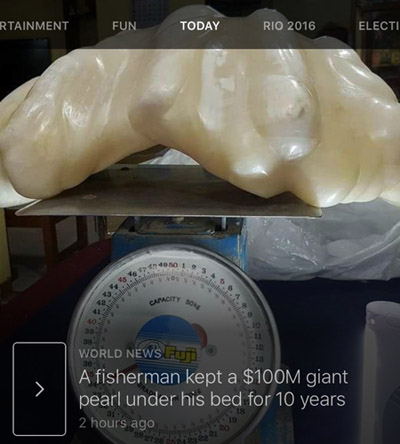

A few weeks ago, the financial world couldn’t stop talking about the old fisherman who, for the past 10 years, had secretly held onto a $100 million pearl… under his bed of all places.

Although the complete lack of any kind of safe storage for the largest pearl ever discovered would personally make me a little nervous, this fisherman probably slept like a baby on top of his $100 million pearl mountain. I mean, just take a look at this thing!

It doesn’t take a pearl expert to know that’s freakin’ huge, and worth a fortune large enough to ensure our fisherman never has to fish another day in his life.

Which means while this giant pearl was sitting under his bed, it was, by all accounts, the greatest emergency fund in history.

…I wasn’t impressed.

Okay, that’s a lie. A pearl bigger than a few bowling balls and weighing more than a small child is pretty damn impressive.

But think of the investment returns lost by leaving one tenth of a billion dollars underneath his mattress. The life he missed out on for 10 years. And the difference he could have made. $100 million is an unreal amount of money.

- Uber needed only $47 million to start an international tech powerhouse and overthrow the taxi monopolies of San Francisco, New York, Seattle, Boston, Paris, DC, Los Angeles, and London.

- The Republic of Palau, a small island country located in the Pacific, needs annual expenditures of just $97 million to run its entire country.

- $100 million dollars is enough money to launch over 500 different Subway franchise locations. That’s enough to generate $1 billion in sales revenue every four years.

Meanwhile, this pearl was sitting under the fisherman’s bed, doing nothin’.

Keeping this amount of money as cash, it would likely lose about 3 percent every year to inflation, or nearly 1/4 of its value every 10 years.

We’re talking nearly $25 million of lost purchasing power.

“Haha, crazy fisherman…” we all say as we glance at his story before moving onto the next topic to judge.

But what if I told you that you too might be just like the fisherman, sitting on a completely ridiculous amount of money? And that by doing so, it’s costing you thousands?

The Ridiculously Enlarged Emergency Fund

Let’s take a quick look at what most of the personal finance “experts” will recommend for an emergency fund:

- “Aim for an eight month emergency fund.” –SuzeOrman.com

- “It’s time to kick debt for good, with 3–6 months’ worth of emergency savings.” –DaveRamsey.com

- “Putting aside 3 to 6 months’ worth of expenses is a good rule of thumb, but sometimes it’s not enough.” –Vanguard.com

If we’re going to take generic advice like this, let’s assume some generic numbers. In 2015, the average American household spent $55,978 per year.

Which means by taking the common advice on emergency funds, the average financial expert is recommending a savings account which holds, at all times, right around $28,000. Cash, of course. Everything else is too scary for our experts.

If we take Suze Orman’s 8 month advice, we are looking at holding about $37,000 in cash! I don’t know about you, but where I come from, that’s an absolutely insane amount of money, so for our example we’ll round down to $30,000.

Let’s see how much a $30,000 emergency fund costs.

Peace of mind is priceless. Or maybe it costs almost a million dollars?

Protip: An Emergency Fund is for Emergencies

At this point I think it’s time to take a step back. It’s important to remember this whole thing is named an emergency fund. It is not named the “I plan on spending this money” fund.

An emergency fund is supposed to be the sort of last ditch rescue that’s only tapped into in the event of a catastrophic, life threatening… emergency.

