Hey Money Wizards!

Time for an… end of summer?… net worth update.

If you’re new here, every month I share my progress in growing my investment portfolio. Originally, my goal was walking away from work by age 37. Recently, I updated that goal to age 35, because why not? So far I’m a little ahead of schedule at age 29, so let’s see the latest!

Life Update: August 2019

August is always a fun month in the land of Minnesota.

More than any other summer month, the Twin Cities really come alive in August.

By then, everyone has settled into the beautiful summer weather. The snow is long gone, the flowers are in full swing, and it seems every other day has some sort of festival packed with locals and tourists alike, who are all embracing the 75 degree highs and clear summer skies.

Lady Money Wizard and I had signed up for one of those festivals – a 35 mile summer bike ride.

Technically, the event isn’t until September. But that meant to get ready, we spent many August days biking around town.

While that might make us sound like awesome fitness go-getters, the truth is much less glamorous.

In reality, I’d recently read in a fitness book that one of the best ways to hold yourself accountable for exercising is to sign up for something slightly outside your abilities.

So I tried it out, and I can definitely vouch for the strategy. Knowing we had less than a month to get in true biking shape, the clock was ticking fast!

Nothing to get you motivated for a workout then the thought of getting whipped by one of the big day’s monster hill climbs!

Outside of the bicycling guilt, August saw a few other seasonal festivities.

Of course, there’s the Minnesota State Fair – the largest of its kind in the country, at least from a per-day attendance measurement. There, I did a good job counteracting all my hard work on the bike, by packing in as many corn dogs, mini donuts, cookies, sandwiches, and whatever else could fit in my stomach.

And then there was also one of my favorite summer traditions – the all you can drink beer fest held in Saint Paul. Again, I did my best to counteract all my hard work on the bike, this time with a liquid diet…

Oh, and last but not least, I’m happy to introduce a new member to the family!

After a few weeks of mourning last month’s loss of The Cash Cat, we started the process of finding a new critter to rescue.

After many internet searches and our fifth or sixth in-person meeting, we finally settled on a friendly and easy-going 5-month old kitten.

So, without further ado, please welcome The Money Meow!

I’m sure he’ll keep up plenty busy over the next few months. In fact, he’s circling my feet as I type this, clearly ready for another play session. Guess it’s time to wrap this section up!

Net Worth Update: August 2019

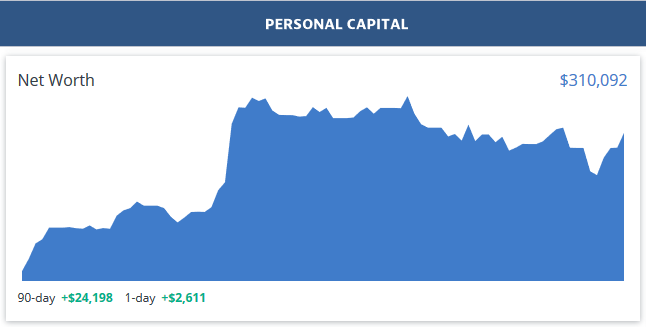

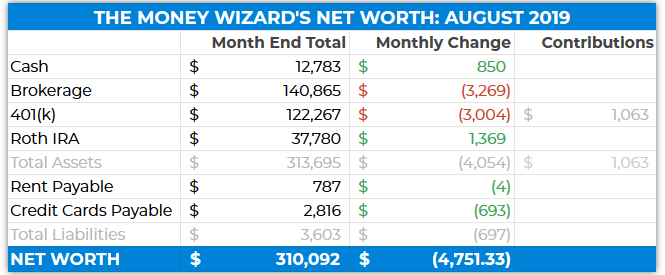

And the monthly spreadsheet:

A ~1.5% drop following a wild month in the market.

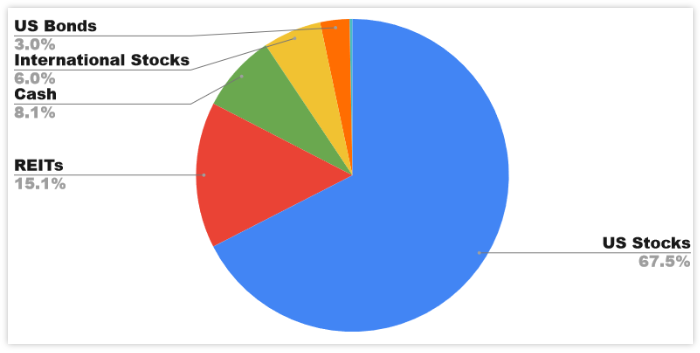

As of month end, my total allocation across all accounts was:

So let’s take a closer look.

Cash: $12,783 (+$850)

I’m comfortable building my cash balance to a higher amount than ever before, given my concerns with the economy right now and my own personal risk tolerance. (If you missed last week’s post about my thoughts on the market, definitely check out that article.)

