Well, it’s official.

The world is panicked, toilet paper is sold out, and the stock market is tanking.

It turns out, I’m not the only one that found this coronavirus stuff terrifying. In the days after I voiced some concerns, the rest of the world followed suit. It’s like everyone collectively realized worldwide pandemics are most definitely not a good thing. All at once.

The result was like a falling stack of dominoes.

First, Italy went from 30 confirmed cases to zero available hospital beds and a country-wide lockdown, in just 10 days. Then, Japan announced they were closing all schools for a month, amid rumors swirling that the 2020 Summer Olympics might be cancelled. Country after country followed, and the world locked down in a way we have never before seen.

But really, things seemed to come to a head in one particularly wild 24 hours.

Following the WHO officially declaring a pandemic (to which all of us following the situation since December gave a big huge “DUH!”) the NBA also suspended its season. (After a particularly twisted bit of karma, when NBA player Rudy Gobert tested positive, shortly after mocking the virus and doing his best to touch everything in sight… Which only managed to get him sick and spread the infection to his poor teammate, Donovan Mitchell, too.)

Oh, and Tom Hanks also tested positive.

Now… the world can be falling apart at the seams, but if there’s one thing that’s sure to get the attention of Americans, it’s cancelled sports and celebrity gossip.

Officially Entering a Bear Market

Almost immediately, the stock market fell 9%. Making the “worst” drop from a week earlier feel like child’s play. (That one took a 6 days to fall 10%.)

The plummet officially ended the bull market of the last 12 years. Now, we’re firmly in “Bear Market” territory, which the stock folks define as a 20% drop from previous highs.

But what seems to be making this bear market particularly panic inducing, aside from the fact that its driven by a Zombie-Apocolypse virus hell bent on killing us all, is the overwhelming speed at which it happened.

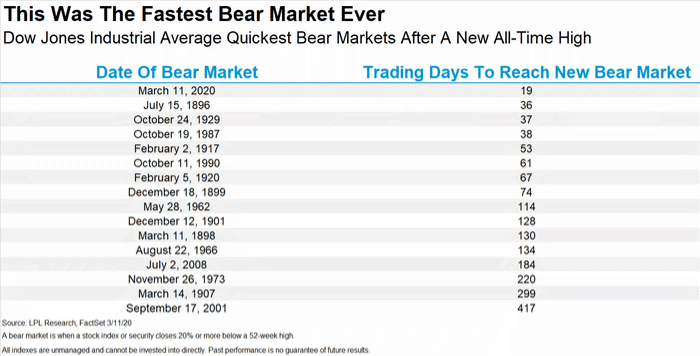

In fact, if the drop felt like the fastest ever, that’s because it was.

While even legendary Bear Markets like the 2008 Great Financial Crises took 150+ days to happen, this one hit the undesirable -20% milestone in just 19 days.

Absolutely insane.

So, what’s a Money Wizard to do?

Well, what if I told you there were two extremely simple ways to come out of this mess significantly ahead? No excessive risk taking or balls-made-of-steel trading needed.

Times like these prove how impossible timing the market really is.

First off, it’s worth addressing the elephant in the room.

In times of massively falling stock prices, most people’s first reactions will be to make significant changes to strategy. Specifically, they’ll try to “time the market.”

You’ll hear all about people selling early, to avoid the future pain. Or buying now, to take advantage of the reduced prices.

Ignore all that.

And if you’re still feeling the temptation, read back to my article showing how horrible those “smart” strategies could have ended during 2008.

Need more proof? You’re living it.

But you really don’t have to look back at history to see how difficult timing the market really is. Because we’re living it right now.

I mean, who would have guessed that after an 8% crash on March 12 and the declaration of a National Emergency, the market would… rally by 9% on March 13???

Yeah, talk about unpredictable. Good luck investing in the perfect bottom.

