Hey Money Wizzes,

Welcome to what might be the first official update of Fall?

As you’re probably sick of hearing by now, every month I track my progress towards a goal of around $1 million dollars. I’m hoping that amount will let me leave my office job. FOR GOOD. Within the next four years.

The goal? Early-retirement and/or hobby employment by age 35. I’m currently 31, getting closer to 32 every day, but hopefully getting even closer to the goal!

Life Update: October 2021

After September’s Honeymoon, October was certainly a little less eventful.

Our wedding wrap-up and week-long trip to Hawaii were replaced with more low-key events with friends.

We watched one friend run the Twin Cities marathon (and I was reminded how woefully behind I am on my New Year’s Resolution to run a 6 minute mile…), we took a quick weekend cabin trip with another group of friends, and we went to another friend’s one-day wedding event.

Otherwise, Fall rolled in hard and strong here in Minnesota. As I seem to write every year, nature seemed to flip a switch, and seemingly overnight, the leaves fully turned, the cool weather arrived with a bite, and the days started getting shorter.

Call me nuts, but I’m actually a little excited for winter this year. For a few reasons:

- The shorter days always seem to make for more sleep. After a busy summer, that’s a welcome change.

- The holidays mean I get to see family that I don’t see nearly enough.

- And if all goes well, I might get to throwback to my favorite hobby – skiing – which took a tragic hibernation during last year’s pandemic.

Of course, I’ll probably be singing a different tune when I’m snowed in with negative 20 degree weather. But a guy can hope, for now…

Net Worth Update: October 2021

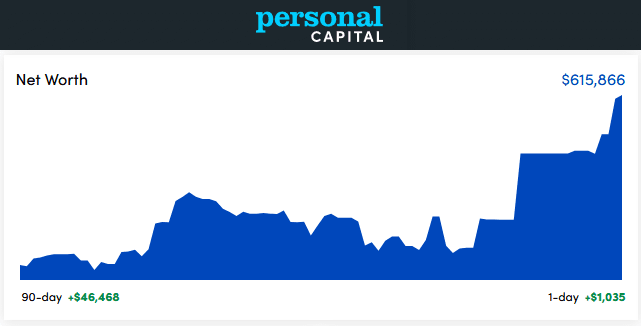

In September, my portfolio lost about $15,000, but October roared back with over $40,000 of growth.

These big portfolio swings can be kind of scary, but mostly I find them exciting. As your portfolio gets bigger and its weight starts sloshing around, it begins to prove one of the most important parts about financial independence – that your money can work harder than you do.

This month alone, my investments added 5-10x more to my bottom line than my working income did. (The wide range is whether you want to count pre-tax or after-tax income.)

Either way, that’s a staggering amount, and a little glimpse of what can happen once you build up a big enough lump sum.

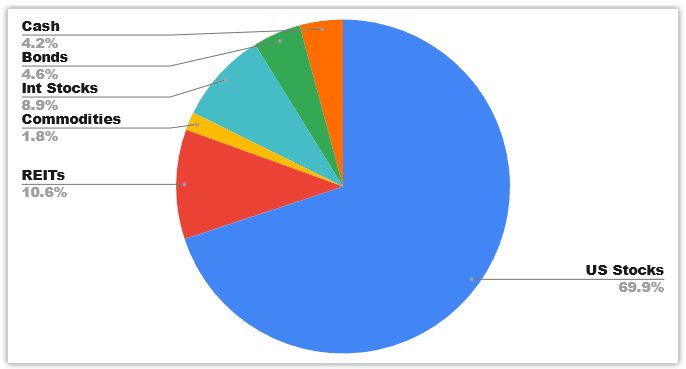

My current portfolio allocation, excluding crypto:

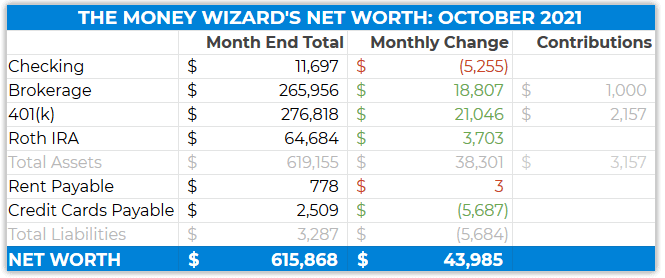

Checking Account: $11,697 ($5,255)

A big reduction in cash, since I paid off the enormous credit card bill. (The bill was huge because of the wedding and honeymoon expenses.)

As I’m doing every month now, I also transferred $1,000 cash to my brokerage account as part of Vanguard’s automatic investing feature.

Brokerage: $265,956 (+$18,807)

$1,000 of my own contributions and nearly $18,000 of investment returns. What was that bit about your money working harder than you can?

