Hey, Money Wizards!

How is it August already??

But you know what that means… time to look back on last month’s progress.

Yep, every month I share all the details of growing my investment portfolio. The goal? Walking away from mandatory work by age 35.

I’m currently 29 with a couple hundred thousand to go, so let’s see the latest!

Life Update: July 2019

July was a month of highs and lows. (Well, one low to be specific, but we’ll get to that in a minute.)

The Highs

July started how you wish every month could start. With good times, good friends, and lasting memories.

First, I took an extended weekend away from work to spend some time celebrating the Fourth of July. In doing so, Lady Money Wizard and I continued what’s becoming a familiar ritual – trekking up to the friends and family’s lake cabin and then spending a few days relaxing in the peace and quiet that only those northern waters can provide.

The celebration was compounded when we returned to the cities and greeted some visiting friends.

The weather was beautiful – blue skies and 75 degree highs – which made for a perfect setting for exploring Minneapolis’s best sights, foods, and patios.

I had a blast playing tour-guide to these out-of-towners, showing off my city’s highlights and reminding myself why I live where I live. (When you live in a place that gets 20 below zero during winter, you need these summer morale boosts to keep you from packing up shop and heading south for good.)

The good times kept rolling through the middle of the month. Mother and Father Money Wizard organized a big family vacation, which is no easy task when the “kids” are all approaching their 30s with spouses in tow.

They’d set up the get-together in Milwaukee, Wisconsin, of all places.

Why Milwaukee? I asked the same thing, but I quickly ate my words when the weekend started. For the second time in the same month, I found myself exploring an awesome city with beautiful weather, all while enjoying the company of my favorite people on the planet.

As we enjoyed all the cool spots in Historic Milwaukee, I had to stop and reflect. Good times with good people just might be what this whole life thing this is about.

I felt the wave of fortune wash over me.

The Low

Unfortunately, the good times didn’t last forever.

Shortly after we returned from the awesome family trip to Milwaukee, we found The Cash Cat in rough shape.

Several trips to the vet later, and we learned the awful news. An aggressive form of bone cancer. We’d have to put him down.

I couldn’t believe it.

Just a few weeks ago he was his normal self. I even posted about our nightly play sessions in the last net worth update.

(I’d never been a cat person before. In fact, for a while I was the opposite of one. The Cash Cat changed that.

Most interesting for readers of this site, he sat by my side while I wrote most of the posts you find on this blog…)

I’ll spare you the gut-wrenching details of what followed. As my first experience with a sick animal, the process was far harder than I ever imagined.

But I will share this one story, mostly as a journal to myself.

Before bed, Lady Money Wizard and I usually watch TV or read books. The Cash Cat, ever the cuddle monster, would always find a way to crash this private party.

Somehow, he’d always manage to sneak into the room. Usually, he’d slip through the tiniest crack in the door, or even be so determined to make it in, that he’d pry open the door with his tiny paws.

He’d even go as far as full stealth mode – camping out before our arrival and creeping into the bed just as soon as we thought we were alone.

From there, he’d want nothing more than pets and cuddles all night long.

Eventually though, I’d have to get up and let him out of the room. I’d close the door, give him a treat on the other side, and pet him goodnight.

At the time, I remember nights where I’d be annoyed I’d have to get up to close that door. Or annoyed that he found a way to sneak again.

And yet, now that he’s gone, I find myself wondering what I wouldn’t give to have to get up and close that door again.

It might sound silly conferring life advice from a 10 pound furball. But that was The Cash Cat’s last gift to me, among many throughout the years:

To always live in the moment. Don’t take anything for granted. And enjoy the full journey of life, through the good times and the bad.

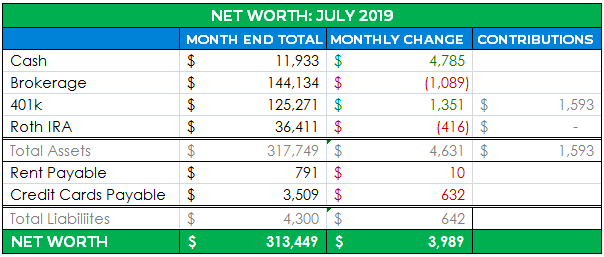

Net Worth Update: July 2019

And my detailed spreadsheet:

Some ups and some downs, which fits with the overall theme of the month.

