Bitcoin is currently tanking.

Why?

The dreaded tweet…

Or, Elon Musk’s dreaded tweet, to be more specific.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Yep, that right there was enough to send the whole asset class into a tailspin.

Aside from how funny it is that Tony Stark, I mean Elon Musk, can single handedly crash a trillion dollar industry*, the whole story raises an important question that many people are wondering…

Is bitcoin’s energy usage going to kill the planet?

The way I worded that sounds like an obvious exaggeration, but that’s not to take away from some eyebrow raising truths about bitcoin:

- Bitcoin currently uses 129 TWh of energy per year.

- I had no idea what a TWh was either, but apparently the entire country of Norway only uses 124 TWh per year.

- Meaning if bitcoin were a country, it would use the 29th most energy in the world.

So, I looked into it. And, I was surprised to find out that no, bitcoin will not kill the planet.

Here’s 4 reasons why:

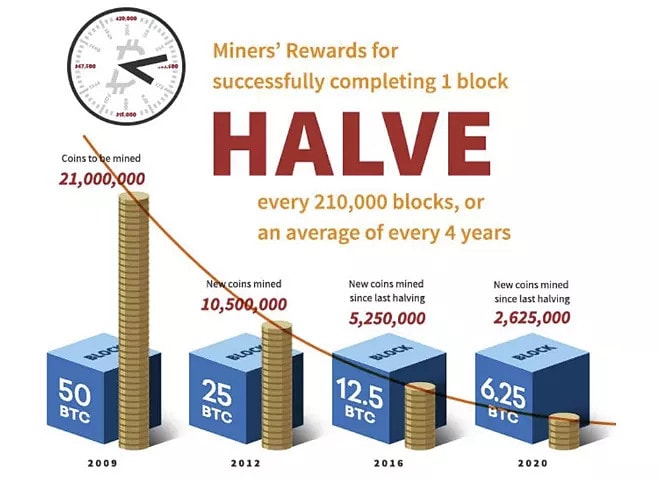

1) Bitcoin’s energy usage is designed to decrease by 50% every four years.

Right now, most of bitcoin’s energy usage is from the creation of new bitcoins.

But by design, bitcoin’s supply is limited, and the rate of new coins being created is dropping significantly.

You see, when the mysterious Satoshi Nakamoto created bitcoin, he coded a set limit of 21 million bitcoins, ever.

Except, he couldn’t just release all those into the wild right away. That’s just not good monetary policy. (Although The Fed and their money printer might disagree right about now! Hey-o!)

Instead, Satoshi devised the system of “bitcoin mining” which is really just a fancy way of saying “lending computing power to bitcoin’s network.” In exchange for lending computing power, miners get paid (aka mine) new bitcoins.

Not surprisingly, applying all this computing power (aka mining) uses a lot of energy.

But here’s the important part…

The rate of bitcoins released gets cut in half every four years.

For example, when bitcoin started in 2009, the network released 50 bitcoins per transaction. Today, the network only releases 6.25 bitcoins per transaction.

Less bitcoin paid = less bitcoin mined = less energy used.

Eventually (in the year 2140) all of bitcoin’s 21 million coins will have been mined, so energy used for bitcoin mining will drop to zero.

2) Bitcoin uses almost entirely renewable energy.

That said, all that mining does currently use a lot of electricity. Which is why the boomers like to hop onto 60 Minutes and report on shocking stories about how a single computer mining bitcoin somehow uses 4,000 times the electricity as the average American household.

Scary stuff, except they omit one very key fact.

75% of the energy bitcoin uses is from renewable energy sources.

It’s too cost prohibitive not to.

For a simple (exaggerated) example, if you live in the United States and try to use your computer to mine bitcoin, you’ll get slapped with sticker shock after your first month’s energy bill. Put simply – $10,000 worth of energy usage sure isn’t worth the $10 worth of bitcoin you might receive.

Instead, the only people in the United States who successfully mine bitcoin usually buy a plot of land in the New Mexico dessert, strap up some 100% renewable solar panels, and run their whole bitcoin operation in a way that would make a eco-conscious, off-the-grid van lifer proud.

Same story in China. One region of China (Sichuan) currently does half of the world’s bitcoin mining. Why? They have cheapest renewable energy in the world – 95% of miners there use 100% renewable hydroelecticity.

Of course, mining is just one cause of bitcoin’s energy use. The other is the network’s transactions. But on that front…

3) Geniuses are working on ways to make bitcoin exponentially more energy efficient.

