Earlier this month, the sun decided it was time retire Minnesota’s dreary winter clouds, and the leaves decided it was time to bud from the trees. I took the hint, got myself outside into some beautiful Spring weather, and began one chore I can actually get behind – Spring cleaning.

For this bout, I was tackling our gas grill. Long time readers might remember that two years ago, almost to the day, I picked up this beauty off Craigslist:

Total price? $40.

At the time, I boasted about what a steal I’d found. As I undertook the first true deep clean in my ownership’s history, I realized why the grill was probably so cheap…

Tons of inside parts were totally rusted out.

Whether I’d picked up a lemon or I’d caused its early demise due to a lack of maintenance, I’m still not sure.

Nonetheless, I knew what my next steps had to be. She was beyond repair, or at least any amount of repair that my unhandy self was prepared to deal with.

So, The Craigslist Grill and I said our farewells. As a last ditch effort, I put her back on Craigslist, this time for just $20.

I figured it was a lost cause, especially since I’d fully disclosed which parts were 100%, totally, completely… Rusted. Out.

To my shock, somebody quickly responded with interest. Apparently, he didn’t care about the rust one bit, and instead was interested in the working parts for a similar grill he had. He planned on scrapping the rest for metal.

As I rolled her to the curb, rusty parts and pieces literally began falling off one by one. A rusty screw here, a whole support beam there. I laughed at the dramatic disintegration, and then took solace knowing I was definitely not parting ways too early.

It wasn’t until the happy new owner eagerly handed me a $20 bill that I realized what just happened.

I’d just rented a $400 grill for $10 a year.

I’d looked up the grill in question when I originally bought it off Craigslist. It was a Char-Broil professional chef series, complete with dual-fuel and a whole bunch of other fancy features.

I’m not really sure what any of that means, but I could understand the price tag: $400, if I bought it new.

But I didn’t buy it new. I’d bought it for $40. And then I sold it for $20 after two grilling seasons.

On first glance, a rusted out grill after just two seasons might sound like a huge fail. And truthfully, it’s pretty close to a worst case scenario.

But what happened? For two seasons, I had a great grill that cooked up many-a-mouthwatering and perfectly charred steaks, chicken breasts, and roasted veggies. And it cost me just $10 a year.

Compare this strategy with the average consumer’s.

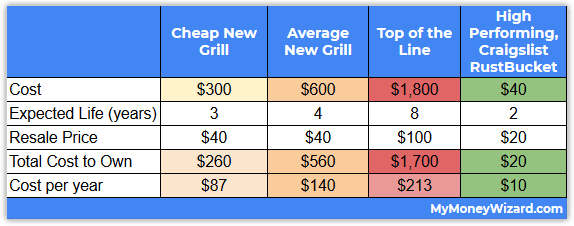

Take a stroll through any new grill showroom and you’ll see the cheapest new grill still costs an impressive $300. The average model seems to be about $600, and some go all the way up to $2,000 or more!

Now consider that the average American, who like me is apparently too lazy to do basic maintenance, replaces their grill every three years, according to Consumer Reports.

This means the average person is spending anywhere from $100 to $600+ per year to own their grill!

Here’s a conservative breakdown:

How to use Craigslist as a library for cheap (or free!) stuff

I quicky realized how often I unintentionally use this strategy.

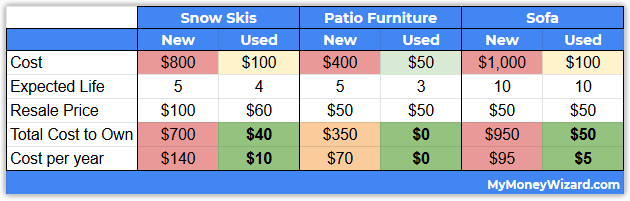

- Even though most snow skis cost $800+, when I first learned to ski, I picked up a used pair for $100. I loved them for four winter seasons, before selling them for $60.

- Total “rental” cost: $10 a year.

- Lady Money Wizard and I bought patio furniture three years ago for $50, and sold it just recently for $50.

- Total “rental” cost: Free.

- Lady Money Wizard bought a nice, clean sofa off Craigslist somewhere around ten years ago, for $100. She and I moved that thing around from apartment to apartment, before eventually selling it ten years later for $50.

- Total “rental” cost: $5 per year, for an item most people spend thousands on.

I could go on and on. (And we’re not even talking about taking this strategy to the next level level by flipping furniture for profit.)

The right way to think about the price tags for used stuff

How is this possible?

When you buy used, in most cases, whatever you’re buying is already fully depreciated.

Whether you use it once or use it until the insides rust out and you can’t even wheel it to the curb, in most cases, the change in price you paid versus the price you can sell it for in the future is pretty minimal.

Compare this to buying new, when driving the proverbial car off the lot results in an immediate and unrecoverable hit to the resell price.

This means that for used stuff, the purchase price isn’t really a purchase price. It’s more like a hold, or a deposit that you can redeem once you’ve finished using it.

This is huge.

Using this strategy at scale, you’re essentially buying everything for free. Played correctly, you can reduce your consumer spending to near zero.

Considering the average person spends thousands per year on stuff, this unlocks thousands of dollars for yourself.

Say you’re currently saving $15,000 a year, and you use this strategy to avoid two big ticket purchases, like a set of skis and a new sofa. That $2,000 saved is equivalent to getting a 13% raise at work! (Or closer to 20% if we consider income tax!)

That’s an extra 10-20% that could be saved and invested towards early financial freedom, or even just earmarked away from boring purchases and towards splurges that you actually care about.

Bonus: This strategy lets you enjoy $1,000+ luxuries for pennies.

Counter intuitively, this strategy often results in enjoying better stuff than if you were to buy something brand new.

