When it comes to tracking your money, the personal finance industry has two clear leaders in the free category. Which leads to one of the most common questions sent across the Money Wizard inbox: Personal Capital vs. Mint?

There’s only one way to settle this dispute, and that’s a head to head comparison between the two offerings.

Ahh, who doesn’t love a good cage match?

In one corner, we have Mint.

Mint was one of the original FinTech companies bursting onto the scene in 2006. Hyped as the “Quicken-killer” their free service allowed users to automatically aggregate all their spending info in one place.

Mint’s service was a revolution. So much so, that in 2009, Intuit sold Quicken and bought out Mint for a cool hundred million-ish. The supposed Quicken-killer was victorious!

Fast forward to today, where Personal Capital burst onto the scene hyped as a “Mint-killer.”

In some ways, we have the old dog vs. the up-and-comer. What a match-up!

Who’s gonna win this battle of the juggernauts??

The Personal Capital vs. Mint Experiment

Mint and Personal Capital are the two most popular personal finance tools on the market. Both offer online platforms to help you manage your money, and they’re both free.

The gist of their platforms is simple enough:

- Create an account

- Link your bank accounts, credit cards, investment accounts, etc.

- Enjoy your new simplified financial life. With all your accounts in one easy to monitor dashboard, you can easily track your account balances, spending habits, and investment performance.

Of course, this is a simplification, and each has their own strengths and weaknesses. Which is the whole reason for this article!

Now is the part where the typical reviewer starts regurgitating product specs straight off the box.

NOPE. NOT HERE.

Instead, for our comparison, I created accounts with both platforms, and I got as familiar as possible with the systems. My goal was to uncover each service’s strengths and weaknesses, find the bugs and the quirks, and report back to you.

For 8 rounds of cage match, here’s an overview of tonight’s entertainment:

Round 1: Linking Accounts

To start, Mint and Personal Capital will both ask you to link any accounts you’d like to track.

The process is pretty similar for both, and surprisingly easy. You just search or select the provider of the account (Chase, Vanguard, etc.) then give Mint or Personal capital the login info for your online ID. (If you’re worried about security, we’ll get to that in a little bit.)

I didn’t have a problem with either Mint or Personal Capital supporting all my accounts, which is nice. Some people report issues with linking up small credit unions or other obscure accounts, but this is rare. They really do have a staggering number of accounts covered.

Winner: Well, it’s hard to find a standout in something as boring as account linkage, but Personal Capital was a smoother process overall. Mint hit a small hiccup with dual factor authentication, which I was able to sort out via an unsuccessful trip to their help center and a lot of googling.

Round 2: Dashboards

With your accounts linked up and ready to rock, Personal Capital and Mint can start working their magic.

Both tools seek to simplify your finances with a nice, easy to read summary dashboard. A picture is worth a thousand words, so here’s a peek at the two:

Personal Capital’s Dashboard:

Mint’s Dashboard:

You’ll notice Personal Capital’s dashboard is more investing/net worth focused, while Mint’s focuses more on spending and budgeting. That’s a key distinction between the two programs, and a pattern we’ll see throughout the features.

Mint’s dashboard does have the advantage of being customizable. You can select which features to show and even the order which they show.

That said, I find Personal Capital’s emphasis on charts and graphs to be easier to digest, and as you click through the dashboard, Personal Capital’s interface just seems more user friendly.

Since that may just be personal preference, we’ll label this round too close to decide.

Winner: Draw.

Round 3: Budgeting

Personal Capital and Mint both sport the awesome feature of tracking your spending automatically, once you’ve linked your credit card accounts.

Budgeting with Mint

Mint is first and foremost a budgeting app, so you’d expect it to have the edge here. And it does.

Unlike Personal Capital, Mint allows you to build a budget category by category, and the program then tracks your spending in each category.

For someone trying to get their spending under control, this categorization provides a nice frame of reference.

Mint also has a robust bill feature. The dashboard will automatically notify you of any upcoming bill, and you can even link recurring online bills, like insurance or utilities, or even offline bills, like rent, the babysitter, or that handyman you pay under the table. Shame on you, you tax evader you!

Budgeting with Personal Capital

Budgeting with Personal Capital is more cash flow based, meaning the program emphasizes your overall income versus expenses for each month.

You can set a budget by total dollar amount, and the program will automatically report on your spending by category, but you won’t be able to compare category wide spending versus a broken down budget. For this reason, I’d consider Personal Capital’s budgeting feature as more of a “spending report” than an actual budget.