Cash: $11,933 (+$4,785)

The cash account saw a nice spike, thanks to one of my favorite traditions of the year – a three paycheck month!

Brokerage: $144,134 ($1,089)

A thousand big ones sounds like a huge drop, until I do the math and realize that’s a 0.7% change.

It looks like this was mostly due to the S&P 500 staying relatively flat, with a very minor decline on the last day of the month.

If you’re curious, my totally imperfect brokerage allocation looks still looks like this these days:

- 69% Vanguard Large Cap Index Funds (65% is the VTSAX fund and 35% is Vanguard’s VUG and VTV etfs.)

- 14% Individual Stocks back from the when I was young and dumb and thought I could beat the market

- 10% Vanguard Federal Money Market Fund

- 7% Bond Index Funds (2/3 in Vanguard’s VBTLX fund and 1/3 in Vanguard’s BSV etf)

That said, I still think for most people, a simple 3 fund portfolio would knock the socks off my current setup.

401k: $125,271 (+$1,351)

Again, the stock market was pretty flat, although the 401k’s value was carried along by the contributions made from my paychecks. (Three paychecks!!!)

My 401k contributions are broken down as:

- 50% Large Cap

- 30% Small Cap

- 20% International

Roth IRA: $36,411 ($416)

I made my last conversion from the money market fund to Vanguard’s REIT Index this month!

Which means this account is now 100% in VGSLX.

And even better, I’ve officially maxed out my Roth for the year! Woot! Woot!

Rent Payable: $791 (+$10)

Ran the air conditioning a little more as the weather heated up, although Minnesota’s 85 degree summer days don’t have nearly the impact on our energy bills as the cold winter ones.

For newer readers, I live in a house purchased by my girlfriend fiance. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.

Apparently, our home maintenance fund is up to nearly $6,000 these days. Lady Money Wizard keeps this in a separate account, and her accounts aren’t included in my net worth total. In either case, it’s a nice little security blanket, especially knowing that a new roof is in our near-future.

Credit Cards Payable: $3,509 (+$632)

Again, this number just represents the total amount outstanding on all my credit cards, which I pay off in full each month.

To channel my inner mother from Waterboy, credit card interest is the devil!

There’s always some reimbursable work expenses in here, which is the reason for this next (more accurate) section:

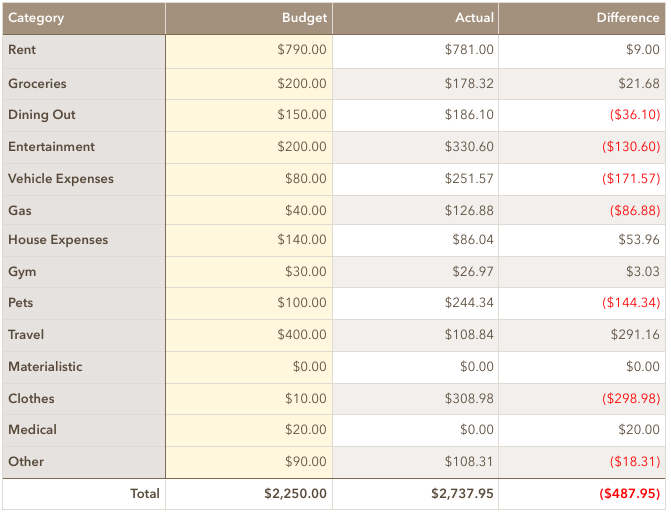

Total Monthly Spending: $2,738

A little over my goal, but I won’t stress too much since there was some weird stuff going on this month.

Entertainment: $330

It’s pretty rare that I go over my entertainment budget, so I must have really been living it up.

And it turns out that yes, I was definitely entertaining hard!

Bigger items here included:

- My stint as a tour guide to the out of town friends

- My week to bring the beer for my beer league softball team

- Sporting the cost of river cruise tickets for a good friend. He was moving across the country, so we sent him off by literally having him sail off into the sunset – on a cruise around Minneapolis!

