Hello to all the long time (and many new!) Money Wizards! It’s Net Worth Update time for… August??? When did that happen? Where did the summer go?

Thanks to some strong site growth recently, chances are you’re new around here. If so, consider this my official welcome!

Every month, I get financially naked for my readers in the form of an in-depth net worth report. If that’s not dedication to the cause, I don’t know what is.

I’m not just a sick exhibitionist, and you’re not just a voyeur (right?). This is all part of a broader plan to track my progress towards nearly one million dollars and an early retirement.

Anyway, lots of fun developments went down in August. This site was featured in Rockstar Finance, my twitter account crested 1,000 followers, and I (finally) stuck to my previously secret goal of two new posts per week. Yes, this is me publicly holding myself accountable to a sort-of-formal posting schedule. In other words, if a week goes by and you don’t see two updates on this site, I fully expect you, my loyal readers, to break out the pitchforks and flood my inbox with hate mail. Deal?

Much appreciated!

In other August news, I experienced my first trip to the fried-everything-on-a-stick-extravaganza that is the Minnesota State Fair. Every August, the state of Minnesota comes out in droves for what has become the largest state fair in the country. The fair is a two week spectacle which spans from carnival rides to butter sculpture carving, and everything in between. It was quite the experience to say the least, but mostly I was left fighting the urge to spend my entire net worth on a lifetime supply of fresh mini donuts.

Really though, those mini donuts are unbelievably good…

I also dodged the barrage of MyPillow, 5 Hour Energy, and massage chair salesmen who slithered their way into the fair and set up booths at every corner. Does everything really have to turn into a money grab these days?

Earlier in the month, I found myself taking a quick roadtrip to Madison, the capital of Wisconsin.

And I saw a cat play the Cowbell in front of a live audience. Yeah, that one is a long story…

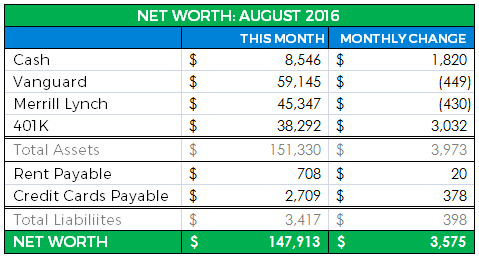

Then then there’s the reason you’re actually here. In August, my net worth increased $3,575! Onto the update.

August 2016 Net Worth Update

Cash Savings: +$1,820 I’m not a huge believer in emergency funds, so this is about as high as you’ll see my savings ever get. I’m in the process of saving for a new(er) car, hence the cash growth.

I’m also in the process of maxing out my annual 401K contributions, which means nearly 30% of my salary is automatically funneled into my retirement account. Usually this hampers my cash savings, but August turned out to be a good month! Other than my roadtrip, I didn’t do any serious travel, and I also cashed in $187 of credit card cash back rewards.

I consider a good month one which I can save $1,000 cash. Why $1,000? No clue… it sounds like a nice number. Either way, very cool to see my arbitrary goals exceeded for the month.

Vanguard Account: ($449) My Vanguard account value declined a tiny bit in August. After July’s ridiculously crazy run up, I’m not sweating this at all.

I believe in simple investing, and my Vanguard account is laughably simple. No fancy charts or analysis here, my entire account is just two funds. VTSAX, an index fund that tracks the entire stock market, and VGSLX, a Roth IRA which tracks real estate investment trusts.

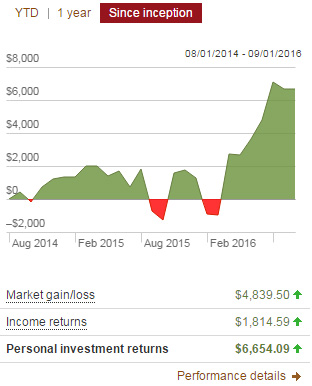

At the end of August 2016, my VTSAX holdings had a balance of $45,088 while VGSLX has a balance of $14,065. Take a look at this nifty performance chart since I opened the account in August 2014:

Merrill Lynch: ($430) More market changes after last month’s crazy run up. I haven’t added any money to this account in years.

The majority of this account was formed when a younger, more naïve version of myself was convinced I could beat the stock market by picking individual stocks. My returns in this account have lagged the overall market quite a bit, and I’d be several thousand dollars richer had I just kept it simple.

BUT, this account was a great learning experience. All of my first investments occurred in here, and the run ups in companies such as Altria and Eli Lily showed me the power of the stock market. Most likely, the thrill of these first few investments are what got me fired up to invest more and more money. Today, the account consists mostly of low fee, exchange traded funds (ETFs) and a small percentage of individual stocks.

