Hey Money Wizards!

As you probably know, every month, I track and share my progress towards growing my net worth to roughly $1 million. Let’s check in on the latest…

Life Update May 2020:

May was a bit of a bummer, to be honest.

For one, this COVID-19 thing is still doing it’s best to ruin summer fun. And if that wasn’t enough, the city I love (Minneapolis) boiled over and turned into ground zero for peaceful protests, which unfortunately got overshadowed by mayhem and destruction.

The result is the closest I’ve ever experienced to living in a warzone. As I type this, I can smell smoke out of my window while many of the city’s buildings are burning to the ground. Sirens are constant, and I’ve spent most of the last few nights awake, wondering whether I was hearing fireworks or gunshots.

Every single business, large and small, has been closed for days. Nailed sheets of plywood cover the doors and windows of entire city blocks, in a last-ditch plea from business owners to the angry crowds to please spare their livelihoods.

I’m glad I stocked up on groceries a few months back. It’s just ironic that the cause of dipping into the pile wasn’t COVID-19, after all.

*Update: June 2 – some businesses are opening back up, but military grade humvees are now a normal neighborhood sighting.

We also officially pulled the plug on our June wedding. This meant our June Honeymoon was done too. And while we got a backup date for August this year, I’m thinking there’s a zero percent chance of feeling comfortable enough to gather all of my favorite people in one place.

On the plus, I’ve still got my internet connection! (A lot of Minneapolis residents lost theirs during the chaos.) Which means I can keep myself productive with blogging, creating, and a few too many Hot Ones episodes.

And we did keep enjoying the simple things. We ate a picnic on this picturesque tree branch:

Kept exploring nature:

And kept cheffing it up:

Hopefully we look back on all this as just a crazy chapter in the history books. Hopefully COVID-19 gets contained, hopefully George Floyd and others get the justice they deserve, and hopefully society doesn’t unravel at the seams.

Here’s to hoping for a brighter future.

Net Worth: May 2020

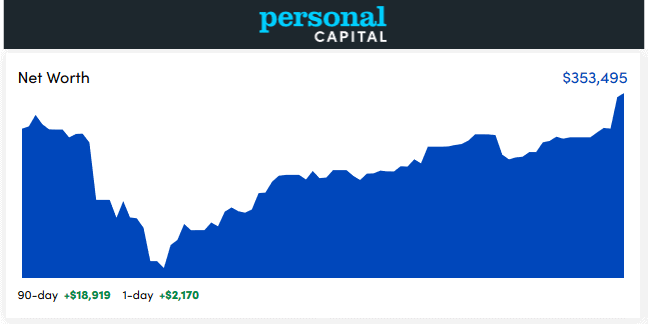

CRAZY rebound in May. The stock market has now recovered around 90% of the losses since Mid-February.

Which makes absolutely zero sense to me. It does, however, provide reason #3,000 why trying to time or outsmart the market is a terrible idea.

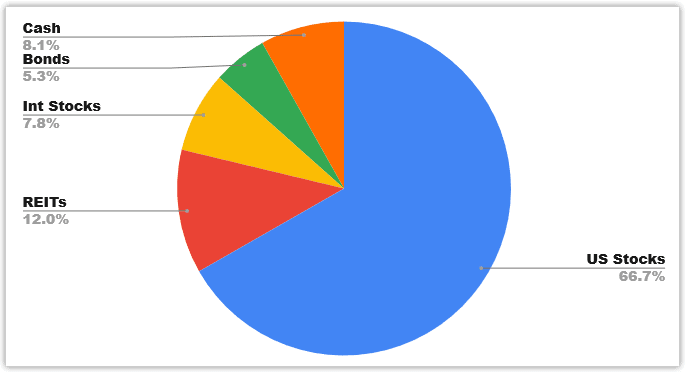

Portfolio Allocation: May 2020

I’m going to try to start tracking my portfolio allocation each month.

Study after study shows that for buy and hold investors like myself, the biggest impact on returns is allocation. (Aside from not going off the rails and doing something crazy, like selling in a panic.)

In past net worth updates, I feel like I’ve put too much emphasis on the individual account balances. This is good for tracking savings progress, but the bigger picture gets lost in details.

Instead, what I think makes more sense is to focus on the target allocation, and then arrange the individual accounts to best meet that allocation. So that’s what I’m hoping some of this month’s formatting changes helps achieve.

But wait, where’s the bitcoin?

Astute readers might remember I bought some bitcoin last month. I funded the purchase with a small amount of this website’s earnings.

While I always try to be as much of an open book as possible, I’ve chosen to keep those holdings separate for a couple reasons:

- Per Mark Cuban’s suggestion, I’m already mentally prepared for those risky investments to go to zero. So I’m not counting on them in my longer term goals.

- Revealing your exact bitcoin holdings is a bad idea, and opens you up as a hacking target.

