Hey everyone,

Welcome to the 7th net worth update of 2021 and number “too high to count” over the life of the blog.

If you’re new here, every month I track my progress towards my goal of about $1 million in net worth (house excluded). I’m hoping that amount will let me leave my white collar office job by age 35. I’m currently 31, so let’s check in on the progress!

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do your own research and always consult a professional.

Life Update: July 2021

Man, after a few months of lull, July came out with a bang. Literally.

We started the month with a trip “up north” for July 4th, fireworks and all. (I’ve learned that “up north” is a a Minnesotan term to describe any trip to a cabin anywhere.)

Shortly after our return, we hosted a really fun Bartender Night with friends.

What’s a Bartender Night? It’s a drunken concoction we all dreamed up a few weeks ago, where each friend is assigned a different type of alcohol, then uses it to make a fancy cocktail to serve the entire group.

Like a White Elephant gift exchange’s drunken cousin.

The result was tons of fun. We ended up having 6 different “bartenders” (friends) making their own takes on margaritas, rum-spiked bunch, vodka bees knees, bourbon old fashioneds, and even a Kahlua dessert cocktail.

If you’ve never tried it, I highly recommend it as a frugal night out! Total cost? A bottle of alcohol and whatever cocktail supplies your heart desires.

Keeping the boozing rolling, a few weeks later we entered the most pre-COVID-style event I’ve attended to date – an all you can drink summer beer festival.

And just to make sure the month wasn’t all sin and vice, I also set up a free month-long trial at a local yoga studio, hoping to counteract some of the destruction I’d done to my body so far. (While I did enjoy it, at the end of the day couldn’t justify the $120/month price tag over my home gym setup, so I won’t be continuing the tradition.)

Oh, and in other news, I took on a bizarre mentor role to a neighborhood kid. More info about that under the Spending report at the bottom of this article..

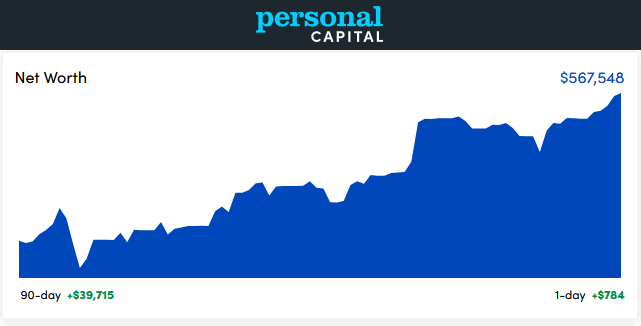

Net Worth Update: July 2021

An interesting month in the market… by Mid July the S&P500 was down 1.1%, but the market’s incessant climb wasn’t to be deterred, and it ended with a 1.9% gain by the end of the month.

Here’s the exact impact of that on my net worth:

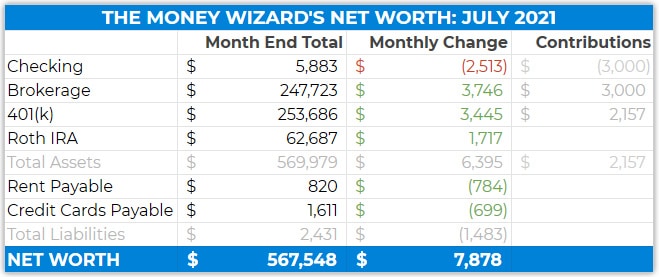

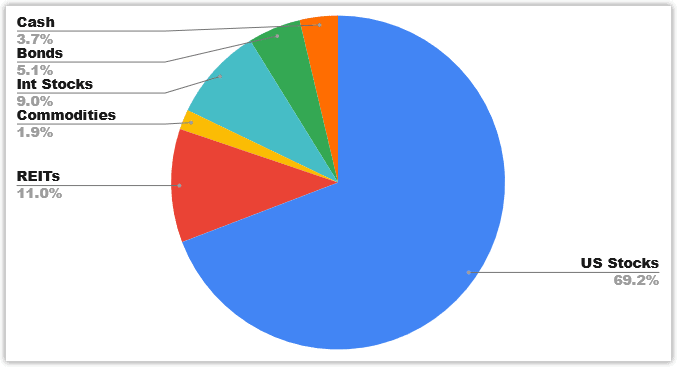

Quite a bit of movement this month, but we’ll get to that. For now, here’s what the allocation looked like on July 31st:

Nothing too ground breaking to report. Maybe the biggest observation is that with inflation picking up, I’m happy to report my cash position is at an all time low.

