If I were making a personal finance 101 cheat sheet, I don’t think anyone would blame me for placing compound interest right at the top of it, in bold letters.

I mean, compound Interest is the most powerful force in the universe, or so Albert Einstein’s Instagram account told me.

(There’s actually no proof Albert Einstein ever said this, but that doesn’t make the motivation posters any less motivating. And it doesn’t make compound interest any less impressive.)

But as amazing as compound interest is, if I were finalizing that personal finance cheat sheet, I’d place another, much less talked about topic, right underneath it:

Compound Spending.

Compound Spending in Action

Just like the incredible power of compound interest to build on itself, compound spending slowly works away to increase our expenses.

Stop me if this sounds familiar:

The gift shop deal

1. You’re browsing a gift shop when you see a super cool poster. Rather than taking a mental image and filing it away, you decide you need to own this piece. What good is simply appreciating something?

Besides, it’s only $20…

2. Once home with the artwork of your dreams, you realize the poster would never look right just thumbtacked on the wall. No, this beauty deserves a worthy picture frame. So you dig through your coupons and head to Hobby Lobby, where you find the perfect picture frame for $25.

Boom, just like that, the cost of your purchase doubled. Take that, magical doubling penny.

The Extra Bedroom

1. You’re shopping for a new house. Even though you’re like most people and spend 70% of your time in the kitchen and living room, you’d really like to have that fourth bedroom.

Luckily, you can have everything on your wish list just by stretching the budget a couple grand.

2. Time for the first home project – replacing the flooring.

Wait, at $10 a square foot, that extra bedroom means an extra $1,500 in remodeling costs!

3. Speaking of added costs, it’s a shame how property tax assessments are based on home value, which in turn is based on square footage. That extra 150 square feet from the extra bedroom means an extra $300 in taxes every year!

4. Ditto for home insurance.

5. And we can count on an extra $20 a month to heat and cool the extra space, aka $250 a year.

6. And we can’t leave that extra bedroom empty. We’ll need a $500 mattress, a couple hundred more in furniture, and wow… this $20 poster would be perfect!

The Sticker Price is Just the Start

These examples got pretty extreme in a hurry, and they’re also filled with a heavy dose of sarcasm. But that’s not to discount the very real possibility of compound spending sneaking up on even the most cautious savers.

We’ve all probably had an experience where “just one drink,” with a group of friends turns into four or five, which is then followed by a midnight trip to that greasy taco joint down the street, and topped with an expensive Uber ride home. Plus a pricey brunch the next morning to eat off last night’s headache.

Or maybe we received a “50% off any one item!” coupon to our favorite clothing store. Which was a great deal, right until the rush of the deal had us adding an extra 3 pieces (with accessories) to our original shopping plans.

And I know I’ve fallen victim to an AMAZING deal on airplane tickets… which quickly compounds into a couple hundred dollars spent on hotels, a rental car, and then a week’s worth of vacation spending.

Ever wonder why credit card companies are so eager and willing to give out free travel points? It’s simple – they understand compound spending.

Companies know better than anyone – a little spending leads to a lot of spending. Sometimes just a little taste is all it takes to get hooked.

Staying on the Path of Happiness

Confession: I’m an internet junkie. I’m addicted to the idea that the entirety of human knowledge sits at our fingertips every day.

With one click of the button we can be transported to the renaissance teachings of Aristotle, the futuristic predictions of NASA, or even just some 20-something’s blog about wizards and financial freedom.

On the whole, this curiosity is probably a good thing. It keeps me reading, learning, and improving. But there’s also a dark side to my love of the internet.

And no, weirdos, it has nothing do with dirty websites.

The challenge is, I have to stay focused whenever I’m using the internet. If I don’t, I’m liable to blink and realize three hours have passed, and a little light reading about vanguard index funds somehow devolved into a detailed video analysis of the latest Christopher Nolan movie. How did THAT happen??

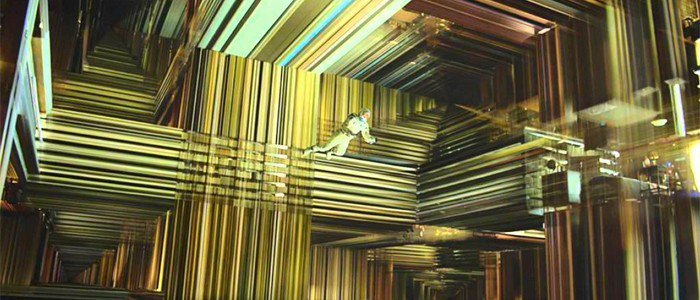

I veered off course, one thing lead to another, and soon I was tumbling down the teserract of distractions.

Staying the course with our financial goals is pretty similar.

On the whole, we can realize that we’re already 1-percenters and that money is an amazing tool for building freedom. But with a little distraction, we can easily veer off the path of happiness and step towards the Vegas-style flashing lights of temptation. And whenever we do, we’re inevitably building ourselves a lengthy domino of spending.

So, the best way to control your spending? Stop it before it starts.

We have to recognize that cheap or free isn’t always cheap or free. In fact, it’s typically the kickstart to a whole new host of expenses. And we have to recognize that justifying our purchases with a low sticker price is faulty logic.

