Hey Money Wizards,

We aren’t dead yet!

Every month For the first time in the last three months, I’m tracking my net worth to see how close I am to leaving my office job in the near future.

I’m currently 32 with the goal of $750K to $1 million bucks within the next three years. Let’s see the latest!

Life Update: October to January 2023

Busy stuff! Which pushed the blog a little lower on the priority list, unfortunately.

What can I say? The pay around here stinks!

In all seriousness, a big reason for the delay was that Lady Money Wizard and I finally started the process of combing finances.

Hey, only 1.5 years late! By that scale, this blog post is looking good!

What else? Get ready for the lightning round:

- November 2022: Thanksgiving festivities with family, Thanksgiving with friends, Thanksgiving with more friends, and I’m pretty sure another thanksgiving with friends? Almost like there’s a holiday this month…

- December 2022: Flew down to Texas for an early Christmas with my family, then flew back to Minnesota for a timely Christmas with Lady Money Wizard’s half of the family. Even reunited with some new friends from our big fat trip to Greece!

- January 2022: Battled some epic snow in Minnesota. Seriously, I can’t ever remember it being this snowy! Then escaped the snow with a trip to Florida to visit some family.

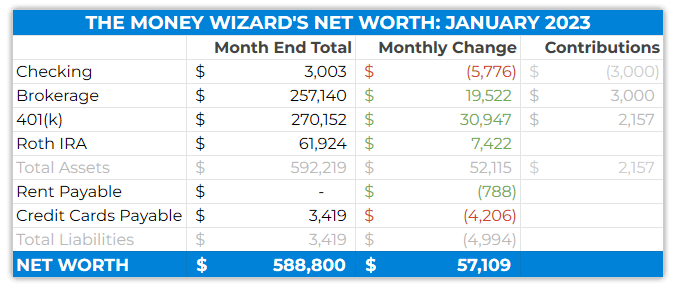

Net Worth Update: January 2023

And the details…

In November, the overall market gained about 5%, then slid back down 5% again in December.

The market’s final tally for the year 2022? Down about 20%.

Then in January, the market climbed another 10%, which means my portfolio is finally getting near its previous peak in October 2021, which was $615K.

Enough of a roller coaster for ya?

It’s easy to get bummed about a lost year+, but that’s only one pessimistic way to look at it.

The other side is that the market has, historically, recovered and rallied after times of great discount.

As I keep telling myself – it’s all about those assets! Because in that last year+, I’ve been buying up more and more shares of assets which should, one day, take off.

It’s building the base. Kindling before the fire. Dynamite for the explosion.

One day!

Account Changes

For the past three months, the checking account continued transferring $1,000 per month into my brokerage’s Total Stock Market Index fund, and the 401(k) kept getting the maximum allowed.

Moving forward, Lady Money Wizard combined our checking accounts, so I’ll play with the numbers and see how much to auto transfer to the brokerage moving forward.

My current strategy

In 2023, I still plan to max out the 401(k) and Roth IRA.

Now that Lady Money Wizard and I are combined, we’ll probably have more investible income, so I’ll probably have to play with how much we’re dumping into index funds. (I expect it to increase slightly.)

With the real estate market correcting, I’m also finding myself with an itch to become a landlord again, although regular readers will know I’m typically all talk in this area. We shall see!

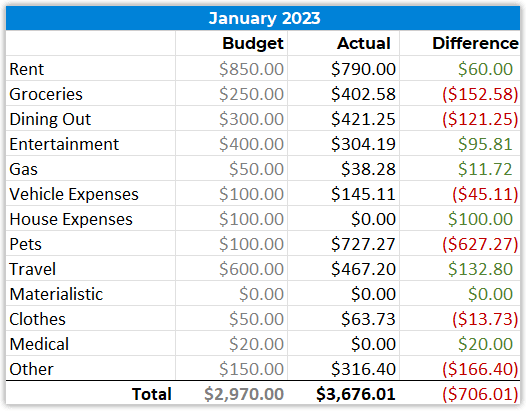

Total Spending: January 2023

The rent category will need some adjustment moving forward, since we now share an account.

Otherwise, the big expenses in January:

Groceries and Dining Out: $821

Those food costs are killer right now!

Pets: $727

The Money Pup got his first ever dental cleaning, so that was quite the bill.

Travel: $467

The Florida trip, which was greatly reduced in price thanks to staying with family and using some companion credits.

How have you been?

It’s been a few months since one of these posts. Would love to hear from you!

P.S. – The New Year is a great time to start tracking your Net Worth, and Personal Capital is still my personal favorite tool to do so.

Related Articles:

Great to see an update!

My wife and I got married 2 years ago. We have both a shared account and separate and I track ours combined and separate in terms of net worth.

Despite contributing >50 percent of our incomes, we still ended up in the hole in 2022 (down 10k from 12/31/21 through 12/31/22). However, January is already been a great start and we are up 20k from our 12/31/21 numbers!

What saved us was that property values for our 3 properties largely appreciated a healthy amt despite the stock market downturn so our total net worth overall increased over 2022. Right now, about half our net worth is property equity and the other half is invested in the market and we are currently at just over 1.1.

