So you’ve finally got some cash. Awesome!

And you want to make some money with that cash. Even better!

Maybe you’re looking to build up a safety net. Or you’re in the market to buy a first house, but it’ll still be a few months until you’ve got the full down payment saved up. Or maybe, you’re still a little hesitant about jumping headfirst into the stock market, so you’re wondering what your options are to earn some easy money.

Well good news, because today we’re going to look at my favorite strategies for making cash with your cash. Cha-ching!

Before we get started, you know there’s always gotta be a disclaimer… So, all investments carry risk, I’m not a professional advisor, and everything in this article is my opinion. Make sure to do your own research prior to ever investing in anything.

The Wrong Way to Invest Your Cash

The worst way to invest your cash is, unfortunately, also one of the most common. When most people think about holding cash, they envision opening up a checking or savings account and stockpiling all their money in there.

This might have been a viable strategy back when your grandparents were growing up, but with all due respect, have you seen interest rates these days?

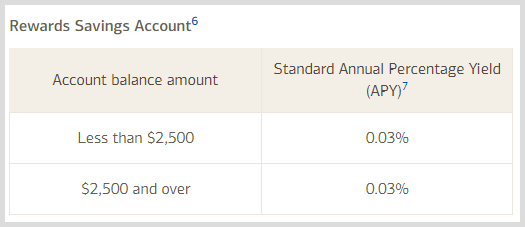

Here’s Bank of America’s “generous” rates on a new savings account today:

Yeah, that’s three one-hundredths of 1 percent. In other words, holding $10,000 in your savings account would earn you… wait for it… $3 a year in interest.

Yeah… this “investing strategy” barely ekes out burying your cash in the backyard. Doomsday-prepper style.

To be fair, traditional savings accounts shouldn’t even be considered investing. With annual inflation usually ranging anywhere from 1-3%, every single month you keep cash in a savings account like this, you’re losing money.

That sounds harsh, but it’s the truth.

This realization is one of the biggest hurdles in breaking the mindset of a beginner investor. It’s also a huge reason why I don’t believe in anyone, except maybe the most beginner of savers, to throw away nearly $800,000 over their lifetime on traditional emergency fund advice.

The Best Place to Invest Cash Right Now

Of course, there’s a better way. This list could be a whole lot longer, but today we’re focusing on my three favorite low risk options for investing your cash.

3. High Yield Savings Accounts

If investing in low-yield savings accounts is the wrong way to invest your cash, then why not find a high-yield savings account?

Sometimes the simple solution is the right solution.

You can always check whether your bank is one of the rare unicorns offering a higher-than-pennies interest rate. If you’re with one of the big box banks (think Bank of America, Chase, Wells Fargo) then the answer, at least in this environment, is probably a flat out no.

But not all hope is lost! Some smaller banks, credit unions, and especially, online banks, have begun offering higher and higher interest rates. Some of which are actually worth holding!

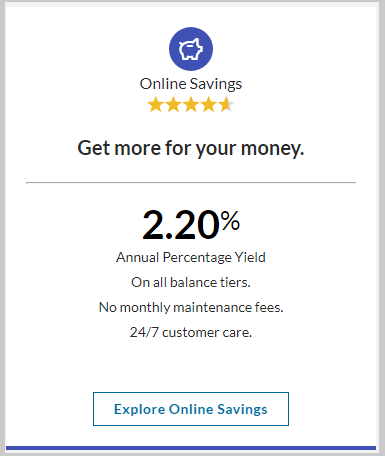

The classic and most popular example in this space is Ally Bank. As of this writing, Ally offers 2.20% interest rates on their savings accounts:

For a bank account, that’s a very attractive rate of interest. Sure, it’s a solid 4-5% less than what you’d expect from the stock market, but you’re not investing your cash to get rich. You’re investing cash for the safety and security that only cash-equivalent investments provide.

And on that front, a savings account is as safe as it gets.

Unlike other investments, a savings account balance will never fluctuate in value based on market movement. Instead, those savings will sit there like an indestructible piggy bank, earning 2.20% each year.

Savings accounts are also FDIC insured up to $250,000. This means that even if the bank goes belly up, the FDIC will reimburse your cash. And if the FDIC can’t reimburse you, well then we must be in the middle of a catastrophic nuclear war, and we’ve all got much more pressing issues to worry about.

High Yield Savings Account Pros:

- The safest choice on our list.

- FDIC insured up to $250,000, so a loss is nearly impossible.

High Yield Savings Account Cons:

- The lowest returns on our list.

