Right now, there’s a battle raging. You might not know it yet, but you’re smack dab in the middle of a personal finance World War III.

It’s called The Great War of Oversized Homes. On one side, the axis of evil: realtors hunting commissions, bankers praying for loan closings, and an uninformed general public who still thinks you can’t throw money away on a house. On the other side, your hard earned savings, desperate not to become the financial equivalent of doused in gasoline and lit on fire.

How do we bunker down our wealth from the onslaught of aerial bombings heading our way on a daily basis? Let’s dive in.

Are Millennials Really Getting Screwed on Housing?

Here is a common complaint I hear from my fellow millennials. “Yeah right baby boomers, you don’t have it as hard as we did. The American dream is dead, just look at how much homes cost now.” This is usually followed by some stat about how their grandparents only paid $20,000 for their first home, how a pack of gum used to cost a nickel, and how things were so much simpler before we had the entire world’s library at our fingertips.

First, I have a friend I’d like you to meet. He’s called inflation. That $20,000 home cost a hell of a lot more, on an inflation adjusted basis, than $20,000. We’ll leave that for another time.

For now, let’s adjust for inflation and take a look at this common claim.

It turns out, it’s true! Based on housing data from the US Census Bureau, Americans today are paying about 62% more for new homes, even after adjusting for inflation, than they were paying just 40 years ago. A travesty right?

Woe is us, fellow millennials.

…Not quite.

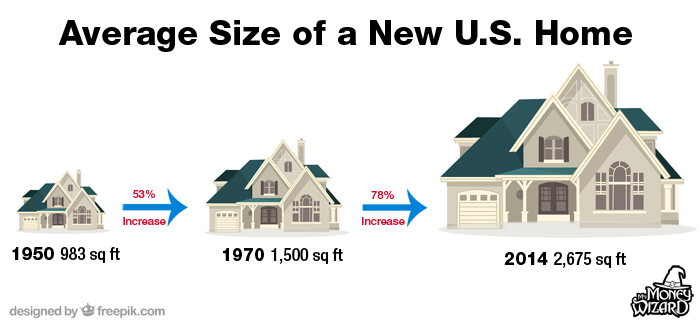

Here’s the part everyone keeps leaving out: While the average home price has increased since the 1970s, so have home sizes. In fact, the size of homes increased even more than the 62% increase in prices – the size of homes actually increased 64%!

Follow the data back a little further, and the growth is even more rampant:

Either humans in the 1950s were much smaller than they are today, or things have gotten out of control.

Let those numbers sink in again. Even adjusted for inflation, homes today are cheaper per square foot than ever before.

Plus, they’re equipped with incredibly luxurious features that would have previously been cost prohibitive: central air conditioning with programmable thermostats, high tech alarm systems, fancy appliances, and in some cases, HD surveillance systems streaming directly to smart phones so we can complete the ever important task of watching all the cute things Fido does while we’re at work.

If the American dream is dead, then it’s the American need for a walk in closet, Jacuzzi bathtubs, and more bedrooms than heads in the house that killed it.

When Keepin’ It Real Goes Wrong

50 years ago, people considered it normal for a home to have one bathroom. Multiple siblings sharing a room was also par for the course. A really wealthy family might own a cabin* for summer vacations.

*Back then, a summer cabin did not mean a beach house monstrosity. It meant a tiny shack that was a slight upgrade from tent camping. It may or may not have had air conditioning, and it definitely included lots of tiny bunk beds to pack as many people into as small of a space as possible.

Today, houses have more rooms than people, and small vacation cabins have been replaced with huge vacation mansions. Being wealthy isn’t even a prerequisite for owning a second home anymore, thanks to the miracle of buying anything and everything on credit.

Back on topic…

“Money Wizard, houses are bigger today because families are bigger.”

Wrong. The average family size has shrunk notably from 1950 to today. In 1950 the average family had 3.4 people per home. Today that number is 2.6.

In other words, the average home’s square footage per person has skyrocketed from 289 square feet to over well over 1,000.

STOP THE MADNESS.

The girlfriend and I are currently house shopping, and by house shopping I mean window house shopping, and by window house shopping I mean we check out Zillow.com every once in a while.

Here’s the amazing part: finding a single family home without thousands of square feet and thousands of bedrooms is a serious challenge. As the graphic earlier showed, the American taste has quickly reached a massively oversized breaking point.

“But I want a big house!”

No, you don’t. You might think you do, but you really don’t.

