Earlier this week I published my monthly net worth update and got a reader question that immediately sent me barreling down the bumpy dirt road we call Memory Lane.

The question was innocent enough – what stocks had I invested in when I first started my investing journey?

Oh, man… could those stocks tell a story…

If I were writing a book, each one of those stocks could be big bold chapter, topping pages upon pages of lessons.

Some lessons good… some bad, but most highlighting the naivety of a young investor eager to become the next billionaire Wolf of Wall Street, then realizing – surprise, surprise – that becoming Warren Buffett is a whole lot harder than it looks.

Join me for a quick post down memory lane? (Just don’t laugh too hard…)

Young Money Wizard’s Investing Approach

Early on, my approach was pretty simple.

Somewhere along the way, I’d discovered that the everyone in the universe seemed to agree Warren Buffett was the best investor of all time. After all, he was the richest, and isn’t that how we measure the score of this game? Seems like it couldn’t get any clearer.

So naturally, I read everything I could about the guy. And I was especially ecstatic when Buffett conveniently revealed his whole secret to the world in the form of his investing manifesto.

According to Buffett, the best book on investing ever written is The Intelligent Investor by his college mentor, Benjamin Graham.

Graham touts the “value approach to investing.” Like most things Finance, the name is a little vague but the practice couldn’t be simpler. With value investing, it’s all about buying stock in good companies that are currently under-priced.

In his book, Graham explains this investing approach from every angle. Which meant that right there, in about 500 pages, was a complete how-to guide to becoming the richest person in the world.

And here I was toiling away with silly index funds… Time to beat the market!

How hard could it be?

Investing my life savings into 5 value stocks

So there I went, off to find myself some good, under-priced companies. (Me and a few million other investors…)

With a few thousand dollars of my teenage earnings and college savings, I started picking stocks.

And then waited.

After waiting for the last 10 years or so, here’s how those picks turned out.

1. Eli Lily

- Company Info: One of the biggest drug companies in the world, best known for manufacturing Prozac, Cialis, Methedone, and all sorts of other goodies.

- Original Investment: $2,000

- Investment Result, a decade later: $5,000 gain

- With dividends reinvested: $9,000 gain.

This was one of my first buys, back around 2008. At the time, the price was depressed, as was the rest of the entire stock market. So you could literally throw darts at a board and make a profit.

I guess it pays to be in the right place at the right time.

2. Uranium Producers

- Company Info: Uranium miner supplying raw materials to nuclear power plants.

- Original Investment: $2,000

- Investment Result, a decade later: $1,500+ LOSS.

I can’t even remember what the original name of this company was, which definitely isn’t a good sign.

That’s because I bought a few thousand dollars of this bad boy after the Japanese Fukushima nuclear meltdown. As you’d expect, nuclear power plants exploding isn’t good for business, and the price of anything even remotely related to uranium had plummeted.

Most people naturally assumed this mean the writing was on the wall for nuclear power. Young Money Wizard, on the other had?

“A PERFECT value buy!” I thought to myself at the time. Time to make uncle Warren proud!

“Once people get over it, the price HAS TO skyrocket.”

Turns out… it doesn’t. A decade later, nuclear power is still the black sheep of the “clean” energy world, this company literally went bankrupt, and I lost thousands.

3. AT&T

- Company Info: Cable & satellite TV company that eventually pivoted towards being one of the largest cell phone providers in the world.

- Original Investment: $2,000

- Investment Result, a decade later: $500 LOSS

- With dividends reinvested: $1,700 gain.

I bought this back when cell phones weren’t nearly as much of a third appendage as they are today.

At the time, a few fringe people had just started cancelling their cable TV packages in favor of this up and coming idea called Netflix, and the stock market was fearful for the future of big cable.

Another perfect value buy in Young Money Wizard’s eye. Unfortunately, even after rising to power as a huge cell phone company, the price of AT&T stock has actually declined, and my only investment returns have been from reinvested dividends.

4. Intel

- Company Info: Tech manufacturer whose processor chips can be found powering your computers and cell phones.

- Original Investment: $2,000

- Investment Result, a decade later: $1,500 gain

- With dividends reinvested: $5,000 gain.

I’d love to tell you I did all sorts of advanced analysis that lead me to purchase this stock. But I’ll be honest. I literally bought this stock because some guy, somewhere, wrote a really convincing blog post about why he thought it was a good investment.

Yeah… not the best investment thesis…

This profit looks impressive, but I’d have actually made more money in an S&P 500 index fund.

5. Altria

- Company Info: Big tobacco. They own Phillip Morris & the Marlboro brand, and have since expanded their empire of sins to include some of the biggest alcohol and cannabis companies in the world.

- Original Investment: $2,500

- Investment Result, a decade later: $500 gain

- With dividends reinvested: $5,000 gain.

For a while, this was actually one of my best investments. As it turns out, selling an extremely addicting product is good business, even if it makes you a bit of a scumbag.

But I think the world is turning on this. Profits lately have been down, and this investment definitely would have made more money in an index fund.

Final Result? Stock Picking Made Me $11,000 Poorer.

Man, that was painful. There’s some serious stinkers in that mix.

While the final profit might sound impressive, I’d definitely be tens of thousands of dollars richer today if I had just put my money into a basic index fund. (Not to mention all the time wasted doing my best Gordon Gekko impression.)

