I’ve always heard that keeping a journal makes you more mindful about the passage of time. As I sit here closing this e-ledger on August, it feels like just last week that I was bitching about the cold Weather in December’s update.

If journaling makes you more aware of time – consider me fully aware. Time is flying!

Welcome to the August edition of my monthly Net Worth Updates. Every month, I share my progress towards a goal of nearly $1 million and an early retirement by age 37. If you feel like time traveling, check out the net worth updates page where I keep all the entries since April 2016.

In past month’s updates, I mentioned I was cutting back on summer travel in order to take advantage of the cool, mild northern summers. A smart traveler would limit hot climate travel to the winter, and stay in the cold states during the summer, I thought.

It was a brilliant plan, right until I left the cool, comfortable northern summer weather for the scorching triple digits temperatures of Texas.

I stepped off the plane and immediately reintroduced myself to the warm oven blast that Texans call a summer breeze. In any case, the trip to visit family was as comforting and recharging as only a family visit can be.

Even though I booked the whole trip with points left over from chase’s free $2,000 sign up bonus, it was a friendly reminder just how priceless family really is.

In other news, a proper August 2017 update wouldn’t be complete without some talk of The Eclipse of the Century. Like a good space geek, I ordered my pair of ISO compliant solar glasses, cleared my August 21 afternoon, and looked towards the sky.

I was in Dallas at the time, which according to the surprisingly accurate eclipse predictions, would only experience around 70% coverage. The sight was still a strange experience, and I briefly stopped to consider my tiny, insignificant place in the universe.

Then I immediately wondered why this whole spectacle looked nothing like the advertisements.

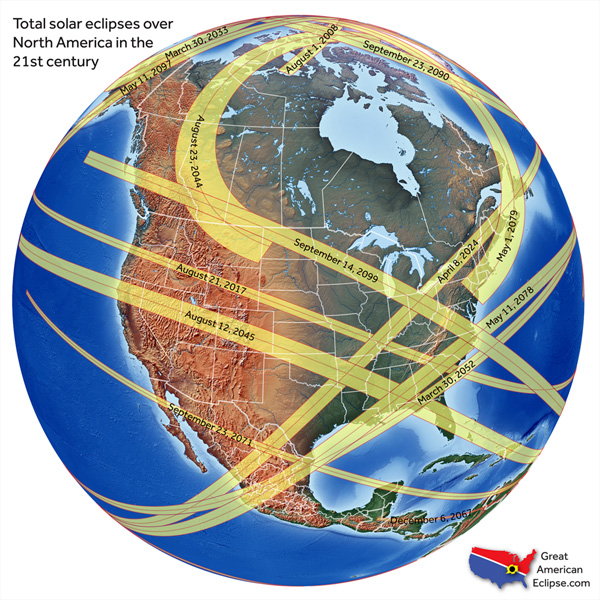

Maybe when I’m nice and retired, with zero career obligations, I can take a road trip towards North America’s next total solar eclipse. Here’s a neat graphic showing all the areas with 100% solar eclipse coverage over the next century:

Which future eclipse I see will serve as a nice barometer for how this whole early retirement experiment is progressing. If I don’t reach the goal a little ahead of schedule by April 2024, I’ll have to wait all the way until August 2045!

Other August news included the hazy blur that is Saint Paul, Minnesota’s Summer Beerfest. For one August day every summer, 120 craft breweries take over the local independent league baseball field.

They all stake out tents in the outfield and all around the concourse, and they serve out “free” samples paid for by your $45 entrance ticket. If my buzzed math is any good, that’s actually a pretty good value, since the whole event turns into a non-stop, 4 hour-long power hour of delicious beer sampling. I did my best to report back on the exact value, but I lost track somewhere around my 20th sample, each roughly the size of 1/3 of a beer.

Cheers! Score one for frugality!

But maybe the most important event of the month: I saw this guy driving down the road, apparently trying to set some sort of record for number of pallets carried by a rust bucket.

To the update!

Net Worth Update: August 2017

And the detailed breakdown:

Cash: $8,074 (+$290)

The cash is slowly but surely moving in the right direction. In the mean time, I decide whether to funnel it straight to my Vanguard index funds or keep saving up for some sort of rental property.

Keep reading for my most detailed spending report EVER.

Brokerage: $101,401 (-$1,049)

No contributions this month, which means the fluctuation was just from market swings.

At month end, my brokerage account included:

- $52,400 invested with Vanguard’s Total Stock Market Index Fund. (Related: How to Choose a Vanguard Index Fund)

- $49,000 in a mixture of Vanguard ETFs, with a few individual stocks back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $69,543 (+$2,360)

This $2.36K change in account value was driven by $2.33K of automatic contributions and employer matching. After a slow start to the year, I’m still contributing almost 30% of my take home pay so that I make sure I max out my 401K in 2017.

Roth IRA: $18,539 (-$63)

No contributions this month. Investing $5,500 sometime between now and April 2018 (the cutoff date for 2017 eligible Roth IRA contributions) is still a goal of mine. If my cash account keeps growing and no promising rental property investments show up, I may not have an excuse any longer.

My Roth is invested entirely in Vanguard’s REIT index fund. I like this allocation, since I otherwise have no exposure to real estate and do not own a house.

Rent Payable: $719 (+$9)

Same rented apartment, although the monthly obligation went up slightly as the AC worked a little harder to keep the place cool.