That said, even though I’d like to build a larger “cash” balance, just having that cash sitting in a checking account is a bit of a waste. So, I’ll probably transfer that cash to something like a money market account later this month, where I could at least earn 1-3% interest.

Brokerage: $140,865 ($3,269)

The S&P 500 fell about 2.8% in August, and so that was somewhat reflected here in my 2% drop in the brokerage account.

401(k): $122,267 ($3,004)

Similar drop in the 401k account, which is almost 100% stocks.

Roth IRA: $37,780 (+$1,369)

Pretty cool to see some diversification benefits here. While the stock market fell around 3% in August, Vanguard’s REIT Index Fund rose 3.3%. (My Roth is invested entirely in this fund.)

This counter-cyclical nature is interesting to see, and makes me wonder about something I’ve been toying around with in my mind.

A look at recent history would show that Real Estate REITs are pretty highly correlated to the stock market itself. When the 2008 crash hit and stocks fell 30-40% across the board, Vanguard’s REIT index was falling right there with the rest of the market.

Of course, that makes sense, considering the 2008 market crash was driven first by an implosion in the real estate markets.

Which then raises the question – what if a stock market correction occurs that’s not triggered by real estate problems?

Hypothetically, REITs should offer a little more diversification benefits in that case. I have no idea if my hypothesis is correct, but it’s something interesting that I’ll research further.

Rent Payable: $787 ($4)

Another pretty low bill, since the weather has been nice enough to not need to run the AC.

In fact, looking at the upcoming forecast, I think this means I went through the whole summer and can count on my hands and toes the number of times I turned on my air conditioning. Another cheer for Minnesota summers!

(For newer readers, this cost represents my half of the mortgage, utilities, and anticipated home maintenance. We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $2,816 ($693)

Still overinflated, per usual, due to some reimbursable work expenses.

As a reminder, this number is just my monthly credit card statements, which always get paid in full. Credit card interest is a massive wealth killer, and I never intend to pay it. Ever.

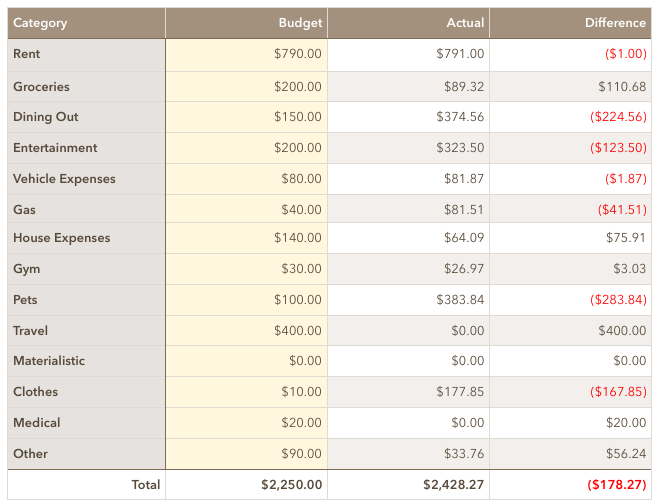

Total August Spending: $2,428

Dining Out: $374

Whoa! Maybe my new record?

Part of the reason for this massive tally is a funny story, and also a good cautionary tale for others.

In August, I bought a discounted Groupon for a dinner at a really fancy restaurant in town. Then, I smugly patted myself on the back for what a good deal I scored.

That is, until I actually went to the dinner and saw the menu prices! When it was all said and done, my “cheap” and “discounted” dinner still cost me $82!

A nice reminder – just because it’s on sale, doesn’t mean it’s a good deal.

Groceries: $89

Unusually low this month, probably because of how many times I ate out instead.

Entertainment: $324

All those festivals added up! Included here is:

- At least $50 at the state fair

- $30 for a concert

- $20 for a food truck festival

- $80 for all-you-can-drink tickets for two to the beer fest.

- $40 for a baseball game

- Over $100 on random bar and brewery trips with friends

That said, I had a blast at all these and consider them money well spent, so I’m not stressing too much about this bill.

Pets: $384

Got the final bill for the loss of The Cash Cat, which Lady Money Wizard and I split.

Also bought some new food to win over The Money Meow.

Clothes: $178

Replaced one more pair of shoes. Also stocked up on these arch-support inserts, which for somebody with flat feet like me, are total lifesavers. They’re only $10 or so, but I had a brief moment of panic when I thought they were discontinued, so I bought about 6 pairs in hopes of building a near-lifetime supply.

How was your August?

There’s really something special about the summer. I hope you’ve had a great one so far!

PS – Want to easily track your own net worth? I still think Personal Capital is the best way to do it.

More from My Money Wizard:

Congrats on the new family member, Money Meow! And that Beer fest looks like something that we would not be able to pass on either. Looks awesome.

We had a bit of a rocky August as well. Mostly market related and an expensive end to the summer. I’ve attached our update below.