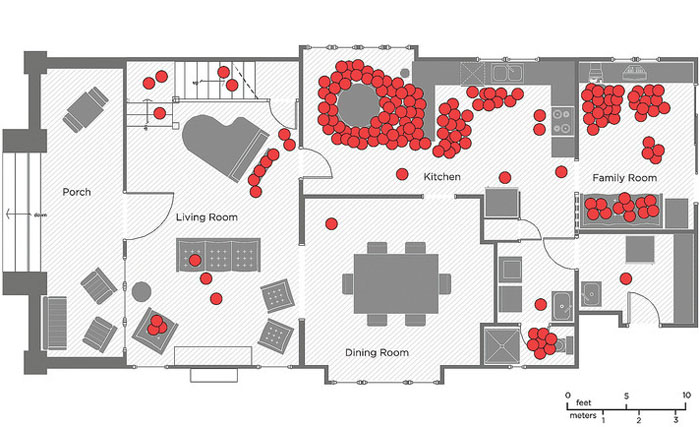

Consider this: in 2012, the Wall Street Journal published a study measuring the average use of a family home. In the study, a team of UCLA researchers performed a sweep of an average family’s house every 10 minutes. The location of each family member was recorded and plotted. Here are the results:

68% of the family’s time was spent in the same two locations – the kitchen and living room. The patio was entirely abandoned, the dining room was almost entirely abandoned, and the home’s sitting area was pretty much entirely abandoned. All in all, the unused parts of the house accounted for nearly 75% of the home’s square footage.

Meanwhile, all that unused space is costing very real money, whether it’s used or not.

Unfortunately, we do not get the luxury of adjusting our mortgage payments based on frequency of use, which makes this unused space a seriously money draining fixed cost. It costs money in the form of every month’s rent or mortgage payment, it costs money to heat and cool the unused space, and it costs money to maintain all that space.

Unless for some strange reason this family enjoys financing space they don’t use, I’d imagine rolling down the car windows, grabbing a fistful of hundred dollar bills, and throwing them out the window at highway speeds would provide a similar experience.

Sure, it’s easy to point the finger, but if those UCLA researches ran a similar study on me and you, would we look any different? Think about your own home, and how much space you use on a regular basis.

Even in my relatively small 1,000 square foot apartment, a plot of my use would have similarly barren areas. On many nights, the living room and dining room would be lucky to score more than one or two red dots, and there are several days where I’d estimate I don’t even use half of the space I’m paying for.

Of course, we’d all like to have a little extra space for entertaining, but how often do we really entertain? And is it worth paying for that space every single minute of every single day, during the 364 other days of the year?

I think back to an interview I saw years ago from one of the original tiny house dwellers (before the fad became cool). They asked the owner, “Don’t you ever wish you had more space for entertaining?” To which he answered, “I could rent out the entire Bellagio with the money I’m saving each year.”

Don’t Die in the War of Oversized Homes

So how do we preserve our wealth during this great war?

First, we recognize how overrated the out of control mansions really are. Take it from me; unless you enjoy impractically large layouts, a fleet of maintenance men invading your privacy, and a high priced mortgage robbing your freedom, big houses suck.

Second, we recognize how the same disease plaguing the high square footage arms race has slowly crept into the entire housing market. In just 60 years, have you evolved so much from your homosapien peers of the 1950s that you now require an additional 1,700 square feet just to survive?

I didn’t think so, so turn off the House Hunters comparison to some poor couple stretched far too financially thin, and temper those home needs wants to something which leaves you a little breathing room.

We can do it! In the Great War of Oversized Homes, wealth will prevail!

If you enjoyed this post, there’s more where that came from! Check out all the posts, ever, and subscribe to the newsletter below for new posts twice weekly:

One solution to the oversized home issue is to rent out a room on airbnb. The fiance and I originally lived in a 600 square foot apartment, but recently moved back into a house that she already owned from before we met (she had been renting it out).

House was too big for us, so I put up a guest room on airbnb and have been pulling in good money and having fun meeting new folks.

Where you live might determine whether you can do this, but I think it’s one way to reduce your housing and get more of that space to work.

And really, if you aren’t sure about Airbnb, my suggestion is, try it out once. If it’s not for you, you can just deactivate your listing and at least you can say you gave it a shot.

Good point Financial Panther. If you have the space, might as well use it! Thanks for the comment.

