Welcome to the LAST net worth update of 2020.

See ya later, 2020! Don’t let the door hit you on the way out!

For newer readers, every month I track my progress to a nearly $1 million net worth and an early exit from the working world. I’m currently 30 hoping to retire by age 35. Let’s see if I’m on pace!

*As always, nothing in this post or on this site should be considered investing or financial advice. I am not an expert, please do your own research.

Life Update: December 2020

The biggest life news in 2020 is that I finally got to see my immediate family for the first time since the pandemic started.

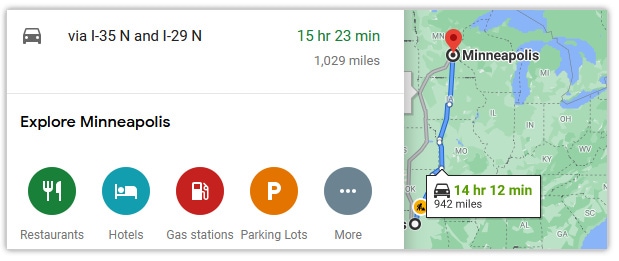

They live in Texas, and I live in Minnesota. Normally, 1,000 miles of distance is easy-peezy thanks to modern conveniences like air travel. But in case you haven’t heard, 2020 decided to throw out the modern conveniences in favor of grounded airplanes and bubonic plagues.

So, two negative COVID tests later, and I found myself driving 15 hours across the country to celebrate Christmas with my parents.

Surprisingly, this was actually much less of a battle than I imagined. Maybe the $13,000 Mazda 3 is just that comfortable. Or maybe I’m secretly destined to be a long haul trucker.

Either way, I made the trek in one sitting, as did The Money Pup. What a good boy!

Legs stiff, I was rewarded at the end with a fantastic 10 days with family to celebrate a Christmas/Thanksgiving combo holiday.

Back in Minnesota, I kept the holidays rolling. Lady Money Wizard and I got into the season with all the usual traditions, including Christmas-light touring, where this guy had my favorite decoration of this year:

Touche, good sir. You perfectly captured our collective spirit of the season.

Moving along…

Net Worth Update: December 2020

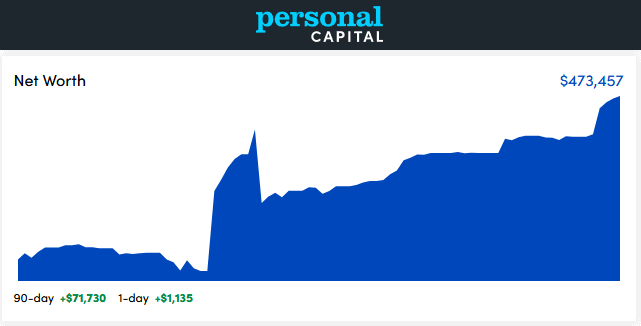

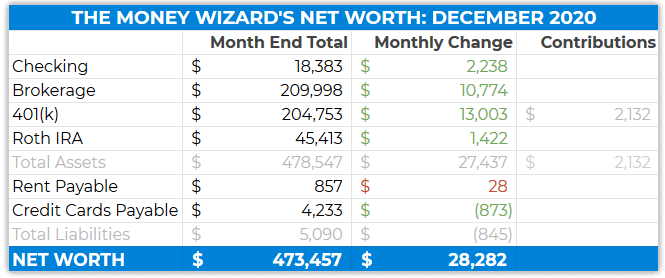

Not quite as ridiculous as November’s $50,000 gain, but $29,000 in a month is still insane!

You know we’re living in a bizzaro upside-down world when the worst year in over a decade actually saw the markets gain somewhere around 15% when it was all said and done.

But hey, that’s what $20 trillion of global stimulus spending will do. Toss in a promising COVID vaccine and mandatory work-from-home orders (which actually boost profitability for most big companies) and the market future is actually looking surprisingly rosy right now.

Who’d have thought?

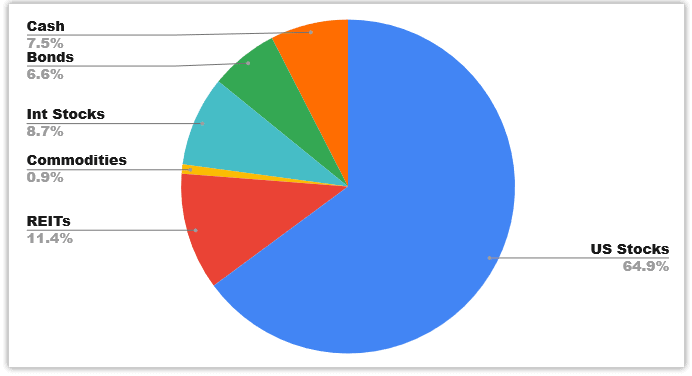

For me, this whole roller-coast just proves yet again that taking a balanced index fund approach (and avoiding constant market drama) is really the best path for most of us.