For advanced money wizards, I actually prefer this approach. I find categorized budgets can tempt people into spending money, just because they’re “under budget” in a certain category. Personally, I try to spend as little money as possible; I don’t care what category the saving comes from. But beginners probably won’t appreciate the lack of guidance.

Personal Capital’s bill feature is also not as robust as Mint’s. I haven’t found a way to add utilities and other offline accounts, and while you can see an overview of bills for your linked accounts (mostly credit cards bills) alerts are pretty much nonexistent.

Winner: Mint.

Round 4: Investing

Just like the budgets, both Personal Capital and Mint will link and track your investment accounts.

Monitoring Your Investments with Mint

I’ll be blunt. In my experience, Mint’s investment tracking is garbage, to put it nicely.

Like Personal Capital, Mint shows your individual investment balances and tallies up a final net worth figure. But that’s about where the features end and the bugs begin.

The first thing you’ll notice is that the historical performance tab is limited to when you set up your Mint account. Depending on the age of your investments, this could mean years of lost information. What good is the historical performance without, you know… history?

Scroll over to the comparison tab, and the quirks continue.

Umm, anyone want to explain what’s going on in this graph?

- The scale dates back to 2016, which is strange since the investments date back to 2012.

- The graph is supposed to compare my account’s performance to the benchmark, but for some reason the comparison stops halfway through.

- The graph defaults to stopping in May 2017, for some reason.

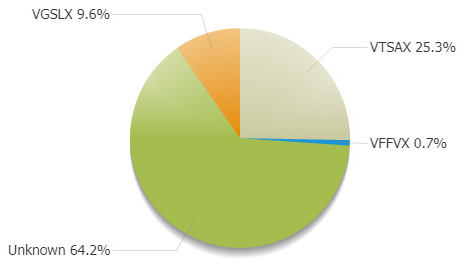

And forget about detailed reports. For 65% of my portfolio, the investment tracker can’t even figure out what stocks I’ve invested in!

And the asset type is 100% broken:

Just ridiculous.

Monitoring Your Investments with Personal Capital

Personal Capital was created as an investment analysis tool, so it’s no surprise its features here are top notch.

Put simply, Personal Capital’s investment tools just work. No bugs, no hassle, and even a few high tech features for a pleasant surprise.

Unlike Mint, Personal Capital had no problem tracing my portfolio’s performance waaaay back in time, and Personal Capital had no issue breaking down my whole portfolio into the accurate allocations.

Even more impressive, Personal Capital broke down the individual holdings within each index fund, in order to give me an exact total portfolio allocation. That’s a level of detail I’d never be able to calculate without the help of a computer program, and is seriously impressive coming from a free tool.

The software also has a pretty nifty investment checkup tool, which analyzes your portfolio’s allocations, calculates the risk, and offers suggestions. These sorts of features are usually pretty gimmicky, but Personal Capital’s are actually based on some really solid financial theory:

Winner: Personal Capital, and it’s not even close.

Round 5: Bonus Features

But wait, there’s more! (There’s always more, btw…)

Extra Features from Mint

Mint has a couple of bonus features worth mentioning.

1) Bill Pay: Mint has a bill pay feature, which lets you pay bills directly from the dashboard. I could see it being especially convenient if you used it to its full potential. Imagine paying your car insurance, utilities, credit cards, etc. all from one place. Pretty cool!

2) Free credit score: Mint offers a free credit score for all users, right in the dashboard. I was pretty excited for this, but unfortunately, I could never get the score to pull up during my test, for some reason.

3) Goals: The budgeting feature allows you to add goals, like saving for a house, buying a car, or paying off debt.

It’s a really cool idea, but I found it to be hit or miss. For example, here’s me adding the goal of our upcoming kitchen remodel, which makes for a really nice addition to the budget tool:

On the other hand, the “buy a house” goal recommended I look for something in the $415-$485,000 price range. Considering we are loving the $180,000 house we just bought, this is some insane advice! I’d damn near be living paycheck to paycheck with a $400,000 mortgage!

Extra Features from Personal Capital

Not to be outdone by surprises, Personal Capital swings back…

1) Investment Fee Analyzer and Retirement Fee Analyzer: Personal Capital scans all your investments and calculates just how much you’re really paying in fees. The answer might surprise you!

Since fees are without question one of the biggest determining factors in investment success, I found this really helpful. For somebody caught up in a high fee mutual fund, this could save them thousands over their investing career.