Credit Cards Payables: $1,761 (-$629)

This amount equals total outstanding balances for all my credit cards. With the way the billing cycles work out, this number usually represents about a month and a half of credit card spending.

As previously hyped, here’s my most detailed spending report EVER:

Total August Spending: $1,275

Most of the categories are self explanatory. Here’s some explanations for those that aren’t:

- Travel – $36

- Since I booked the Dallas trip on sign up bonus points, my only expense was a few Uber rides to/from the airport.

- Entertainment – $84

- A friend’s wedding, the previously mentioned Beerfest, a Greekfest, and a Food Truck Fest. Apparently August is the month of the fest.

- Vehicle Expenses – $77

- The pesky car insurance bill.

Overall, I topped my frugal July, making this my most frugal month of the year!

If you’re not already tracking your spending, I can say from experience it’s probably the easiest way to start taking control of your spending. I recommend my new most underrated iphone app, or if you want an even easier and automated experience, personal capital.

Readers, how was your August?

Nice update! Hope you enjoyed your trip to Dallas! It’s certainly been hot here, though not as hot as it should be in the summer.

Thanks!

The Dallas weather was a shock only because of where I came from, but I’ve lived through enough Texas summers to know when I should be grateful! I know better than to complain about “only” 90 degrees in August.

Nice update! Good news is that the next U.S. eclipse will have Dallas in the path of totality – perfect timing for another family visit.

It may seem hot here, but we’ve been celebrating how mild a summer Dallas has had. It’s all relative…

I noticed that on the graphic! I might not have to retire after all. 😉

Holy crap! Only $1275 for the whole month. If you could maintain that you would only need $382,000 to retire. That is awesome. I assume the grocery bill isn’t usually a $100 and that had more to do with hanging with the family?

Beerfest is a blast when you have a good group to go with. Be sure to make a pretzel necklace before hand. We usually treat the first 60-90 minutes like beer geeks and the second portion is more drinking contest.

$100 is unusually low for my groceries. You can see the ballpark budgeted amount is around $200/month.

Ending $100 under budget was due to three:

1) Visiting family

2) A little bit of work travel

3) Timing of grocery store runs. Since the GF and I split grocery visits (she pays one week, I pay the next) meaning sometimes my grocery spending bookends a specific month.

Quick on the draw with that rust bucket pic. Beautiful ride. I want a Datsun/Old Toyota so bad. Hopefully that guy is taking all that lumber and converting it into some beautiful hipster Adirondack chairs.

Haha, luckily he was driving by slowly thanks to the mountain of pallets.

I envy your spending habits. Sometimes I think that living with a girlfriend might be worth it to be able to split rent, but I might end up paying for it in other ways. Regardless, my take-out and happy hour habits break my budget each and every month. Lifestyle creep is one helluva thing and as a single guy working downtown and living in a large city, drinking and restaurant temptations are everywhere. I figured that if I reeled in my excessive take-out and drinking habits to a more reasonable level, it would only increase my savings rate by 3-4% and I’m not sure if that’s worth it in the scope of things. I’d rather work to increase my savings rate through house hacking a duplex rather than give up Chipotle.

Split rent saves me money, but it’s not without expenses. Spending on a date night/food truck night/beer fest becomes a lot more tempting when there’s a second person. On the whole though, I definitely still come out ahead, but I could see the scales easily tipped in the other direction if I had a high maintenance girlfriend.

I feel you about the downtown temptations. When I lived alone, Chipotle and social happy hours were pretty common expenses for me. I was never willing to give up Chipotle either, although I did make an effort to pare back. I realized I was mostly defaulting to solo-takeout due to laziness, as opposed to a happy hour/social dinner which is more of a social investment. One-man take out is functionally no different than a slow cooker meal – it’s just more expensive and less healthy.

Overall though I think there’s better places to focus your willpower. Especially when you consider that finding a slightly cheaper apartment or car funds a Chipotle habit tenfold.

Just have a noob question I’ve had a few months into investing into a vanguard stock VTSAX (admiral shares) currently have around 15k in it. Does VTSAX pay out dividends like quarterly or do they have a schedule? Or investing in this stock relies solely on market gains? It shows on my graph that for last month my 15k investment only went up by 24.69, is this correct? Thabk you.

VTSAX pays a dividend of around 1.86%. Dividend rates are quoted as annual returns, although the frequency of payment varies by investment. VTSAX splits that 1.86% return over quarterly payments.

You can check the current dividend rate for any Vanguard fund on it’s fund page; Vanguard refers to it as the “SEC Yield.” You can see all the dividends you received by going to your account and clicking “Transaction History” and looking for all the line items labeled “Dividend Received.” If you haven’t held the fund very long you may not have received any dividend payments yet.

The beginning of this article talks about some vanguard’s key metrics, which you might find interesting:

https://mymoneywizard.com/how-to-choose-a-vanguard-index-fund/

This was a slow month so that $25 gain sounds correct. Don’t stress about it. A month is barely a second in stock market investing; your real time frame is years and decades.

Nice job on having a very frugal month! I actually had one of my *least* frugal months this August… but most of it was pre-paying towards some fantastic experiences!

Thanks Mr. Tako! Hope you enjoy those experiences!

After reading your monthly net worth updates, I’m always super motivated and inspired, so thank you for taking the time to share them. I’m roughly the same age as you, but have a lot (read: $120K) of work to do to catch up with you, but it’s inspiring none-the-less.

Keep up the good work, and looking forward to next month!