I mean, in January 2020, people like yours truly might have been grumbling about an overpriced stock market (I wrote about it here) but even I was blind-sided by a virus fueled crash that led to an absolutely unprecedented 30% drop in the market, all in a matter of days.

At the same time, who would have guessed that same legendary crash would look like nothing more than a blip come year-end?

Yet here we are.

Just another lesson from Mr. Market. The patient investor, focused on the long term, does best. Sometimes (all the time?) it’s best to hold the course.

Speaking of which, here’s my current allocation, which is really the only “stock market news” I should care about:

Of course, I also have a handful of cryptocurrencies which I don’t report for security reasons. I’ll just throw out that anyone brave enough to jump into bitcoin when I wrote about it back in May has been rewarded handsomely – since that article, Bitcoin has quadrupled in price from $8,000 to a new all time high of $32,000.

If this continues, this crapshoot portion of my portfolio might become too large to ignore.

Checking Account: $18,383 (+$2,238)

Normally I’m not a fan of having this much cash on hand, but it will actually transition nicely into a fully maxed our Roth IRA as soon as possible in January.

From there, I plan on upping my automatic contributions to my after-tax vanguard account. I’m thinking I’ll set up anywhere from $1,000 to $2,000 per month to automatically transfer from my checking account and invested into VTSAX. (Vanguard makes this process super easy.)

Brokerage: $209,998 (+$10,774)

Pretty cool to see this cross $200K for the first time ever!

I did buy another $2,000 chunk of Gold/Silver ETFs, in order to get closer to my target of 1-2% gold in my portfolio.

Current breakdown is roughly:

- Vanguard Total Stock Market Index Fund (VTSAX): $135,000

- Vanguard Total Bond Market Index Fund (VBTLX): $29,000

- Vanguard Money Market Fund (VFFX): $14,000

- Gold & Silver ETFs: $4,000

401(k): $204,753 (+$13,003)

Another $200K milestone!

I max out my 401k ever year, and also receive a generous match from my employer. (About 7%) The result is that I dollar cost average around $2,000 into my retirement account each month, no matter what the market does.

The contributions are still broken down like this:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $45,413 (+$1,422)

I contributed the $6,000 maximum to this back in the beginning of 2020, and I’m looking forward to doing the same again in 2021.

My Roth is mostly Vanguard’s REIT Index Fund (about $38,000 worth) and some of Vanguard’s Total International Stock Market index (almost $7,000 worth).

Rent Payable: $857 (+$27)

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $4,233 (+$873)

Always wildly inaccurate, since I pay it off every month and put lots of reimbursable stuff on the cards. Hence, the reason for my monthly spending report below.

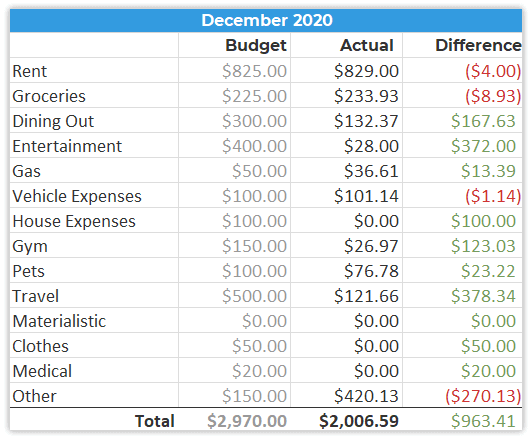

Total December Spending: $2,007

As an aside, due to popular demand I just finished updating my spending spreadsheet (which used to be exclusive to numbers for iPhone) to also work for Microsoft Excel. I also made some really cool improvements to it – it now automatically tracks all my income and spending, calculates my savings rate, spits out pretty charts, etc.

If you want to make sure you get notified when I release it to the public, make sure you’re subscribed to the Money Wizard Newsletter!

Vehicle Expenses: $101

My usual $70 car monthly car insurance plus an oil change and tire rotation in preparation for the 15 hour trek from Minnesota to Texas.

Travel: $121

It turns out that driving is a lot cheaper than flying, assuming you’re willing to burn a whole day each way. This cost was mostly the gas for the trip and a few miscellaneous expenses.

Gym: $27

Wtf!? Pretty sure gyms are closed here, and I still got charged somehow. Gonna have to add an investigation onto next month’s to-do list…

Other: $420

Almost entirely Christmas presents for friends and family and some charity giving that’s become a holiday tradition for me.

How was your December?

And how happy are you to see 2020 end, haha!? Hope you all had a great holiday season, and I look forward to posting and talking with you all about 2021’s goals and plans over the next few posts!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Geez, if bitcoin keeps up at this rate you can look into retiring by the end of the year! I remember you considered placing 15% of your crypto allocation in ETH, if you did then that paid off nicely too.

Happy New Year!

