Hey Money Wizards,

It’s time for another Net Worth Update!

This is the final one for an interesting year. So I’ll keep the usual intro short – I’m trying to leave my office job by age 35 with around a $1 million portfolio.

I’m currently 31, so let’s check on the progress!

Life Update: December 2021

For the most wonderful time of the year, we did our best to get into the season.

We started the month soaking up as many Christmas lights as possible. Around here, the state fair covers their grounds in a couple million LEDs, so that’s always a trip to see:

We also took an interesting spin on Christmas.

Lady Money Wizard’s family decided that instead of stressing about what consumer junk to buy each other, they’d all just donate to a charity instead.

I loved it. We ended up adopting an Operation Santa letter from a kid in Michigan who had his eyes set on a coat, winter boots, and some racing toys. He wrote to the right place, because if there’s one thing us Minnesotans can do, it’s finding awesome cold weather gear!

Although on a personal level, I didn’t do nearly as good of a job limiting the consumerism. As you’ll see at the bottom of this report, before I knew it, I’d racked up a couple hundred dollars worth of gifts to my favorite people. Because how am I supposed to say no to ultra-premium Tequila for that extra special sipper in my life?

Oh well… Ho Ho Ho!

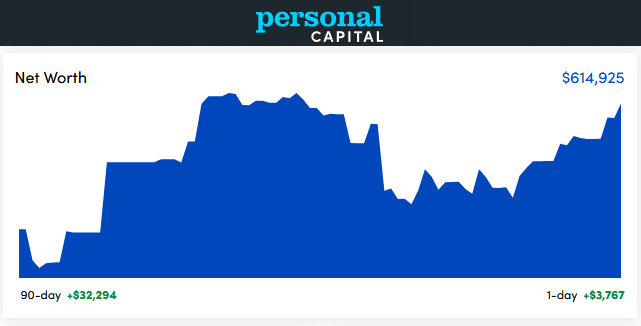

Net Worth Update: December 2021

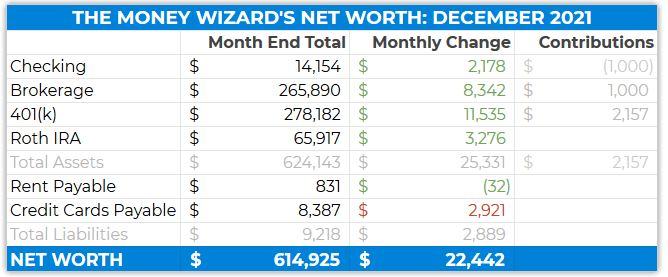

And the details:

Maybe I’m getting ahead of myself, since this is the type of thing I should write about in one of my “year-in-review” type posts. But a quick glance back at the Net Worth Archives, and I’ve gotta blink to double check what I’m seeing.

Over the past year, my Net Worth increased from $473K to $615K.

That’s 142 thousand big ones, or a 30 percent overall increase in the portfolio’s value.

Of course, the stock market as a whole ended the year up 27%, which is bonkers. And there’s that pesky bit of 7% inflation.

BUT, I’ll count it as a major victory that my savings efforts at least helped my portfolio outperform the economy as a whole.

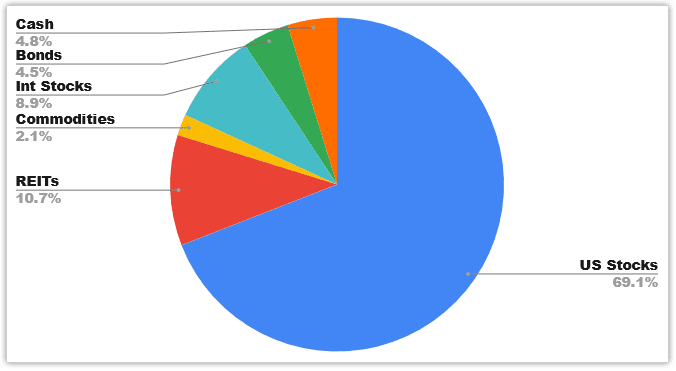

Here’s the most recent allocation:

When I compare the above allocation to the same time last year, the big changes were:

- Cash and bonds each went down about 2%

- US Stocks went up about 4%

So basically, I shifted out of things that will get hammered by inflation and into things that are somewhat protected by inflation.