So for now, that bitcoin sits in the same separate account with the rest of this blog’s earnings. Rest assured though, the amount isn’t life altering, since I’ve decided that investing any more than 1-2% of my net worth into cryptocurrencies is too rich for my blood.

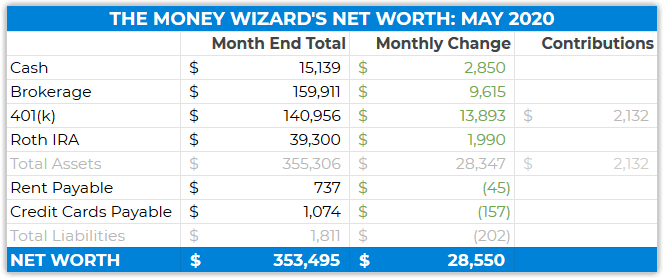

Monthly Account Changes

Checking Account: $15,139 (+$2,850)

I’m officially changing the name of this category from “Cash” to “Checking Account.”

Why? Well, it dawned on me that calling this account cash actually makes no sense at all.

This “cash” account is really only the portion of my cash that’s sitting in my checking account. I also have cash in my brokerage account, in the form of money market funds, and until this month, in my Roth IRA, too.

A more accurate description than “cash” would be “money that I haven’t decided what to do with yet.” Which… is all your checking account should be anyway, considering the awful interest rates they pay these days.

In any case, tracking the month over month changes here serves a nice benchmark for my monthly after-tax savings. (Aka, my savings in addition to my automatic 401k contributions.)

Brokerage: $158,881 (+$9,615)

Since the overall portfolio changes matter more than the tiny segments, I think I’m going to limit my commentary here to just highlighting a rough breakdown of the account’s major holdings, at month end. Rounded to the nearest thousand. Because I’m lazy like that.

(And because the exact pennies don’t matter compared to the overall portfolio allocation, which I’m already tracking.)

As of May 2020, those major holdings were:

- Vanguard Total Stock Market Index Fund (VTSAX): $95,000

- Vanguard Total Bond Market Index Fund (VBTLX): $15,000

- Vanguard Money Market Fund (VMFXX): $14,000

401(k): $140,956 (+$13,893)

I plan on limiting this section to how I’ve set up my automatic paycheck contributions. I could track the exact balances, but anyone who’s ever switched jobs or had their employers change 401k providers knows how messy than can be.

The contribution breakdown, as of May 2020:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $39,300 (+$1,990)

I think showing a rough breakdown of the major holdings makes the most sense here:

- Vanguard REIT Index (VGSLX): $34K

- Vanguard Total International Index (VTIA): $5K

Rent Payable: $737 ($45)

The weather was so nice here this month that I’m pretty sure we ran zero heating or cooling, making my total portion of utilities about $25.

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $1,074 ($157)

Another liability, which gets always paid in full each month.

As Robert Boucher, Jr.’s mother always said, “Credit card interest in the devil!” Or something along those lines…

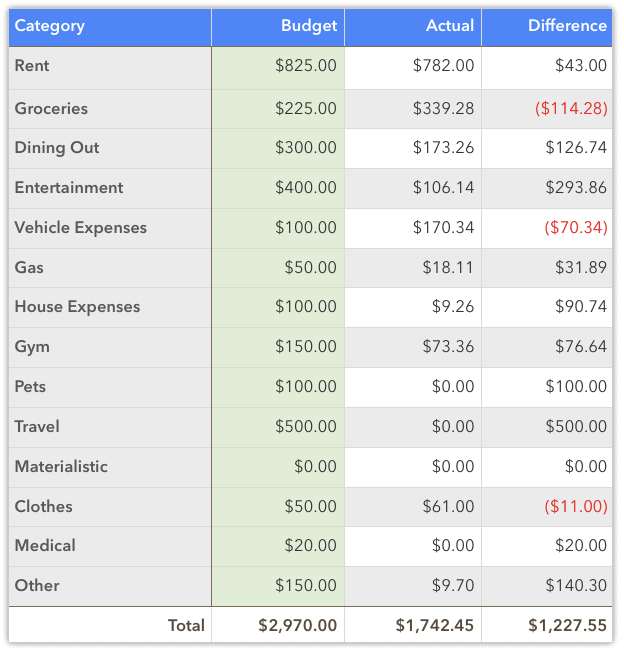

Total May Spending: $1,742

Not a whole lot to report on here.

For the second month in a row, the spending has been FAR under budget. Which isn’t all that impressive, since there’s not much to spend your money on when the entire city is closed for pandemics and riots.

Groceries: $339

I do think that coming out of this apocalypse, I’m going to relax my grocery spending a bit.

Sure, I’m still a big fan of a lot of the strategies I’ve used to keep my weekly grocery spending below $35. But I also think I might have gotten carried away with some of those strategies in the past.