I never thought of it like that but so true – home size and home expectations have increased significantly. Unfortunately I was swept away by the trend and my fiancé and I bought a 3600 sqft home and we don’t have kids either. Woops. It’s under contract now thank goodness. Also interesting UCLA study although I’m sure we all know we don’t use all the rooms in our house, we just choose to forget it. Great post!

The oversized home marketing machine is a strong one. No judgments made for the axis of evil claiming another victim.

Are you planning on downsizing now that it’s under contact? Interested to hear the opinion of someone who’s seen both sides.

Thanks for the comment!

I see all these McMansions all over here too. I live in a pretty simple place, property taxes are ‘only’ ~$200 a month. I see some properties that are over $1,000 a month. I have a friend that had property taxes over $40K a year.

I would rather save that money and get out of the work force earlier, like I actually did…

Couldn’t agree more Eric. And very cool story by the way!

Tell your girlfriend; “The smaller the house, the less you’ve to clean”. This trick work all the time.

Haha, no worries there Rudy. She’s sold on a houseboat.

This sounds extremely preachy to me. You rail against millennials as if we all want large homes. There isn’t enough supply of reasonable small homes to go around. And when they’re available, its like you said, they’re overpriced – and maybe even bidding wars start. So when do you find a smaller sized home it still wouldn’t make sense to buy.

You bring up great points. It’s probably more fair to place the blame on the boomers, who built up the supply of huge McMansions as part of their American Dream. That said, I’ve seen plenty of peers my own age keeping the trend alive by moving further out and building a big ‘ole custom home from the ground up.

Whether the Millennials are to blame or not, the reality is that we’re the ones taking hold of the ship. We can either continue the same old course, building up and buying more house than we need, or we can shift the trend. This is exactly why I write, because it’s our generation that has the power the change these things.

I found your site an hour or so ago and I’m loving your insightful way you integrate wisdom from diverse readings you’ve done into your writing.

I think you mean family room, the living room has barely any dots in it.

Thanks!

I always mix up the naming of the family and living room. Seems a little backwards that we do our “living” in the family room and our “not-living” in the living room.

Just discovered your website and I too am loving it. What caught me was your post on houseboats. Love to hear more on that if you have more insight.

Definitely some possible future updates there. Moving into a houseboat is looking more and more likely, so we’ll see.

One thing to add to your article. Average home price (morgage) / income ratio.

This is what has held me up buying my first house. I was raised in a period where 2 was the ideal ration, and 2.5 was a stretch. now that ratio is up to 3 or 4 even 6 in some areas. So say somebody earning 30k mortgaging 60k. Now I see coworkers earning 50k buying 300-350k houses. That to me is unaffordable. Even with a good income and a down payment, I refuse to pay so much but that’s all that’s on the market, so i keep renting.

Wow, great point. It would be fascinating to see a study of the mortgage/income ratio over time. At some point in the not too distant past, it would probably be pretty close to zero. The incredible book Borrow: The American Way of Debt talks about how before the 1900s, the mortgage was considered a shameful family secret, and something to be avoided.

Concur with Daniel. When I was growing up, the age old rule of thumb was NEVER spend more than 3 times income on housing, preferably much less. Or conversely, devote no more than 1/3 income on housing (or rent), again preferably less. Not sure where that rule came from, but my guess is long term actuarial experience that higher ratios sharply increased risk of default.

During the housing crises there were many sad foreclosure stories. But if you carefully read (or viewed) between the lines, for those that kept their jobs, in almost every case that ratio exceeded 3. One memorable documentary illustrated about six such stories, and the ratios ranged from 4 to 8! Yes, some folks bought homes at 8 times annual income using interest only loans. No wonder they all went bust.

Not to just blame the victim, but there did seem to be a stunning lack of common sense for too many purchasers that bought homes they clearly could not afford. Under sane rules such loans would never have been made. Doesn’t it seem more than a little bizarre Congress had to pass a law mandating banks not issue unaffordable loans?

Of course, in some areas buying a home within these guidelines is impossible. Aside from renting, unless your job truly requires otherwise, moving to a lower cost area (despite lower wages) is probably better than trying to attain the unaffordable.

I can absolutely support the concepts you and those who have replied are spot on! I am single and 62 now, retired from government job at age 50. Had a couple of as needed, fun, and flexible side jobs and have continued to work them on an as needed basis because I want to. My pension alone is way more than enough to support me and I continue to save. I advocate “practicing living on one”s anticipated retirement plan before actually retiring” by using you projected retirement income as your living.