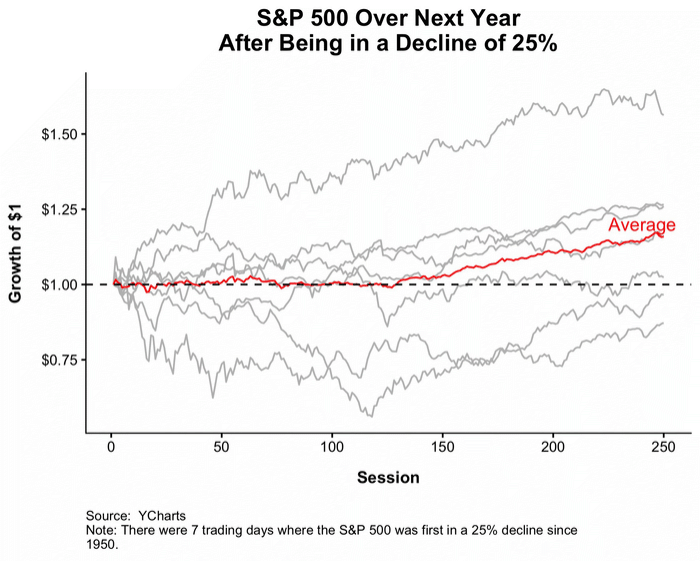

Here’s a chart from Michael Batnik and Nick Magguilli that shows just how unpredictable. After similar 20-25% falls to the stock market, history has shown us the next year has been as bad as -33%. But also as good as +50%.

(It’s also worth noting that the average is a 9% gain over the next 1-20 years.)

So is this the start of a true recession? Or are we entering into a V shaped recovery? Who knows…

Save yourself the stress. Because there’s two easier ways to gain from a falling stock market.

1. Dollar Cost Averaging

Dollar cost averaging is the simplest investing strategy ever, and also one of the best. (Warren Buffet recommends it to everyone who doesn’t read 1,000 pages of financial statements a day.)

All you do is define a set amount of money, and invest that money into the stock market at equal intervals.

For example, saying to yourself, “I’m going to invest $1,000 every month into VTSAX” is dollar cost averaging.

Then, each month, you do it.

Pretty boring, right? That’s the point!

Why it helps you profit during falling markets:

By nature, if you’re investing a fixed amount of money into an asset, that same amount of money will buy more of the asset when prices are low, and less of the asset when prices are high.

To continue our $1,000 per month into VTSAX example, let’s take a look using current data.

In February, VTSAX hit $83.79 per 1 share. After all the March madness (and not the fun kind) VTSAX is now around $66.14 a share.

That means that in February, dollar cost averaging $1,000 into the fund would have bought you only 11.94 shares, while your March contribution would have bought you 15.12 shares.

In a way, dollar cost averaging automatically allows you to “buy low, sell high.” Your contributions automatically take advantage when stocks are on sale, and are cautious when the market may be overpriced.

In other words, you’re “timing the market” without having to be right. Or even doing any of the legwork that usually accompanies a risky market timing bet.

BONUS: If you’re maxing out your 401k, you’re automatically employing a dollar cost averaging strategy. Because a set amount of money automatically gets deducted from your paycheck and invested every pay period.

2. Choosing an asset allocation, and sticking with it.

The second tried and true strategy is to choose a percentage of assets to hold, then check that percentage periodically and rebalance as needed.

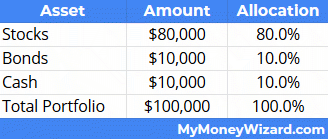

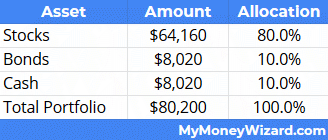

To keep things simple, we’ll assume you’ve got $100,000 and have decided you want to hold 80% stocks, 10% bonds, and 10% cash.

You invest during the market peak, at which time your asset allocation would look like so:

Then a market shock hits. Like oh, let’s say, the worst pandemic in modern humanity…

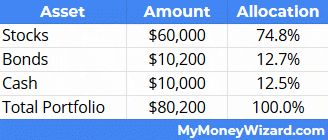

Seemingly overnight, the value of your stocks plummet 25%. Bonds moved in the opposite direction, as they tend to do, and went up 2%.

Your new portfolio values look like this:

How do you get back to your 80/10/10 split?

You have to buy some low priced stocks!

And to fund that, you’d deploy some of your cash and sell some of your now highly priced bonds. (Specifically, you’d need to buy $4,160 of stocks, which you could fund by selling $2,180 of your bonds and spending $1,980 of your cash.)

Your new portfolio would look like this:

Why it helps you profit during falling markets:

Yet again, you’re automatically and systematically buying low and selling high. As stocks fall, you’re buying more. As bonds rise, you’re selling at their top.

Congrats! You just achieved the type of sophisticated market timing that the market timers yearn for. Yet your profit was achieved not through stressing over daily debates buried in the Wall Street Journal, but from just sitting on your sofa and checking Personal Capital every month or so.

Conclusion – Don’t get caught up in the recession hype. Stick to the basics.

Times like these are especially trying. You’ll see your net worth falling, and you’ll hear all sorts of predictions.

