Being rich and being wealthy… same thing right?

WRONG.

Most people don’t realize this, but the two have one extremely important difference.

Understanding that difference is huge key to reaching financial freedom. (And for fun, learning how your average teacher can be wealthier than an NBA All-Star.)

We’ll get to that mind-bending comparison in a minute, but first we’ve got to start with two important definitions.

The definition of rich:

You probably don’t need anyone to explain this to you. Rich people have a lot of money. Duh.

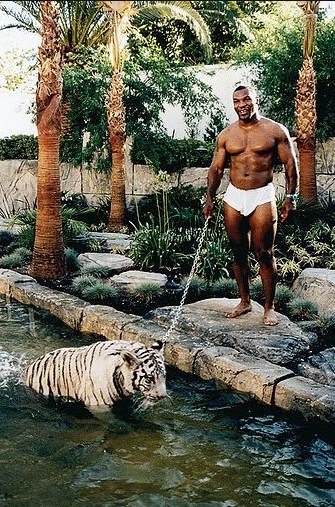

Rich people also have a lot of rich people things – fancy clothes, fast cars, and if they’re Mike Tyson, maybe a tiger or two.

A doctor is rich. An actor is rich. A professional boxer who just cashed his $25 million pay-per-view check and is ready to add a giraffe to his tiger collection is definitely rich.

The definition of wealthy:

Here’s where it gets interesting. Wealthy people have a lot of money too, but they may or may not have the in-house menagerie.

That’s because wealthy people have something that doesn’t necessarily come with being rich.

They have time.

The subtle difference between being rich vs. wealthy

Did you catch the difference?

It’s kind of like when your mind was blown in fifth grade math class, and your teacher told you that all squares are rectangles, but not all rectangles are squares.

All wealthy people are rich, to some extent. (At least, they could choose to be if they wanted to.)

But not all rich people are wealthy.

That’s because building wealth, not riches, is another step up in the game of money.

Level 1) Getting Rich

Getting rich comes first. And in most cases, it’s mostly a game of following the crowds.

You go to a good school, accept the highest paying job, and devote your life to a career.

Of course, there’s a few alternate paths. Maybe you’re born with the ability to punch harder than anyone in history, and before you know it, you’ve got a $25 million fight purse falling into your lap. Or maybe you win the lottery.

Isn’t that how all the lottery winners always phrase it? “I’m gonna win that lottery and be rich.”

The strange part is that for most, getting rich enough to impress your neighbors comes mostly from either taking advantage of a break or floating through life, doing the best at whatever you’re told.

But here’s the problem. Unless they’re one of the previously mentioned lottery winners, most people are actually trading their time to get rich. They work long hours, devote themselves to professional certifications, and then work even more long hours.

They trade all this time for rich incomes. And they use their income (aka converted time) to buy things that most often, require even more time. A big house, a fancy car, a boat or two. Before they know it, those rich purchases have addicted their owners towards a dependence on a specific income level.

So they continue trading more and more time to maintain their “rich” status. But without ever stopping to build wealth, they’re still stuck on the never ending spin of the hamster wheel.

Level 2) Kicking it up another notch, and using your riches to build wealth

As Robert Kiyosaki says, wealth is measured in time, and not dollars.

Wealth builds time.

Certain people become rich overnight, or even accidentally. Nobody gets wealthy on accident.

That’s because unlike getting rich, building wealth requires even more careful planning. It requires critical thought, and breaking free from the norm. To get there, you have to look around at your surroundings and actually plan for the future.

This stops most rich people right in their tracks.

Someone focused on building wealth might trade their time for income like everyone else, but the wealth builder views it as a temporary sacrifice. Because they’ve broken through the rat race of riches, they find a higher purpose for their time for money exchange.

That purpose? Using their income to invest into building wealth. (And buying time.)

They put their money to use not on fleeting materialistic junk, but into productive investments. Those investments start working for their owners, spitting off more and more income, which only serves to buy their owner even more time.

Instead of increasing their spending requirements, they’re building themselves a fortress of security. The wealthy person is giving themselves options, while the rich person is only cutting their options down.

How a school teacher can be wealthier than a professional athlete

In 1996, Antoine Walker was drafted as the sixth overall pick in the NBA draft.

Also in 1996, Sally Teacher just graduated from the same college as Mr. Walker. Unlike Antoine, she could barely dribble a basketball, and nobody knew her name.

While Antione was busy getting showered with praise and signing his million dollar signing bonus, Sally Teacher was unceremoniously accepting her first job at an elementary school, making just $40,000 a year.

Over the next 13 years, Antoine Walker went on to win an NBA Championship and become a three time All-Star. In that time, he earned over $108 million dollars.

Antoine was balling in more ways than one. He was rich!

During the same time period, Sally Teacher settled into her teaching position. After the first year on the job, she married her high school sweetheart, also a teacher. The two climbed through the school system together, gaining modest cost of living adjustments along the way.

Unlike Antoine’s $10 million a year in earnings, they brought home just $50,000 a year. ($100,000 combined between their two salaries.)

While Antoine spent his time buying $400,000 cars, flashy jewelry, and not one, but four different homes, Sally Teacher and her husband lived frugally on just $30,000 a year, investing the difference into a basic 3 fund portfolio.

While they didn’t get the benefit of a quarter million dollars worth of bling-bling, they still enjoyed a happy home, delicious meals, and plenty of travel during their summer vacations.

You can guess how this true story ends.