401K: +$3,032 A-ha, finally we get to the bulk of this month’s net worth increase. Although the market stayed relatively stable for the month, this account sails on.

As I said earlier, nearly 30% of my paycheck is automatically invested into my 401K, and coupled with the incredible power of the employer match, the continued upward movement of this account never ceases to surprise me. I’ve said it before and I’ll say it again, choosing to max out my 401K is the single most powerful wealth building decision I’ve ever made.

Rent Payable: (+$20) Guess we ran the old air conditioning quite a bit this month. This expense should decrease as summer comes to a close.

I rent a modest two bedroom apartment with my girlfriend near Minneapolis, Minnesota. Apparently a lot of people are afraid of snow, which allows this native Texan to enjoy a pretty low cost of living. My rent today sure beats the $1,300 per month I was paying for a 1 bedroom, suburban Colorado apartment.

Credit Cards Payable: (+$378) The biggest area for improvement here is my absolutely ridiculous restaurant spending in August: $269 for the month! Delicious meals out have always been my one spending weakness.

This amount would have been slightly less, but as I mentioned last month, I prepaid some more expenses for a January trip to my dream ski location: Whistler, British Columbia! Somehow out of our massive group of friends, I was the guy stuck fronting the money for the ski-condo, and I’ve got the credit card bill to prove it. Ah well, I know my friends are (eventually) good for it, haha!

Calculate Your Own Net Worth

If you’ve never calculated your net worth before, or even if it’s just been a while since you’ve checked, give it a shot! Log into all of your bank accounts, dust off your 401K account information, search for cash under the couch cushions, and subtract your outstanding debts.

Analyzing your net worth can be an enlightening exercise, and you just may surprise yourself.

So alas, as the sun sets on yet another Net Worth Update, I leave with you with an only fitting photo of the sunset, taken at the State Fair.

Congrats! Looking forward to reading more of your posts.

Thanks David! Hope you enjoy the rest of the site.

Thanks for the update Money Wizard! Hoping I can be at your level someday. Had to spend 2 years paying back those student loans, so it set me back, but I’m building up!

Your pay down story is impressive! You’ll be there before you know it; the savings add up unbelievably quick when there’s no interest rate holding you back.

Awesome to hear about the site growth!

Also super jealous you got to see a cat playing a cowbell. Another item to add to the bucket list. 😉

Thanks Felicity! I have to say, the Cowbell Cat was one bucket list item I didn’t know I had…haha! Highly recommended though.

Heard about you from Reddit. Overall looks like you’re killing it. Keep it up.

Thanks Max! Didn’t know I was on Reddit, I might have to take a look. Thanks for stopping by!

Hey there,

I was wondering what the actual cost is to run your VANGUARD/Meryl lynch account? Is it worth starting that account out with 10K

Hey Dennis,

Most Vanguard funds have annual fees of 0.11-0.20%. If you invest over $10,000, you can get into their “admiral” class of funds which have lower expense ratios. My Vanguard fund is invested mostly into VTSAX, which is an admiral fund and sports a 0.05% expense ratio. Here’s the fund’s page. You can see the expense ratio for any Vanguard fund under “fund facts.”

Hello Wizard,

I was hoping you could share your thoughts on exposing your portfolio to emerging markets. Some say people are missing out on huge potential returns while others preach that it’s far too risky to consider.

Are you predominately invested in simply tracking the S&P500 returns while minimizing your costs? Do you advocate any large diversification into other asset classes?

I appreciate any advice, and great blog by the way 🙂

Hi there,

Glad you’re enjoying the blog! The taxable account I invest in (VTSAX) is the total stock market, which includes emerging markets in in proportion to how much of the total stock market they make up. As far as diversification, I feel pretty comfortable with how diversified that fund is, and I also have exposure to real estate through the REITs in my Roth.

Just started reading recently, but didn’t see any posting about your recent choice of brokerage (Vanguard). I started investing through a Vanguard account myself and can’t emphasize enough how awesome it is. Awesome – because of free commissions – at least on Vanguard funds. As a person who invests money every paycheck to slowly grow my portfolio, the $7+ trading charges some brokers charge can add up.

Hope to see a future post about this steal of a deal!

Also just wanted to let you know how inspired I am from your story. I’ve read MMM, but his story is honestly a little dated, having retired 10+ years ago. As a 23yo with similar goals, it’s good to see your progress in real time, so I can have someone to compete against and look up to.

Great point Austin. The commission free Vanguard feature is HUGE.

Glad you find some inspiration in my story. That’s what this site is all about! Hope to see you around.