I’ll take it.

Checking Account: $14,154 (+$2,178)

A decent increase to the checking account.

$14K is more cash than I’d like to carry, especially in a world with 7% inflation. But this amount will get eaten up quickly – I’ve I’ve already earmarked $6,000 of this for my Roth IRA in January, and as you’ll soon see, I’ve got a massive credit card bill that needs paying.

Brokerage: $265,890 (+$8,342)

Thank the heavens for inflation protected assets, like the stock market.

And it’s even better when they don’t “drop like a brick.” (How I described my brokerage’s movement in the previous net worth update.)

Feel free to check past updates for a better breakdown of where this is all invested.

401(k): $278,182 (+$11,535)

The automatic 401k investments kept on keeping on, to the tune of a little over $1,000 every two weeks. That’s is a mix of my own $19,500 yearly contribution plus a strong match from my employer.

Roth IRA: $65,917 (+3,276)

Nothing exciting here. The Roth is still about 75% in Vanguard’s REIT index fund and 25% in Vanguard’s international stock market index fund.

I’m excited to max this out to start 2022. I plan on deploying my $6K in the same 75/25 split.

Rent Payable: $831 ($32)

For newer readers, I share a house that was purchased by my now-wife. This number is my half of the mortgage, utilities, and a couple hundred dollars a month that we throw into the “home maintenance” fund to help prep for any big projects.

Credit Cards Payable: $8,387 (+$2,921)

Hey-OH!

Every time I think the credit card bill can’t get any bigger, it goes and surprises me.

I sure HOPE I’m not on pace to spend six figures a year, because that’d sure blow my retirement plans to smithereens.

After doing a little more digging, it turns out this crazy tally was due to a few irregularities:

- I fronted $2,000 worth of hotels for a friends’ trip to Canada next summer.

- I booked $600 worth of flights for Lady Money Wizard and I to go on that trip, plus another $300 for us to go a Salt Lake City skiing trip this winter. (The damage would have been even worse had I not had some leftover points from previously COVID-cancelled trips.)

- There was still a $500 hotel charge from November’s trip to New Orleans.

- I fronted $750 for some home projects. Astute readers might be thinking, “Wait, isn’t that what your monthly home maintenance fund is for?” and they’d be exactly right. We just put it on my card since I got better credit card points, then Lady Money Wizard wrote me a check to cover the total.

All together, that’s a little over $4,000 from the ghosts of spending past and future. I find it more accurate to account for expenses in the months when they actually apply, so those flights, for example, will show up in future updates.

Which means, thankfully, I didn’t exactly spend $8K in a month.

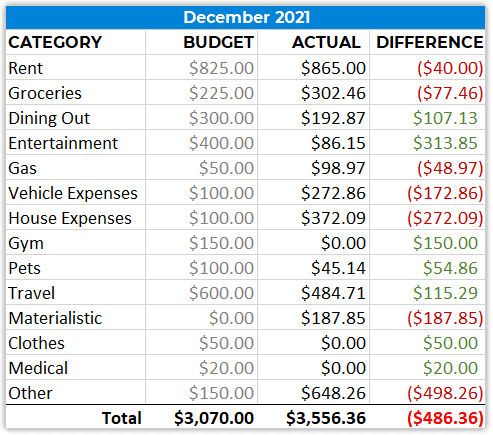

Here’s the more accurate tally:

Total Spending – December 2021: $3,556

Materialistic: $187

Okay… this one is way too cool not to share. We bought a… wait for it… vintage Pacman machine!

Someone on Craigslist was offloading it for a hundred bucks. We grabbed it thinking we could sink some cash into it to get it working again. So you can imagine our surprise when we plugged it in, flipped a switch, and heard that Pacman music blasting over the retro speakers!

