Hey Money Wizards,

As you probably know by now, every month I track my updated Net Worth, so that I can hopefully leave my office job in the very near future.

I’m currently 32 with a goal of a million bucks within the next three years. The race is on!

Life Update: July 2022

July was all about family time, and I can’t count myself more fortunate.

We started the month on Lady Money Wizard’s side, with a long July 4th at a family cabin. Then, we ended the month with more of the same – this time on my side – hosting family who came all the way up to Minnesota from Texas. (For a perfectly timed retreat from the summer heat.)

In between, we spent quite a bit of time enjoying our state’s good months. Lots of bike rides on the new wheels, plenty of outdoor walks with The Money Pup, and my weekly beer-league softball.

It was a nice reminder. As long as you’re lucky enough for quality time like that, it doesn’t really matter what your portfolio is doing.

But of course, this website is all about the Benjamins! Onward!

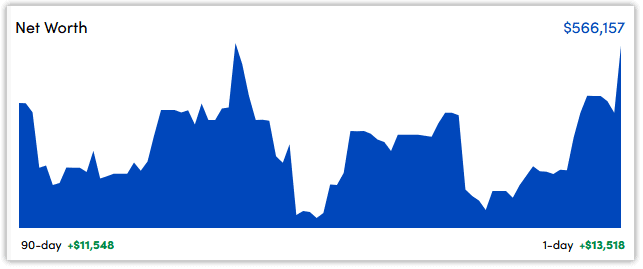

Net Worth Update: July 2022

Hey, we’ve got some greenery!

After last month’s absolute massacre, the portfolio recovered slightly.

Why? Because up is down and down is up, apparently. Welcome to The Upsidedown.

In July, The Fed raised interest rates by 0.75%, for the second month in a row. Because what else are you gonna do when your job is to control inflation, and inflation is burning like wildfire? (Official inflation was 9.1% as of July, by the way.)

As we talked about before, The Fed raising interest rates usually crushes the stock market. So naturally, in this new upside down world, the market soared on the news!

All in all, the S&P500 rose 9.11% over the month, which doesn’t really make any sense at all and is reason number 5,231 why trying to actively trade the market is a bit like agreeing to pound your head against a wall.

Meanwhile, GDP fell for the second quarter in a row. Usually, that’s the official benchmark for a technical recession, but so far, the National Bureau of Economic research hasn’t been willing to pull the trigger on that call. (They cite the strong job market.)

Oh, and the yield curve inverted again. I’m not one for trying to predict the future, but that metric has signaled the last eight recessions in a row.

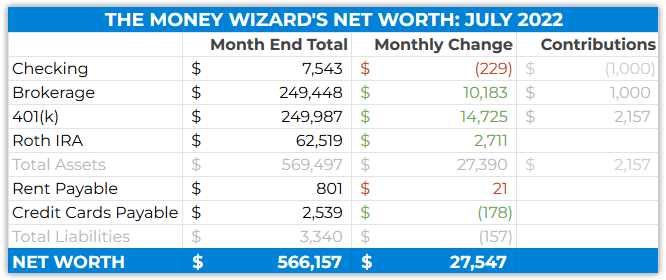

Account Changes

Not much to report here. The checking account showed a loss, but I think that’s mostly because I measured last month’s net worth update halfway through the month, so it’s not getting the benefit of my usual number of paychecks.

Otherwise, the brokerage and 401(k) accounts mostly followed the inexplicable stock market rally.

My Current Strategy

With all the doom in gloom (namely the yield curve inversion) it’s tempting to pull everything out and sit on the sidelines.

Sell! Sell! Sell!

But IMO, that’s a fool’s game.

If you’ve been following these Net Worth Updates for any period over the past 5 years that I’ve been publishing them, you know that there’s always some sort of concern on the horizon that a sufficiently nervous person could use as reason to stop investing.

But we all know that doing nothing is the only investment guaranteed to lose half its value every 24 years. (Even more in a high inflationary environment.)

That said, I do personally believe the yield curve inversion is one of the most reliable economic indicators. I talk about that in this post that semi-predicted the 2021 market crash.

But I also don’t really believe in selling investments.

If anything, I may divert some of my extra cash (and future paychecks) towards slightly less risky assets.