Checking: $5,883 ($2,513)

Hey, for once I stuck with a goal!

For the past few months I talked about setting up automatic investments from my checking account into my Vanguard account, and in July I actually set it up!

The whole process took exactly 3 minutes, so stay tuned for a tutorial post in the next week or so. (Full disclosure: since it’s such a simple process, that post will probably take twice as long to read as it will to implement.)

In any case, moving forward I’ll be automatically investing $1,000 every month from my checking account into Vanguard’s VTSAX fund.

Dollar-cost-averaging another $12,000 per year is no joke, so I’m excited to see the impact this has on the growth moving forward!

Brokerage: $247,723 (+$3,746)

$3,000 worth of contributions this month plus $746 worth of market gains. That includes $1,000 of those automatic investments from my checking account into VTSAX plus another $2,000 into commodities (gold).

You can read previous net worth updates to see a more detailed breakdown of my brokerage account, but it’s mostly just boring old index funds.

401(k): $253,686 (+$3,445)

About $2,000 worth of pre-tax contributions from my paycheck plus employer matching. Those contributions are still broken down as:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $62,687 (+$1,717)

No contributions here, since I maxed out my Roth at the beginning of the year. Just general market movement to the portfolio which consists of:

- Vanguard’s REIT Index (VGSLX) – about 75%

- Vanguard’s International index (VTIAX) – about 25%

I talk about why I like VTIAX more than VFWAX here.

Rent Payable: $820 ($784)

The only reason this went “down” is because last month, like a true deadbeat, I owed Lady Money Wizard two months rent.

After facing the wrath of my slumlord, I’m now all paid up-to-date.

Credit Cards Payable: $1,611 ($699)

I’ve gotta track this number for an accurate net worth picture, but it’s never a very good proxy for my spending. (That’s what the next section is for.)

As a reminder, I never pay credit card interest, and you shouldn’t either.

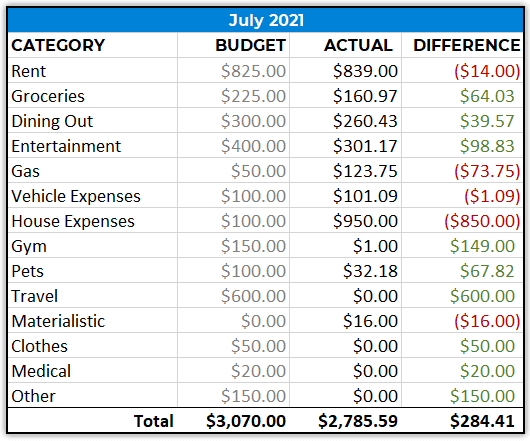

Total July Spending: $2,786

Entertainment: $301

Mostly the previously mentioned:

- July 4th cabin trip

- Cocktail night

- Summer beer festival

Pets: $32

Bought some treats for the good boys, but also paid $24 to a local neighborhood hustler.

One day, this 8-year-old kid knocked on my door with a proposal – he’d scoop The Money Pup’s poop for $10 every two weeks. To be honest, his prices seemed a little high… the job requires maybe 6 minutes worth of work since The Money Pop does about 90% of his pooping on our daily walks, putting our 8-year-old’s wage at about $100 an hour. But more power to him, because who am I to shoot down a hustling young entrepreneur!?

He’s come a few times already and takes his job hilariously seriously – he recently scored a good deal on “business supplies” aka his poop bags. Meanwhile, I use the opportunity to impart as much of The Money Wizard’s wisdom as possible. I’ve already convinced him to open a checking account to start saving his business earnings; investing will be lesson #2.

House Expenses: $950

For years, we had a random door in our house that didn’t match any of the others. It was cheap, lightweight, and a completely different wood color than every single other door in the house.