In 2009, Antoine Walker was arrested and charged with three felony counts for writing over $1 million in bad checks to Las Vegas casinos. (True story)

By 2010, he was filing for bankruptcy. (Like 60% of former NBA players) The court records show he had Total Assets of $4.3 million, which sounds great until you realize he also had $12.7 million of debts. The situation was so bad, he couldn’t even afford the fee for his bankruptcy attorney. (He got his friend and teammate Nazr Mohammed to foot the bill.)

By 2011, Walker had nothing.

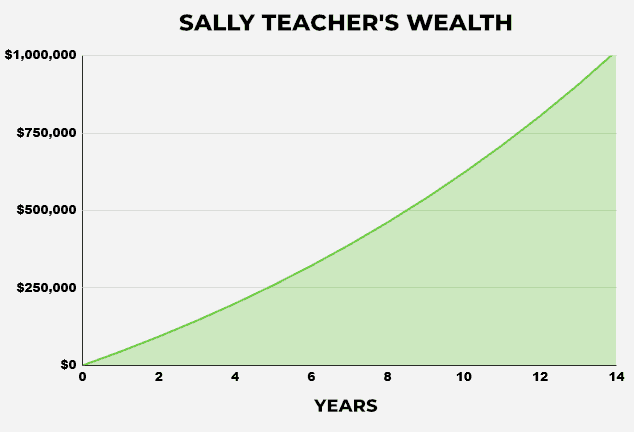

Sally Teacher? Her and her husband had been slowly but steadily building wealth while Walker was writing all those checks. Their $45,000 of savings each year for the past 14 years had earned 7% in their portfolio of index funds.

Total account balance? $1,014,772.

Measuring true wealth

Sally Teacher and her husband didn’t just end this story with $1 million more than Antoine Walker (despite earning about $107 million less than him).

No, that $1,005,160 of wealth is enough that using The 4% Rule, they should be able to withdraw 4%, or about $40,000 per year, forever.

Considering that’s more than their entire annual spending, they’re now completely free.

Antoine Walker was rich.

Sally Teacher is wealthy.

Oh, PS – you get a bonus if you’re wealthy, too.

In case this inspiring story/cautionary tale wasn’t enough to convince you, here’s the icing on the cake.

In the United States, the government punishes you for being rich.

That’s because you’re taxed based on your income. The richer you are, the more you pay. The richest portion of the population must pay the government a shocking 37% of their earnings.

By comparison, the government rewards you for being wealthy.

Your wealth, by itself, is taxed at 0%.

Most interest you receive on that wealth (usually known as “qualified dividends” if it’s paid from a stock or index fund) is taxed at no more than 20%, no matter how wealthy you are. If your wealth is tied up in real estate, that property tax rate is even lower, and most rental income can be partially offset with generous deductions.

In fact, a savvy person who’s devoted their life to building wealth, not riches, can actually earn $101,200 per year and pay ZERO taxes.

Feeling motivated to get wealthy yet?

Related Articles:

Long time reader, first time commenter – thanks for all you do, Money Wizard!

In the hypothetical about Sally Teacher, what kind of accounts were her three fund portfolio held in? If she started teaching at the age of 22, let’s say, and was a millionaire by age 36, would she have invested most or all of her money into an IRA so that she could withdraw contributions tax-free beginning at age 36, or would she have used the five-year convert-401(k)-to-IRA loophole to start withdrawing from her 401(k) account before retirement age, or would she have used some other kind of account(s)?

All valid possibilities. It’s just a hypothetical example so there’s no exact answer to your question. Running the numbers I made the upfront assumption it was all just after-tax savings. If she took advantage of 401ks, employer matching, IRAs, etc. she could have hypothetically saved even more.

No such thing as a 5 year convert 401k to IRA loophole.

Hi Steve! What I meant is the Roth IRA conversion ladder described here:

https://www.moneyunder30.com/roth-ira-conversion-ladder

Fantastic TRUE story. I have a nephew who owns his own company. He and his family go on lots of vacations, buy fancy new electric cars, buy expensive groceries, never look at price tags on anything. They do not own a house, they do not own their vehicles. They rent ($3000 per month, Southern Calif.) they have car payments, credit card payments, even “let’s share a plane” payments (yes he went and got his pilots license) But, if he or his wife were ever to become sick or disabled, they have nothing saved, no retirement….NADA. They would have to go live with a relative.

Thanks for the article

Tracy aka

americanseniorcitizen.com

Sounds stressful. Always want to be building wealth, not just riches!

Great post. This post really resonated with me given my current situation: I recently decided to leave a Sr Manager position in the international trade industry (salary was $145k per yr with 12% annual bonus based on salary) for a data manager position at a top tier university working in their social sciences dept (I have a BA and MA in economics). The pay cut is substantial… about half of what I make now. At age 35 (older generational millenial) I realized I value time/leisure over everything else at this point in my life. Time, specifically as it relates to 1) spending it with my family, and 2) traveling more for pleasure rather than for work. I also wanted to avoid burnout at my age. Luckily, outside of our 15 yr mortgage loan, my wife and I paid off all of our debt within the past 5 yrs which allowed me to enter a new career path at lower pay. Essentially, I’m thinking long term and I’m now excited for what the next 30 yrs of my professional career holds (first time I’ve ever been able to say that). Plus… there’s quite a bit of opportunity to move up within the university if I choose to do so. With slightly better benefits at the university position, no international travel (very grueling… surprisingly) and no more being “on call” with ridiculous long hours week in and week out, I’ve decided to choose a path of building wealth at a slower rate (while doing something I enjoy) compared to grinding long hrs out week over week with the higher pay. Only thing I’ll be sacrificing is buying material goods that I never needed to begin with…. which was always the tendency with the higher paying gig that I had.

Congrats on the change! Hope it works out!

To be fair Sally Teacher had half because she split it with her spouse.