Remember when you were younger and you found money in the couch cushions? Remember how exciting that was?

Well I just had that moment, to the tune of a couple thousand dollars.

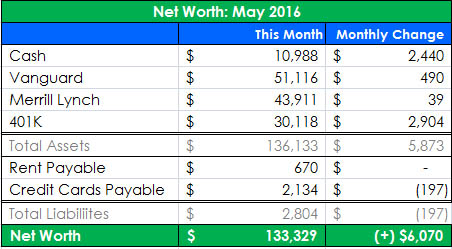

Long story short, while I was putting this Net Worth Update together, something didn’t seem quite right. And as it turned out, there was an error in the net worth spreadsheet that I use to track all this madness. Kind of a big one actually… the formula to calculate my final Net Worth wasn’t including any of my cash savings!

So while I’m not actually any richer for having “found” this money, I have been completely under-reporting my net worth for these first few updates! Score another one for the scrutinizing power of the Net Worth Update.

I have adjusted my previous net worth reports to fix this. Long story short, my Net Worth last month was actually $127,000, not the $118K I previously thought. How’s that for a plot twist?

Onto the update…

Cash Savings: (+$2,440) Cash savings were up this month mostly due to a $600 bonus at work. Nothing better than pocketing a windfall!

As I said in the past net worth report, I do not normally carry this much in cash. In fact, I hate cash. It’s slowly eaten away by inflation when my money could otherwise be invested and working for me. But my 13-year-old car is on its last legs (or would it be tires?), and I’m preparing for the purchase of a new(er) vehicle. Since a Money Wizard would never do something as ridiculous as finance an automobile, I’m saving to throw down straight cash for the car.

Vanguard Account: (+$490) The change here was all market appreciation, since I didn’t contribute any money to this account in May.

My Vanguard account is broken down into just two funds: $38,947 is invested into VTSAX, an index fund that tracks the entire market, and $12,165 is in a Roth IRA invested in VGSLX, an index fund which tracks real estate investment trusts.

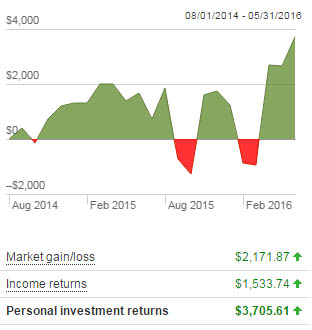

According to one of Vanguard’s nifty performance charts, this account has earned $3,612 since I opened it in August 2014. Not bad for a few clicks of the mouse!

Merrill Lynch: (+$39) Just market changes here too, since I haven’t added any money to this account in years. The holdings consist of:

- 35% in Vanguard ETFs which track the overall stock market

- 25% in individual dividend paying companies

- 15% in government and corporate bond ETFs

- 10% in International ETFs which track the international and emerging stock markets

- 10% in cash

- 5% in ridiculous and foolishly speculative companies. Not surprisingly, some of these have TANKED since I invested…

The majority of this account was formed when a younger, more naïve version of myself was convinced I could beat the stock market by picking individual stocks. My returns in this account have lagged the overall market quite a bit, and I’d be several thousand dollars richer had I just kept it simple.

I have considered moving money out of this account, but don’t want to trigger a large taxable event by selling everything. I’m currently in the process of researching options here.

401K: (+$2,904) My 401K is invested in a mix of small to large cap index funds and a small portion of bonds. The monthly increase includes both my contributions, market appreciation, and my company’s match. Never underestimate the power of the company match!

I still can’t believe how quickly the 401K contributions are adding up. Without a doubt, maxing out my 401K in 2016 has been the most powerful wealth building decision I’ve ever made, thanks to the benefit of investing pre-tax dollars and reducing my taxable income at the same time.

Rent Payable: (+$0) I rent a modest two-bedroom apartment with my girlfriend near Minneapolis, Minnesota. Apparently a lot of people are afraid of snow, which allows this native Texan to enjoy a pretty low cost of living. My share of the rent and utilities almost always amounts to $670.

The weather is starting to warm up a bit here, so it should be interesting to see how our air conditioning usage effects this number in the coming months.

Credit Cards Payable (-$197): I buy pretty much everything using credit cards (gotta love those reward points!) so this amount usually equals my monthly spending. The number is slightly inflated due to work related travel, which I get reimbursed for.

Although I didn’t take any vacations this month, I did purchase a Spirit Airlines flight (and saved $36 using my favorite trick) for an upcoming trip in July. Other major areas of spending included $170 for two tickets to see the Book of Mormon play (which was incredible), $65 for a weekend trip to a friend’s lake cabin, and $105 for a Minnesota Twins game. Note to self… beer at a baseball stadium is NOT cheap.

I should end the year having lived off right around $22,000, which means I’m still on pace to retire by age 37.

Calculate Your Own Net Worth

If you’ve never calculated your net worth before, or even if it’s just been a while since you’ve checked, give it a shot! Log into all of your bank accounts, dust off your 401K account information, search for cash under the couch cushions, and subtract your outstanding debts. And definitely, make sure your excel formulas are correct! 🙂

Let me know what you think of these net worth updates below. And as always, feel free to send me a note about anything and everything on the contact page.

Congratulations on the pace you’re running at – retired by 37 would be a-freaking-mazing! Good luck on that car purchase.

Thanks Ty, definitely not looking forward to the car purchase, but it’s something that needs to be done. I’ll be blogging about it as I get closer to buying!

Congratulations–“finding” that extra money is a good feeling! Good thing the error *under*estimated your actual net worth, rather than giving you an unpleasant surprise…

Haha, no kidding right?? Would have made for a much less exciting update!

Well, it still would have been an interesting read…you just wouldn’t have been so happy 🙂

Haha, on that note, it might have been even more entertaining for you all!