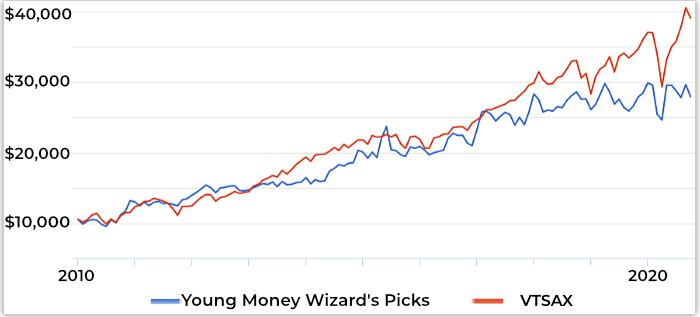

Here’s a graph comparing my investment in the companies I picked versus a broad index fund like VTSAX:

All told, my $10,500 investment grew to around $28,000. Which sounds great, until you realize an index found would have grown to $39,000.

But good news! When you’re investing, you can be wrong and still be right.

But here’s the most amazing part about this jaunt down memory lane:

Even though some of those stocks lost money, you know what would have definitely lost even more money? A new car. The latest headphones. A wardrobe of expensive clothes that’d probably be rotting in a landfill right now.

Instead, that little portfolio, picked mostly by a clueless teenager who was more focused on this week’s party than anything else, has still made me tens of thousands of dollars.

Nearly $20,000 gained on a $10,500 investment.

A 183% Return on Investment.

This just highlights one of the coolest parts about investing.

You don’t have to get everything right.

More often than not, just putting your money into any kind of productive assets (no matter what those assets are) is doing yourself a favor.

I don’t care if it’s value stocks, growth stocks, small stocks or big stocks. Gold or bitcoin. Real estate. Some crazy side hustle idea.

More often than not, investing in something… anything… is better than doing nothing. And it’s always better than spending.

Thanks for reading! Go easy on me in the comments 😉

Do you enjoy my free blog? Share this article on your favorite social media or take advantage of free, awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

Just remember it could’ve been worse! At least you’ve learned from your mistakes! That’s part of life. I loved the ending – stressing the importance of investing in anything rather than letting inflation take away from the value of your hard earned money. People have such a fixation with the upside of individual stocks and you helped shed some light on the mystery. Great job!

Agree with FreshLifeAdvice! I just wrote a post on how people should focus on progression not perfection. I think your story fits it perfectly! You started off learning and investing in individual stocks which was better than nothing but likely not the perfect play. Ever since then you’ve grown and progressed your investment portfolio to what it is today. Thanks for the good read!

Good article!

I’ve invested approx. $1,000 in individual stocks “just for fun” – a number of stocks have seen great returns (beating the market!!) – but unfortunately, I have one awful stock (Aurora Cannabis) which has lost 94% of it’s value – ouch. This one bad stock has eaten away a huge portion of the gains from the great stocks.

Fortunately, there wasn’t TOO much invested in that ill-faited weed stock – so I’m still at a 3.7% return in individual stocks overall, but this is approx 11% less than the S&P 500 over the same period. This is a relatively new investment, so hopefully in time the great stocks will far outweigh the loss on that bad stock and give a higher return than 3.7%!

On the plus side, this $1,000 was from personal spending money which I decided to save for a rainy day. Rather than stick it into a low-interest savings account – I invested it and have beaten inflation! Like you said – investing in something is better than not investing or spending!

That’s another great lesson from both of our stories – one bad stock can wipe out TONS of winners. In my case, without the one bad Uranium stock, I’d probably be beating the market. But recovering from one stock’s losses is HARD.

Great post! I asked that question to you last month because my investing journey started the same as yours did. I did not start putting my money in index funds until I found your site a few years ago. Ironically my 2 original individual stocks I picked far out paced the market since (Amazon and Microsoft) but I do not regret having learned the benefits of index investing and building up that side of my portfolio now.

Nice! Thanks for the question, by the way!

I love this post! If only people realized that it doesn’t need to be that complicated. This is soo true and I wish more people knew this: More often than not, just putting your money into any kind of productive assets (no matter what those assets are) is doing yourself a favor. When I first started investing, I bought Netflix “just for fun” at $55/share. Now it’s trading at app. $525. I totally regret not buying more shares but I’m glad I bought a couple of them “just for fun” : )

I have been doing research on just this topic! I want to start gifting my grown children with stocks instead of useless gifts. I was very encouraged by the statement- investing in something is better than nothing! I think im down to Ally, Fidelity, Schwab, or TDAmeritrade as the brokerage account. I plan to set up one for me first to see how it works. Any thoughts from this site about which might be better?

I’m almost rethinking buying individual stocks after reading this….I was on the fence anyway. I’m going to stick with my low cost index fund.

You have to cut your losses at a max of 10%. Why hold a stock that everyone’s selling and let it go down 50-80%?

Selling at -10% would have you liquidating your entire portfolio every time there’s a market correction. Wouldn’t that be a disaster?

Thanks for the article. Do you recommend investing in single stocks at all? I bought some funds but should I bet some on individual stocks? How much in % should I allocate to it?

Thanks,