300,000 The average number of items in an American home.

80% Portion of items in our house we rarely or never use, according to surveys conducted by the National Organization of Professional Organizers.

100% Increase in consumption of material goods over the past 50 years.

1% The total material flow-through of consumption which is still in use after 6 months. That is, experts estimate 99% of the materials used for producing consumer goods are used up, thrown out, or obsolete within 6 months of purchase.

100% Increase in the number of self-storage facilities in the US from 1994 to 2004.

2.3 Billion Square feet of stuff in self-storage units across America. That’s more than three times the size of Manhattan.

21 Square feet of self-storage space per household in America despite the…

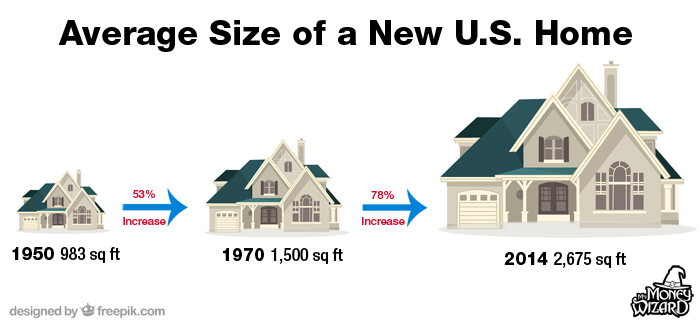

172% Increase in the average US Home size since 1950.

25% Of people whose two car garages cannot fit any vehicles inside them, because they’re filled with too much stuff.

3.7% The percentage of the world’s children who live in America.

47% The percentage of children’s toys consumed by American children.

12 The number of toys played with daily by the average 10 year old child, despite owning an average of 238 toys.

Step aside baseball – buying stuff and filling every available space with it has quickly become America’s favorite past time.

I’ve always been fascinated by our obsession with stuff. What is it that makes those cool little giftshop trinkets so irresistible? Why do our minds always race wild with the positives of new stuff, without ever considering the negatives?

And those negatives are real. Clutter, stress, and a surprisingly large hit to the bank account, thanks to the cumulative effect of so many small purchases, plus their ongoing maintenance and housing costs.

Tough love time: You can’t own the world. Just because you think something is neat, doesn’t mean you have to own it.

We’re not barbarians anymore. It’s okay to admire something without conquering it.

Do you view the Stonehenge wondering whether you should buy it? Or do you appreciate it for a few moments before moving on with your life?

So then why can’t we appreciate that funny t-shirt for a second, without needing to bring it home to an already overstuffed closet and carrying it around for the next 30 years?

(Or worse, using it for a short while before tossing it into the landfill with 99% of the other items we buy.)

You’d think running out of room in our homes would be the first warning sign, but never deterred, we build bigger houses. When that’s not enough, we park our cars on the street so our stuff can fill the garages. Still never enough, we rent more storage space for our stuff. After running havoc on our budget, only that uncomfortable feeling of running out of money can contain our stuff.

This is classic addiction behavior, folks.

Free yourself from this madness. Take a step back, and pare down. Breathe. Don’t you feel lighter already?

Becoming just a little bit more minimalist allows us to buy less, spend less, and stress less. Rather than our stuff getting lost and overshadowed, it allows us to highlight and appreciate those special things important enough to own.

You’ll free yourself from the burden of stuff, and you’ll find yourself free to live the life you want. With or without your stuff.

Related Posts:

- 14 Mind Blowing Stats About Clothes Shopping [Go Figure]

- When a Sale Isn’t Really a Sale

- Millennials Are Getting Screwed on Home Prices… Right?

Love when you show stats like this. It truly emphasizes the impact of clutter and how terrible it can be for people and the environment. The increase in new home size is INSANE though not shocking. Thanks for sharing!

The housing size might be the craziest stat of all to me.

I have a 3 car garage with so much space still available in it that for me it is a source of pride. The anti-clutter is what I call it. I have been actively and purposefully removing/donating items we have not used in 6 months. If you do’t use it then it is useless (at least to you), so give it to someone else to use.

I don’t understand clutter. My in-laws have no room for their 1 car in their garage because they are keeping things for us (the kids). We say we don’t want it but for some reason they just can’t part with their stuff. Craziness.

You’re an inspiration! Great point about usefulness; no sense in hoarding something when it can actually be used by someone else.

It’s absolutely stunning to me how much we’ve started using and buying in just the last 50 years. Most of the humans in history were able to survive with significantly less crap. It’s important to look inside ourselves and at our surroundings to understand what we truly *need*.

Love your point about comparing today to the rest of human history. Really puts it all in perspective.