2. Certificate of Deposits (CDs)

CDs act almost identical to high-yield savings accounts, with one big catch…

Once you deposit your cash into a CD, you’re not allowed to take it out for a predetermined time frame. If you do, you’ll get slapped with an early withdrawal penalty. The amount of penalty varies by bank and product, but typically it totals several months of interest.

All this to say, it’s probably not wise to invest in a CD unless you know for sure you won’t need the cash for a specified time frame.

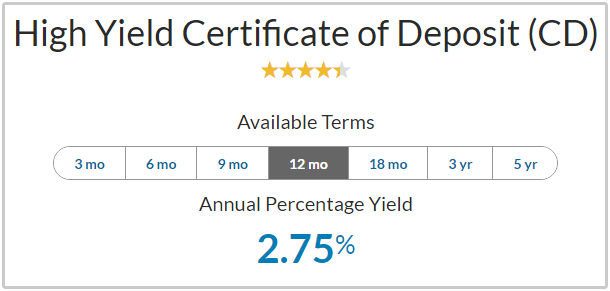

The trade off, of course, is that CDs often offer higher interest rates then traditional savings accounts. Ally, for example, offers CDs terms ranging from 3 months to 5 years, and offers interest rates ranging from 0.75% all the way to 3.10%.

In my opinion, CDs offer a very specific benefit to a very specific person, and it’s unlikely to be most readers of this site.

The coolest use of a CD involves having so much cash, that you buy several different CDs maturing at different times. This is called laddering CDs, and the strategy builds you a sort of DIY stream of risk-free income. Unfortunately, it takes a ton of cash to make this worthwhile, so it’s best for rich folks who are already retired and want a less risky option than the stock market.

For the typical Money Wizard reader, who’s most likely saving cash to build an emergency fund, buy a house, or just wants to earn some interest while waiting for some other investment opportunity, the CD’s lockup period is a pretty big negative.

What happens when you find the house of your dreams, and you’ve still got 6 months left on your CD? IMO, we can find a better balance.

CD Pros:

- Similar to savings accounts, are virtually risk free

- Also FDIC insured

- Can offer higher interest rates than savings accounts

CD Cons:

- Locks up your cash for a pre-defined time frame, and subject to early withdrawal penalties if you break those terms

1. Money Market Accounts (or my personal favorite – Money Market Index Funds)

Money Market Accounts are basically savings account on steroids. They usually offer higher interest rates than traditional savings accounts, for a few reasons:

- Money Market accounts usually require a higher minimum deposit

- They usually allow for less frequent withdrawals than checking or savings accounts

- With Money Market accounts, banks often invest your deposit into higher yielding vehicles, like CDs and government issued debt

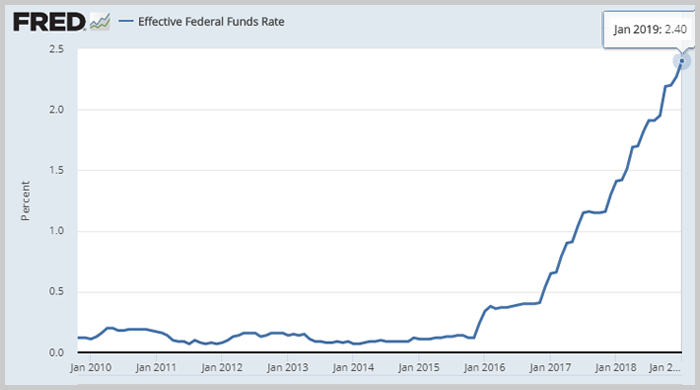

The last point is a big one. Because banks primarily invest money market accounts into government issued debt, the interest rate they pay you closely tracks the the US federal funds rate.

Why is this interesting? Well, over the past few years, the US Fed has slowly but steadily increased interest rates. Which has caused the federal funds rate to do this:

And as a result, most money market accounts have risen in step. So the strategy here is similar to savings accounts and CDs – check the Money Market account rates at your bank and invest accordingly.

But what if your bank, like mine, doesn’t offer Money Market account rates anywhere close to the federal funds rate?

Enter The Money Market Index fund.

Like the name implies, money market index funds invest in the same sort of things which bank owned money market funds invest in. (Mostly government issued debt and other conservative, short term investments.)

But what’s interesting is how much more stable these funds are than regular index funds.

While even the most conservative stock market index funds (and their even more conservative cousin, the bond index fund) fluctuate in price daily, money market index funds are managed so that their price remains exactly $1 per share.

In other words, they behave almost identically to the best money market funds. You invest however much above the minimum that you’re comfortable with, the fund’s underlying price stays solid as a rock, and you collect the fund’s stated interest rate.

