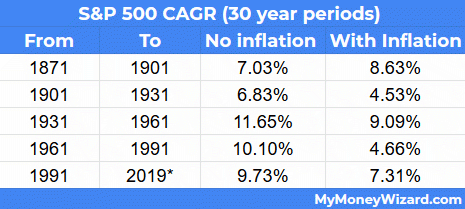

Then, I ran the numbers for different 30 year periods throughout history:

As you can see, when we shorten to a 30 year time period, our results obviously aren’t as consistent. But, we do still see average inflation adjusted returns from 4.5% to 9% per year.

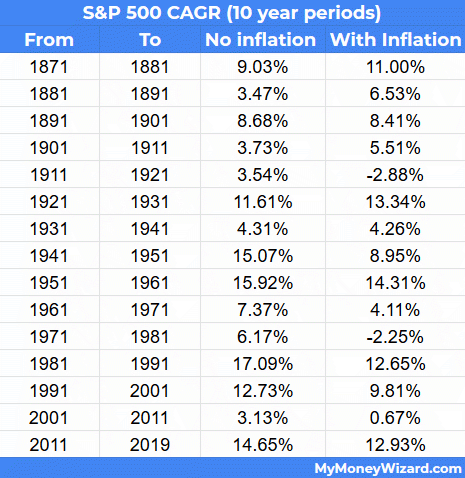

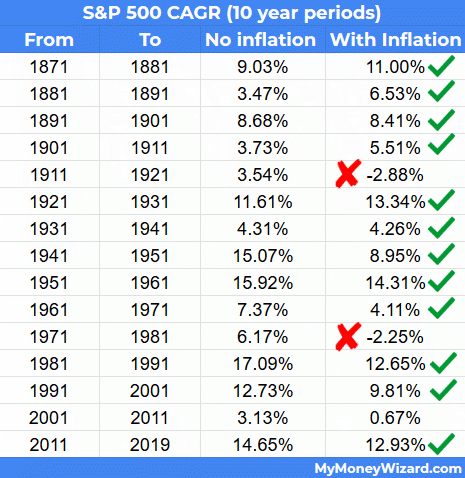

And for fun, I also looked at 10 year periods:

I stopped here, because if you’re planning on a less than 10-year time frame in the market, IMO you’re better off with other investment vehicles. Or at least diversifying those stock contributions with a higher percentage of bonds, REITs, etc.

(Personally, once I invest in the stock market, I don’t ever plan on selling, if I can help it. Once I reach financial independence, I’d prefer to live off my portfolio’s dividends or even hobby income, so that I can ride out shorter term fluctations.)

Yea, but that’s all history. What return should we plan for in the future?

Great point. One of the most classic disclaimers in all of finance is that past returns are not indicative of future performance.

It’s important to keep this in mind when evaluating any investment, the stock market included.

(Just ask all those folks who lost their shirt around 2008 thinking “real estate can never go down.” They were basing that opinion entirely on past returns, and more specifically, very recent past returns.)

Why the market should go up…

I personally put a little more weight into past returns of the stock market than say, real estate. Real estate is actually dirt, or four walls and a roof. At a baseline, you expect real estate to grow at the rate of inflation, plus however much a specific area’s population grows.

Stocks, on the other hand, aren’t just dirt. And they’re not just numbers on a computer screen either. Stocks actually represent ownership interests of living, breathing companies.

Each of those companies employs thousands of real humans, and they collect profits through the goods and services they sell to millions of other humans.

In other words, during a normal economic environment, you should expect businesses to make money, and then return that money to stockholders.

I heard Vanguard said we should expect 4% returns?

I get this question a lot, so we’ll start with another disclaimer. Nobody can predict the future, myself and Vanguard included.

In other words, most predictions aren’t worth the paper they’re printed on. “Experts” are wrong all the time.

That said, here’s where this question comes from. Vanguard, the original creator of the index fund and rare financial good guys, releases an annual research report where they throw analysis and predictions around. Historically, this report has been relatively accurate, although not perfect.

In recent years, Vanguard’s report has continued to predict the stock market’s 10 year CAGR (before inflation) of just 3-5% – quite a bit lower than the historical 10% or so. (I’ll say!)

In fact, Jack Bogle, Vanguard’s original founder, presented a pretty compelling case for stocks to return about 3% (after inflation) over the next ten years.

My Personal Opinion on the Average Stock Market Return

First thing’s first. The ten year time-frame that Jack Bogle, Vanguard, and others are referring to above, is not exactly “long term” in the stock market.

In fact, ten years should be about your shortest possible time-frame in the stock market.

On that front, it’s entirely possible to see 10 year returns in line with Vanguard’s prediction. Scroll up to my chart of ten year time periods. In periods following 12-13% stock market returns, like say… 2009-2019… it’s not all that uncommon to see the next period return 0-4%.

Personally, I actually find this somewhat comforting. It means the predictions of a slowing economy aren’t predictions of a broken economy, rather just evidence that we can expect things to normalize a bit.

Does that mean you should cease all stock market investments? ABSOLUTELY NOT.

For the 15 different ten-year periods above, we only saw a loss in 2 of those 14 periods.

In other words, if you’re trying to time the market to “avoid a downturn” then you’re playing a losing game. The odds are completely against you, and about 90% of the time (literally) you’re going to lose money.

Remember, missing out on gains is just as detrimental to your portfolio as avoiding losses. (Especially the younger you are…)

What average rate of return on investment does The Money Wizard use for forecasting?

All that said, there is one major factor worth mentioning, which I think makes it reasonable to expect a slight decline from 140 years of 7%:

Look at the S&P 500’s returns from 1950 onward, and you’ll notice a slight uptick in returns.

What I find interesting is how this coincides with America’s reign as the world’s only true superpower. In other words, is it any surprise that our stock market had a great run while the rest of the developed world had been bombed into oblivion, post WWII?*

For this reason, I like to take the 7% historical returns of the market, and whenever I’m doing my own long-term planning, take a look at what my portfolio looks like assuming around 6% long term returns moving forward.

And then, for fun, I like to take a second look at what might happen with 7-10% returns, or even 2-3% returns. (Although the latter exercise is much less fun…)

*note to self: consider a higher allocation of international stocks?

Why I No Longer Stress About Stock Market Returns

Like most things, the truth usually lies somewhere in the middle.

The people closing their eyes and believing in 10% returns with no inflation until the end of time (cough… Dave Ramsey… cough…) are probably off. As are the people predicting the collapse of the modern financial world.

And in any case, what’s our alternative?

Invest less? That only assures you earn 0%! Which statistically, is a very much a losing battle.

And it’s not like there’s some surefire investment vehicle that looks amazing compared to stocks in the current environment, anyway. (Bitcoin lovers… go away and enjoy your 50% daily rollercoaster…)

So instead, I focus on what I can control. I save as much money as I can, consistently invest for as long as I can, diversify according to my risk appetite, and trust the rest will work out.

So far, the strategy’s done alright. I’ve built up $300,000, and even assuming a massive long term shift in returns, that’s enough of an investment base to get me to millionaire status, even IF I stop investing entirely and the market somehow starts earning crazy low returns.

Cheers! We’re all in this together!

Want to easily track the returns of your portfolio? Personal Capital is a free tool that does that better than any other I’ve come across.

Related Articles:

Great article, do you know if there are similar calculations based on other countries indexes?

Really enjoyed this article, a very good read.

For those of us who are your European neighbours, do you know of an alternative to Personal Capital? Thanks!

Great work mate. When people ask me for advice I tell them word for word what you just said. I couldn’t agree with you more