This is a great book if you’re looking for some insight on how to de-clutter your house/apt. and the positive impact it can have on your life: https://www.amazon.com/Life-Changing-Magic-Tidying-Decluttering-Organizing-ebook/dp/B00KK0PICK/ref=sr_1_1?ie=UTF8&qid=1504021820&sr=8-1&keywords=the+life+changing+magic+of+tidying+up

I’ve heard good things, and it’s been on my reading list for a while. Thanks for the link!

One time, I was purchasing a necklace at a clothing store. They had a BOGO sale on jewelry but I didn’t want any other jewelry so I just bought the thing I did want. The cashier could not believe that I was turning down something that was “free.”

It really blows me away how people go crazy over FREE stuff. People constantly tell me, “But it’s free” when I turn down things. But I don’t want or need that t-shirt. I don’t want or need another pen with a hotel name on it. If you need that stuff, then by all means, get it for free if you can. But if you have no need or desire for that stuff, free can just create a lot of clutter.

I almost always turn down the junk freebies at events and fairs.

Everyone always acts like it’s somehow rude to pass on these freebies. I think it’s rude to invade my house with junk advertisements.

Exactly! Swag bags are my nightmare (except the ones given to me at food festivals because those are just delicious).

I read an article about this recently saying that baby boomers entering old age or dying is contributing to the amount of clutter and storage units. Millennials can’t afford houses to be able to store their parent’s hand-me-downs when they die or go into retirement homes and so a lot of the stuff ends up in land fills or in storage.

I’d consider myself a minimalist (I love the Netflix documentary Minimalism, you should check it out) and I actually got into minimalism first (biggest change was selling my car), before realizing that I could FIRE. Minimalism + FIRE = match made in heaven. People have come over to my apartment and said that it doesn’t look “lived in” so I bought some art for the walls, and a couple of plants but otherwise I only have the necessities.

Come to think of it, that was actually my path as well. I stumbled onto minimalism first, then learned it meshed pretty well with early financial independence.

When I lived by myself my apartment was pretty similar. One piece of art on the walls, a rotating plant I unsuccessfully tried to keep alive, and just enough to have the optimum amount of everything and nothing more. I enjoyed the quiet of it, and as a bonus I never stressed over messes or lost stuff.

Interesting point about the boomers, and thanks for the reminder about the documentary.

Good article, but I’ve noticed a huge boom in self-storage places in my area in the past 5 years, so I bet it has doubled or more again since 2004.

We follow a simple process of one in and one out. We regularly go through items to donate or throw away what we don’t use or wear anymore. Occasionally we have a yard sale for larger accumulations.

Today, my wife’s car parks comfortable in a 2 car garage and i could probably fit except for having too large of a vehicle for the garage. Meanwhile, my neighbors have garages (and sheds and houses) full of clutter.

We are building a home that has the right rooms for us, but is ultimately too big. It’s just shy of 2600 square feet for the two of us. Four bedrooms, an office, living room, amazing kitchen. We’re excited, but I worry that over time we’ll end up accumulating too much stuff. We go through our closets regularly and have moved a lot in the past few years, so we’ve kept our possessions relatively minimal. But now that we’re moving into a home, there’s a possibility that could change.

Thankfully we agreed that we’ll save my wife’s income – 100% of it – and only spend my income. We also agreed that we will not go into debt to buy stuff, and that any side hustle money goes toward a split of paying down the house (30%) and investing/saving (70%). This will kick in next-year; there’s some stuff we need to get this year figured out to host five guests for the holidays, and that’s unfortunate but won’t blow our budget – so all is good there.

That means that we’ll hopefully nip a lot of the clutter stuff in the bud; we just plain won’t be able to afford to do the things we want to do (like vacation, going out to eat, etc.) while also buying a ton of stuff with my income alone.

We’ll see how it pans out. I’m planning on watching that like a hawk. Heck, I might even consider renting out some of our basement and garage space to earn some extra money and make use of all the space we wouldn’t otherwise be using 🙂

What do you think about that freepik.com site you used for the home picture? They have some really cool free content it seems. I guess free if you show watermark? Anyway baller post. I don’t buy too much, but what I do buy I tend to hold onto for way too long. Need to get rid some of my books that I haven’t read in years.

Fascinating numbers. And how ironic – family sizes are decreasing (on average in the US) while single-family home sq footage is increasing as time goes on. So not just more junk… eh hem… I mean “stuff” we can waste…. but why not waste more space while we’re at it too.

I’m certain we don’t have any more than 290,000 items in OUR home! Seriously, though, this is very convicting. It’s making me think about the 80% of items we probably don’t use and how they could be helpful to someone else, or a way for us to raise some cash. Thanks for the article.