We are talking the type of emergency where your appendix suddenly decides to rupture, and in your frantic pain you accidentally stumbled into a hospital not covered by your first layer of insurance. You know, that thing called health insurance that you’re paying an arm and a leg for every two weeks.

Or the sort of emergency where you lose your job, the economy crashes, and you’re out of work for months on end. And your employer offered no severance package AND you don’t qualify for any unemployment.

Or maybe even the sort of emergency where Alien overlords start reigning down fire from the sky, leaving us all poor, homeless, and enslaved.

The point is, you shouldn’t be expecting to ever need this stuff. The situations truly requiring an emergency fund are… emergencies, which means by definition they are the sort of once in a lifetime events where the stars align to screw you over.

Yes, we all have little and not-so little expenses that crop up. Car repairs, more expensive than anticipated doctor visits, and unexpected homerepairs can surprise even the most careful of planners. But if you’re doing it right, situations like these are covered by intentionally living below your means. A budget designed with breathing room is easily able to manhandle these annoyances.

Which is why permanently carrying a hoard of money for an unlikely once in a lifetime event makes no sense at all. Especially when you factor in today’s abysmal interest rates.

Look, I’m not saying emergencies don’t happen. I’m saying that we should recognize:

- Insurance is your primary emergency fund.

- If you really won’t be able to sleep at night, there are better options for an emergency fund than wasteful cash.

Two options for emergency funds better than cash

Home equity line of credit: It’s no secret that I think home ownership is overrated. But, one of the coolest benefits of this money hole is the eligibility for a home equity line of credit.

A Home Equity Line of Credit (HELOC) essentially works like a credit card in that the balance can be drawn upon and paid off, with interest only accruing on the loan whenever you maintain a balance. The big difference, however, is that interest rates on HELOCs are as low as 3.5% today.

Apply for a HELOC with reasonable fees today, let it sit, and be covered tomorrow. You’ll thank yourself for being such a genius pre-planner when your emergency hits.

Credit cards: Is it ideal? Absolutely not. But that’s why they call it an emergency. Depending on the date relative to your billing cycle, floating the emergency cost on your credit card can allow up to 60 days to search the couch cushions, pick up a part time job, beg your rich uncle, or sell your body before being charged a cent of interest.

Which will allow you enough time to sell some…

Liquid Assets: The Ultimate Emergency Fund

Probably the best part about controlling your spending and boosting your savings is that you’ll soon find yourself with all sorts of assets.

On the least liquid end of the spectrum, you might own some real estate, which can be borrowed against (hey, our HELOC talk coming full circle!) or eventually sold if times get hard enough. You might have some bond exposure, which is shielded from most market fluctuations and therefore less “risky” as an emergency fund. And you might have some stocks, which can always be sold quickly.

“But wait!” the personal finance ‘expert’ says. “You should never keep your emergency fund in stocks, because they are too prone to fluctuations and market swings!” Naysayers will then recite the dangers of the slim chance your emergency coincides exactly with a stock market plummet.

I call BS, and I’ll recite the dangers of the guaranteed chance of your cash emergency fund costing $800,000 over a lifetime.

Consider this: the 2008 market crash was the worst financial event in the past 70 years. Had you invested all your money on the highest valued trading day, and then your emergency required all of our money on the exact lowest trading day, your stock market emergency fund would still hold half of its value.

Emergency funds are financial training wheels. Fine for beginners, but eventually they will hold you back.

You’re not a novice. You’re a Money Wizard. And if you’re playing the game right, the idea of putting even more money into an unproductive savings account will feel like carrying along an inflatable life raft when you’re already swimming with a life jacket.

So, how much should I keep in an emergency fund?

Well, the only correct answer is however much you feel comfortable with. In finding that number, I just want you to consider the hundreds of thousands of dollars these cash emergency funds actually cost. They’re like insurance policies for things you already have insurance for.

Personally, I keep enough in my emergency fund to cover my credit cards and have $1-2,000 left over. Plus, because I live below my means, my monthly budget has a built in safety margin of around $1,000 which could be spent, rather than invested, if unexpected costs come up.

