Here’s the crazy story of the week: A computer image just sold for $69 million dollars online.

$69,346,250… to be exact.

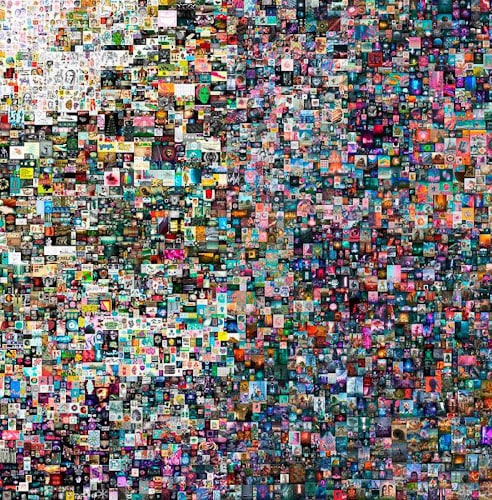

Yep, the legendary Christie’s Auction House just finished an auction for its first ever piece of digital artwork. This .jpg image was created by graphic artist Mike Winkelmann, better known by his Instagram handle Beeple:

The artwork attracted some some crazy buzz for its use of “NFT” cryptocurrency technology. (We’ll get to that.)

Bidding started at $100, and this story got on my radar when the leading bid had climbed to $3 million, with 5 days still left in the auction. With 3 days left, bidding had jumped to $12.5 million. And in the last 30 minutes of the auction, the price for the piece skyrocketed from $15 million to a final winning bid of $69.3 million.

It’s the third highest sale of any living artist and one of the highest value auctions in Christie’s 300 year history.

If you’re like me, you might be wondering wtf just happened…

Why would somebody pay 10-mansions-worth of cash for computer pic that they could just right click and save as?

And why might this quirky story actually change the world of money forever?

Why “NFT” is the latest cryptocurrency mania

NFT stands for “Non Fungible Token.”

Like most things cryptocurrency, the geeks branded that name in the nerdiest way possible, so here’s what it means.

In normal economics, “fungible” means something is easily traded for similar things.

For example, a $20 bill in your wallet is said to be “fungible” because it’s exactly the same as the $20 bill in my wallet. The fact everyone agrees that all $20 bills are the same makes buying and selling stuff really easy.

All good currencies are fungible, which means most cryptocurrencies are fungible, too.

Just like the US Dollar, 1 bitcoin is the same as all the other bitcoin.

Enter a new type of cryptocurrency coin. One that’s NOT fungible.

These coins are completely unique. They can’t be cloned or replicated.

In fact, using blockchain technology that is way too complicated for this article, the cryptocurrency systems can mint a 100%, one-of-a-kind, completely unique coin.

A non fungible -coin. Or non fungible token. Or NFT.

(It’s basically just a serial number that anyone can look up to verify it’s authenticity.)

NFTs and digital collectibles

Here’s where things get interesting.

Again, using technology that’s way too complicated for this article, the blockchain can then attach those unique NFTs to digital items to verify the authenticity of those items.

Like, say, a digital painting created by Beeple.

By attaching the one-of-a-kind NFT to Beeple’s digital image, it’s like stamping the back of the Mona Lisa with a 100% uncounterfeitable seal of authenticity.

Art collectors get giddy at the idea of having a one-of-a-kind original, and the next thing you know, you’ve got a .jpg image selling for $69.3 million.

Ta-daaa!

For an equally crazy story, check out CryptoPunks.

Those goofy, pixelated avatars have built up a cult following, and now original CryptoPunks are selling for ridiculous sums – a single avatar just sold for $7.6 million.

Other artists are cashing in too. Kings of Leon just sold a copy of their album with an NFT certifying it was “The Original” album for $2 million. Grimes just sold $6 million of NFT videos, art, and music.

Wait, why is this even valuable? Can’t I just “save as”?

This question is eloquently summed up in this video:

Me stealing a $69 million dollar piece of art pic.twitter.com/niHxzhfC2T

— Alex (@thealexpatel) March 11, 2021

Why are people paying so much money for something that’s so easily copied?

I mean, I could download Beeple’s exact $69 million dollar painting and make wallpaper out of it, if I wanted to. Or save a CryptoPunk avatar and just pretend I coughed up millions for it.

But collectors don’t care about that.

And they never have.

- Exact replica reprints of The Mona Lisa aren’t worth millions.

- I could print out a Michael Jordan rookie card, but that doesn’t mean it’s worth anything.

- Nobody will pay $20,000 for a counterfeit Rolex, even if it looks the same.

For better or worse, humans are strange, ego-driven creatures. And they see a value in rarity. In pounding their ape chest and telling the world, “I’ve got a real original.”

The Crazy Trend of Digital Collectibles

If this all sounds ridiculous to you (it does to me) then I hate to break it to you. We’re old…

Spending on virtual stuff is absolutely a trend that’s here to stay.