And they’ll probably succeed.

Quick recap – the secret sauce to bitcoin’s functionality is the blockchain. That’s a fancy word that basically means a public ledger… no different than a big accounting notebook the whole world can see.

But how to make sure nobody tampers with the notebook?

Computers on the network have to solve a complex math problem – a mathematical “proof” to, incidentally, prove the transaction is legit.

Like bitcoin mining, that math is a complex process, and it uses electricity. Critics will say it’s too complex and too slow, especially if bitcoin is ever going to grow big enough to put a dent in the world’s existing payment systems.

Here’s the part they’re ignoring though…

They’re assuming each bitcoin transaction (math problem) equals one payment.

Bitcoin’s code is open source, which means everyone can look at it and try to find solutions. So, geniuses are doing what geniuses do – finding genius solutions to problems.

So far, they’ve figured out that they can actually use one bitcoin transaction to fuel hundreds, or even thousands of other transactions.

If you’re curious about how this works and/or want to feel dumb for a minute, just do some light reading on bitcoin’s lightning network or the potential of the Stacks protocol.

4) Other forms of money aren’t exactly clean, either.

As surprising as it is to learn about bitcoin’s energy usage, this whole argument is a bit silly.

Comparisons in a vacuum aren’t very useful. Bitcoin’s energy usage sounds awful until you consider that something as innocent as idle electronics in the USA (your TV or computer that’s turned off but still plugged in) use four times as much electricity as the entire bitcoin network each year.

Along the same lines, when is the last time Tesla scrutinized the current banking industry’s energy usage? Or the government’s money printing? Gold mining?

Think about:

- The traditional banking system, complete with towering skyscrapers, branch offices, ATM machines, computer servers, personal computers, endless telephones, etc.

- Traditional money creation, which mines tons of copper, nickel, paper, and ink, feeds them all through an energy intensive printing press, and then throws it all away every five years.

- Don’t even get started on the environmental impact of gold, which not only destroys the earth from the get-go, but then gets loaded into armored trucks and planes that burn fossil fuels transporting the dense material around the planet.

And besides, at the most fundamental level, Bitcoin’s energy consumption (and the intense computing power confirming the blockchain’s security and accuracy) is actually what backs its value. If you want to play the real comparison game, ask yourself what truly backs the value of the United Stated Dollar?

As Fiat currency, it’s sure not gold or gemstones anymore…

Any guesses?

Bueller…?

Bueller…?

Try military strength.

More than anything, that’s what keeps the US dollar secure. And those tanks, F-22 raptors, tomahawk missiles, intercontinental nukes, and millions of military pensions sure aren’t cheap.

Given the choice, bitcoin fueled by renewable energy could actually be the most environmentally friendly form of money we have!

*Maybe one day, if you sneak Uncle Money Wizard enough booze, he’ll share his conspiracy theory about Elon Musk’s bitcoin concerns.

PS – If you’re interested in crypto, investing through my referral links to Kraken, Ledger, or Trezor helps this site immensely!

Related Articles:

What do you drink? 🙂

Haha! I’ll take that as a vote for the next post…

Does Elon Musk suggest everyone stop driving his cars because they are charged by fossil fuels? His challenge is dishonest and this is a great article pointing that out!

Also, in 2017, bitcoin BTC was forked to create Bitcoin Cash (BCH). This increased the maximum throughout of the network. So even though BCH’s network would use the same amount of energy usage, the number if transactions it can handle is currently 16x’s higher than BTC making it 16 x’s more efficient per transaction.

One other huge benefit of Crypto mining on renewable energy is that renewable energy is inconsistent, but mining can be adjusted as well! There are some areas where crypto mining follows the peaks and valleys of renewable energy generation. Wind is blowing and sun is shining? Turn on the miners! Wind stops and it’s night time? Turn off the miners so people can keep their lights on. It makes sure that the renewable energy consumption is optimized.

My bigger concern is one man’s ability to influence 25% market swings with a single tweet…

No doubt the Elon tweet had an impact, but it’s an oversimplification to state that the entire drop was due to that tweet (or that dogecoin’s rise is entirely due to his actions for that matter). There was big news out of China last week that likely had a significantly greater impact, and probably 1,000 other data points we don’t know about. Markets process vastly more information than any individual has, and it’s very rare that any claim that “one thing” moved the stock market or crypto markets will be accurate. A counter-example I can think of would be something like 9-11. But Elon’s tweet had some impact – not enough to do a 50% drop.