I sleep like a baby, and trust me, there are no $100 million dollar pearls under my bed.

Instead, I’m rocked to sleep by the wonderful thoughts of all my money invested, steadily working away to earn me hundreds of thousands of dollars.

Speaking of emergencies, why not take advantage of technology to manage your money like a pro, with Personal Capital? It’s how I track my whole portfolio.

Related Articles:

The emergency fund advice from the big money gurus are definitely meant to appeal to the lowest common denominator. People who are listening to Dave Ramsey and Suze Orman aren’t trying to retire early or become financially independent. They are just trying to get to retirement age with some money in the bank, collect their social security, complain about the government, and avoid catastrophe along the way. You can’t really get way ahead if you’re keeping a large chunk of your money in cash. But you can’t mess up that bad either if all you’re trying to do is get people to 65 years old.

I’ve also found that a lot of these Dave Ramsey folks from middle America are almost always single income households and not working in particularly good jobs, which again, leads to them recommending the giant e-fund. Again, you want the average, lowest common denominator person to avoid catastrophe and just get to the finish line.

Us in the PF blogger community are a little different. We’re typically in good jobs, we have skills. We can probably find new jobs if needed or create our own jobs if necessary. We’re saavy enough to figure out how to survive. And we’re almost all living well below our means.

I’m still building up my emergency fund just because I want to feel a bit safe, but I’m not cutting off my investments for the sake of the emergency fund either.

Great point FP, I definitely think a lot of their advice stems around just limping to the finish line.

I agree, Ramsey’s and Orman’s advice is geared towards appealing to the masses of people who don’t have any personal finance knowledge and need a jumpstart. It’s simplified advice to show that it really can be done by anyone. Many people are turned off from trying to learn about PF because it’s too “complicated” or “time consuming.” Once they get started learning more and taking the first few steps, they’ll ideally take more ownership of their situation.

I think Dave Ramsey and Suze Orman both have callers with generally above-average incomes; I think the call screening is intended to weed out low earners. And yes, I’ve also gotten the impression that DR’s callers tend to be one-income couples.

My “emergency fund” is my Roth IRA from which I can withdraw the contributions penalty free. If I need money quicker than that, I’d just use my credit cards and repay them after the 2-4 days it would take to liquidate some of the holdings in my Roth and transfer to my checking account.

Julian, good point about the accessibility of Roth IRA contributions. The only trouble would be building the Roth back up, due to the $5,500 yearly contribution limits.

So i d like to start investing and put at least some of my sleeping pearls into (hopefully) good use. Though i am planning on buying a house somewhere within the next three to five years. Everyone keeps telling me there s no point in investing if I cant part with my money for a period of at least 5 to 10 years. Are they right? Am I too late to invest? should I start after I ve bought a house and I am saving from scratch again?

It’s never too late to invest!

You bring up a good point in that your risk tolerance is important to consider, and how much you’re relying on the money is also important. Historically, a stock market investment has a 20% chance of losing money when invested for “only” 5 years. Although i personally like the idea of making money 8 out of 10 times, if this scares you, there’s nothing wrong with that. There are a number of safer investment alternatives for a 3-5 year time horizon. Certificates of Deposit, Inflation Protected Securities, and high quality bond funds are all “safer” options, albeit with lower expected returns.

Love the site! You have a lot of great content on here.

The emergency fund debate is certainly one that invokes a lot of passion from both sides (pro-emergency fund vs anti-emergency fund). I try to take a balanced approach to personal finance. The sad reality is those who need an emergency fund the most, don’t have one. The people who can afford to build an emergency fund (6-12 months in cash) probably don’t need all that money in cash.

What’s the solution? I put together a 5 step plan to building an emergency fund (http://www.ninjapiggy.com/blog/5-steps-to-an-emergency-fund-infographic). To summarize, people should focus on building a cash cushion. The larger the balance grows, the more a person can afford to start investing the cash.