At a basic level, people have been paying real money for stuff to use in video games for years.

World of Warcraft players are the O.G.s at this. They pay hundreds of dollars for rare items in the game, like this cannon thing that’s worth a couple hundred bucks:

Fortnite took it to the next level, with this in-game costume selling for $5,000:

Even redditors spend real money for “Reddit Gold” which they then give away to other posters.

You can’t make this stuff up.

But it’s going mainstream.

Even the NBA is cashing in, with NBA Top Shot. These are basically digital trading cards. Instead of printed photos, they’re digital videos, and they’re linked to the blockchain with NFTs to certify their rarity. Before you laugh, a clip of a Lebron James dunk recently sold for $208,000.

👑ALL HAIL THE KING👑@YoDough scooped up this Legendary LeBron James Moment from our Cosmic Series 1 set for $208,000‼️ This Moment is from our first Legendary set ever minted 💯

The top acquisition for any NBA Top Shot Moment … so far.

Congrats on the nice pickup! 👑 pic.twitter.com/rFLMzbwXN7

— NBA Top Shot (@nba_topshot) February 22, 2021

Yeah, that’s a clip of the exact same dunk. Not worth $208,000 though!

How NFTs Could Change the World

In my opinion, this is just another example of cryptocurrencies entering the mainstream.

And if you step back from the ridiculous snootiness of the rare art and collectibles world, you can see that the security and authenticity of NFTs could actually be a really useful technology.

What’s more secure? A dusty document with a human signature that’s hard to read and easy to forge? Or a completely unique serial number that’s verified by a 100% secure public ledger, with thousands of computers working around the clock to verify its accuracy? (Which can be confirmed, not by a pricey expert with a magnifying glass who’s prone to deception, but with one foolproof click of a button.)

In the future, it’s not hard to imagine NFTs being used not just for goofy avatars and NBA dunks, but even to verify the deed of trust on your house, the title to your car, or even the authenticity of your passport.

Maybe I’m just falling victim to the good old confirmation bias, but all this makes me feel better about my portfolio’s ~10% exposure to Bitcoin and, more specifically in the case of NFTs, Ethereum.

What a crazy time to be alive!

PS – If you’re interested in gambling on crypto (not financial advice) then Kraken.com is my favorite exchange. I’m also a fan of the Ledger and Trezor wallets.

Related Articles:

This is pretty crazy. I can’t say I understand it. But I don’t claim to understand everything. This is a market it will be really interesting to follow in the coming years.

I can’t with this. I am too old & this makes me sad the way some try to get or make money & others have enough to just throw it away.

I think whoever purchased that Beeple image is some Crypto millionaire/billionaire who wanted to make a statement. I mean if you suddenly make that much money, why not do something ludicrous like this?

Agree. Also it’s likely they are invested in other digital assets NFTs and are using this type of auction as a run up on exposure to take advantage of others who get on the tow train. I love blockchain tech and it’ll likely be the backbone of the entire internet eventually, and there is a place for NFTs, but man, this be nuts!

I think it is a great idea on the 10% exposure to these different assets and don’t believe it goes against your overall strategy at all. I’m doing the same thing. I would recommend you start dabbling in the options world. To this point, like me, our main strategy is put away x a month in long term investments and let the magic happen. Obviously it is a great strategy, but it isn’t necessarily fun, nor should it be. Even putting all of that 10% in crypto and holding isn’t exciting (besides watching it grow). Enter options. I’ve been using a portion of my 10% there and have been enjoying it alot.There are plenty of strategies that aren’t wild wsb and mitigate risk. Research the wheel strategy ( I smell future My money wizard article on it). That’s strategy i’ve been doing and its up your alley.

Side note – My financially savy friend has been talking up whole life insurance. I always heard it to be a rip off, but going to start looking into it more now. Possible future article idea.

-Tom

Man, technology is making such big headwinds. Who knows what will come up next. I knew nifties were becoming huge in recent times but I didn’t know it was becoming this huge this quickly. That is insane.

Maybe I should look up “how to sell something as an NFT”… At first glance, that picture looked like the website that sold 1 pixels for a dollar (with a million pixels to be sold).

The price was little crazy in my opinion.

No one has been able to answer the question: was it sold for U.S. Dollars, or was it sold for cryptocurrency dollars? I ask because I don’t know of any American bank that has an American branch here in America, that will give you U.S. dollars in exchange for bitcoin. Does anyone have a URL that answers this?

It was paid for with Ethereum. The guy who bought it had been involved in crypto for a while, so it seems he had $69 million worth of Ethereum laying around.

https://indianexpress.com/article/technology/tech-news-technology/a-digital-art-by-the-artist-beeple-sold-for-69-million-heres-why-it-is-big-news-7225396/