I appreciate that you address this problem in a very succinct and cohesive manner. I agree the bigger problem is that Tony Stark can mess with the market, but I think that problem will resolve itself has larger companies continue to adapt and or invest in bitcoin. Though it has been around for a long time I still think we’re really only toying with the early adopters here. And there’s so much volatility there are a lot of people who have made good money trading versus investing. If and win more mature investors drop into the asset class will start to see less price price moving and wild swings overtime.

I read an article years ago that stated that the amount of time you’d have to drive your Prius (yes I know it’s a hybrid versus an EV, but used far less Lithium than an all EV) for the savings in auto immisions to cancel out the toxic contributiion to the environmental damage that mining the Lithium and other rare metals used in the battery’s caused is 15 years. So in my mind while I believe in EV and that technology and science will continue to improve efficiencies, the statement by Musk seems kind of hypocritical.

Energy consumption has been a known problem for years. If the geniuses are working on it, why have they not come up with a solution already? I believe Bitcoin is designed purposefully such that the next coin is harder to mine. If the next coin was made easier/cheaper to mine, more miners would pile in, start running more computers and end up using just as much power. I’m way out of my bandwith in this topic, but logically if bitcoin cold be mined with less energy – it would have by now. Huge sums of money at stake.

Why not just go to another crypo that is inherently more energy efficient to achieve the same end?

Gold has a long track record. Crypo has a long way to go to prove itself.

Good question. Energy consumption is balanced by two things: 1. What are the rewards for mining a block of bitcoins vs the energy cost to mine it and 2. How difficult is it to mine?

1. The rewards of mining a block is a certain number of bitcoins plus all of the transaction fees that have occurred since the last block was mined. The number of bitcoins in the block reduces over time as Mr. Wizard explained above. So if the block reward decreases due to a halvening, there is less incentive to mine unless the value of each bitcoin increases or the difficulty of mining decreases.

2. Mining difficulty is based on requiring it to take an average of 10 minutes to mine a block of bitcoins. If the number of computers mining doubles and they start solving blocks in 5 minutes, the algorithm will adjust and increase difficulty until it takes 10 minutes again.

So why not just make it really easy to mine bitcoin? The energy requirement actually gives a physical element to the security of bitcoin. It isn’t just a code that someone can hack or exploit. If you want to attack bitcoin, you need to expend physical effort in the form of energy consumption. So there are other forms of crypto that don’t require energy consumption, but some would argue that those coins are not as secure from an attacker. I don’t know what the right answer is, but in the bitcoin world, energy consumption is a good thing.

The problem is efficiency. You need to be able to increase the number of transactions that the network can handle while keeping energy consumption constant. That’s where Bitcoin Cash (BCH) wins. They increased their network so they can process at least 16 times more transactions that the original bitcoin (BTC) can process for the same energy use.

doesn’t halving make it 2x more energy intensive to mine per bitcoin?

No, the difficulty has nothing to do with the halving. Difficulty is only based in keeping the difficulty such that it takes 10 minutes to solve each block.

Bitcoin may not kill the planet but it’s killing peoples hopes of buying a new graphics card 😮

Regardless of the energy-related merits and demerits of cryptos, they are backed by ‘nothing’. Its value is influenced by hysteria, not supply and demand. BUT, efficient energy consumption might very well be a compelling argument in favor of cryptos and as viable alternative to fiat money in the future.

Yep–I’m done betting against Bitcoin. Too many smart people involved, and institutional adoption is underway. They’ll figure out the energy concerns and navigate through any regulatory issues. Just a tad late to the party here haha.

Something on my mind lately that’s aligned with the context in this post… Namely

1) is the Petrodollar regime/USD as global reserve ending?

2) how does FIRE community navigate this transition?

Looking forward to your thoughts – perhaps in a future blog post.

I get your points, MoneyWiz, but the usage of “renewable” energy to mine cryptos is a big idiocy.

If producing renewable electricity is economically and ecologically reasonable you do it anyways. As a conclusion you have to shut down fossil fueled power plants.

Mining Bitcoin and Co. simply prevents those plants from Fossil Age to shut down by constantly increasing electricity demand.

It is just dishonest to use additional (partially scarce) resources for renewable power plants for environment´s sake while effectively increasing overall electricity consumption. It´s not. At least not in the overall picture.

The same logic is incidentally true for electric vehicles (Tesla, anyone?!) or hydrogen or any other planet saving technology with a “100% renewable energy” stamp on it…