Would love to hear your thoughts on my plan. Keep up the good work!

Hey Ninja Piggy,

Cool infographic!

6 months of emergency fund is a little too much for my taste, but I also probably have less to support than most (no family, mortgage, etc.) I like your idea of building up a cash cushion with the intent of eventually investing and reducing the e-fund to a few less months. This seems like sound advice for beginners.

Once those beginners get more comfortable and start designing their life to be low expense with a high savings rate, they can reduce the e-fund, knowing they have invested assets and have enough cushion in their take home pay to handle life’s surprises.

I absolutely agree with this philosophy! However, my wife does not. In the interest of marital harmony and her peace of mind, we have an emergency fund in a 1% online savings account). We have about 3-4 month’s worth of bare-bones expenses saved up and are contributing a bit more every month.

I’m 32, she’s 31, no kids yet, but they’ll be coming in the next couple years. Right now we’re both working, but she’ll be a stay-at-home mom when the time comes.

I’m aiming for us to hit financial independence sometime in our mid-40’s. My wife isn’t as driven to extreme frugality as I am, but I’m grateful that she’s more budget-conscious than most. We find a good compromise. Mortgage should be gone in 3-5 years, and we’re building up the brokerage and retirement accounts.

Just found your blog today via the Forbes article that showed up in my Twitter feed. Love your perspective and story from the few articles I’ve read thus far.

Karl, a wise man once said, “happy wife, happy life.”

As someone a little more recently removed from the dating game, take it from me – finding a spouse that is at all budget conscious is no small feat.

Sounds like you two have a solid plan, and financial independence in your 40s is incredible! Keep it up, and I’d love to hear your opinion in the comments more often.

LOL – amen – around here it’s mom/wife who is the frugal one after blowing it for years – I dug us out of debt, took away my husband’s atm card twenty years ago and put him on a cash diet. Only in the last five years or so is he really on board with it all because he sees the changes it’s made – he still spends money like water – but we’ve found balance.

Great article and has me thinking about what to do – we have three teens, no debt but a fairly short remaining low interest mortgage, investments, and a high income. And high expenses [though not close to our income]. We’re in our early 50s and have a 4-5 months of expenses tucked away [with cuts for luxuries].

But it’s in cash or almost no interest accounts.

It was very comforting recently when my husband lost his job. There was no hurry to take whatever he could get, but instead to find the right one – he now makes more money and is treated a kajillion times better [I was pressing to a change of jobs for several years! The universe apparently agreed].

So now that the waters have calmed a bit it’s a very useful thing to think about what is the best use of that EF – some will stay cash, but some can be in CDs at the very least, and perhaps I can find a way to lower the amount I’m holding so tightly to since I have real world experience in how much we really needed to go forward in a ‘crisis’. Thanks for the nudge, signing up for your posts 🙂

Sounds like you have a good handle on things cherie. Like you alluded to, it’s all about personal comfort level, but it looks like you’ve already proven to yourself that you’re comfortable carrying less cash than previously thought. Time to put some of that cash to work!

Our cash reserves are huge right now. But part of that is because we are taking a year long sabbatical and I am not sure what we want to do when it’s over. There are so many factors depending on the risk folks have, I think the 3-6 months rule just isn’t helpful.

I agree, 3-6 months is too broad. Like I mentioned in the article… personal finance training wheels that will eventually need to be taken off.

I love this! We only keep enough in our emergency savings account to cover 3-6 months’ worth of expenses. Everything else either goes straight towards debt, house equity, or investments. Otherwise it’s money that’s just sitting there, not doing a damn thing! You can’t grow your money if it’s kept in a cage out of your own insecurities and fears.

