Hey Money Wizards,

It’s time for another Net Worth Update!

This is the final one for an interesting year. So I’ll keep the usual intro short – I’m trying to leave my office job by age 35 with around a $1 million portfolio.

I’m currently 31, so let’s check on the progress!

Life Update: January 2022

After nearly two years of CONSTANT VIGILENCE (bonus points if anyone gets that reference), Omicron proved too contagious for the Money Wizard household to fend off any longer.

Lady Money Wizard picked it up from someone at her work. Luckily, she was fine. And strangely, I never got it?

In any case, it meant that we spent the first third of January mostly hanging around the house, drinking lots of water, and eating lots of healthy food in hopes of turbocharging that immune system.

I’d planned to take a ski trip near the middle of the month, but this slight curveball meant I never pulled the trigger on that one.

After our little quarantine-cation, we did go on a dining out bender to end the month. Hey, we had to celebrate Lady Money Wizard not losing her sense of taste somehow!

Otherwise, here’s to a better February!

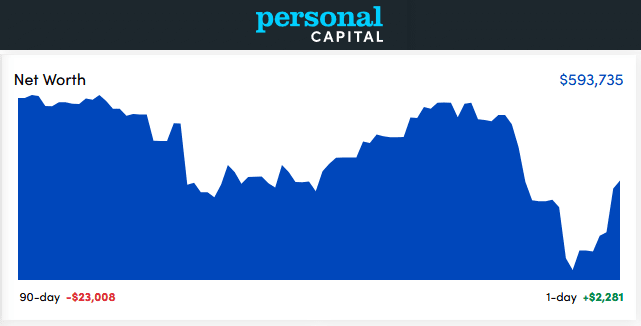

Net Worth Update: January 2022

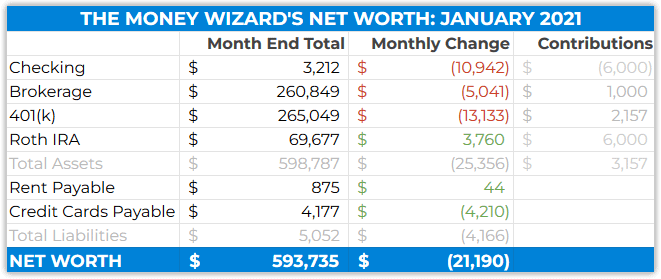

And the detailed spreadsheet that I keep:

A brutal month in the market.

In January, the real most powerful person in the country (Jerome Powell, sorry Mr. President…) announced The Fed’s economic plan for the upcoming year.

With inflation running wild, politicians were pressuring The Fed to get it under control. Their answer, as announced in January, was to raise interest rates over the upcoming year.

Through an economic game of dominoes that’s beyond the scope of some dude’s monthly net worth update, raising interest rates is one of The Fed’s main tools to slow inflation. Unfortunately, it also has the side effect of plowing down asset prices.

Not surprisingly, Wall Street traders sold stocks en-masse when they heard the news, resulting in the $20,000+ drop you see in poor Money Wizard’s portfolio.

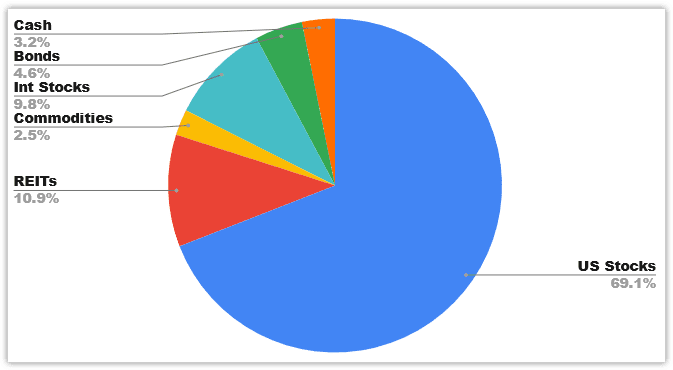

Portfolio Allocation

International stocks increased thanks to some Roth contributions (more on that later) while U.S. stocks stayed exactly identical to the last month.

Overall, the thing I’m most happy about here is cash at only 3%. Because who wants cash when it’s getting crushed by double digit inflation each year?

Checking Account: $3,212 ($10,942)

Big changes!

The bad – As expected, I had to pay the piper and take care of last month’s $8,000 credit card bill.

The good – I was on top of my Roth contributions this year! While I usually procrastinate this for no good reason, this year I made the full $6,000 transfer at the beginning of the year!

Brokerage: $260,849 ($5,041)

Here’s the first place you’ll see the impact of the Fed’s announcement.

Not as bad as expected, thanks partially to my automatic monthly contribution and to a much lesser extent, the larger commodities portfolio (gold) I’ve been building up over the last year or two.

401(k): $265,049 ($13,133)

Ouch, now that’s pretty ugly.

Especially when you considered I added my usual $2,000 per month to this. (In 2022, I still plan on maxing out the 401k, as I have for the past few years.)

Roth IRA: $69,677 (+$3,760)

In January, I did my yearly chore of adding $6,000 to my Roth IRA. (The max allowed per year.)

Of the $6,000, I put:

- $5,000 into VTIAX (Vanguard’s International Stock Index Fund)

- $1,000 into VGSLX (Vanguard’s Real Estate (REIT) Index Fund)

So the final breakdown of the Roth is now about 75% VGSLX and 25% VTIAX.

But the more important thing I was thinking about when deciding on how to break down this year’s contributions? My overall portfolio.

The $5,000 into the International Stock Market index moved my overall allocation to about 10% international stocks and 10% real estate funds, which is more in line with my portfolio targets.