Have a great week,

-Chris

https://moneysavvymindset.com/net-worth-update-august-2019/

The beer fest is a great time! Will check out your update.

Money Meow is so cute!

Haha, thanks Lily!

Hey Money Wizard. In Australia we can’t use the Personal Capital app, it’s not available. Any other suggestions for apps that are available here? Cheers

Hi Jack,

I’m in Australia too and have used a few of the local Personal Capital variants… including “Buxfer” , “Pocketbook” , “My Prosperity” and, just recently “Money Brilliant”.

Naturally they all offer different pricing structures and have differing strengths and weaknesses. If I recall, Buxfer is completely free and is a spartan as it comes, which is good if you want a no-frills looking experience.

I’ve finally settled on “Money Brilliant” because they have much snappier response times when selecting menus and changing categories, which is convenient when you’re trying to reconcile across a months worth of transactions.

Would love to hear if there’s any other Aussies out there who know of anything better?

Cheers,

Kris

Good info, thanks for sharing Kris!

What money market account would you suggest?

You’ll like this article:

https://mymoneywizard.com/where-to-invest-cash

Another solid option depending on your tax bracket are Vanguard’s tax exempt money market funds. They yield less but if you’re in the 30%+ tax bracket, it’s worth running the numbers to see if you come out ahead.

Keep up your persistence! A couple things came to mind.

1) Sometimes the convenience of something or the overall enjoyment of an experience is worth the cost. For instance, I’d agree that the beer fest was great fun and worth it. I’m not there in Minnesota, but there was a beer fest near where I live where I was able to enjoy beer for free. A friend of mine and I ended up volunteering to help work at the beer fest, and we received a few tickets for beer samples for free in return as part of the deal. So, even though we saw this as a fun work around, I didn’t mind later allotting about $120 for me and wife to take kids to enjoy a renaissance festival. Also another convenience factor that we’d ended up paying is lawn care service for not needing to take the time and effort away from possible family things, plus I don’t have the right equipment.

2) Cash flow timing for my bank account some time ago forced me to make credit card payment decision that I don’t normally do – I paid only the minimum. Though I subsequently called the company like about a week or 2 later to pay the remainder when I did have the funds. I knew this would incur an interest fee. I waited until a bit later when the billing cycle was done and called to ask about any fees or interest. I’d asked on that phone call if the interest could be waived. They did so, citing that I usually pay in full and on time in the lengthy duration I’ve had the credit card account. The representative said that they don’t normally do that but made an exception. I’m NOT suggesting that this approach be a routine habit but pointing out that there can be times when a credit card company can help remove fees and interest when asked, especially if it’s a reasonably small amount.

Nice comment, Ian. And good point about #2. I wrote an article when a similar thing happened to me:

What To Do If You Miss a Credit Card Payment

“…thought of getting whipped by one of the big day’s monster hill climbs”

Minnesota has hills? I always heard it was perfectly flat. If there are hills hidden somewhere, I’m packing my bags!

Minnesota might be flat, but Minneapolis and St. Paul definitely aren’t.

Anything along the Mississippi river here has river bluffs that drop down pretty drastically. It’s no Colorado, but that’s where you’ll find Minnesota’s ski hills with 300 to 800 feet of elevation change. The bike ride in question had 2-3 climbs with 300+ feet of elevation change.

My August was good. At least considering the market volatility we have experienced.

The biggest issue for me this month, at least from a finance blogger is that the dollar/NOK conversion rate is really messing up my month-to-month performance.

Had to add tables showing both of the currencies to justify.

Hey Money Wizard!

First I want to start off by saying thanks for all you do, you are an inspiration to all of us. To give you a little background I’m a 25 year old student pursing a nursing degree who is eligible to transfer into a 4 year school’s nursing program after this semester. I currently work a server/bartender almost full time and I only started my saving journey 2.5 years ago. In that time I’ve been able to pay of my student debt, but a used 2011 Cadillac CTS with only 75000 miles on it, boost my credit by 130 points and save in excess of 25000 dollars cash. If I keep up this pace my net worth would be around 50000 as I have also maxed out my IRA and contributed 56 percent of my check to my trad 401k with a 4 percent match. So my question is how do I go about making sure my money doesn’t lose value to inflation while I’m in school but at the same time make sure they don’t count the money I have towards what I need financially from financial aid. Any tips would be helpful. My plan next year is to put 100 percent of my checks towards my 401k and get 104 percent sent to my 401k, max out my Roth IRA again and open an HSA since at age 26 I have to pay for my own insurance. I plan to do that via a high deductible insurance plan. Thanks in advance for all your help.

Hey Money Wizard!

Mike again. I also wanted to start my own blog but I definitely don’t have a net worth of 300000 or been on the today show so I was wondering if you thought it would be a good idea? And if so if you had any tips for me? Thanks again