In the words of the late 1990s prophet Smash Mouth, “My World’s on fire, how about yours?”

It’s hard to imagine that boy band was referencing a worldwide coronavirus panic some 20 years later, but here we are.

One interesting consequence? International stocks have been absolutely decimated. And since our friendly Uncle Warren (Buffett) told us we should be greedy when others are fearful, maybe you’re like me and considering increasing your international exposure?

(A good international fund is a solid pillar of any good 3-fund portfolio. Plus, re-balancing is one of the 2 easiest ways to profit from a falling market.)

If that’s you, you’re bound to get stuck up on the next logical, yet waaay too confusing question…

Vanguard offers two different, yet very similar international index funds. There’s the Vanguard Total International Stock Index Fund (Ticker: VTIAX) and the Vanguard FTSE All World ex-US Fund (Ticker: VFWAX).

To make things even more confusing, at first glance, they look almost identical!

So, if you’re looking to invest in the international stock market… VTIAX vs. VFWAX? Which one is best for you?

Hold tight, because in a minute or two, you’ll have your answer.

The Confusing Part: The Similarities Between VTIAX and VFWAX

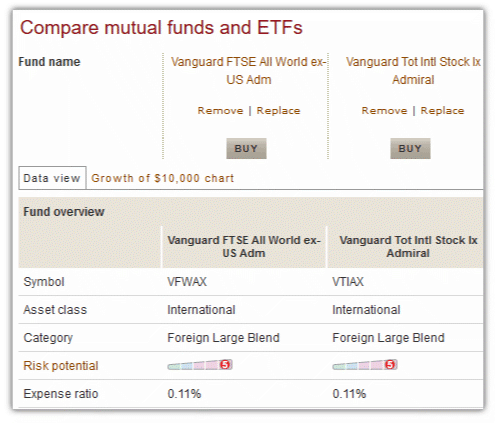

So you pull up these two funds on Vanguard.com, and you plug them into Vanguard’s handy “Compare Mutual Funds Tool.” Surely, this will get you to the bottom of this question…

And then, you’re stonewalled with this screen:

Yep. That’s zero help.

As you can see from the screenshot, these two funds actually have more in common than they do apart.

- They both show up under Vanguard’s “International” Section.

- They’re both considered “Foreign Large Blend” to boot.

- Both names hint at being the broadest diversified index funds possible. (I mean seriously, does “Total International” vs. “All-World” really give us any hints??)

- With identical expense ratios of 0.11%, neither is cheaper to own than the other.

Digging down further, and the mystery continues.

VTIAX and VFWAX Performance

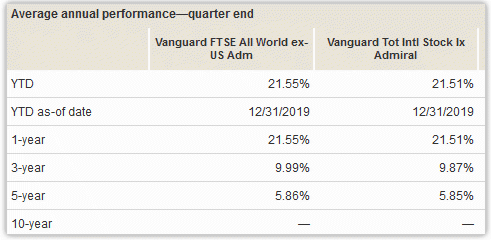

Maybe the answer lies in the returns?

Well, VFWAX has average annual returns of 5.86 percent over the past five years. VTIAX? 5.85 percent!

Can things get any closer!?

Difference in Fees

No clues here, either.

Like nearly all Vanguard funds, neither fund charges load fees, commissions, 12b-1 fees, redemption fees, or any other rackets. Good news for investors wanting to score a good deal, not good news for those of us trying to figure out what on earth the difference between these two funds actually is.

Minimum Investment

Nope, exact same minimum investment, too.

- VFWAX requires a minimum investment of $3,000.

- VTIAX requires a minimum investment of, you guessed it, $3,000!

10 Largest Holdings:

Stonewalled again! VFWAX and VFIAX both have the exact same top ten holdings.

At the time of this writing, those 10 biggest companies in each fund are:

- Alibaba

- Nestle

- Tencent Holdings

- Taiwan Semiconductor

- Samsung

- Roche

- Novartis

- Royal Dutch Schell

- Toyota

- HSBC

(In the exact same order for both funds, because at this point, why not?)