2) Retirement Calculator: Personal Capital rocks a solid retirement calculator. The system runs a Monte Carlo analysis, which is a fancy finance model that analyzes 5,000 scenarios simultaneously to determine how likely it is your cash will last.

Like any good retirement planner, the model is based on how much money you want in retirement, and not just some arbitrary hand waving by a financial planner. It’s also crazy customizable; you can add income events like social security payments, inheretances, rental income, etc. and you can even factor in big spending goals like vacations, charitable giving, or healthcare. It’s really an incredibly deep tool that I’ve only scratched the surface on.

Winner: For my money, (literally!) Personal Capital. But the budget oriented folks might appreciate Mint’s bill pay and budgeting features.

Round 6: How do Personal Capital and Mint make their money?

Mint’s business model is an ad based system. Within the dashboard, you’ll see “suggestions” for how to save money, which usually involve opening up a credit card with lower interest rates or switching to a lower fee brokerage. These ads are included in the “ways to save” tab, but you’ll also see random popups throughout the software.

Personal Capital also has a hidden agenda with their free offerings. Personal Capital actually has a financial advisory firm, and they hope to recruit high net worth individuals to their financial advisory services, who do charge a fee.

I knew this going in, and yet I was still surprised when I got a call on my cell phone from a financial adviser from Personal Capital hoping to pitch me his services. You’ll also be hit with the occassional message steering you towards “meeting with a professional.”

(At my age, I’ve saved enough money to get featured on the front page of Yahoo Finance, yet Personal Capital is sure to remind me that “25% of users like me have saved more… schedule a call today!”)

To be honest, I don’t find either business models to be a big deal, but you may have different tolerances.

Winner: Draw.

Round 7: Is Personal Capital Safe? Is Mint Safe?

I’ll admit. The idea of aggregating all of my financial information in one place sounds like an online hacker’s dream come true, so this had me concerned at first.

Well, here’s the technical answer first. Personal Capital and Mint both uses AES-256 bit encryption.

I don’t know what that means either, so I had to google. Apparently, it’s the same stuff used by the US government, and basically impenetrable to brute force attacks. Supposedly, it would take 50 supercomputers checking a billion billion keys per second about 3,000 years to crack. (Seriously!)

I like my chances there.

And now let’s say somebody actually managed to get into your Mint or Personal Capital account. Because the software is just viewing your account balances, and not actually doing anything with them, our thieves wouldn’t have a lot to do.

In that, you could say using Mint or Personal Capital is actually safer than logging into your online bank. Whereas if somebody hacks your online bank, there’s the very real possibility that they can transfer money out. If somebody hacks your Mint or Personal Capital, all they get is a peek at what a diligent saver you’ve been!

Of course, nothing is invincible. But I like my chances against 50 supercomputers.

Winner: Draw

Round 8: The Cell Phone Apps

One of my biggest pet peeves is cell phone apps that don’t have as many features as the website version. So, I hit up the App Store to see how well the online apps translated to their iPhone versions.

Personal Capital passed with flying colors. The app worked flawlessly, and was basically a miniature version of the website. Every single feature was included, from the net worth tracker to the complex retirement planner, all scaled down for easy finger swiping.

Mint also boasted a nice cell phone app. The ability to see your budget in the palm of your hand could really help some folks stay on track during that impulse late night trip to the bar.

But that’s about where the app version features of Mint ended, because several of the website’s features, like goals and investments, were missing from the app entirely. (Although judging by the unfinished nature of the website’s investing section, we might not be missing much there.)

Winner: Personal Capital.

Final Thoughts: Personal Capital vs. Mint

So there you have it folks! Personal Capital with a judge’s decision, winning 4 rounds to 1.

But it’s worth emphasizing that’s just this judge’s decision. If you’re more focused on setting a budget and sticking to it, Mint probably represents the better option for you.

Personally, I continue to use Personal Capital like an addict, for a few reasons:

- Mint has the advantage over Personal Capital in budgeting, but it’s not a total landslide. But Personal Capital is light years ahead of Mint in investment tracking.

- I’ve never been a big believer in budgeting certain amounts for specific categories. I find that tracking my spending overall is more effective for me, so I actually prefer Personal Capital’s summary spending reports.

- Personal Capital’s fee analyzer and retirement calculator are incredible features.

- I like Personal Capital’s iPhone app a little better.

- Overall, I found Personal Capital to be a smoother, more polished product. Mint’s errors in investment tracking is embarrassing, and I never could get the credit score to work. Even as I wrote this post, Mint somehow got disconnected from one of my credit cards, and 4-5 repeated login attempts couldn’t fix the issue.