Remember those I-Bonds I’ve been talking about?

Now would probably be a good time for me to cross that $10,000 investment off my to-do list.

I’ll also keep those automatic stock market purchases going, because consistency is the name of the game there.

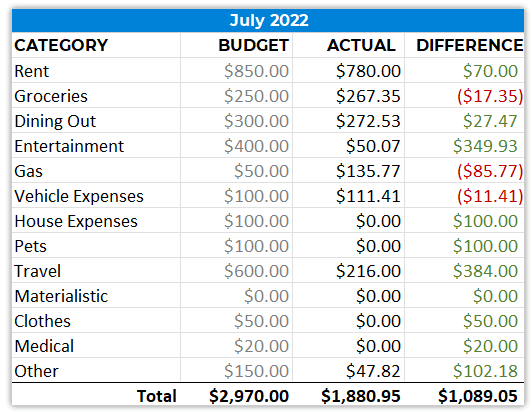

Total Spending July 2022: $1,881

Wow, July was a surprisingly frugal month.

Other than the usual food costs, we basically didn’t spend any money.

Travel: $216

Travel was to a family cabin, and it seems that bribing family with beer in exchange for a free bed is quite the economical trade.

Entertainment: $50

I think that “investment” in my new expensive bike might actually be paying off.

With the new bike in hand, we found ourselves more frequently planning free weekend activities like “local bike ride” instead of “hundred dollar meal out.”

If every month was this cheap, we might be able to bump up that early retirement date!

Final Thoughts

How is you summer going?

Hope all is well! Financially and otherwise.

PS – Want to track your net worth like this? Personal Capital’s free net worth tracker is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Hi Sean,

We had similar thoughts on the recent stock market performance. I just figured that stock market Gods re-watched Pirates of the Caribbean 3 and followed Jack Sparrow’s advice of “Up is down!”

The 10K iBond Purchase is on our bucket list as well. Just need to figure out how to navigate the 2000’s-looking TreasuryDirect website. LOL.

-Matthew

Haha!

Nice to see you here, Matthew.

$267 for groceries for an entire month? Please explain how that’s possible.

-Jeremy

probably because he has no kids lol

Do you mean high or low? I’m assuming this is just him (and not his wife’s budget too) – so this seems about accurate for an individual. He also has this article: https://mymoneywizard.com/how-i-spend-less-than-35-a-week-on-groceries-my-full-shopping-list-exposed/ – from 2019, so not today’s current crazy grocery prices.

Out of curiosity, I averaged my past few months of groceries and came out with $1,209/month – but that’s for four people – so $302/month per person. I’m sure there are some economies of scale with cooking for multiple people. But our budget has also been higher than usual due to some new dietary allergies that have developed. My budget also includes some extra or superfluous items – like beer, some hosting, etc. My family cooks almost all of our own meals – rarely goes out to eat – definitely much less than Money Wizard; and little to no prepackaged stuff. We also eat extremely well – often buying pricer cuts of meat or the “nice” $5 pasta box if we aren’t making our own from scratch, etc. (I worked professionally as a cook for many years.) We also have very little food waste, and grow some of our own herbs. Happy to answer any questions if you have them.

Thanks for linking, Mike. I was going to share the same article.

Not much has changed with that linked shopping list, except for crazy inflated prices. The average grocery store trip these days (once a week) is about $60-100, which averages out to about $300 a month. I do almost all the grocery shopping, so this is for two people.

How much are other people spending?

Loved this line. “…reason number 5,231 why trying to actively trade the market is a bit like agreeing to pound your head against a wall.”

Which hopefully my relative will luck out when he went to cash in December of 2021 but I told him that I do not try that type of thing. He’s still not in the market now; maybe it will work out for him but it’s not my cup of tea. I always invest like you and if I get extra money I invest that right away as well.

I realized recently that for me, the stress of not being in the market is almost worse than the stress of just riding out any downturns. Missing the rallies somehow feels even more painful.

Just another reason to buy and hold!

How did you not spend any money on the money pup? Does the dog not eat through kibble like a monster? We have 2 golden retrievers that blow through kibble, so just curious haha.

Haha!

We do our Money Pup food shopping at Costco. So the spending usually comes in waves. We stock up on a huge bag of food every few months.