My husband and I struggled with this because he was quitting his full-time job to go to school full-time (2 years to finish his B.S.). I’ll be the only one working and he didn’t want me to stress about work. We ended up with increasing our emergency savings from $30k to $60k (I know — I was thinking that’s too much!) But he was right. Doing this allowed us to pay his tuition in full – no student loans, while having money leftover. (We also live in a high cost of living area.) My income covers of monthly expenses (if I contribute minimally to a 401k). While it hurts to think about not being able to invest the cash, I think, in our situation, it’s worth opportunity cost.

You may also put a portion of the emergency fund in fixed income securities and the other portion in stocks. For instance, 40% in fixed income securities and 60% in stocks. You only touch the stock portion when the kind of emergency consumes all the fixed income portion.

It depends on where you are placed in life. If you are struggling to make ends meet, building an emergency fund equal to 3-6 months of living expenses is a good place to start. Everybody needs a bedrock (pun unintended!) of security to build a retirement plan on. Clearly, you don’t need that bedrock to be a $100 million pearl, but leaving that outlier aside, the idea of an emergency fund for an average Joe or Jane is solid. Where one must grow out of it is when you have a sufficient investment portfolio where you are generating passive income (dividends) that cover your living expenses, then you don’t need a separate emergency fund. HELOC and credit cards also serve the purpose then as long as their ’emergency’ use is paid back soon.

I think several commenters are right on. Many, MANY people’s “emergency fund” is a credit card account with a 24.99% interest rate (which is used often!). That’s obviously no good. First, let’s encourage these folks to put away some cash so they don’t have to borrow money at Capital One rates every time a bill in excess of $400 comes along, which I think is what the pop money gurus are doing. (I don’t choose the $400 figure arbitrarily. 47% of respondents to a 2014 Fed survey indicated they lacked the cash to cover a $400 emergency expense.) With that done, we can move on to more ‘sophisticated’ ways to be prepared for emergencies.

I work in a industry where I have been unemployed a few times, due to circumstances beyond my control (entire building sold, 60 person research company closed). My emergency fund allows me to not wrack up credit card debt. I live frugally to begin with, but rent and power bills are still going to show up. I relocated for my last job, and the company paid, but some of the expenses I had to pay for and submit. I know I am not in the biggest center of this industry and next time I may have to relocate on my own dime. I am working on balance with savings emergency fund and investments to find what let’s me sleep at night.

I follow Betterment’s safety net philosophy: 40/60 stock/bond portfolio for emergency fund. I am comfortable with this volatility and it will keep up with the inflation.

Needless to say, this is one of the thing where “conventional wisdom” is not always optimal.

Interesting post. 2 things though:

1) Once someone spends less, 30k will be more like a 3 year e fund. 5k will be for half a year and that’s less than the deductible on your HSA eligible health plan.

2) That pearl ain’t cash, it’ll keep up with inflation and be very nice to fondle with.

Great read! Having a ton in your savings account really just isn’t that smart. Why throw away money?

Regarding the HELOC. Our home is paid in full. Would it benefit us to open a HELOC, take a large portion out and invest the money for 10-15 years?

I’m not a big fan of using borrowed money to invest in the stock market. Things can go south in a hurry if there’s a big correction.

I just found this website. I like it and am on the same path as many here. That being said, I am disappointed in some of the comments here. Elitism, haughty attitudes about “the masses”..everyone has a friend or family member that is not as advanced in their financial knowledge as they are. Perhaps those here that think so much of themselves could help those individuals. Teach them. Or, use some of your wealth and share it with others.

Your accomplishments mean nothing without generosity and compassion as your foundation.

Hi Lisa, I’m not sure which comments you’re referring to.

We’re usually a pretty supportive group, are you talking about something written by me in the article or someone else in the comments section?