Winner: Personal Capital

Fellow Money Wizards, do you have an opinion on Mint vs. Personal Capital?

Note: I think Personal Capital is so awesome that this site worked out an affiliate agreement with their company. This means if you click through one of my Personal Capital links, this site may receive a commission, at no cost to you. The information in this article is based on my opinion and is not influenced by the agreement.

I am one of those Personal Capital recruited as a managed account customer. I love Personal Capital as a net worth tracker and have also invested a large part of my portfolio with their managed accounts. They charge a significant fee, but a lot less than a normal advisor, for my size investment but they also use a smart alpha approach that avoids being over invested in FANG stocks because it isn’t capital weighted. I have a similar amount invested with Vanguard and Betterment but of the three, so far, I think Personal Capital is more than earning their somewhat higher fees. They, like Vanguard managed accounts, provide a real and excellent human advisor. Betterment seems to be a purely robo but they are ultra low cost and have performed very well also. I know I could manage my investments myself but I don’t enjoy doing that and am willing to pay discount fees to let PC, Vanguard and Betterment do it for me.

Glad to hear it’s working out for you, Steve!

I’ve been using Personal Capital since I discovered it six months ago. I log on every day, so I’m addicted. 🙂

One thing I wasn’t able to do was compare my investments versus the benchmark going back years like in your picture above. For some reason, “custom” wasn’t an available choice for me on that screen. Not a huge deal but I was curious to see how I stacked up.

I’ve never used Mint but I love Personal Capital! No reason for me to change.

Try manually entering a date a few years back in the top right. Custom wasn’t available from the dropdown for me either, but I just went in and adjusted the start date to 2013 to get that graph.

I feel you on the addiction, haha. Having all the accounts updated to the minute can get to be way too much fun to check.

Ahh thank you!! Very cool how it has that feature.

I’ll admit, I’ve tried mint but never to its full potential (never linked all my accounts to it). I have never been a person to do a budget, but I have wanted too. If that makes sense?? I am thinking Personal Capital might be the way to go because I am more interested in tracking spending than making a budget.

I have been turned off by Personal Capital due to every finance blogger out there pushes it like it is the best thing ever but it seems solely based on the referral fee that they get for signups. I appreciate your comparison and based off of the work you did (and showed) between the two, when I sign up for Personal Capital, I will use your link.

If I understand your comments correctly, if I sign up for PC I will get a sales call to be placed with an adviser? I assume you can just say no and continue to use PC?

Yeah, I’ve never actually made a budget. I include one in my NW Updates but that’s just to give the reader some frame of reference. I guess the process is nice for some people, but the only thing I care about is my overall spending.

I was pretty skeptical about blogger’s undying love for PC too. Just like RE agents, gotta consider the incentives… but when I gave it a shot I was seriously impressed. It’s not perfect, but it really is the best money app around, IMO.

And yeah, you’ll probably get an email or two and a phone call from an advisor with a sales pitch. They were respectful and low-key, I just said no thanks and they moved on. I think a year later they left me a check-in voicemail.

I actually use both to maximize what they are built for, and separate the two. I have been using Mint for years to track my spending, which as you learned it does a great job of. I have never made a spreadsheet before, plus I would never want to take the time to do that monthly as you do, but all that data is stored for me in Mint. I have never added any investments to it though, just credit cards and spending, essentially my liabilities.

Pretty much every personal finance blogger recommends Personal Capital to track net worth though, so since I started learning about this a couple years ago I downloaded it and only have my assets in there, so the spending reports are essentially irrelevant, but it is a great tool to track net worth, which I check on once a month or so. Anyways, nice write up, keep up the good work!

Thanks Steve!

And that’s a good point; I framed this article as a 1v1 cage match, because that’s what I always get asked. But there’s no reason somebody can’t use both! Best of both worlds then.

Thanks for offering such an informative article. I set up,a Personal Capital account a few months ago and added my investment accounts but not my credit card, nor checking accounts. I’ll have to,do that in order to monitor my spending. Admittedly, I have no budget and haven’t analyzed my spending. This is foolish considering I plan on early retiring within a few years. Your article is my inspiration to get off my ass and get started!

It’s easy man! You can probably add your checking and credit cards in less than 5 minutes. Give it a try!

This is a great comparison MMM. I personally use both as well, but since I don’t have any real investments right now I don’t find quite as much value from Personal Capital. I use Mint almost daily, though, and each month without fail I get my updated Credit Score.