That’s because high quality stuff tends to hold its value better than new junk.

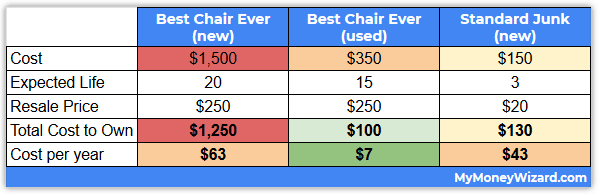

For example, when my hours upon hours of blogging meant it was finally time to upgrade my home office furniture, I was surprised to realize that I could literally buy the best, most comfortable office chair ever made for cheaper than if I went with a new “value” purchase.

Here’s the specifics: The Herman Miller Aeron is an office chair that costs an absolutely astounding $1,500 new. (Yeah, I couldn’t believe it either… until I sat in one…)

But interestingly, these chairs can also be had all day for anywhere from $250-400 used on Craigslist or Facebook Marketplace. And what’s even more interesting is that whether those used versions are nearly spotless or have a giant knife slash down the middle, they don’t seem to fluctuate much in cost.

So, I found myself a pristine refurbished one for $350. Because these things are made like tanks, they’ve got an average life expectancy of anywhere from 10-20 years. After which, I could just sell the chair for around $250.

Total cost to enjoy a $1,000+ luxury? $5-10 a year… which surprisingly, is far cheaper than some new, cheap piece of junk that won’t last half as long.

In conclusion, here’s the easy 4 step process to renting stuff for basically free…

I planned on continuing this post, but that’s literally it. The process couldn’t be easier.

The hardest part is avoiding the temptation to buying something sparkling new, and instead realizing that:

- Most things can look sparkling new with a little basic cleaning.

- Most new things don’t stay sparkling new for that long, anyway.

Oh yeah, to the 4 steps:

- Find a good deal on something used. I recommend scouring both Craigslist and Facebook Marketplace. Don’t be afraid to negotiate.

- Enjoy your stuff! Ideally for a few years. And for heaven’s sake, do some basic maintenance so it doesn’t rust out. 🙂

- When it’s time to sell, take good photos. Nothing drives the price of these online marketplaces more than the photos. A simple change in lighting can be a $100 difference between selling prices.

- Repeat for anything and everything you’d like to score for free or dirt cheap.

Happy Deal Hunting!

Related Articles:

I’ve thought about using this strategy to buy a nice used camera for a video series I’m looking to shoot. I don’t need the camera long and I’ve found it easy to flip items like this on Facebook Marketplace or Craigslist. Thanks for posting! I liked the numerical breakdown of the situations.

Fantastic post! I buy and sell used items regularly, but never looked at it from this perspective, which is really helpful. I’ve typically looked for low-cost items, which sometimes are not the best quality, tho still perfectly usable. I’m more inclined now to look at higher-quality items that might be a little more expensive on the front end but likely to bring more in on the back end.

Yep, the higher end stuff is where things can get really interesting. Good luck!

Thanks! Good luck on the camera search!

Excellent post sir! This reminds me of an Andrew Tobias quote which expounds on Ben Franklins famous proverb: “A penny saved is two pennies earned”. After taxes (on both the earnings and on the purchase) and tithing (if you are religious) you only keep roughly half of what you earn. But if you can avoid spending it in the first place, you keep 100%. As an added bonus, we can pat ourselves on the back for being environmentally conscious by keeping 2nd hand items out of the landfills until it has really reached the end of its useful life.

Very true, and good point about the environmental benefit. Our habit of buying nearly all furniture either from Craigslist or FB Marketplace has probably kept a few tons out of landfills by itself.

I love it. My wife and I have been doing this for years. We recently got an awesome deal on a stroller ($40) and later sold it for $80!

Getting PAID to use something. So awesome.

Just ran across your website, and saw this post which I really enjoyed. To play a small devil’s advocate here, do you factor in the cost of your “research time” in finding the object you decide to buy?

I only mention this as I’ve concluded that sometimes the amount of time I spend looking for a good deal, or perfect item ends up costing me MORE as that time spent could have been used to make me money in some capacity.

I now do a bit of quick upfront math before searching or researching to get an idea of how much time I’m willing to invest before just going with a purchase or walking away.

Curious to hear your thoughts…

True, and it’s a good point. Most of these finds take some time. They’re also usually 15-30 minutes away, rather than Amazon one click delivery.

That said, I don’t dwell on it too much. If you’re searching for deals when you should be working, that’s one thing. But very few people are truly maximizing their time, and instead spend their evenings watching Netflix and eating food. The “time is money” logic is usually just an excuse to be lazy or buy new. If you divert some of that wasted time towards deal hunting, then you’ve beaten the game.

Plus, searching for deals can actually be kind of fun and a form of entertainment by itself.

I buy used stuff a lot. My luxury sports car only cost me $7,000 and it’s as good as a new one for $50k. My iPad Pro and accessories were barely half price, as good as new. But I think your typical grill pricing is high. I have a grill I bought brand new from Home Depot last week, looks exactly like the picture of your used grill. Price was $180. I’d say average price for grills of that size, with a side burner, if you exclude Webber and a couple of other premium (over priced) brands is maybe $200.

Really enjoyed this breakdown. This is particularly useful for certain types of items that are sort of more niche. An example is bar stools. I had a year where I lived in an apartment that had a kitchen bar as our table. It’s a pretty specific type of furniture you need for that. Ended up buying two stools for $85. When I moved from that apartment, I no longer needed those stools. Listed them up for $90 and got them sold. So essentially I got paid to use those stools for a year.

Certain items really hold their value well too. Ikea furniture basically loses all of its value once it’s used once, but after that, the value of it pretty much stays the same. So like an Ikea coffee table, side table, dresser, etc are great to buy used.