The comments from Financial Planner and Matt Spillar are the ones that I find offensive. Nothing that you have written! I like your blog. 😉

This is interesting. Thanks for the opinion. Here’s a slightly different perspective. I assume since you don’t keep an emergency fund of cash (beyond a couple thousand USD), you pile it away into index funds. Probably predominately USA based index funds, and likely concentrated in the Dow or S&P or maybe the Russell. Putting most of your money into index funds when a market economy is in an advanced stage of a cycle and exchanges hands at 23x this years profits, then your going-in yield is about 4% (1/23). In other words, you’re buying the market’s return on equity of 12.9% but buying that equity(book value) at 2.9x (current P/B of SP500). You’ve got to be relatively confident that your going-in yield provides you with enough margin of safety to account for the cyclical nature of markets and economies. Or you’ve got to be relatively confident in your ability to extrapolate or predict macroeconomic trends. The return on capital of the S&P net of cash is 6.3%, but capital to American businesses isn’t free. So what’s their cost of capital? If their cost of capital is anywhere near that 6.3% (combined equity and debt) then obviously one cannot simply count on an expanding profits for that going-in yield to be bailed out by reinvestment growth unless you’re pretty confident at predicting macro market movements or trends. So, cash does provide some option value – ie a call option on anything that costs you ~4% p.a. for the time being. More importantly, think of how cash has performed during times when there are historically high valuations. When CAPE ratio is above 25x, cash has outperformed in the subsequent rolling 5-year periods 77% of the time. The CAPE ratio is 29x today. For the past ~30 years, cash has outperformed the market almost half the time over rolling 5-year periods. Having cash when assets are priced to perfection generally has not been a bad idea, although it MAY NOT serve one well over the near-term.

I’m not a market bear – really. I’m not saying get uninvested or predicting a crash, etc. I’m just saying and “emergency fund” costs a lot less at certain times than others. I just don’t think being as invested as possible specifically in indexes and advocating a small allocation to cash is always a good idea – and may not be so now. As with most things, it depends.

A few more in-depth thoughts on this here: https://poorbobsalmanac.wordpress.com/

I just re-read this for the 6th or 7th time. I waffle quite a bit on how I want to handle our EF moving forward. Previously I was fine with just $1k extra, but now I’m feeling like I want a bit more.

I was laid off in early February. We were still planning a wedding (which happened last month) and are in the process of building a home (which we’ll close on late this year). It was basically the worst possible time to get laid off. As the primary breadwinner, making about 75% more than the wife, that hurt.

The sting of that layoff and the stress it caused isn’t lost on us. We’re a dual-income household, no kids, and live off of the bigger of the two incomes – save 100% of the other. That flexibility does give us some wiggle room in case just one of us lost our job. I’d like to have enough saved up where we could use a savings account to buffer the difference between our two incomes for a couple months – about 5k.

Overall I think we’ll be relatively lean, because like you I hate the thought of the missed potential to make our money work for us. Realistically, I think the wife will want $10k minimum sitting there.

In the end it all comes down to risk tolerance.

Do you have taxable accounts invested in index funds? Those can be sold and turned into cash within 3 days. Between that and a second income source, you’ll probably be set for whatever life throws at you.

But like you said, it’s all about risk tolerance and it’s more of a personal preference. I could see how coming fresh off a layoff would make you more hesitant. And hey, no sense in being 100% perfectly optimized if you can’t sleep at night.

Yeah using a taxable account with index funds is what we’d rely on. It’s not ideal, but it gets the job done for things that are truly emergencies. For everything else, there are, IMO, better alternatives.

I think we’ll start at a bit higher of an amount and slowly scale down by a little bit each month, simply transitioning that money from earning next to nothing into index funds as part of our regular investment strategy.

I should specify: It’s not ideal if I need money TODAY. But few of life’s emergencies that I could foresee would require that money today in a way that I couldn’t cover some other way (HELOC, credit card, or cash on hand which will still be ~5k at any given time)

I’m building my emergency fund using Acorns: it grows a little each month with automatic round-ups that I don’t miss, sometimes I throw extra money at it, and it’s invested. And I can access it fairly easily.