Normally this would be pretty easy to overlook, except this door sat smack dab in the middle of our living room. Eventually we got tired of looking at the misfit every day, and decided to hire a carpenter to reframe the thing into something that matched the rest of the house.

Superfulous? You bet. But the end product is great.

In other news we also had to repair some siding on the house. When it rains it pours, right?

Usually this stuff comes out of the home maintenance fund, but the handymen offered a cash discount, so we took them up on it.

How was your July?

We’ve now officially over halfway done with the year. How’s it going?

Hope you all are doing great!

PS – If you’re serious about tracking your net worth, here’s my favorite tool to do so.

Related articles:

Love the fact that you are helping an 8 year old. Just think, if we all had someone who would have taught us about money at an early age (my parents never had a savings account, never owned a house, never taught us about money) maybe we all could be financially awesome (like you!) and we wouldn’t have struggled our whole lives. Keep up the good work. You are helping this person more than you realize. You are being a blessing in his life.

Thank you, Tracy!

Your spending never ceases to amaze. To spend $2,800 in a month WITH $900 door replacement is incredible. What’s your average savings rate?

Yeah, I was pretty surprised this month’s spending was so low. I guess that’s what happens when I don’t travel. Plus we always have the benefit of a really cheap mortgage, which just goes to show how important it is to control those big 3 expenses.

My savings rate last year was 65%. Here’s a full write up on that:

https://mymoneywizard.com/how-i-spent-30841-dollars-last-year/

will your spending double when you get married? I’m assuming wifey same the same expenses more or less.

I probably cover 70-75% of our expenses, so I don’t think they will double. 1.5x seems more likely.

Two years ago I started the monthly automatic investment into our brokerage account. Draws the money from the checking account on the same day every month and automatically invests between a few mutual funds. Best decision I have made and will surprise you at how fast the money starts piling.

Awesome to hear!

Your progress is incredible….and fun to monitor. Have you temporarily shelved your plan to get to 10% bonds? You invested another $3K this month, but still no recent investment in bonds.

Prior to purchasing your house, you wrote some great posts on the “rent vs. buy” argument. Those articles generated some passionate feedback from your readers. Now that you have been a homeowner for a few years (yes – LMW ponied up initially), and just dropped some $$ on insulation and a door, it would be interesting to get your thoughts if the move has made sense.

That downpayment would be looking good in VTSAX right now!

Thanks Ian – that’s a good article idea.

It’s hard to work up the enthusiasm to invest in bonds when interest rates are basically zero. I should just do it in the interest of diversification, reduced volatility, etc… but easier said than done. The near term goal is to get commodities closer to 5%, since that provides similar volatility smoothing as bonds, with the added benefit of some inflation hedging.

Hey. Appreciate the update. Quick question if I may related to your summary table – your “brokerage” line, is this your taxable vanguard brokerage account? If so, does that mean all of your interest earnt is taxable at the end of the year?

I’m a recent binge reader of your blog and based on your other posts and surprised to see your holdings n your taxable account so high compared to your 401k. But maybe you’re already maxing those contributions?

Thanks and thanks for sharing your journey!

Welcome aboard!

Yes, I max out the 401k and IRA. The brokerage account is what I invest after maxing those out. Plus the brokerage got a head start because back when I was saving and investing from age 16-23, I didn’t have an employer with a 401k.

The interest is taxable, but it’s important to specify “interest” just means bond income and dividend income. Any increase to the value of the stocks would be capital gains, and you don’t have to pay taxes on those until you sell.

Thanks a lot! So investing in a mutual fund like the vanguard total world stock index…those would be capital gains and not taxable until sold?

Joe

Correct. Any changes to the fund’s price wouldn’t be taxed until sold. That fund does pay a small dividend though (about 1.5% of the fund’s value per year) according to dividend.com. The dividends would be taxed at the dividend tax rate.

Nooo!!!! You’re going up too fast!! I feel like I’m getting left behind Sean, stop!!!

Jokes aside, congratulations on another great month. Maybe by the end of next year… we’ll actually get to see the coveted double comma club 🙂