What to hold… what to hold…

I’m talking about investments. Because what else would a money blog like this be holding? A fork? Ha!

If you’ve ever poked around my Net Worth Updates, you’ll notice that my Roth IRA mostly holds Vanguard’s REIT index fund.

In a world where everyone talks about stocks and bonds, a REIT is a somewhat unusual choice.

In fact, it almost always leads to some questions in the comments. Questions like this one, from Frugal Jon:

Quick question: I noticed that you have your Roth IRA primarily invested in a REIT fund. What’s the benefit of this fund over a stock index fund?

I realized it’d be easier, and more helpful to you, if I answered this common question with a fully-coherent post. (Rather than the underdeveloped, half-way coherent ramblings that I can barely muster via the abbreviated comment section.)

REITs in my Roths

Sounds like the title of a rap song, yo.

A quick refresher…

As of this writing, my ROTH IRA totals about $63,000. That $63,000 is broken down into about 75% Vanguard’s REIT Index Fund and the remaining 25% into Vanguard’s International Index Fund.

In other words, at any given time, I own upwards of $48,000 of this REIT stuff, which usually approaches about 10% of the total value of my portfolio.

What’s a REIT, anyway?

A REIT stands for a real estate investment trust.

Basically, it’s an index fund that invests entirely into companies that make their money from real estate.

Here’s Vanguard’s more official definition from the page of their REIT index fund that I invest in. (It’s called the Vanguard Real Estate Index Fund, ticker VGSLX.)

This fund invests in real estate investment trusts—companies that purchase office buildings, hotels, and other real estate property. REITs have often performed differently than stocks and bonds, so this fund may offer some diversification to a portfolio already made up of stocks and bonds.”

Let’s look at this claim a little more closely.

To do so, we can click the “portfolio” tab of VGSLX. This shows the fund’s 10 largest holdings, which include companies like:

- Public Storage – those big orange storage units you see everywhere.

- Prologis – An enormous company that owns “logistics facilities” aka warehouses. When you order that Amazon delivery, if it doesn’t come from an Amazon center, there’s a good chance it came from a Prologis warehouse.

- American Tower – a real estate company that rents out most of the cell towers in the U.S to the major cell phone companies.

In other words, REITs are a way for Average Joes like me to pretend to be real estate moguls.

Why REITs Pay Big Dividends

Vanguard’s description continues:

The fund may distribute dividend income higher than other funds, but it is not without risk. One of the fund’s primary risks is its narrow scope, since it invests solely within the real estate industry and may be more volatile than more broadly diversified stock funds.”

Let’s translate that part about higher dividend income.

REITs were established by law in 1960, and that law has an interesting quirk where, by law, those REITs have to distribute 90% of their taxable income as shareholder dividends.

OBJECTION, your honor!

Except not, because paying out 90% dividends is crazy high, and a cool benefit to shareholders.

For reference, many companies in the S&P 500 don’t pay any dividends. Of those who do, the average payout ratio for the past hundred years is somewhere around 50-60% of income.

So in the world of stock investments, REITs paying 90% is definitely high.

Why would a REIT want to pay so much dividends?

Well for one, it’s the law, at least if you want to be a REIT.

But that begs the question… why would any company want to be a REIT, if they’re just going to distribute away all their earnings?

One word: taxes.

By law, when a REIT distributes their profits to shareholders, the IRS doesn’t tax those profits.

This is awesome for the company. They can go on running their business, mostly tax free, as long as they distribute nearly all of their profits back to their shareholders.

Of course, the government, never one to miss an opportunity for taxes, does eventually collect tax on those profits. They just do so by taxing individuals on the REIT dividends they receive.

Specifically, any REIT dividend income you receive is taxed as ordinary income.

Quick example:

- Say I invest $10,000 in Vanguard’s VGSLX.

- At current rates, the REIT should pay me about $250 per year in dividends.

- BUT, those dividends will be taxed at my ordinary tax rate of 24%.

- Run the math, and my $240 dividend check gets whittled down to $190 after the tax man gets his cut.

That’s kind of brutal.

Especially when you consider that dividends from all stocks besides REITs are usually taxed at the “qualified dividend rate” which for most people (me included) is just 15%.

But what if…

Avoiding brutal taxes by holding REITs in a tax-advantaged account

The bogleheads talk about something called tax-efficient fund placement.

The idea is that for “tax-inefficient” investments like REITs (and more commonly, bonds) you should hold them in accounts that are protected from taxes.

Usually, this means retirement accounts.

Like, a Roth IRA.

In a Roth IRA, you don’t have to pay taxes on your investments’ earnings.

So in the case of a REIT, instead of your dividends getting taxed at 24%, they get taxed a big fat 0%.

Sign me up!

But it gets better.

In an efficient stock market, the market should price in the effect of taxes. Meaning that if everyone knows REITs dividends will be subject to high income taxes, then the price of REITs should be less.

This makes sense. Imagine you have the choice between two investments.

- Investment A: Pays you 5% dividends, subject to a 15% tax rate

- Investment B: Pays you 5% interest, but is subject to a 24% tax rate

If you were any kind of rational, you’d pay less for Investment B since you’re going to pay twice as much taxes on it.

As all investors come to this decision, the market en-masse makes the tax-inefficient stuff cheaper to invest in.