Vehicle Expenses: $251

Although Lady Money Wizard and I usually keep our finances separate, she found herself with a $150 flat tire, and I picked up the tab. Because… I’m just a gentleman like that. 😎

The rest of this category was just the usual monthly insurance on my paid-off Mazda 3.

I did get an oil change this month, but when I bought the car, the dealership gave me 9 free oil changes. The Mazda’s only got 20,000 miles, so at this rate, Tesla’s self driving cars will take over before I ever pay for an oil change!

Gas: $127

A crazy amount of driving this month between the cabin trip, friends being in town, and miscellaneous errands always popping up.

House Expenses: $86

Apparently, bark mulch is expensive. I spent $70 to re-up our small garden beds.

Pets: $244

The Cash Cat’s vet bills, and we still have one big bill left.

On a side note, I’m still pretty sure we came out ahead by saying no to pet insurance.

Travel: $109

The Milwaukee family vacation benefited from free airline miles, mixed with extremely generous parents who, despite my best attempts to slip my card in wherever possible, insisted on footing the bill for everyone involved.

Apparently, with their son all grown up into a 29-year old who’s obsessed enough with money to type out ridiculous spending reports like the one you’re reading right now, they’re no longer worried about teaching me the value of a dollar.

I’m extremely grateful. Both for their amazing upbringing and their generosity on the trip.

Clothes: $309

With my feet about to fall off from walking around in flip flops all summer, I decided it was time to actually buy some quality shoes I could wear in the warmer weather.

I picked up some great Eccos for $160. Considering the other Eccos I own are are going on five years strong with no signs of slowing down, my new shoes’ $160 price tag might actually be a relatively frugal buy. Especially compared to the $50 Nikes which seem to disintegrate every few years.

Apparently, I then got shoe buying fever, and I replaced my well-worn hiking boots, too.

My clothes shopping-spree eventually came to an end with a few new t-shirts.

How was your July?

Thanks for reading along, and I’d love to read about your July, too!

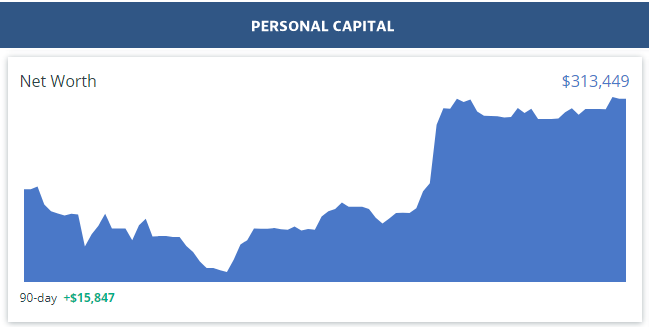

PS – If you haven’t jumped on the bandwagon yet and want to track your net worth like I do, I’m still obsessed with Personal Capital. Personal Capital will automatically track your spending, double check your portfolio allocation, and add up your entire net worth in one place.

Related Articles:

Great update as always. Sorry to hear about your cat. July was good for me, nice and relaxing. Financially it was okay. You can read about it here https://10yeartarget.com/financial-status-july-2019/

Thanks!

So sorry to hear that about cash cat! Our cat hangs out with me all day as I work from home and sleeps in our bed each night. Going to be a really sad day when he’s gone. At least you have the fun memories to think about.

They make the best coworkers around!

Hello,

First of all, great website. Second, I was wondering what sort of diversification or counter measures you are using to protect yourself from an impending stock market crash. Based on your July report, it seems that you have over 95% of your wealth in the stock market (401k, brokerage, IRA). As you know, anyone can make money in a stock market that has been going up for 10 years… Seems like you would certainly want to preserve your wealth and all the hard work you’ve put in to get you this far. Especially given the declining state of our country’s financial position and ridiculous debt. I know the token answer is to ride it through, maybe “average down” your investments. But wouldn’t it be so much better to gain more credibility with your followers (and handle the psychological swings) if you’re proactively hedging against such an imminent crash? Do you at least have exposure to gold and silver?

Thanks and good luck.

The IRA is invested entirely in a real estate REIT, and the brokerage account includes ~$15,000 in a money market (cash) fund. Plus the $10,000 of cash in my checking account.

All in, I’m around 67% US stocks, 7% international stocks, 15% real estate, and 12% cash/bonds. Still heavily exposed to stocks, but not nearly 95%.