Rent Payable: $875 (+$44)

Natural gas prices are crazy right now, so even though we cut our usage in half by investing a ton of money into insulation, we could only run (but not hide!) from rising utility bills.

For newer readers, I share a house that was purchased by my now-wife. This number is my half of the mortgage, utilities, and a couple hundred dollars a month that we throw into a “home maintenance fund” to help prep for any big projects.

Credit Cards Payable: $4,177 ($4,201)

Last month the total was $8,387, so compared to that… this doesn’t look too bad!

(Hey, everything is relative!)

After pre-paying for a lot of 2022 trips and vacations, I’m glad to see this category start to return back down to earth.

Speaking of which, let’s check out my monthly spending.

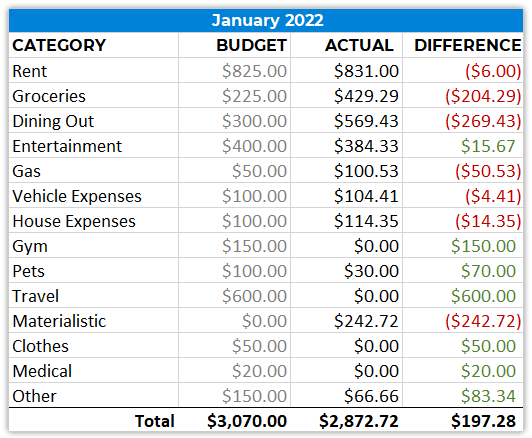

Total Spending January 2022: $2,872

Groceries: $429

Umm… inflation much?

Dining Out: $569

Yeah, we went a little wild on the dining out this month.

Interestingly, we chose quality over quantity, although the result on the wallet was also quantity. The bulk of this was just three very fancy dinners that totaled $100, $150, and $200.

Entertainment: $384

We celebrated a friend’s birthday at the breweries and distilleries, and let’s just say the shenanigans added up quick!

Materialistic: $242

After searching Craigslist and Facebook marketplace for months to no avail, we gave up and eventually bought a perfect corner accent chair for our living room.

How was your start to the year?

I’ve got a good feeling about 2022! Maybe?

I think…

I hope…

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

What are the primary crypto investments? My core portfolio is pretty similar to yours, but I have some smaller investments in crypto and I was curious what you’ve been getting into there.

Nothing too exciting – Bitcoin and Ethereum make up 90% of it. I’ve got some extremely small hedges in the “Ethereum killer” type coins in case ETH doesn’t work out for some reason.

Quick question/comment – Now that you are married, are you not filing taxes jointly? I would assume that you are over the income limit to be able to contribute to a Roth IRA. I’ve been following your model site for some time now, similar age and savings rate (it appears), love the work. I got the advice toward the end of last year to stop contributing to my Roth IRA, now I do have access to a Roth 401k that I now make contributions to.

Good question. I’ve got an appointment with my accountant next month, so I guess I’ll find out then.

We’d be under the Roth income limit either way though.

Not sure how many you were feeding, but those dinners were eye popping! Compare a dinner to the chair, which you will enjoy for many years….

Yes, stock values are down, but you are in accumulation phase, this is good! Much more concerning for retirees like me who are in the de-accumulation phase.

I heard a great idea for dinners, it was just before COVID, hopefully it will come back soon. But the concept was that an ethnic cook would come over to cook dinner at your residence. So a cooking lesson along with a meal as well as some cultural background. A great evening. As an added benefit, many of the cooks were poorer ethnic folks, mostly women, who could make some money as side hustle doing something enjoyable vs. other work available to them.

Good point – now that we’re married I’m pretty much paying for all our dining out bills, so you can assume any dinners out are dinners for two!

I’m in the twin cities as well and my energy bill has been absolutely chaotic. As a first time homeowner/bill-payer, I am going crazy over this! One month gas/electric is $90, the next over $100, then $250, now over $350!!! I’ve been walking around in the dark, put shrink wrap on all the windows, and if anyone even looks at the thermostat, it’s off with their heads (I get it now dad, I get it)! If it goes up anymore I am turning the heat off and wearing all of my clothes every day for the rest of winter!! On the bright side, less than 45 days until spring!

Anywho this is not a bill paying blog, but an awesome inspiration for myself and many others! I’m early on the journey and have been following for maybe 5 years now. It’s been amazing to watch you stick to it year after year! I’m not where I want to be, but the fact that I am much farther than peers shows that I’m doing something. Thanks for divulging info on things people rarely want to talk about so money nerds like me can geek out once a month!

Haha, thanks, Tiana. I saw a stat earlier today – inflation is 7 percent overall but energy inflation is 29 percent. Just wild. Hopefully The Fed actually reigns in this inflation we’re seeing. (More on that in a later post)

You probably need to remove the $150 Gym line item.

Haha, very true.

Hi MMW! Is Lady Money Wizard saving and investing as well or will you both be living off the 1 million returns? Asking because my husband and I are on this journey as well but we think we might need closer to 1.5 million to feel more at ease about leaving the workforce. Thanks!

Yeah, $1 million is a bare bones number. $1.5 million seems totally reasonably for a couple.

January was tough, it’s never fun waking up every morning to go to work and realize that you are in a worst off position than you were 30-60 days ago. Hopefully things will start to slowly turnaround here sooner than later. Curious to hear some of your thoughts about the current investing landscape and how you are navigating things…not to be critical but you seem to have been a bit MIA lately 🙂

Hello M. Wizard,

If you had a Roth 401(K) (I do), would you contribute to it instead of a regular 401(k)? What would be the reasoning on your decision?

This article should have what you’re looking for!

https://mymoneywizard.com/deciding-between-a-roth-or-traditional-ira/