When most people consider real estate investing, they make a common mistake.

They:

- Estimate their rental profit each month

- Calculate a rough return on investment… which on a decent deal usually comes out to somewhere around 5-7%

- Compare that return to the stock market, which usually lets you earn 7% for doing nothing except having money

- Decide investing in real estate is not worth the effort.

Unfortunately, that analysis only tells half the story.

Had they completed the other half, they’d have realized something amazing – real estate investing often yields upwards of 20% per year.

Today’s post will quickly break down the math…

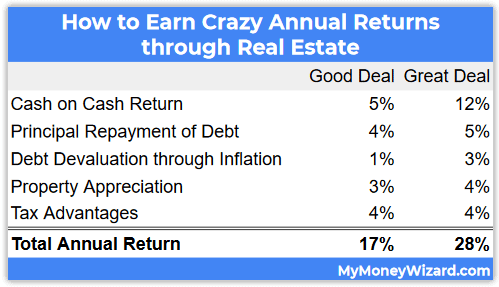

Cash on Cash Return: 5-12%

“Cash on Cash Return” is probably the most common metric used to calculate a rental property’s profitability.

As the name implies, it’s simply how much money you earn per year compared to how much cash you coughed up to buy the property.

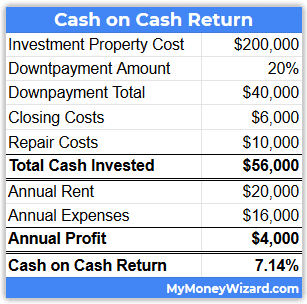

Getting into a little more detail, investors usually calculate cash on cash return like this:

(Downpayment + closing costs + any repairs made out of pocket) / (The property’s annual profit)

Here’s a basic example for a $200,000 property that needs a few minor repairs:

Long story short, most real estate investors hope to find a deal with a cash on cash return somewhere around 7-8%. Some get lucky and score higher, others score lower. (And fair bit of warning… some even have negative cash flows!)

The interesting part? As I mentioned in the intro, this is where most people stop their analysis, even though this number only tells half the story…

So let’s find our true return by adding the four areas most people forget about.

+ Debt (Principal) Repayment: 4-5%

For most people, the thought of a renter paying your mortgage is one of the most attractive parts about a rental property.

Remember though, a large portion of that mortgage is interest paid to the bank, so you can’t count that as profit.

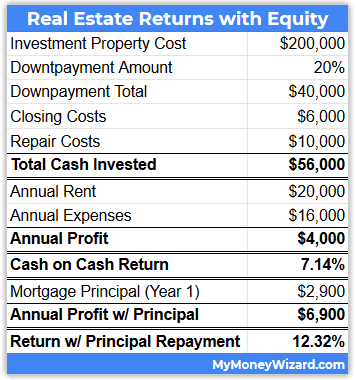

BUT, there’s definitely a portion of the mortgage that does go towards your “principal” aka… the portion of your loan that’s directly paying off the property. (And increasing your net worth through equity.)

This portion can often boost real estate returns an extra 4-5%. On top of your cash on cash returns.

Here’s the same example used earlier, with three rows added to show what happens if $240 per month ($2,900 per year) of the first year’s mortgage payment goes towards principal repayment. (I found this amount through a mortgage calculator’s amortization schedule.)

And the best part? The amount of your mortgage that goes towards principal increases over the life of the loan, so this return continues to increase each year you hold the property.

+ Debt devaluation through inflation: 1-3%

Imagine if you could pay rent at prices from 30 years ago. Your living arrangement would be crazy cheap!

Thanks to the effect inflation has on debt, that’s actually possible.

Consider this example.

If you bought a $250,000 home today, you can expect a mortgage payment of about $1,100 per month.

Now imagine you took out a 30 year mortgage for that same house back in 1990. Back then (30 year’s worth of inflation ago) that house would have only cost $125,000. It’s monthly mortgage payment would have been about $450 bucks.

Today, your mortgage would still be a measly $450 a month!

This is the power of inflation on debt.

When you buy a house, you lock in your “rent” at today’s dollars.

Since the federal government has openly stated their goal is to keep inflation somewhere around 3% per year, that means every year, your mortgage payment becomes 3% more affordable.

+ Property Appreciation: 3-4%

And we haven’t even considered the possibility of your investment increasing in value yet!

On average, the price of real estate increases about 3-4% per year.

Sometimes,

That rate of growth can be much higher in some areas (cough… California!… ahem… trendy up-and-coming Minneapolis neighborhoods!…) or some time periods (cough… early 2000s housing boom!… ahem… post great recession recovery!…)

+ Tax Advantages: 4%

Real estate investing comes with tons of tax advantages. Coach Carson talks about nine of them here.

This will be different for everyone depending on their income situation, but on average, it’s totally feasible for these benefits to leave you with 4% more money, each year.

Taxes saved are absolutely a real return, so this is definitely something worth considering when you calculate your total real estate returns.

Final Total? Annual Returns of 17% to 28%

It doesn’t take a Money Wizard to realize those sorts of returns are absolutely INSANE.