With the recent inversion of the yield curve, I might stop contributing my after tax savings to stocks and instead keep building up bonds/money market funds/cash. I’ve sort of done that for the last year anyway, dating back to my original plan of saving cash to buy a rental property.

Keep up the hard work, my friend!

We love reading these updates.

Our July was pretty good. https://moneysavvymindset.com/net-worth-update-july-2019/

Thanks, Chris.

I’m so sorry about Cash Cat. I know how hard it is having to make that decision- I hope you find comfort in the sweet memories you both have of him and knowing that you provided the best care possible.

Thanks so much Kara. I am thankful that it was at least a clear decision.

Sorry to hear about the Cash Cat 🙁 Pets are family too and I remember balling my eyes out the day we had to put down the family dog. She had shattered her leg one day by simply climbing up the stairs to go back into the house. She was old at the time, but it was still incredibly tough to have it happen so suddenly and unexpectedly. As time goes by, the shock and sadness will ease and you’ll be filled with nice memories 🙂

Thanks so much Brian, and sorry to hear about your family dog.

Enjoy the read and long time follower (similar situation / numbers as you). One thing I’ve noticed you haven’t mentioned in your post (unless I’ve missed it) is any career progression. I’m starting to see my peers get promoted or switch jobs which leads to increase income. Any insights on your career progression / future potential moves. It’s something I’ve been starting to pay more attention to.

I’ve posted about a few promotions in some older net worth updates. I’ve been promoted three times in the last 6.5 years, and so my salary has increased from $50K to almost $90K now. It’s not something I write about too much, since my main goal isn’t to climb the corporate ladder, but to exit it entirely.

My main advice would be to understand how the game is played around you, play the office politics when you need to, and yes… job hopping is actually the fastest way to a quick raise. BUT, it does wipe out all the work you’ve done building a good reputation in one place, so think about the long term prospects before you drop everything for the first good offer that comes along.

I’m praying for you and Lady Money Wizard! I’m so sorry about Cash Cat.

Lily

Thanks so much Lily.

Always a great read to check on all your accounts and experiences. Soryy to hear the Cash Cat – he can hang with my ol Hank. You really are never prepared for that.

PS Love the Sandler shout-out!!

Thanks Dominic.

Do you feel any sense of purpose from your work? If not, does that bother you at all?

I feel a huge sense of purpose from this blog, so that covers any shortfalls in the corporate world. 🙂

How about you?

I’m so sorry to hear about Cash Cat passing. He looks so adorable! Good times with family (including furry family members) and friends are priceless!

So true, Morticia. Priceless indeed!

Sorry to hear about your cat my dude. What a cutie that guy was. Best of luck in the market this month. Looks like it’s gonna be a wild ride.

Thanks Eric, and good luck to you too.

I’m so sorry about your cat. That little fur ball was loved. Time to go pet my pup. I shouldn’t be ignoring him on the computer.

Thanks J. And yes, The Money Pup has been gotten lots of extra pets out of this whole situation.

My condolences to you Sean and Lady Money Wizard on the loss of Cash Cat. Thank you for posting valuable life lessons that he taught you, they are definitely worth remembering each day.

Thank you, Kim.

What kind of Eccos did you get? I hate buying new work shoes

I bought the Ecco Soft 7s. They’re more casual. I also have some business casual that I wear into the office. Huge fan.

I am so sorry you had to put your cat down. That is one of the hardest things to do. I did invest in a higher premium for dog insurance. Two of my dogs needed 5k surgeries in their lives. Here it is so expensive to have a pet. But since I don’t have children they are my fur babies. Boeing and Ella. July was spent with friends. Kind of a blur for me. I picked up some side work as I have left my job almost 4 years ago. Time flies. Good start to August went to the movies to see The Lion King and will take my nephew who is turning 15 to the beach for 2 days. I have been recovering from spine surgery. 6 months now. Stock market sure is flat but We will all have to ride the wave. Don’t get discouraged I tell myself that. Enjoy the rest of your summer. I am looking forward to some cooler weather. The humidity is awful this year. Have fun.

So sorry for your loss! :(( How old was your cat ? I haven’t heard of pet insurance before this, good article.