Your job, if you want to come out wealthier, is to stick to the basics.

The exact reason the market provides higher percentage returns than so many “safe” asset classes is because of the type of volatility we’re experiencing right now. In finance, there’s no return without risk. It’s the price of admission.

If you keep calm and weather through that risk, you’re eventually rewarded with the return.

PS – I mentioned it earlier, but Personal Capital and its awesome free portfolio allocation calculators are extremely useful in times like these.

PPS – I’m not a professional and none of this should be considered financial advice. Everything on this blog is my personal, unprofessional opinion.

Related Articles:

Fantastic article, as always Wiz. Way to lay it out. Cheers to all the other money wizards out there. Hang tough during these tough times. When it’s all said and done, and things are back under control, we’ll look back and ask, “What did you do to make yourself better during these trying times?” I don’t plan on saying I panicked, or put energy into fear. Here’s to improvement in finances, in self, and in life. Be positive, and stay tough everyone.

Hi,

Thanks for the advice, very valuable as usual.

Question: do you have an active tax -loss harvesting strategy? And if so, how can you benefit utilizing it in this environment?

Thanks and godspeed..

One thing I would like to add – when the market is falling, CONTINUE to do the dollar-cost averaging/rebalancing you mentioned above, but if the idea of “discounted stocks” gets you excited – feel free to invest MORE than your normal dollar-cost averaging through, say, eating out less or taking on some freelance work, etc.

While I agree against holding back funds to time the market, it never hurts to invest more. Thoughts on this?

(Full disclosure – Paula Pant said pretty much this exact thing on a recent podcast.)

Yes, I agree 100%. It’s another reason why the lifestyle I advocate is such a cheat code. When you live below your means you can make changes just based off your cash flow.

So in the re-balancing allocation example, you probably wouldn’t have to actually sell any bonds and could instead just divert more of your monthly savings towards stocks. And like Paula is saying, you could also just live more frugally or find a way to side hustle. That’s a tool that people with weak savings rates don’t have, but a HUGE advantage for those who can make it happen.

What are your thoughts on lifecycle/targeted date funds and reallocating during this time? Most of my money is in lifecycle funds based on retirement age (though I don’t strictly go off of age and mostly off of the risk level I’m comfortable with). For example, here is one of the funds current breakdown:

Vanguard Total Stock Market Index Fund Investor Shares 53.50%

Vanguard Total International Stock Index Fund Investor Shares 36.00%

Vanguard Total Bond Market II Index Fund Investor Shares** 7.50%

Vanguard Total International Bond Index Fund Investor Shares 3.00%

Are these smart to stick to or do you recommend doing your own reallocating?

You’re a reasonable man my main man. Good points. Solid head on your shoulders. Me? I’m a wackadoddle. I bought 10X my normal buy in on the dip, but at least I can dollar cost average a lil at the bottom right? It’s weird, just given how long I’ve been buying in, I’m still way up, but it feels like I’m down. Life huh?

Hope you don’t end up having to work from home. That’s the real rock bottom. Very hard to get anything done imho.

Stay safe broham.

Everyone always talks about “re-balancing” but no one ever takes into account capital gains taxes, etc. That’s an important caveat to consider when doing it, as it’s not as simple as just moving money between bonds and stocks. I’d love to see an article getting into more detail with regards to this..

What a wild couple weeks. I just put another 13k to work today (bonus + tax return). Feels kinda wild throwing it into this insane market, but i know i would have done the same thing with that cash at January’s prices so now makes more sense.

For perspective. In ’08 (with the world panicking about the same amount, but the financial system is much worse shape at the start of the decline), down 28% (where we stand today) was about 60% of the way to the bottom. Are we at the bottom yet? Absolutely no way to know. Are we at the top? Absolutely not. I feel good about investing right now but i really don’t want to check my balance for the next few months.

OK about the first advice, but not on 2nd.

You know that everything went down, stock, bonds, commodities, gold ecc, during these times they tend to move in the same direction, and the correlation can even be reversed for long periods.

I have a friend that has been in cash for a long time (as you said timing the market is hard, he missed years of upwards trend), but now has decided to enter the market.

What I suggested to him was the dollar-cost averaging technique. I wrote about it here if you’re interested https://10yeartarget.com/how-to-invest-10000/

Very very great article.

Thanks for giving out the example of rebalancing the portfolio. I always heard people mention about it but I don’t really understand the mechanics behind the rebalancing. Keep on sharing!

Mat Kewangan