For comparison of just how insane, the rule of 72 shows that annual returns of 24% mean that you will double your money every three years.

Put another way, Warren Buffett has averaged somewhere around 21% annual returns since 1965. That’s enough to make him one of the richest people on the planet.

Yet, these returns are totally doable with real estate.

Does every rental property earn this much? Obviously not. A lot of real estate investments barely break even, and some even lose money.

But at the end of the day, these sort of returns are probably why, when it comes to the most common paths to financial freedom, the route of real estate consistently crops up more than any other.

All this is why I’ve restarted my search for a rental property. I’m looking to partner with some long time friends (who thankfully, have much more construction and maintenance experience than yours truly) and I’ll hopefully invest in my first rental property within the next year.

Do you enjoy my free blog? Share this article on your favorite social media or take advantage of free, awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

It would be helpful in this article to discuss the depreciation that is allowed on your tax return for 26 years. However, IF the home is sold, all that money that was depreciated has to be recaptured and it can result in a large tax bill. Just one more thing to consider. Rentals are good to pass on in an inheritance. The depreciation starts over again. If sold then, the new price of the home is used for tax purposes.

Yep, that’s what plays into the roughly 4% benefit of inflation. Coach Carson does a great job talking about this in the article I linked.

Great article! I’ve been crunching similar numbers on buying a duplex and house hacking (which will also free up the $1,000 we’re currently paying on rent each month), then in a few years buying a second house to live in (my daughters will be a little older and we’ll def need the space) – renting out both units in the duplex is projected to pay both mortgages. (We also plan to rent a room or Airbnb in house #2 as well.) So we’d be living for free, making some rental income, AND paying down two mortgages which we could eventually sell or continue to get rental income from (at a higher return).

Some quick additional notes – by house hacking for 1 year, we get to lock in that low-rate primary residence mortgage on the rental for the remaining 29 years! And yeah – as time goes on and tenants move out, the rent can increase with inflation while your mortgage payment remains constant (as you mentioned).

Some negative aspects of this vs. simply investing in index funds – the huge upfront cost, the risk of having a physical asset (liability?) that can burn down (for instance), the added work involved (with being a landlord and dealing with possibly bad tenants, doing your own basic maintenance, etc.) – or hiring a property manager (which cuts into profits and still requires some work as now you are running a business with an employee).

Nice plan!

Yeah, definitely much less passive than index funds. The added work is what’s scared me off for the past few years.

Interesting article. Which index fund you recommend today, because I can’t afford to buy a house to rent out. Lol.

Do your annual expenses include property taxes and insurance?

Yes, those are very real expenses and you absolutely should include those in your analysis.

Cool. I forgot to ask if you consider your primary residence as an investment? Seems like people believe that it is the best way to build wealth but I think that should be used judiciously as it’s an asset that you can leverage or sell for a profit but you’ll still need a place to live.

I was curious if you have looked into Passive real estate investments like the Groundfloor and Rich Uncles platforms.

I’ve heard of them but haven’t even done a deep dive. Maybe something I’ll do in a future post.

Your reasoning is quite sound, and you could make a similar but lower payout case for borrowing against your house to invest in the stock market. However, just like any high rate of return investment the risk is also higher on leveraged investments than on conventional ones. Since my house is paid for there is no circumstance in which I could lose it, but that’s always a possibility on any rentals you have loans for if you can’t find renters. I agree it works well most of the time for real estate investors, but when it doesn’t you can lose everything. I just don’t have that much risk tolerance, mainly because I haven’t had to take any risk to achieve financial independence. I think it is a great way to go for many people, like yourself, it just wasn’t for me.

I am glad somebody has at last put the benefits of real estate in such a good and simplified way. Most people usually over or under evaluate with the numbers. I started with $9k deposit to buy my first rundown house 11 years ago after I realised my pay would not let me retire easily nor get me the life I want. I have bought, lived, done up, rented and sold 4 properties since than and have always made a profit. Last year I put $135k deposit in cash for a 4 bed house and 888sqm property, spent 30k doing it up n furnishing it and renting out the rooms to boarders to cover all costs n having my room for free. At present I am planning to make 2 more houses on the property, 1 for myself to live for free and rent out the other 2. I certainly would not have been able to do this on my pay alone.

Great article. I’ve never thought too much about debt devaluation through inflation – definitely given me a new perspective. Are you planning on buying an investment property?

I have 9 rental properties that give me passive income (accumulated over a 10 year period) and at present am completely debt free.

I have decided that in the coming months, I want to scale this up and with interest rates at an all time low take advantage and grow my portfolio of real estate.

I do not have any other investments in equities, I have put all my eggs in the property market.

Great article and this has bolted me into action.

Best of luck with property hunting. In my experience, doing proper background checks on tenants is very important. Good tenants will not only pay the rent on time, but also take care of the place. I also prefer finding people who will stay for at least a few years and treat it as a real home — less hassle and lower maintenance costs for you as well!

The biggest thing holding me back from real estate is I feel like I have to become a lawyer to become a landlord. Keeping track of all the rules and all the forms seems like a huge headache.