(In finance, there’s always a caveat – so here it is: In very rare instances, the fund price theoretically could dip below $1. The last time this happened was in 2008, when certain money market index funds happened to invest in Lehman Brothers, the main financial institution tat went bankrupt during the crisis. As a result, certain money market index funds saw their price go from around $1 to around $0.97. That said, the two funds I’m about to talk about weren’t impacted.)

Where to get these glorious money market index funds? Well, let’s take a look at my favorite place for all things index funds – Vanguard.

Vanguard’s Money Market Index Funds:

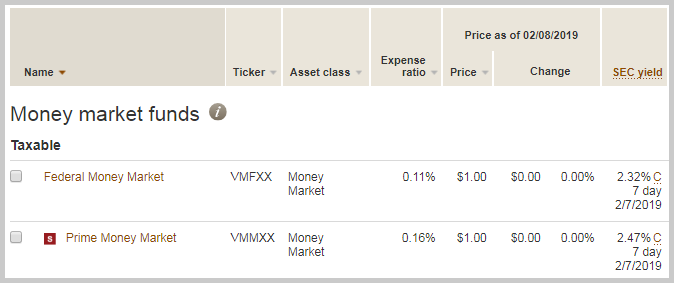

Vanguard offers two main money market index funds:

(They also offer a third called Treasury Money Market (VUSXX) which requires a $50,000 minimum deposit. I don’t have that kind of cash laying around, but if for some reason you do, it’s a great choice.)

The two are pretty similar overall, with two subtle differences:

Federal Money Market (VMFXX)

- Pays 2.32% a year after expenses, as of February 2019.

- Invests almost 100% into US government debt and obligations, which are considered the safest forms of investment. (See my previous comment about a nuclear war being essentially the only scenario in which the US Government defaults on its debt.)

Prime Money Market (VMMXX)

- Pays 2.47% a year after expenses, as of February 2019.

- Invests about 35% in the US Government, with the rest mostly invested in foreign governments. This is still considered about as safe as it gets, but foreign governments are obviously a little more risky than the United States.

Either of these funds have some attractive pros and cons:

Money Market Index Fund Pros:

- Some of the highest interest rates of all cash investments

- Extremely unlikely that the fund price ever fluctuates

- Still one of the safest investment choices anywhere

Money Market Index Fund Cons:

- Due to regulation in response to the last crisis, these funds are technically allowed to limit withdrawals in extreme times of financial duress. To do so, they’re allowed to either charge a 2% selling fee during an extreme crises, or they’re allowed to temporarily suspend withdrawals for up to 10 days at a time. To be clear, it would take another mega-market-meltdown and a few other rare scenarios for either of these unlikely events to occur, but it is a risk worth noting before you go throwing around your life’s savings.

My Personal Money Market Index Fund Strategy for 2019

In the past, interest rates were so minuscule that looking into these cash investments didn’t even matter.

But at 2.3 to 2.5 percent, money market index funds are finally looking attractive again. (Last year, I carried almost $20,000 in my checking account as I saved for a down payment. That could have earned $500 in a money market index fund!)

You can take your pick as to which specific fund you’re more comfortable with. Personally, I like the idea of a virtually risk-less US government fund, like Vanguard’s Federal Money Market Fund. (VMFXX)

I’ve taken the first steps towards my strategy with my 2019 Roth IRA contributions. To start the year, I transferred $6,000 to VMFXX. Over the next few months, I’ll enjoy the fund’s return while I finish transferring that money into more long-term investments within my Roth.

And remember, Vanguard doesn’t charge fees on funds purchased directly through Vanguard. Therefore, I see no reason why I shouldn’t funnel as much as possible from my checking account into these money market index funds.

With this strategy, instead of my extra cash sitting in a checking account getting eaten away by inflation, I can earn a cool 2.32% return while I wait to deploy my cash into a rental property, the stock market, or any other longer-term options.

Obviously, I don’t want to have the money earning just 2.32% forever. But as a temporary storage solution, the money market index fund sure is an upgraded piggy bank.

PS – Want to automatically track your cash holdings and avoid overpaying on fees? Personal Capital is my favorite financial software.

Related Articles:

Thanks for the tips/ideas on safer investments for cash. Agreed, all is much better than letting something sit in a checking or savings account.

Specifically, good to know about the money market funds. Last time I searched, most of the high yield savings accounts had similar, if not better, interest rates than the money market funds. Which made me questions why they even existed. Looks like you found some good ones that provide a 0.1-0.3% better return!