I think you underestimate “Emergency.” I am so much in agreement t with Suze Orman and Dave Ramsey, my emergency fund is $30k in cash (cold hard $100. bills stuffed in my gun safe) and $20k in precious metal bullion. This in addition to an online high yield savings account with an amount equal to my mortgage balance. I’m not joking. Whit the shit hits the fan or a catastrophic emergency (as in medical emergency possibly) occurs, those doubters reading this comment would appreciate having a sizable emergency fund.

Two questions for you Kirk:

-Payment for medical emergencies is usually done over a 90+ day period. Why not keep that emergency fund in something like an index fund, which can be sold and turned into cash on hand in less than 3 business days?

-Does it ever bother you to miss out on approximately $2,000 per year in gains by keeping so much in cash? ($30,000 * 7% historical market returns)

I’m not putting down your position. We obviously have different risk tolerances, so I’d love to hear your perspective.

Hi,

I’d never use an index fund for emergency cash equivalent, sim9ly because I’m not optimistic about equities going forward. I feel we’re on the cusp of a top and/or a period of negative real returns from several asset classes.

The $30k I keep in cash is < .027 % of my liquid net worth, so on a relative basis, as a % of investable assets I’m not at all concerned about losing out.

Your liquid networth is about $111M. So I am supposed in a way you are following the advice from this post. Imagine if you have $111M and let’s say 50M that you have stays in cash, and the post would then advice you to actually invest that 50M since over the time, you will earn more money than losing that to inflation.

Wizard, I really enjoyed reading this post which to some extends is in line with my strategy of not having an emergency fund. The way I see it I have options in terms of buckets with money working harder than a regular online savings account. Some of these include Roth IRA contributions, 0% APR 18 months credit cards, Taxable account (40/60) and actually an online savings account (5% APY). I recently posted an article that’s very much in line with yours (https://www.ajourneytofi.com/i-dont-have-an-emergency-fund-and-thats-ok/) so feel free to check it out. Glad to see I’m not alone or crazy as some might think.

Also, the longer your 40/60 stay invested, the less likely it will dip below the invested amount, even followed by a market crash.

Hello there,

I really like this post. I started thinking the same thing as too much money in savings is not doing anything for you and should be put to work instead of sitting doing nothing. I recently wrote about this on my blog. Check it out here https://www.greenbacksmagnet.com/2018/01/01/money-lessons-learned-scrooge-mcduck/ Let me know your thoughts. Any comments are appreciated.

Thanks,

Greenbacks Magnet

“should be put to work instead of sitting doing nothing.”

That cash *is* doing something: protecting all your other assets.

Sorry, I agree with Suze here. In 2001 I was laid off and the dotcom bubble burst in the Bay Area. It was extremely difficult for even qualified candidates to find work. As a contractor, I had no severance package, and had just gotten married and had a $4k mortgage payment every month. Just 24 yrs old, I had very little savings. Only source of income was unemployment and my wife’s job, which were not enough to cover our expenses.

That’s the very definition of an emergency, and it CAN happen. Took me a month to find work, and that was considered lucky. And it was another contract (all I could find), and guess what, it wasn’t renewed after 3 months. It was amazing luck I landed a permanent job after that.

Lesson learned? Keep an 8 month emergency fund readily available, because disasters can and do happen. You don’t realize it until it happens. You have to do what you feel comfortable with, and I sleep well knowing that if something like that happens again, I’m covered.

Think of “that cash” not as an Emergency Fund, but as *your cash position*.

For me, enough cash to fund TWELVE MONTHS of lean expenses is just EIGHT PERCENT of my stocks+bonds+cash. We we go into another bear market, I can take some of that cash to buy some really low cost stocks and make a killing on it.

Money Wiz, just to add that although a stock position can “theoretically” be quickly turned to cash, in reality it is not so. Remember during the market crash, flash crush, etc. Markets were invoking “circuit breakers” …aka ALL trading was hauled, for hours and later days. It is not unforeseen that another hit to the Market may invoke an extended “no trading policy” as such you are stuck with digits on you monitor.