In order to find out what’s actually different, we’re really going to have to start splitting hairs.

To the splitting! Where I was able to find four primary differences between the two funds…

1) The First Difference between VTIAX and VFWAX! Number of Stocks held.

Ah ha! We’re finally getting somewhere.

Vanguard’s All-World Index Fund (VFWAX) holds a total of roughly 3,000 stocks.

But Vanguard’s Total International Index Fund (VTIAX) holds over double that number – over 7,000 total stocks.

2) VTIAX has a slight tilt towards smaller companies.

In stock market lingo, Wall Street likes to classify small companies as “small caps.” Because why not add some jargon when none is needed?

And VTIAX has more small cap exposure than VFWAX.

Look at it logically. There’s only so many massive international companies to go around. So, with VTIAX’s index of 7,000 stocks, many of those extra stocks are smaller than the 3,000 larger companies found in VFWAX.

VTIAX’s International Small Cap Tilt: By The Numbers

You can see the impact of this tilt towards smaller companies when you compare the two funds’ stats:

- Median size of the companies VTIAX invests in is $27.2 billion, versus $31.5 billion for VFWAX

- VTIAX’s 10 largest holdings make up 9.80% of the fund. VFWAX’s 10 larrgest holdings make up 10.90% of the fund.

- The “smaller” companies that VTIAX invests in are growing barely faster than VFWAX. And by barely, I mean an earnings growth rate of 10.3% versus… 10.2%.

- Because VTIAX has a broader index, its turnover (the number of times underlying stocks are bought and sold to match the index) is slightly lower. (3.9% vs. 4.4%) Lower turnover is a good thing, because it usually results in lower costs to run the fund and increased tax efficiency.

3) (Very) Slight Dividend Differences

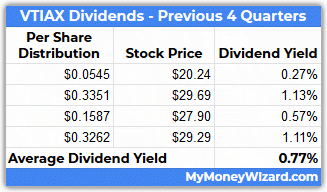

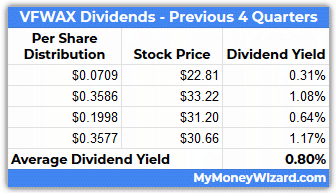

I also compared the two funds’ historical dividend distributions.

VTIAX Dividend

VFWAX Dividend

As you can see, VFWAX pays out a slightly larger dividend.

Emphasis on slightly though. These dividend yields are so small overall that a 3 basis point difference isn’t likely to have much of an impact on your wealth. At all.

4) Fund Concentration Differences between Vanguard’s Total International and All-World Funds

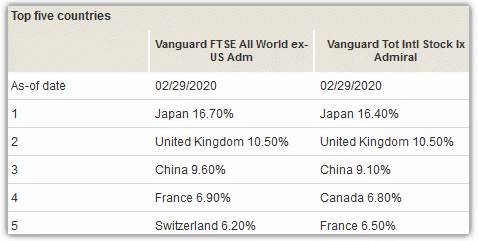

That difference in number of stocks held also shows up within the top five countries each fund invests in.

Because VTIAX holds more stocks overall, its highest concentration (Japan) is slightly smaller than VFWAX. (At 16.40% vs. 16.70%) It’s also oh-so-slightly less concentrated in China (9.10% vs. 9.50%) and France (6.50% vs. 6.90%). It’s also more concentrated in Canadian companies, by about 0.50%.

To be fair, these differences are pretty tiny. Remember when I said we’d be splitting hairs?

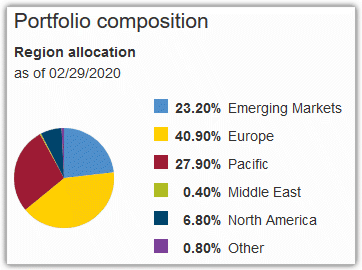

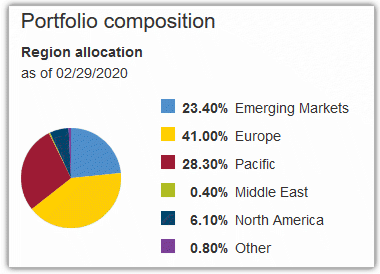

You can also see some minor differences in the markets and geographic locations of the funds’ investments:

VTIAX Portfolio Concentration

VFWAX Portfolio Concentration

Conclusion: The Main Difference Between VTIAX and VFWAX

While the two funds are very similar, overall VTIAX has a little more exposure to small-cap markets than VFWAX. VTIAX is also slightly more diversified than VFWAX, with exposure to approximately twice as many total international companies and slightly lower concentration to its largest countries.