We have to learn to say no, even when every fiber of our being lusts for yes.

Why? Because the sticker price is a lie.

People think I’m crazy when I turn down free trinkets. “But it’s FREE,” the peddlers remind me.

But it’s not free, I think to myself. Sooner or later our stuff will get the last laugh, whether it’s maintenance costs, moving expenses, or just the silent stress of a cluttered life.

Instead, we can reverse the currents. Rather than racing down the path of spending, we can avoid tipping that first domino.

We can say, “No thanks, I’m already happy.”

Related Articles:

Very true! It just kind of sneaks up on you if you don’t pay attention. The extra bedroom thing made me chuckle and then weep a little bit.

There’s no crying in personal finance!

🙂

Great Post Money Wizard! I really enjoy what you did here with compound spending. Normally people talk about compound interest (either way) but you took it to the cause – the slippery slope in your brain.

I love these two quotes: “There’s actually no proof Albert Einstein ever said this, but that doesn’t make the motivation posters any less motivating. And it doesn’t make compound interest any less impressive.” Answer: Of course not, the simple way to make a motivational poster is this – 1. think of motivating quote, 2. attribute to famous inspiring person, 3. print on large piece of paper. Who cares if its actually true, someone will come along and pay $19.99, right? Right??

Also this: “People think I’m crazy when I turn down free trinkets. “But it’s FREE,” the peddlers remind me.” I love it because I do it all the time. People look at me like I have two heads. I have to constantly remind people – if its free, you are the product.

“If it’s free, you are the product.” I love that last sentence, Handy Millennial.

Great article, I never even considered that this may be the reason for credit card companies offering free flights and other travel-based incentives. I try not to spend but I am a sucker for a good deal, so now I will think twice in future about the “deal” that I am being offered.

They’re sneaky like that!

I thought you were going another way with this article. Lately at work, we’ve been joking about the opportunity cost of each lunch we get. If we invest in the market, a dollar will turn into 16 by age 65, so we multiply the cost of lunch by 16 and laugh about the $100 meal we just ate. I like to think others are actually thinking about cutting back a bit.

Haha, so true. It’s an incredibly effective approach, although it can drive you crazy if you’re not careful!

It is true. Spending begets spending. Once you commit to the “buy” whatever it is, it is easy to get caught up in the extra feature, bells and whistles that add necessary cost. We fell into the trap you mention buying a new house and moving this year. Fortunately, we are generally pretty frugal and make it up elsewhere. Tom

It’s so easy to get caught up in the upgrades, especially with the bigger purchases. Congrats on the shift towards frugality!

Spot on. If we could learn to be content with “our means”, and the things we have, our spending could be held in check. But left to it’s own devices, it compounds!! Great article!!

Thanks Chris!

Great article! The whole one drink with friends is so true. I sometimes feel bad not always going out with my friends every weekend night but then realize that staying in sometimes isn’t so bad and it saves a ton of money, cause one drink leads to a couple uber drives, 4 to 5 drinks, a cover charge, and always late night food when you get home. Before you know it that one drink cost $100+, and if your dating some and paying for there drinks that one drink just jumped to $150! I found a good rule of thumb is always try to split the Ubers with friends, never by shots, don’t buy drinks for the whole group, and eat food that you have back home saves at least some money.

So true, and one of the best examples of compound spending in action.

Great insight. All those little things you buy can turn in to additional expenses, or long term maintenance costs. My wife and I were talking about getting an extra fun car in addition to our regular daily cars several years ago. This was before I found the FI/ER community. Thinking about it long term was what finally made me disenchanted with the idea. It’s not just the initial car purchase. It’s all the future insurance, fuel, maintenance, and storage costs that really turned me off. I like to keep my cars in good running order, and that would just be one more financial and time burden.

Solid post wizard!. Loved the storytelling, especially the examples you shared around compounding spending. Sometimes understanding the beginning of it all is the only way to recognize the implications of our decisions. This is something I try to bring up when in conversations with the wife. Not only stopping but perhaps challenging the decision with the “what happens next” of the “what if” has paid dividends for us. Don’t just say no, understand and be aware of why you’re saying no.

This reminds me of a post I wrote about some free night stands I saved from the trash truck. You are right. They ended up costing me a pretty penny! Thanks for the reminder of the slippery slope that is consumerism.

Fabulous article! It is so true that we start with one thing and suddenly need a whole host of other things to compliment it. You say your examples are wild but I’d say they are spot on, especially the extra room in the house!

My dad used to say, “Nothings free if you don’t need it.”

I just experienced this yesterday. I bought a new Coordless weed wicker that was on sale. When I brought it home, I realized it did not come with a battery, charger, or string. The $200 purchase became a $300 purchase.

“…Sooner or later our stuff will get the last laugh, whether it’s maintenance costs, moving expenses, or just the silent stress of a cluttered life….We can say, “No thanks, I’m already happy.” ”

This is why avoiding shopping is so easy for me. I’ve learned to automatically tell myself that it [that shiney, new thing] is not going to make me happier than I already am. So, I don’t need it. ?