I won’t bat an eye on a $20 dinner out, and yet I’m agonizing over whether to get the $5 cut of meat or the much more flavorful $7 cut?

No matter which way you slice it, cooking at home is still cheaper than eating out. So I think I’m going to give myself some freedom to relax here.

Ironically, this strategy might actually save me money, since I could see myself eating out less in favor of getting inspired by some nicer ingredients at home.

Dining Out & Entertainment: $279

Still trying to support the local restaurants and breweries, especially now that they’ve got riots to add on top of their COVID concerns.

Vehicle Expenses: $170

The 3.5 year old Mazda 3 crossed 25,000 miles, so I threw a birthday party that included an oil change, tire rotation, and some filter work.

Gas: $18

Now THERE’S something about quarantine I could get used to.

Gym: $73

I placed a pause on my gym membership last month, but I did buy a nice yoga mat for the home workouts. My knees and elbows, tired of getting torn up from my paper-thin yoga mat on top of hardwood floors, said thanks.

Clothes: $61

I’ve been running consistently since December. Considering I used to loathe running with all my out-of-shape heart, I rewarded myself with some upgraded running gear at a big discount.

How was your May?

Is your city falling apart at the seams, like mine?

Related Articles:

Thanks for the article money wiz. If you were saving up a down payment for a house that you might need in the next 1-2 years, where would you keep that cash? If you put it in VTI to grow it then sell for a down payment, what would the tax implications of that be?

If you’re using the money in the next 1-2 years you want that in a savings account.

I told my husband that there will be a history class dedicated to 2020 for the future generations. Hurricane season started for us yesterday and we already have a TD in the gulf that could potentially hit Houston. At this point, I said bring in the 1 million year storm and finish us off. If we survive to December, we should get a reward.

Houston is definitely doing better than other cities. We shall see how today’s protest goes with his family. I’ve had choppers and police all around. I keep thinking this is the day they will say, society has ended and you may now start the apocalypse.

Good luck! I see more and more positive coming out of Minneapolis. Every day, it gets a tad better.

Great month of gains. Sorry to hear about the wedding being pushed back, but I guess you had no other choice.

Boy, if these last few months (between the virus and now the unrest) are not an advertisement for living in the suburbs or away from cities, I don’t know what is.

I have a Robert Boucher Jr football jersey with the Bourbon Bowl patch! Loved seeing that come across! Please stay safe – stay healthy! The wedding will happen – if you plan it, it will come!

Glad to hear you’re doing alright. Been waiting to see this post since last week to make sure you and the Wizard household were safe!

Do you track your spending manually (i.e. entering every transaction into a spreadsheet vs. using Personal Capital or Mint)? What about the monthly account changes? That table doesn’t look like it was pulled directly from Personal Capital and I love how clean it is!

Hey Money Wizard, I’m sorry to hear about your rough month, and your wedding and honeymoon being postponed. But I’m glad that you’re taking things positively (and enjoying the simple things in life) despite everything that’s happening. I hope June will be a better month for you, and look forward to your update then 🙂 In the meantime, please stay safe! Glad you’ve been stocking up on groceries!

Hey Money Wiz!

I’ve enjoyed your blog for couple years now and you are on a great track.

I commend your effort to keep your financial house in order — up and to the right 🙂

The bagels look delicious!!! Any chance you can share the recipe?

I’m starting to follow your monthly report now. I think you’re doing a great job. I’m on my way to that $1 million mark as well. I have a LONG way to go! I think I might start copying a few things that you’re doing. Like the monthly changes per account (i should’ve been doing that this whole time!)

Anyways, here’s my latest report.

Check it out: https://cashaffect.com/make-money-in-the-stock-market-may-2020-net-worth/

Hello and thanks for the great blog! I wish we could have your grocery bill and have read your other articles about cutting those costs. We’re really putting a high value on our health. We grow everything we can in the garden and preserve as much as possible for the winter. But we still need to buy groceries to the tune of about $750/month for 2 adults living in the Rocky Mountains. We eat very healthy and that also includes buying organic whenever available. We go to a regular grocery chain so it’s less expensive than the trendy stores but still everything seems to cost about double. What would you and your readers do if you were in our shoes with our value on organic healthy food- just pay the higher prices or compromise on our values and go back to non-organic (but still fresh and whole foods)? Our savings percentage is somewhere between 60-70%. Thanks for your opinion!

Stay safe bagel master! You excluded, I feel like a lot of the personal finance community has been pulled into the world of daily speculation. Me? Sure, I’ll jump in. I believe (using only the FACTS) that we’re currently pulling back the rubber band on a very big sling shot. Too the moon!

You’ve mentioned the importance of contributing to your HSA but it is not included in your net worth updates. Is the HSA something are maxing out and if so, are you also using investments similar to your brokerage and 401k investments?