I also think Mint is good about giving you updates to your credit scores. The other day I was hoping to get pre-approved for an auto loan and Mint had sent me a notification of the inquiry before the bank had sent confirmation of my request. That’s pretty impressive IMO. It was way faster than the credit monitoring service I have through the Federal Government even.

Very cool. I was really excited for Mint’s credit score feature. No idea why it’s not working for me though.

I use both because, as mentioned, they target different questions. If you pointed me with a gun and ask me to pick one then PC would be the winner hands down. I check mint every once in a while and I really like the alerts in case of incurring in fees. I plan to keep using both but in general for newbies out there mint might be the way to start and then PC could be next. Thanks MMM great post.

A like that approach. Mint to start, then Personal Capital once you’ve got the budget under control and start building up investments. Not bad at all!

“You’ll notice Personal Capital’s dashboard is more investing/net worth focused, while Mint’s focuses more on spending and budgeting.”

This is exactly how I use both, and check them daily, without too much redundancy.

Mint: only accounts I use for spending

-3 credit cards

-2 bank accounts (1 high interest checking where I keep my house fund and 1 checking to pay bills)

I use Mint to build a customized budget and track all my transactions. I have an additional savings account through Discover that really screwed up Mint because it is the same log in as my Discover credit card. Since that is a savings for emergencies I let it sit and don’t have it synced with Mint.

Personal Capital: everything!

-3 credit cards

-3 bank accounts (1 savings and 2 checking)

-2 employer 401k accounts

-2 Wealthfront accounts (1 Roth IRA and 1 brokerage)

-1 car loan (paid off but kept for tracking purposes)

I use Personal Capital primarily to track my net worth, investments, see investment projections, and use the box on the dashboard to see the market snapshot. I don’t find their auto categorization to be accurate at all, they aren’t super consumer spending focused like Mint but they have oodles of investing categories that I don’t need. The sending tracking doesn’t seem to be much of a budget tool so I use it as a means to an end for net worth tracking.

I think there is value in having both!

Only thing that isn’t synced anywhere is Qapital, which I use for smaller gamified savings goals (Sephora shopping spree, new couch, vacation fund, etc.). It won’t sync with either service so I have a budget line item in Mint for transfers to Qapital – it’s nice to have a budget item that is actually stashing away money! When I complete a goal and transfer $$ back for spending it is a nice boost.

Thanks for the in-depth exploration of both services – I thought I was a power user but I learned about some new functionality!

Very cool, and a great example of how somebody can play each one to their strengths. Thanks for the comment!

I use Mint – I much prefer to see my spending and set a budget then to keep track of my investments. That said, I probably mostly use Mint instead of Personal Capital because I used to use an app called “Mint Bills” which used to be called “Check” that… used to be called “PageOnce.” So essentially Mint bought me as a customer.

Maybe I’ll try Personal Capital one of these days. It’s free, too, right?

Geeze, at least when Intuit bought Mint, they didn’t change the nam… again! Haha!

The Personal Capital app and all its nifty features are totally free. The only way you’ll pay anything is if you want one of their advisors to actually manage your money.

I definitely agree with the comments made by Steve and Jess above. I find the relationship between Mint and Personal Capital to be less of an either/or and more along the lines of a both/and. Both systems have excellent feature sets, but both also have critical flaws that prevent them (IMO) from serving as a one-stop-shop for all personal finance needs.

I’ve been a Mint user for over seven years, and Personal Capital for five or so. While I have all of my assets and accounts linked to both, I no longer even bother checking Mint’s broken Investment tracking module, and have found Personal Capital’s spending analysis / budgeting / transaction structure pretty weak. I use PC only for net worth and investment tracking.

But using both systems to their strengths seems to work quite well. I rely on Mint for all transaction categorization, budgeting, cash flow management, and bill pay needs, and check it nearly daily. I only rely on Personal Capital for investment performance analysis and net worth updates, and check it every other week or so.

One of the major shortcomings I’ve found in Personal Capital is it’s character limitation on notes added to transactions. I track my spending down to the penny, and use detailed notes on most transactions to record things like warranty information for large-ticket items or a breakdown of individual items all logged in a given transaction. Mint allows 2,000 characters in a given transaction note field, but Personal Capital is limited to something much shorter. I believe it’s like 80-100 characters or less.

I think Mint serves the “money management” niche better overall than does Personal Capital, which I think serves a smaller audience and niche. But using both can deliver the best of both worlds.