But if you choose to hold that tax-inefficient stuff (like REITs) in a tax-protected vehicle (like a Roth IRA) you’re basically getting the discounted price, without any of the drawbacks!

Why REITs in Roth is the ultimate loophole

What I just explained is true for any tax inefficient investment.

But REITs kick the advantages up a notch.

Why?

Because the REITs, as a company, are barely taxed on their earnings.

Normally, an extremely tax efficient company will be an extremely profitable company, and so the stock price should be higher.

But REITs distribute over 90% of their profit, before any taxes are paid, remember?

In other words, if you hold REITs in a Roth IRA, you are getting paid money that’s never been taxed, in an account that will never have to pay taxes.

This might be the only completely tax-free money in the history of time.

How much does this little quirk matter?

Admittedly, not a ton.

But in theory, these little tricks should boost the expected lifetime return of your portfolio. That said, it’s also not clear how efficient the market is, especially when we’re talking about bizarre layers of taxes.

But in any case, if there’s a free lunch available for taking, so I’m gonna grab it!

Final Conclusion – The 3 Reasons I Hold REITs in my Roths

To wrap it up, here’s my three biggest reasons for this somewhat unusual investment.

- Diversification – REITs are real estate companies, and I like that this is a different asset than the businesses that dominate the rest of my portfolio.

- Tax Efficiency – By holding a REIT in my Roth, I can lower my tax rate on REIT income from 24% to 0%.

- Potential Market Inefficiency – Due to the weird legal structure of REITs, holding them in your Roth represents a direct, tax-free transfer of company profits unlike anything else I’m aware of in the investment world. In theory, this is a cool benefit, although it’s unclear and difficult to measure the real financial advantage of this.

Disclaimer: Nothing in this article is financial advice and is just my nonprofessional opinion. Always do your own research.

Related Articles:

Makes sense! Thoughts on holding REITs in a 401k?

I guess the thing is, if you want to get a passive income before the age of 59 1/2, keeping REITs in a tax advantages fund won’t help.

Sam

You should be able to withdraw a portion of the dividend from Roth ( less than what you have contributed ) as an income which should be tax free.

Despite the 10% penalty, the tax savings of investing in a retirement account are well worth it for early retirement. There is also a way of accessing gains from an IRA using substantially equal distributions, without paying the penalty. Not entirely sure of how to apply for this plan, but it’s worth looking into. I plan to retire early and I am maxing out my Roth IRA because the math works out in my favor.

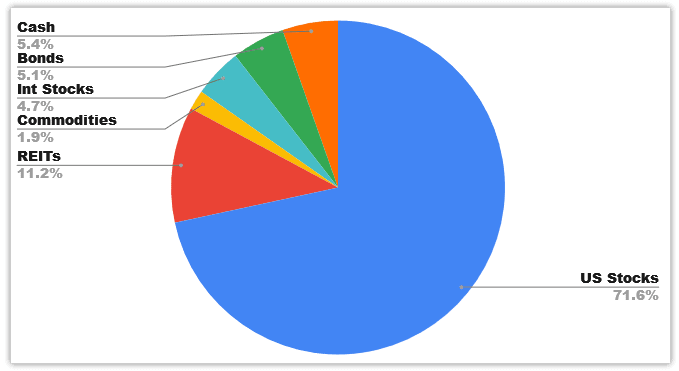

Great post! What is your allocation for REITS in your portfolio?

Thanks for the shoutout and for answering my question! Certainly gives some food for thought. This is something that I’m going to look into, especially since I have limited investment options in my TSP through work. Definitely a good opportunity to diversify more and I’m obviously a fan of tax loopholes.

I follow your thought process and it makes sense on many levels. However since often your Roth $$$ last as you decummulate, do you not want to put your historically highest earning assets in a Roth. Traditionally that will be equities. So in short, any thoughts on why REITs over equities?

Yep! I bought up all of our REIT holdings in both my Wife and my IRAs. And to Financial Samurai’s point, it may make sense to switch that out during drawdown, but tax savings, and the ability to better control taxes for the year is a huge plus.

My employee 401k and Roth does not have an option to invest in REIT funds. What is a good place to open a Roth that does allow that? Thanks

Check to see if you can open a self directed brokerage account inside your 401k.

Does the same apply to HSAs?

Super helpful post, thank you! One question: why 75% and not 100% of your Roth IRA?

“This might be the only completely tax-free money in the history of time” <— HSA contributions also come to mind 🙂

REITs are OK but they tend to periodically cut or suspend dividends and that slams the stock price.

Great Idea. I’m adding this to my Fawcett’s Favorites next Monday to share with my readers.

Dr. Cory S. Fawcett

Financial Success MD

Great piece!

I looked into this regarding bonds years ago. Similarly, bond income is taxed at the higher rate (I believe), so it makes sense to hold bonds in tax advantaged accounts too, right? My coworker challenged this assumption – saying that stocks will grow faster, so they will actually benefit more despite the lower tax rate on gains. The tax benefit is a lower percent (income tax vs 15%), but the actual amount of dividends is much higher in the long term. Of course, this is only true if you’re young and hold assets for a long time period. We did a few hypothetical examples and it seemed that he was right.

Not sure if REITs also follow this logic. Maybe they return a higher percent compared to bonds, so the tax advantage is worth it?

Either way you get diversification, so REITs seem like a good thing to think about more. Keep it up!