Goal is to have my wife not work this year and I follow suit in a few years before we hit 40 and we can devote all our time with our toddler!

Here is to a great 2023!

Welcome back Money Wiz! Glad to hear things are good with you. I wouldn’t be upset if the net worth updates slipped to quarterly if that’s easier for ya. Keep ’em coming!

Yes, it is great to see you’re back! I agree. If quarterly is what it ends up being, we all understand. Life gets busy! But overall I love reading how you’re coming along!!! Your posts are so inspiring!!! Must say though, the dental cleaning for your money pup, did it come with braces??? Wow, never knew there was a market for dog teeth cleaning!

Great to see you back Sean! I’m happy for you both that you’re combining finances. It’s an adjustment but a good one, and it’ll be cool to see how that accelerated your journey to FI. I don’t have a crystal ball but it is fun to make predictions, so my prediction is the last $400k to the $1m mark takes you 2.5 years. With $150k of that being savings and the other $250k coming from appreciation of your investments.

I agree with the others that moving to quarterly makes sense. Honestly, when your net worth is this sizable, monthly is too granular anyway (and perhaps even counter to the “long term investment” message of this site). My net worth is quite a bit smaller, but I only track on a half year basis which is enough to see the general state of things.

That said, I love your other articles better than the net worth updates. Though looking over the past year, it’s been mostly net worth updates. But please only write when you have something to say, rather than just to “feed the beast”.

Lastly, I just want to say that your blog has quite literally changed my life. In 2018, my wife sent me your Business Insider article. At that point we had a negative net worth of $35K (albeit the debt was all low interest student loans, offset by a few thousand in savings and a few thousand being the value of our used car), were essentially spending everything we were making, and more or less saw saving as delayed spending without having any long-term bigger picture. After reading your BI article, I discovered your blog and read through all your blog posts, and then discovered Mr. Money Mustache, Afford Anything, and some others. Your blog is still my favorite, though. I love that, while you are pretty frugal, you don’t shy away from being transparent about spending money where you find value – going out to eat at nice restaurants, travel, and having a maid (haha!) – things that many financial bloggers scoff at. Anyway, here I am some years later – six figure net worth, multiple streams of income, frugal (and spendy) where it counts, and a homeowner. Thanks for the fantastic guidance you’ve provided over the years!

Welcome back Money Wiz!!!!!

I missed your valuable advice!!!!

You are an inspiration for me and my family!!!

Would it be wrong to say the Money Pup needs to get a job and pull his or her weight?

This is a great post. I also have my own goals lost that I put out for the public to read and review, in the hopes of inspiring others to Create their own goals for their own journey in life for success. I learned so much that i created my own website to help others just like you do, if you have but only a SECOND. I would love to show you, my website. Thank you in advance for your time. https://www.investingforbeginnerscommunity.com/

Confirmed blog = not alive

bring back the updates, man! 😉

I figured with the markets going up we might get an update…

Did he pass?

No updates for 7 months 🙁

Can we at least get a parting post?

Your readers who have read your blog for years really deserve you being honest and just saying that the blog is dead and that you have given up on it.

I agree, I feel like I owe the readers an update or ten…

I’ve actually been procrastinating reading the comments because I feel quite a bit of guilt. Hopefully I can get an update going and explain it all soon.

We look forward to hearing what you have to say!

Hi Wizz,

It’s been almost a year since your last post. Now it’s probably a good time to do a November update. 🙂 I’m exited to know where you financially and actually see where I’m sitting vs you. Many many years ago when I found you I said to myself I’m going to do the same and hopefully over pass the wizz someday. Because of you I’m where in at financially. So thank you!

great journey so far, happy holidays, hope all is well with you and your family, I am impressed with the amount of detail you put into your blog about your life as far as saving and investing, i love the transparency, thank you.

i also have a similar blog that I created to put my thought out into the world, because i could tell my wife was getting tired of listening, hahahaha

anyways, I would love for you to check my blog out and maybe we can collaborate on future projects together one day. I do reference and source links from other blogs in my blogs, so if thats ok with you i may use one of your articles as a reference or source for future content, this basically means you get free link from my blog to yours, kind of like a 2 way street back between our blogs.

cheers! I love the style of writing and your journey so far

This is a preview of my blog below

Ares Capital (ARCC) Is A Strong Buy, 10% Dividend Yield, 10% Appreciation YOY, That’s 20% ROI,

Welcome to the Investing For Beginners Community.

Today I talk about Ares Capital (ARCC} Is A Strong Buy, With A 10% Dividend Yield, 10% Appreciation YOY, That’s 20% ROI,

https://www.investingforbeginnerscommunity.com/post/ares-capital-arcc-is-a-strong-buy-10-dividend-yield-10-appreciation-yoy-that-s-20-roi

Exactly 1 year ago today was the last update. Makes me sad to see it stuck here. I enjoyed the monthly net worth updates along with the occasional article.

Hej Money wizard,

We miss you! Are you still alive? 🙂

He must pay the server fees for the website, I would think that would entice him to post something soon!