Now, what’s the practical implication of all this?

Not much, as you can see from the two funds nearly identical performance over the past several years.

In theory, the performance VTIAX could deviate from VFWAX if one of the smaller companies or countries the fund was invested in went on a wild run. (Or on the negative side, had a total economic meltdown.) And vice verse, if one of the developed countries that VFWAX was 0.3% more concentrated in had a major event, then the returns may deviate slightly.

But with overall concentrations of the funds being nearly identical, that’s pretty unlikely. In reality, either VTIAX or VFWAX are fantastic choices for your portfolio, and you probably won’t notice much of a difference, either way.

For what it’s worth, when I recently added to my international portfolio, I went with VTIAX.

Mystery… barely solved!

Hope it helps!

Disclaimer – Any financial discussions in this blog post are my personal, unqualified opinion and should not be considered financial advice. Always do your own research before making any investment decision.

Related Articles:

Thanks for taking the magnifying glass to this matchup. Based on your analysis, a few thoughts that would make me lean towards VTIAX like you did:

– Greater diversification (based on larger number of holdings) at the same expense ratio is a benefit

– That lower turnover number you cited based on a broader index could mean less cost due to index reconstitutions over time

– The tilt towards small could lead to long-term outperformance. Small has underperformed in recent years but over time there’s been a size premium for those small but mighty companies.

None of these are major differences though which makes either one great, and makes these two a great pair of replacement securities for tax-loss harvesting!

I do not own international stocks in my portfolio and probably never will. I cringe a little when people say it out loud because it sounds a little conceited, but I really do believe the US is the best country in the world. As I’m sure you’re aware, Jack Bogle himself does not recommend that the average US investor own international stocks.

There are a few specific reasons why I don’t like international stocks and I won’t go into a ton of detail, but they are: 1) corruption in certain foreign countries, 2) the US and US companies have a front-runner advantage, economies of scale, and influence which all together provide a HUGE advantage, 3) the lack of civil rights in certain other countries (I think civil rights and equality between men and women is a big advantage economically), 4) I think there are certain regulations in the US that protect our financial or other systems from imploding that I don’t know for sure exist in other countries, and lastly, 5) no matter what anyone says, international stocks simply haven’t had a comparable amount of growth compared to US stocks given the amount of volatility that international stocks have. Past returns don’t guarantee future returns, but this is a very strong indication.

People go on and on about diversification, and how you shouldn’t pick stocks, and while that’s true for most people for when it comes to US stocks…I wouldn’t invest in international stocks unless I were picking stocks or at a minimum picking a country specific ETF. This would take too much time and research to do, so I simply just don’t bother with international. Your article is a pretty deep analysis comparing these two funds, but you’d probably spend your time better determining if you should have international stocks in your portfolio at all.

You would be better served by adding a small amount of gold to your portfolio if you want additional diversification. It helps offset the “eggs in one basket” effect of having only US stocks. Sorry if I’m coming off blunt, I’m not really trying to change your opinion, but hope I could provide some useful input.

I love your the way you break this comparison down and show that the difference mainly is the number of holdings and more exposure to small caps with VTIAX.

Thank you! This is my first time visiting this website but I am so impressed with your analysis enough that I plan to revisit again! P.S. I would love to read some of your thoughts on VFTSX (my apologies if you already have. I’ll search this site after this post)

Great breakdown. Thank you for doing the deep dive. Like you I lean toward VTIAX.

Thanks for the detailed and thorough comparison. I will go with vfwax because I don’t need any more small caps in my portfolio.