Bought my first and only house, a well built post WWII 1940s 2BR/1bath 900 sq ft house in good condition in 1988 with a 10% interest rate, which was a ***good*** rate back then, and it has been very best decision I could have ever made! The ratio of the price to my income was price 59k to 35k income. It was a petrifying experience but I chose to keep ratio low because I wanted to afford to keep “driving a car, eating, and wearing clothing!” I was told 2.5 to 3 times income was what I could qualify for….ouch – no way! Refinanced twice to lower interest rate without taking money out of my equity. Paid extra on principal and paid off in 16 years…. this makes for a short term even better opportunity to boost savings.

By living modestly (this would mean frugally comfortably not feeling in any way deprived, traveled some, drove modest well appointed american cars for many years by scrupulously maintaining them, making savings a “pay yourself first” habit, and having an eye on having an worry-free post work life (the prize), and it happened just as I had tried to build it! Forming one’s longterm goals early makes them far easier to attain.

I had a full kitchen renovation in 2011 and added 550 Sq ft age-in-place friendly master suite and screen porch in 2012 all cashflowed – because I “wanted and could afford them.” This house would easily bring 400+k if sold right now. It feels like I have died and gone to heaven…. My location is optimal for ageing in place even if and when driving stops. This is a very desirable area to live in this community.

It is nice to say “I’ll work forever” but your family circumstances, health, or employer may not make that possible…

Thank you for this wonderful blog!

Awesome details and great story. Thanks for sharing, and hopefully we can all be as satisfied in life one day!

One thing to note, it might be a good addition to the article to include manufacturing innovations to your consideration when comparing 1950s homes to modern homes. E.g. what was previously plaster is now manufacturered sheet rock, what was manually made central air units are now more mass produced, I would like to believe that there are 60 years of innovation that should help reduce the cost of building materials.

My biggest concern is the gap between income and home price relative to income growth. My parents bought a house in 1986 for $125k a comparable house/their market value is roughtly 450k. At the same time their income went from 25k to over 150k within 23years, e.g. more than their initial home price. I don’t know about you, but I have a hard time believing I will break a 450k salary. This ultimately means less disposal incom or savings, and never feeling like I’ll actually get ahead, just in a debters prison call housing.

I remember one of our houses had a large formal dining room that almost never got used. Also remember folks buying huge RVs, boats, and the like that sat parked most of the time. Even as a kid I wondered about the economics of that.

I fell for this to some extent renting two bedrooms (using the second as an office/junk room) when an efficiently used one bedroom would have sufficed. Despite that, I never understood the appeal of McMansions, or their prevalence, given hugely skewed wealth and income stats.

Funny thing is, I doubt most Americans in the 1950’s felt deprived. More likely the opposite, their being the Great Depression generation.

Builders build bigger houses because they make more money on them than on small ranch type houses. Your best bet is to find an older small house in a good neighborhood, bid on it the day it goes on the market and be prepared to use sweat equity to fix it up. I’ve gone from one house to another over the years working full time and fixing up while living in the house. Be prepared to spend a lot of time looking and be careful of the neighborhood. It works as I have made a profit on every house move. I am currently living in a total construction mess, but so be it. This too will pass and it will sell at a high premium when the time comes. And, by the way, my folks went through WWII, so I am no spring chicken. If I can do it so can you.

Recently, my boyfriend and I have been looking into buying a home. After spending two years in our 667 sq/ft apartment, it dawned on me we don’t need that much room to be happy. We’ve decided we want to instead build a house, something less than 1000 sq/ft. Reading this article just re-affirms that desire.

We use every space of our house to its fullest–even the small 5×9 balcony has a small reading area with a portable mini projector for date nights. The solution isn’t more space. It’s utilizing every part of the space you have. In our apartment, we have a full bar, a workspace complete with a large desk, a walk-in closet, an outdoor sitting area, a full washer and dryer, a king-sized bed, and a storage area. And plenty of open space for both of us to workout simultaneously. We’re tall people, 5’9 and 6′. If we can do it, so can you!

My husband an I were in the market for a new home to move closer to where all our children (we were early 60’s) had settled (near Edmonton Alberta) We ended up buying a ready to move home. We chose a 1500 square foot home but put it on a full basement, as opposed to the slab we originally wanted, because the real estate people that we know well told us that we’d be unable to sell a “small” home with no basement where we built.

Don’t you have to build down a bit to avoid the frost line anyway?