We paid another $80 to get a repair guy to do a double check. Sure enough, I’m now the proud owner of a working Pacman machine from the 1980s!

Unfortunately, my tiny little house doesn’t have nearly the space for an arcade room, so it’ll start a new life at a friend’s cabin.

Travel: $484

I took advantage of airline miles to visit family in Texas for Christmas, but most of this total was a few hundred to celebrate a friend’s birthday by renting a cabin in the woods.

House Expenses: $372

We framed some pictures from our wedding, and who would have guessed? Custom framing is crazy expensive!

Other: $648

Pretty much entirely yours truly getting carried away with the Christmas gift giving.

Happy Holidays!

And Happy New Year!

Related Articles:

“I sure HOPE I’m not on pace to spend six figures a year, because that’d sure blow my retirement plants to smithereens.”

“Retirement plants” interesting concept? I think it’s a small typo.

Based on your most recent projections, when do you project you’ll achieve that $1M mark using very simple math? I’ve been monitoring your progress for 2 years and you are clearly firing on all cylinders!!! Great job!

Thanks for the catch, just fixed it.

Depending on how much I save and what the market does, I’m currently on pace to hit that $1 million right around age 35-37.

If anyone is wondering, I use a super basic financial calculator for these types of questions:

https://www.calculator.net/finance-calculator.html

Congrats on a great year! I always find that Travel is the biggest budget buster in terms of cash flow timing. We just paid big money for flights for a family of four for a trip that won’t happen until Summer. But at least it helps offset and spread out the cost over the course of the year. Cheers!

True! Thanks for the comment!

Oh man the memories of playing PacMan!! Lots of tokens from the arcade I spent many a hour of my youth. Good score for you. Nice article sir..

It’s a classic! I’m pretty excited to give it some plays!

I’d consider iBonds for cash you won’t need for a year or to replace other bond holdings. They are paying over 7% right now and fully government guaranteed like any treasury bill. I bought $20K worth in December and another $20K worth last week for 2022. You can only buy $10K per person so for my wife and me that’s 20K per year. You can’t get them back for the first year but after that there is only a three month of interest penalty and after five years no penalty at all. But you’ve already earmarked most of your cash, but these are probably a better deal than your bond holdings. You can only get them from the US Treasury at treasurydirect.com.

“Over the past year, my Net Worth increased from $473K to $615K.

That’s 142 thousand big ones, or a 30 percent overall increase in the portfolio’s value.”

Congratulations! Which of the 142k is organic growth and which is your contributions?

Congratulations on the great year, man! Can’t wait to see what 2022 has in store for you. Maybe you will reach the one million big ones this year! You never know.

I agree custom framing is quite expensive but I typically find it worth the investment.

I keep two lines on my cash flow statements for reimbursements – a negative for the item spent and a positive right below this for the reimbursement. I use this for work expenses, the portion of split meals that people have Venmo’d the difference, etc. I find it helpful to keep track of this (since I’m getting credit card points for!), while still having it zero out from a cash flow perspective. (Maybe too in the weeds, but I also highlight items that have not yet posted – for instance a work expense in a report that I haven’t submitted yet – helps me to keep track of money that I trust will come in.)

I also keep a section for future items – tickets for future events, amortized bulk items (for instance, large amounts of unroasted coffee beans which I home roast over a period of a few months!), etc. – which I apply to the appropriate cash flow cycle the event happens/item is used. I don’t get too crazy with it – just for anything that’ll otherwise make my cash flow look crazy and make it difficult to compare cycle-to-cycle.

I think I’ve mentioned this here before – but yes, I’ve actually had custom framing cost more than the original art I’m framing!!!

Enjoy seeing your NW updates! I am also 31 and we are tracking very similarly, within $20K of each other at the end of 2021. We have taken very different paths though. Most of my NW is in RE but you have encouraged me to shift more to stocks. I look forward to seeing how close we stay in the years to come. The race to $1M! lol