401(k): $255,772 ($5,319)

$21,000 of gains in a month is just ridiculous.

I max out my 401k and receive a healthy match from my employer. These two factors result in an average of around $2,500 getting added to this account each month, but that still means around $19,000 of investment gains here.

Roth IRA: $60,981 ($2,455)

This portfolio is about 75% REITs (through Vanguard’s VGSLX index fund) and 25% international stocks (via Vanguard’s VITAX index fund.)

Here’s my full explanation for why I hold REITs in my Roth.

Rent Payabale: $778 ($34)

My half of the mortgage + rent + utilities.

For newer readers, I live in a house that Lady Money Wizard bought before we got married. We’ve split the payments for years, but now that we’re married, we’re still deciding on how we want to combine finances.

Credit Cards Payable: $2,509 ($5,687)

Phew, this is much more reasonable after last month’s $8,000 bill.

Here’s the full spending report:

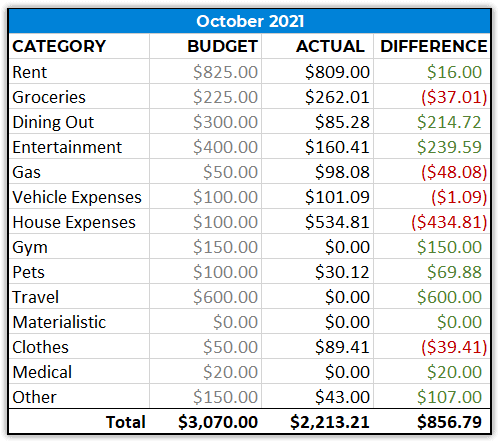

Total Spending: October 2021 ($2,213)

Entertainment: $160

Mostly from our cabin stay with friends… including all the northern essentials like beer, brats, and more chips and dips than anyone should eat in a single weekend.

House Expenses: $535

I don’t even know if this should be considered a house expense, but Lady Money Wizard and I took some art into a local framer, and I got hit with the sticker shock of my life when he handed me a $355 bill for two frames/matting.

Clothes: $89

For the friend’s October wedding, yours truly realized in a panic that he had a total of zero suits that fit. (Thanks to working from home and a lack of office meetings for that surprise!)

Amazingly though, I was able to score a pretty awesome suit setup at a local thrift store, of all places. I then took it to the tailor and got it looking like a million bucks, for only 80 bucks.

Suits are usually crazy-expensive, so if people are interested I might do a write up on that whole adventure.

Readers, how was your October?

Hope it was awesome. And on a random note, thanks for being a reader for all these years.

You all are the best, and this blog certainly wouldn’t exist without you!

Related reading:

Crypto has been hot lately too. I know you don’t disclose your crypto portfolio but are you still regularly contributing to that to maintain your 10% allocation goal?

Good work! I know you don’t “count” your homes value, wife’s net worth or your crypto but with those three included you are probably very close to that millionaire status, if not already there. Congrats!

Wow…. Congratulations on your success. I have a feeling you’re going to reach the millionaire status ahead of your goal.

“These big portfolio swings can be kind of scary, but mostly I find them exciting”

>I feel this too, but mostly because we’re in a bull market 🤣

I’d be interested to know your thoughts on why you feel this way? Is it because you are a fire proponent? Is it because you’re still working and you feel it could even out any downswings? Or is it just because you have a high risk tolerance?

HH

PS – thanks for taking the time to write the blog. It’s nice to read something positive, interesting and thought provoking.

If your net worth is zero, your monthly portfolio swings are also zero.

If you’re Buffett and your net worth is $100 billion, your monthly portfolio swings are massive.

Bigger portfolio swings hint that you’re moving in the right direction. 🙂

But you’re right, it could also be a mix of my salary and having a higher risk tolerance.

You’ve almost caught up to my net worth.

Granted, I include my house in mine. That is because I opted to rapidly pay it off, so I don’t make mortgage payments anymore. It’s nice because that lack of monthly payments gives a perceived interest of almost 5%. (Yearly mortgage payment divided by home value) But it doesn’t grow nearly as fast as stocks.

I’d say this was a poor decision in hind-sight, but I deliberately did it as a risk-hedge. Win some, lose some.

Still better than blowing that money on the type of spending most people do.

Like I always say, as long you’re investing into something (anything!) you’re moving in the right direction.

I would definitely like to know about your suit adventure. You definitely scored a bargain. The question is: Was it worth the extra effort?

Congrats in the excellent passive income growth!

Professional art framing can definitely be costly – especially if custom! I bought some original illustrations from an artist I like, and then spent 3x the cost of the art on framing! As you may say – compound spending!

Nice work … so at 35 you will be free to start your own empire , join Space X or go fishing …. or all 3 … great stuff …. 😀