Mint has played such an integral role in the money management system that enabled my wife and I to achieve financial freedom. In the interest of helping others do the same, I recently performed a comprehensive review of Mint’s features, took an in-depth look at it’s bill pay capability, and authored a detailed overview of it’s transaction logging capabilities. If anyone is interested in taking a deep dive into Mint’s feature set, you can find the links to these three articles below:

https://www.thefinancialfreedomproject.com/personal-finance-made-easy-master-your-money-with-mint/

https://www.thefinancialfreedomproject.com/mint-to-the-rescue-your-bill-pay-safety-net/

https://www.thefinancialfreedomproject.com/laying-your-financial-foundation-a-guide-to-mint-transactions/

Hope this proves helpful for someone!

Have been a Personal Capital user for about 4 months and really like it. However I wish there was a way for on-line transactions using Amazon or PayPal could show what was purchased instead of showing a generic on-line transaction. This makes it hard to know what expense category to assign it to. Now I have to go look up my on-line transactions by logging into those services and then assigning to categories in PC. Also wish there was a way to manually create a transaction (for example my son pays for his part of the mobile cell bill, but that expense doesn’t reflect that). Despite these issues, the pros of using PC still out-weigh the cons

Is there a subscription based software that you recommend more than Personal Capital? We pay $99 a year for our budget software that I’m unhappy with, so we are willing to pay for one that is good. Is there one that maybe combines the best features of both Mint and Personal Capital that you can recommend?

I know this comment is late to the game, but I originally started with PC but eventually shifted to Mint when I discovered I could not split a single expense into two categories in PC. I do like the concept of using both for the areas they excel in.

Norm in Texas

Great read. I hacer up on mint and went to ynab because it gives debt payoff recommendations and debt free goals to. After 30 days of use it really kicked in with expense predictions to.

Thank you for the article! You’re writing is remarkably humble, inspiring and I’m about to open a personal capital account, come back to this site and ready another article:)

Side note- i just finished “the next millionaire next door” -is their a book club/recommendations area on this site?

Thanks so much!

Check out the book reviews category.

I have been an avid user of Personal Capital fr about two years. Recently it stopped accurately updating one account that it never had trouble with before. I’ve notified them multiple times and they have yet to provide a solution

“And now let’s say somebody actually managed to get into your Mint or Personal Capital account. Because the software is just viewing your account balances, and not actually doing anything with them, our thieves wouldn’t have a lot to do.

In that, you could say using Mint or Personal Capital is actually safer than logging into your online bank. Whereas if somebody hacks your online bank, there’s the very real possibility that they can transfer money out. If somebody hacks your Mint or Personal Capital, all they get is a peek at what a diligent saver you’ve been!”

–Thinking a bit deeper on the safety of Mint and Personal Capital. The concern is not around someone logging into a Mint or PC account itself, since both are ‘viewing’ applications. Rather the risk centers around a hacker gaining access to the logins/passwords for accounts linked to one’s Mint or PC account. Once the logins/passwords are retrieved, a hacker could then attempt to clean out accounts. Both companies have encryption safety mechanisms, but so did Target, Capital One, etc. One must decide if the benefits of using Mint or PC outway the risks. Even when probability is low, a clear-eyed acknowledgement of risk is prudent.

I’m not a security expert, but when I looked into this a while ago, my understanding was that PC uses a linking system that doesn’t save those passwords. I’m sure an extremely sophisticated hacker might be able to find crumbs somehow, but it seemed tougher than you’d think.

Like you side, all about benefits vs. risks.

I use Personal Capital and Quicken. I haven’t figure out how to get decent reports out of Personal Capital at tax time, so I keep entering my data into Quicken too. I was hoping Mint would replace Quicken but I’m thinking, after reading this, that’s not going to happen.

My wife really likes Personal Capital’s information and formatting – she just logs into my account so that she doesn’t have to set anything up. I’ve added the estimated value of our vehicles & RV so that our net worth is quite accurate. Personal Capital syncs bank and CC information much better than Quicken does.

We definitely benefitted years ago from Personal Capital; I even changed our 401k accounts at my business because Personal Capital alerted me to the real fees, not the stated fees.

We get phone calls and emails every year or so from Personal Capital but they are always polite and not pushy. Because we’ve been saving for a new house and want to pay cash, PC is very insistent that we “have too much cash” but other than that, they really know their stuff.

My wife and I have been going back and forth between the two trying to figure out which best for us. We found this article at the perfect time. Thanks for your helpful insight. Budgeting and investment are our two major focuses. I think we’re leaning more towards Personal Capital after reading this, but if you have other suggestions, please let me know. Thanks!