Money Wiz

I have my cash in Popular Online. It pays 2.36% I can withdrawal up to 6 times a month. Plus it’s 100% liquid.

Very timely article, as I’m in this exact situation. Are there any additional benefits to a money market fund vs a high yield saving account? It seems that after the .11% expenses the 2.32% dividend yield hardly outpaces the savings account. Is there a situation where there would be greater divergence between the savings account and money market index fund?

One thing to note – unlike Vanguard’s other mutual funds, the dividend yield you see reported on the money market index fund (2.32%) is actually AFTER the 0.11% expense fee.

Another additional benefit that I considered putting in the article but thought it might get too much into the weeds… Traditional high yield savings accounts are definitely correlated to general market interest rates, but at the end of the day, the interest rate they pay is ultimately a management decision by the bank. So it’s theoretically possible that interest rates could be rising faster everywhere else, while your single high yield savings account stays unchanged just because of any number of management decisions at the bank. (They’re no longer as interested in raising deposits, they’re looking to reduce how much they’re paying on the bank’s liabilities, etc.) Compare this to a money market index fund, which is broadly diversified in several different short term options, so the index fund should move directly in-step with whatever movement the general interest rate environment experiences. This could be a good or bad thing depending on the direction of interest rate changes.

It’s a subtle difference, since your bank hypothetically paying 2.0% on a savings account when there’s 2.50% savings accounts elsewhere isn’t anywhere close to a disaster. And if you really were worried about it, you could just open a new savings account elsewhere. I personally prefer the simplicity of the index fund route but your mileage may vary.

Hello Wizard! You are awesome! I tell my Financial Peace University students, “You don’t know anything about finances until you have 6 months of expenses in your emergency fund!” I tell them don’t even dare think for yourself until your there! But once your there now you can begin to think for yourself. We had a $27,000 emergency fund at one point but then funneled it off into our first stock purchase NFLX at $88 a share! Now I have $95,000 in a money market account (will look into the index and VUSXX Fund). Once people get to that point it proves them serious students aka Financial IQ (Rich Dad Poor Dad) and they will think for themselves and realize ya I don’t need $27,000 making 0.03%. Wizard your the best! Keep writing! B

Thanks, I might have to check that out. I’m with FBNO direct at 2.25%

CIT Bank also offers a 2.45% interest rate on its Savings Builder account, with either a $25K balance or $100/month auto-deposit. And it’s not variable like a money market fund, it’s FDIC insured, for those concerned about that sort of thing.

CIT also offers a decent rate on Money Market account, currently 1.85%. They are very aggressive in challenging and besting Ally and other competitive rate banks. We moved our cash there from Ally a year ago or more.

Cheers, great site, I’m new to finding you and am enjoying and appreciating the content.

Hello! Thanks for sharing. I came to the same conclusion and moved my cash to VMMXX last year. I was actually somewhat disturbed to find my fidelity cash management account (FDIC insured deposit) was paying out low rates you would traditionally see with a bank. It looks like they sweep the account from Wells Fargo, Union Bank, and Fifth Third getting the same low rates you might expect from bank like that. I just checked the rate and it is .37% as of today. Definitely an overlook in my part and I probably shouldn’t take it out on Fidelity by moving by funds out, but I didn’t feel like researching if they have any similar competitive options : )

Have a good Wednesday! Max OOP.

You forgot to mention that VMFXX is about 80% state tax exempt and VUSXX is 100% state tax exempt. That makes their Tax Equivalent Yield (TEY) even more attractive.

Is it better to be in a money market index fund or one that pays dividends like VTI, VXUS, VFINX, or a bond fund like VBINX. Just trying to figure out where to put my emergency fund. Thanks for any replies.

Trying to figure out that new WealthFront Cash account. They advertise 2.57 APY, $1 Million in FDIC insurance because they split up the money at multiple banks. Wealthfront appears to just be a broker. No fees, no minimum deposit, and unlimited free transfers; seems too good to be true. What are your thoughts?

It’s good to know that a CD is similar to a high-yield savings account. My brother has been telling me about how he came into some extra cash recently, and he wants to save it while gaining interest. I’ll share this information with him so that he can look into his options for getting some CDs.

I’m looking to invest but honestly I’m afraid as I’ve just lost my job and I have my daughters birthday coming and what she was promised is expensive a dont want to let her down as she has an illness which means she won’t live a long natural life so I need to do something but am scared incase I loose the rest of my money because u do hear stories about some really shaddy people am juse really sceptical as I’ve never done it before cld someone try to get back to me with anything that can reassure me n my partner. Thanks for your time