Best,

Brandon

Haha, no kidding. And yeah, I did end up with around 15% allocation in Ethereum, so that’s been a nice bonus, too.

Happy New Year, Brandon!

What REIT are you investing in?

VGSLX.

*Not investment advice, do your own research, yada yada…

Wow, what a year 2020 has been – your Net Worth is up $100k+ from last year! Love the Christmas lighting picture haha! Glad you got to spend time with the family too. Happy Holidays, Happy New Year, and hope 2021 is even better!

I didn’t realize the total yearly growth was over $100K. Pretty wild when you put it like that!

Best to you too!

Looking at your budget and comparing it to mine. Does Lady Money Wizard roughly allocate the same amounts each month? So is your total household budget double what you listed? Just comparing to my married (combined) budget out of curiosity.

Long time reader, love the monthly inspiration!

I probably spend a little more than Lady Money Wizard does, especially in the Dining Out and Entertainment category. Although she definitely has me beat when it comes to spoiling the pets. 😉

In total, she probably spends about 20-25% less than I do most months, but I guess we’ll know for sure after we *hopefully* combine finances in 2021. COVID willing, haha!

Great to see you pass those 200k milestones! Fantastic update to an off-the-wall year. Quick question – what percentage of your mortgage or income do you put aside for those future home repairs and/or upkeep? I know you’ve mentioned it specifically in past updates, just cant put my finger on it right meow.

About 2% of the home’s value each year. For us that comes to a little over $300 per month or $150 per person.

Love your posts! I’m obsessed with them (in a cool, not-creepy way). Few questions:

1) Would you be willing to share a screenshot, or just type in this reply, the breakdown of your US Stocks into Large, Mid, & Small Cap? I’m also using Personal Capital and I saw that you can drill down

2) What’s the ticker symbol of the Gold & Silver ETF you started in? I know, not investment advice, I’ll do my own research 🙂

3) Are you not concerned about doing dollar-cost averaging throughout the year since you contribute your entire $6,000 of Roth IRA at the beginning of the year?

Thanks!

You are doing very well indeed. Curious, I’ve seen a lot of people with zero international stock exposure and many, like myself, with 20-30% international stock exposure. But, to me at least, a number like 8.7% is unusual. The zero percenters usually feel that the US large caps are all basically doing business internationally so they are covered. The 20-30% crowd feels the US isn’t the only market in town so they should have more diversification in internationals. How did you pick your allocation into international? I’m just trying to learn something here, not criticizing at all, you are outperforming me! And thanks for reminding me, I stopped for a few minutes while reading your post and made mine and my wife’s contributions for 2021 to our Roth’s, which is $14K for old timers like us. Oops, don’t tell my wife I called her that, I want to keep getting older!

I’m happy to get to 2021, but we still have to make it to March. I spent more money in December than I have in the months throughout 2020. i just felt ready to spend some money and to just be okay with it.

I am now close to $450,000 in all of my retirement/savings accounts. I’m so excited. I made a comment on one of your posts who knows when in 2020 about how I was about to hit $400,000. I’m so excited. Plus, I paid off my car loan yesterday. We are a two car household (paid off husbands in March) and we have no more payments after yesterday. Weeeeeeee!

Anyways. Have a great day.

Wow, awesome job! Amazing progress, keep it up!

Congratulations, Sean. You’re enjoying the benefits of compound interest that you talked about a couple of posts ago. The juicy thing is, it can only grow faster from here on out, barring any stock market disasters or aliens attacking the earth. Now that I said it, I might have jinxed it. Well, here we go and see. Here’s to a great 2021!

Wow–nice work on BTC! Better lucky than good sometimes, but plenty of good to go along with it. Maxing out those retirement accounts and throwing an extra few grand at the brokerage is the fast track. Good luck in 2021–and I’m definitely stealing that Santa decoration in the future, maybe for a rival sports team!

Congrats on a good year! Financially, mine was good too. But I’d rather have our normal lives back.

Sam

When you first started this page and your path to increasing your net worth, what were your main sources of investing? I am currently 25 with a net worth of around $35,000, and am looking to jumpstart my financial journey. congratulations on the success you have had over the last several years!

Thanks, Jordan!

Sources meaning the money I invested or the investments I made? In the beginning it was all savings from my salary, and I invested almost entirely into VTSAX.

Congrats on your journey so far !

Have you ever calculated the exact capital you have poured into the portfolio ?

The way you are investing is DCA since you invest every month, so it would be interesting to calculate the ROI based on the capital invested so far and the actual current value of the portfolio.

Once again hats off !

Cheers

I love seeing your net worth updates! It is inspiring to me and glad to see it increase so substantially over the years. With the craziness in today’s market, who knows what crypto will go to!! I have started a blog myself tracking my net worth and writing on topics I find interesting at everydayfinancenerd.com – I aspire to be diligent as you have been! Thanks!